News

The price of gold hit a new milestone this week.

Via The Motley Fool · January 29, 2026

Investors are piling into gold on the back of surging political and economic uncertainty.

Via The Motley Fool · January 29, 2026

First Internet Bancorp (INBK) Earnings Transcript

Via The Motley Fool · January 29, 2026

FinWise (FINW) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 29, 2026

It's important to put that money to good use.

Via The Motley Fool · January 29, 2026

Mortgage REIT PennyMac Mortgage Investment Trust (NYSE:PMT) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 19.3% year on year to $87.1 million. Its GAAP profit of $0.48 per share was 20.7% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

On Jan. 29, 2026, a rare post-earnings tumble in Microsoft rattled tech stocks even as the Dow hovered near records.

Via The Motley Fool · January 29, 2026

Regional banking company Ameris Bancorp (NYSE:ABCB) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 5.5% year on year to $307.1 million. Its non-GAAP profit of $1.59 per share was 0.9% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

On January 29, 2026, the global financial landscape reached a fever pitch as spot gold surged to an unprecedented all-time high of $5,595 per ounce, while silver staged a "parabolic" ascent to touch $120.45 per ounce. This monumental rally, which analysts are calling the "Great Revaluation," marks a

Via MarketMinute · January 29, 2026

In a dramatic shift for global finance, the U.S. Dollar Index (DXY) has plummeted to its lowest level since early 2022, signaling an end to the "dollar exceptionalism" that defined the early 2020s. As of late January 2026, the greenback is trading in the 95.00–96.00 range,

Via MarketMinute · January 29, 2026

The benchmark 10-year Treasury yield has retreated to 4.25% as of January 29, 2026, offering a slight reprieve to a market that had been gripped by a sudden surge in borrowing costs earlier this month. The move marks a cooling from a five-month high of 4.31% reached on

Via MarketMinute · January 29, 2026

As of January 29, 2026, the equity markets are witnessing a significant transformation in leadership. For years, the Information Technology sector acted as the undisputed engine of market growth, fueled by a relentless pursuit of artificial intelligence (AI) dominance. However, today’s market action reveals a stark divergence. While major

Via MarketMinute · January 29, 2026

In a week dominated by shifting monetary policy signals, the United States labor market has once again proved its resilience. Data released this morning, January 29, 2026, by the Department of Labor revealed that initial jobless claims for the past week fell to 200,000, significantly lower than the consensus

Via MarketMinute · January 29, 2026

The stark divide in the financial markets reached a fever pitch today, January 29, 2026, as the long-anticipated "Great Rotation" finally appeared to take hold. While the tech-heavy Nasdaq Composite and the broader S&P 500 were dragged into the red by a staggering sell-off in artificial intelligence bellwethers, the

Via MarketMinute · January 29, 2026

The global financial landscape reached a historic inflection point on January 29, 2026, as gold prices surged past the $5,500 per ounce mark, marking an unprecedented milestone in the history of precious metals. This "metal mania" reflects a profound shift in investor sentiment, as the traditional pillars of the

Via MarketMinute · January 29, 2026

Live cattle futures saw weakness of $1.10 to $1.50 across most contracts on Thursday. Cash trade has yet to get kicked off this week, with $232 bids. The Thursday Fed Cattle Exchange online auction showed bids of $232 to $233.50 but no sales on the 1...

Via Barchart.com · January 29, 2026

As of January 29, 2026, global financial markets are grappling with a dramatic intensification of geopolitical risk as tensions between the United States and Iran reach a boiling point. The deployment of a massive naval armada, led by the USS Abraham Lincoln to the Persian Gulf, has sent shockwaves through

Via MarketMinute · January 29, 2026

In a sweeping move to combat a "lower-for-longer" earnings environment, Dow Inc. (NYSE: DOW) announced on January 29, 2026, a massive global restructuring initiative titled "Transform to Outperform." The plan includes the elimination of approximately 4,500 jobs—roughly 13% of the company’s global workforce—as the chemical giant

Via MarketMinute · January 29, 2026

Mastercard Incorporated (NYSE: MA) shares climbed nearly 3% on Thursday, January 29, 2026, after the payments giant delivered a robust fourth-quarter earnings report that handily outpaced Wall Street projections. The results, underpinned by surprisingly durable consumer spending and a sustained boom in international travel, provided a much-needed shot of adrenaline

Via MarketMinute · January 29, 2026

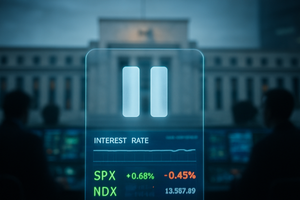

In a move that signaled a shift from aggressive easing to a strategic "wait-and-see" approach, the Federal Open Market Committee (FOMC) concluded its two-day policy meeting on January 28, 2026, by voting to maintain the federal funds rate at a target range of 3.50% to 3.75%. The decision

Via MarketMinute · January 29, 2026

Esterad Bank, a Bahrain-based wholesale Islamic bank regulated by the Central Bank of Bahrain, announced that a specialised healthcare focused investment fund under its management has completed a strategic investment in The Eye Infirmary W.L.L, one of Bahrain’s leading specialised ophthalmology centres.

Via Get News · January 29, 2026

Gold and silver prices are surging to multi-year and record highs, reigniting investor interest across the precious metals and critical minerals sector. As inflation hedging, geopolitical risk, central-bank accumulation, and a weakening U.S. dollar collide, capital is rotating aggressively into hard assets — and history suggests the next wave of upside often flows into undervalued microcap miners .

Via AB Newswire · January 29, 2026

Los Angeles, CA - Bull Market Solutions has announced the launch of a structured 0% business credit card program aimed at helping eligible entrepreneurs explore alternative short-term capital options during the early stages of business growth. The program is intended for founders, small business owners and real estate investors seeking to improve cash flow flexibility while building stronger financial foundations.

Via AB Newswire · January 29, 2026

Equipment rental company United Rentals (NYSE:URI) fell short of the markets revenue expectations in Q4 CY2025 as sales rose 2.8% year on year to $4.21 billion. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $17.05 billion at the midpoint. Its non-GAAP profit of $11.09 per share was 6.1% below analysts’ consensus estimates.

Via StockStory · January 29, 2026

The markets just did something we haven't seen in decades.

Via Talk Markets · January 29, 2026