Broadcom Inc. - Common Stock (AVGO)

345.75

+15.27 (4.62%)

NASDAQ · Last Trade: Mar 9th, 7:31 PM EDT

Detailed Quote

| Previous Close | 330.48 |

|---|---|

| Open | 327.25 |

| Bid | 343.53 |

| Ask | 343.68 |

| Day's Range | 323.61 - 348.49 |

| 52 Week Range | 138.10 - 414.61 |

| Volume | 41,139,986 |

| Market Cap | 160.77B |

| PE Ratio (TTM) | 72.48 |

| EPS (TTM) | 4.8 |

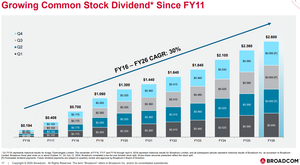

| Dividend & Yield | 2.600 (0.75%) |

| 1 Month Average Volume | 25,171,836 |

Chart

About Broadcom Inc. - Common Stock (AVGO)

Broadcom Ltd is a global technology company that designs, develops, and supplies a wide range of semiconductor and infrastructure software solutions. The company specializes in producing chips that facilitate communication and data processing across various devices and networks, including those used in smartphones, enterprise storage systems, broadband access, and data centers. Additionally, Broadcom offers software solutions that enable businesses to optimize their operations, manage network security, and enhance performance across cloud-based and on-premises environments. Through its comprehensive portfolio, Broadcom plays a critical role in advancing connectivity and computing technologies in various industries. Read More

News & Press Releases

What Happened? Shares of network chips maker MACOM Technology Solutions (NASDAQ: MTSI) jumped 4.1% in the afternoon session after analysts highlighted the co...

Via StockStory · March 9, 2026

The S&P 500 reached a critical psychological and technical threshold on March 9, 2026, as the Cyclically Adjusted Price-to-Earnings (CAPE) ratio—often referred to as the Shiller P/E—climbed to 39.8. This milestone marks the most expensive valuation for the broad market index since the height of

Via MarketMinute · March 9, 2026

Top S&P500 movers in Monday's sessionchartmill.com

Via Chartmill · March 9, 2026

Broadcom's Growth Is Accelerating. Time to Buy the Stock?broadcom

Via The Motley Fool · March 6, 2026

Revenue from its artificial intelligence chip business is projected to exceed $100 billion next year.

Via The Motley Fool · March 9, 2026

Broadcom (AVGO) shares jump as AI revenue hits $8.4B. CEO Hock Tan sees a $100B AI opportunity by 2027. Read the full earnings analysis.

Via Benzinga · March 9, 2026

As of March 9, 2026, the United States economy finds itself at a historic crossroads, propelled by a surge in artificial intelligence investment that has defied early skeptics. New data from the Federal Reserve and major Wall Street institutions suggest that AI-related capital expenditure and infrastructure development have become the

Via MarketMinute · March 9, 2026

Broadcom Inc. (NASDAQ: AVGO) has silenced the skeptics and reignited the artificial intelligence hardware trade following a blockbuster fiscal first-quarter earnings report released today, March 9, 2026. The semiconductor giant posted a definitive "beat and raise" performance, reporting total revenue of $19.31 billion—a 29.5% year-over-year increase—and

Via MarketMinute · March 9, 2026

Connectivity solutions provider Credo Technology surged robustly after Broadcom’s Q1 earnings.

Via Barchart.com · March 9, 2026

As of March 9, 2026, Marvell Technology, Inc. (Nasdaq: MRVL) has transitioned from a cyclical provider of storage controllers to a structural cornerstone of the global artificial intelligence (AI) infrastructure. Often described by analysts as the "architect of the AI interconnect," Marvell has spent the last decade positioning itself at the intersection of high-speed data [...]

Via Finterra · March 9, 2026

As the closing bell approaches on March 9, 2026, the technology sector is bracing for a definitive progress report on the artificial intelligence capital expenditure cycle. Hewlett Packard Enterprise (NYSE:HPE) is slated to release its fiscal first-quarter earnings after the market close, a report that analysts have dubbed a

Via MarketMinute · March 9, 2026

Today’s Date: March 9, 2026 Introduction As we navigate the first quarter of 2026, few companies command as much gravity in the global technology ecosystem as Broadcom Inc. (NASDAQ: AVGO). Often described as the "invisible backbone" of the digital world, Broadcom has evolved from a diversified chipmaker into a dual-engine powerhouse of artificial intelligence (AI) [...]

Via Finterra · March 9, 2026

In a matter of months, last year's winners have shifted to losers, creating compelling buying opportunities for long-term investors.

Via The Motley Fool · March 9, 2026

Los Angeles, CA - March 9, 2026 - AICC (AI.cc), the leading unified AI API aggregation platform, today announced the expansion of its One API solution to help small and medium-sized enterprises (SMEs) protect against escalating AI costs driven by the massive AI infrastructure boom.

Via AB Newswire · March 9, 2026

Iranian Foreign Ministry spokesperson Esmaeil Baghaei provided details on the ongoing tensions, stating that Iran will continue to defend itself.

Via Stocktwits · March 9, 2026

Over the last six months, Primerica’s shares have sunk to $257.38, producing a disappointing 5.2% loss - a stark contrast to the S&P 500’s 4.8% gain. This mi...

Via StockStory · March 9, 2026

The dynamic that held one particular name down for so long is seemingly starting to change direction.

Via The Motley Fool · March 8, 2026

Google's parent company is making all the right moves to corner the AI market, which makes it a safer bet than anything you'll see on a prediction market.

Via The Motley Fool · March 8, 2026

The top AI chipmaker is still firing on all cylinders.

Via The Motley Fool · March 8, 2026

Major market headlines include AI regulation debates, Nvidia chip export uncertainty, Broadcom earnings, and strategic moves by Netflix, Meta, Amazon, and CrowdStrike across technology sectors.

Via Benzinga · March 8, 2026

In February, average hourly wages grew 0.4% and 3.8% from a year earlier, showing pay growth in the employment report.

Via Stocktwits · March 8, 2026

The company just confirmed its enormous opportunity in custom artificial intelligence (AI) chips.

Via The Motley Fool · March 7, 2026

The foundry giant's ability to outperform the market's growth expectations should result in healthy stock price upside.

Via The Motley Fool · March 7, 2026

The semiconductor industry has created massive wealth over the past decade. It is primed to continue, and this stock could be one of the biggest winners.

Via The Motley Fool · March 7, 2026

What Happened? Shares of industrial materials and tools company Kennametal (NYSE:KMT) fell 7.6% in the afternoon session after a surprisingly weak February j...

Via StockStory · March 6, 2026