Tyson Foods (TSN)

58.03

+0.66 (1.15%)

NYSE · Last Trade: Jan 11th, 12:11 AM EST

The global effort to curb food inflation received a significant boost as the year 2025 drew to a close. According to the latest report from the Food and Agriculture Organization (FAO) of the United Nations, the benchmark index for world food commodity prices fell for the fourth straight month in

Via MarketMinute · January 9, 2026

The livestock market has kicked off 2026 with a surge of activity, as tight supplies and robust demand continue to push prices toward historic highs. At the recent Holsworthy Market auction on January 7, 2026, the atmosphere was described by traders as "on fire," with a massive entry of livestock

Via MarketMinute · January 8, 2026

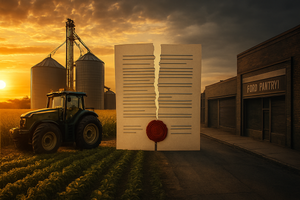

As of early January 2026, the American agricultural landscape is navigating its most significant policy transformation since the New Deal. The traditional "Farm Bill era"—characterized by a decennial, bipartisan omnibus package that married rural commodity subsidies with urban nutrition programs—has effectively ended. In its place stands a fragmented,

Via MarketMinute · January 7, 2026

Before its Q1 FY2026 earnings release, here’s what analysts are expecting from this underperforming stock.

Via Barchart.com · January 5, 2026

Tyson Foods (NYSE:TSN) Shows Bull Flag Pattern in High-Probability Breakout Setupchartmill.com

Via Chartmill · January 5, 2026

As the 2026 calendar year begins, the United States agricultural sector finds itself at a critical policy crossroads. On one hand, the U.S. Department of Agriculture (USDA) has just finalized the enrollment for its $12 billion Farmer Bridge Assistance (FBA) program, a massive infusion of ad-hoc cash designed to

Via MarketMinute · January 2, 2026

As of January 1, 2026, the landscape of American agricultural sovereignty has reached a critical juncture in the Great Plains. Following a three-year legislative blitz aimed at curbing foreign influence, Oklahoma has fully implemented a sweeping ban on land ownership by "adversarial" foreign nations, most notably China. However, the dust

Via MarketMinute · January 1, 2026

As the calendar turns to 2026, the American agricultural sector finds itself at a precarious crossroads, battered by a year of escalating trade tensions and a "Trade War 2.0" that has redefined global commodity flows. Throughout 2025, Senator Jerry Moran (R-Kan.) emerged as one of the most consistent and

Via MarketMinute · January 1, 2026

Pricing is not the only issue for Beyond Meat.

Via The Motley Fool · December 31, 2025

JACKSON, Miss. — In a stark reversal of fortune for the nation’s largest egg producer, Cal-Maine Foods Inc. (NASDAQ: CALM) saw its shares tumble to a 52-week low of $79.42 on Tuesday. The drop marks a significant retreat from the record-breaking highs seen earlier this year, signaling an end

Via MarketMinute · December 30, 2025

Via Benzinga · December 30, 2025

As of late December 2025, the United States livestock market is navigating a period of profound structural upheaval, defined by a historic divergence between the beef and dairy sectors. While cattle producers are grappling with a herd size not seen since the 1950s—sending beef prices to unprecedented heights—the

Via MarketMinute · December 26, 2025

The American beef industry is entering a period of unprecedented structural upheaval as a shrinking national cattle herd and a massive reduction in processing capacity collide. In a dual blow to the sector, the latest USDA Cattle on Feed report has revealed a staggering 11% drop in cattle placements, while

Via MarketMinute · December 25, 2025

The U.S. Department of Agriculture (USDA) released its quarterly "Hogs and Pigs" report on December 23, 2025, delivering a significant surprise to the commodities market. Defying analyst expectations of a contraction, the report revealed a total U.S. hog inventory of 75.5 million head, representing a 1% year-over-year

Via MarketMinute · December 25, 2025

The American agricultural landscape has reached a historic crossroads this December as the U.S. Department of Agriculture (USDA) released its final World Agricultural Supply and Demand Estimates (WASDE) report for 2025. In a surprising twist for a year defined by a massive 16.752 billion bushel harvest, the USDA

Via MarketMinute · December 25, 2025

As the winter of 2025 settles across the American Heartland, the U.S. cattle industry finds itself in the grip of a jarring economic disconnect. Despite consumers paying record-high prices at the grocery store—with ground beef averaging $6.54 per pound and premium steaks topping $12.29—the primary

Via MarketMinute · December 24, 2025

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how perishable food stocks fared in Q3, starting with Tyson Foods (NYSE:TSN).

Via StockStory · December 23, 2025

As 2025 draws to a close, the agricultural landscape of the American South has emerged as a critical barometer for global food security and commodity pricing. According to the year-end report from the Mississippi State University (MSU) Extension Service, Mississippi’s poultry and egg industry has secured its position as

Via MarketMinute · December 22, 2025

As of late December 2025, American consumers are facing a stark new reality at the checkout counter: the "cheap food" era has been effectively dismantled by a pincer movement of climate-driven crop failures and a structural reliance on volatile fossil fuel markets. Recent reports from the USDA and the FAO

Via MarketMinute · December 22, 2025

As 2025 draws to a close, the heavy clouds of oversupply that have loomed over the American Heartland for the past two years appear to be breaking. According to the latest year-ahead outlook from CoBank’s Knowledge Exchange, the cyclical price bottoms for corn, wheat, and soybeans have likely been

Via MarketMinute · December 18, 2025

Bunge Global has outperformed the broader Dow Jones Industrial over the past year, and analysts are highly bullish on its future prospects.

Via Barchart.com · December 17, 2025

Avocado company Mission Produce (NASDAQ:AVO)

will be announcing earnings results this Thursday afternoon. Here’s what to expect.

Via StockStory · December 16, 2025

This beaten-down stock could struggle to recover next year.

Via The Motley Fool · December 15, 2025

Shares of meat company Tyson Foods (NYSE:TSN)

jumped 3.1% in the afternoon session after investors reacted positively to the company's recent move to streamline its beef operations for better long-term efficiency.

Via StockStory · December 11, 2025

As of December 2025, the global agricultural sector finds itself in a maelstrom of intensified trade disputes and escalating tariffs, profoundly reshaping international commodity flows and farmer livelihoods. A renewed surge in protectionist policies, notably between the United States and China, but also involving the European Union, Canada, and Mexico,

Via MarketMinute · December 11, 2025