Global X Copper Miners ETF (COPX)

42.89

-0.53 (-1.22%)

NYSE · Last Trade: Jun 14th, 11:46 AM EDT

Via Benzinga · May 23, 2025

Global copper market faces surplus due to rising production and trade tensions. ICSG projects 289,000 metric tons surplus in 2025, but demand may weaken.

Via Benzinga · May 2, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 29, 2025

KoBold Metals, backed by Bill Gates and Jeff Bezos, expands into DRC, aiming to harness the country's vast mineral wealth responsibly and sustainably.

Via Benzinga · April 28, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 25, 2025

The metal known as Dr. Copper, a classic gauge of global economic health, is now flashing recessionary warnings just as it heads into a historically weak seasonal window. Given this backdrop, we want to analyse the data in more detail.

Via Talk Markets · April 25, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 24, 2025

Growing disagreements between OPEC+ members have oil sitting out the broader risk-on move seen across financial markets as tariff tensions ease.

Via Talk Markets · April 24, 2025

Trump is now backing out of the extreme positions and the markets are taking a big breath of relief. However, what we got today is just an indication of Trump’s willingness not to remove Powell and “be nice to China”.

Via Talk Markets · April 23, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 23, 2025

Risk assets staged a recovery yesterday amid growing hopes for a de-escalation in US-China trade tensions. President Trump also eased concerns he might fire Federal Reserve Chair Powell.

Via Talk Markets · April 23, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 22, 2025

A creeping rotation out of U.S. assets and a subtle, but steady, rethink of the dollar as the default global parking spot.

Via Talk Markets · April 18, 2025

There are way too many critical financial and monetary signals at crisis levels right now.

Via Talk Markets · April 18, 2025

The main risk to this seasonal view is a renewed policy shock that reinforces tariff fears or disrupts global copper supply chains — keeping U.S. copper futures bid.

Via Talk Markets · April 18, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 17, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 16, 2025

As inflation was finally coming under some level of control, paired with a strong economy and robust labor market, many commodities remained bullish.

Via Talk Markets · April 15, 2025

Oil prices rose yesterday despite OPEC making some small downward revisions to demand growth estimates.

Via Talk Markets · April 14, 2025

Given the situation in the USD Index, stocks, and how strongly silver reacted to the first wave of selling, it seems that much bigger declines are just around the corner.

Via Talk Markets · April 14, 2025

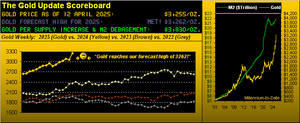

Given price’s present momentum, 3400 from here (+4.5%) seems a mere stone’s throw, barring it suddenly going all wrong for gold.

Via Talk Markets · April 13, 2025

In this video, Ira Epstein reviews the day's trading in various SPDR-ETF markets for the trading day that ended, Thursday, April 10

Via Talk Markets · April 11, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 10, 2025

Trump surprised markets with a 90-day pause in reciprocal tariffs for most trading partners. This provided a boost to risk assets, including commodities. However, there’s still plenty of uncertainty as the US again increased tariffs on China.

Via Talk Markets · April 10, 2025

Mining sector hit hard by new tariffs, but analysts expect a V-shaped recovery with potential for significant upside. Top stock and ETF picks.

Via Benzinga · April 9, 2025