Global X Copper Miners ETF (COPX)

32.67

-3.73 (-10.25%)

NYSE · Last Trade: Apr 6th, 8:39 PM EDT

Detailed Quote

| Previous Close | 36.40 |

|---|---|

| Open | 34.06 |

| Day's Range | 31.97 - 34.32 |

| 52 Week Range | 31.97 - 52.90 |

| Volume | 2,291,977 |

| Market Cap | 21.73M |

| Dividend & Yield | 0.3180 (0.97%) |

| 1 Month Average Volume | 1,200,886 |

Chart

News & Press Releases

Liberation Day isn’t just another headline - it’s a turning point for the global economy.

Via Talk Markets · April 4, 2025

Trump tariff sell-off continues.

Via Talk Markets · April 4, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 3, 2025

Silver is up more than gold – outperforming it on an immediate-term basis. At the same time, miners are down. This is a classic short-term sell signal.

Via Talk Markets · April 2, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 2, 2025

The first quarter was an incredibly tumultuous period for markets, with the S&P 500 posting its biggest quarterly decline since 2022.

Via Talk Markets · April 1, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · April 1, 2025

While gold captures the spotlight, copper is quietly stealing the show.

Via Talk Markets · March 31, 2025

A significant drop in Asian stock markets led to a decline in copper prices, despite rising long-term demand and tightening supplies.

Via Talk Markets · March 31, 2025

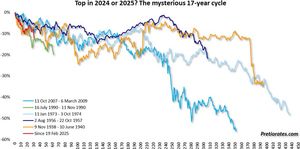

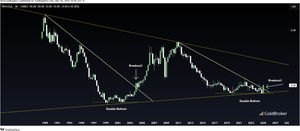

A couple of Copper charts that suggest the commodity boom (think

Via Talk Markets · March 31, 2025

Copper ETFs hit record highs as U.S. considers imposing tariffs on imports. Prices spike, inflows surge and miners benefit. Global supply concerns.

Via Benzinga · March 27, 2025

A standard business cycle in the US economy takes around four years to play out, from weakness to strength to weakness.

Via Talk Markets · March 27, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · March 27, 2025

In this video, Ira Epstein reviews the day's trading in various SPDR-ETF markets for the trading day that ended, Wednesday, March 26.

Via Talk Markets · March 27, 2025

The relationship between tariff announcements and copper prices follows a remarkably consistent pattern.

Via Talk Markets · March 26, 2025

Copper’s weekly chart reveals a major resistance zone between $5.00 and $5.20 — a level that has held firm for the past three years.

Via Talk Markets · March 26, 2025

U.S. tariffs on copper imports could be imposed within weeks, not months.

Via Talk Markets · March 26, 2025

Copper prices are on an upward trajectory, entering new and uncharted territory.

Via Talk Markets · March 26, 2025

In this video, Ira Epstein reviews the day's trading in the gold and other relevant metal markets.

Via Talk Markets · March 26, 2025

US copper prices rise to record highs amid rising tariff risks, while oil briefly slides on Russia-Ukraine ceasefire hopes.

Via Talk Markets · March 26, 2025

Wall Street’s recovery from its recent technical correction paused for a breather on Tuesday, as investors awaited more clarity on tariff developments and digested a downbeat consumer confidence report.

Via Benzinga · March 25, 2025

Copper prices soar to record highs as traders bet on China's recovery and react to tariff risks. Physical buying and dollar weakness also fuel the rally.

Via Benzinga · March 25, 2025

Risk assets rose amid suggestions the Trump administration will take a more measured approach with tariffs. Oil got an additional boost after the US announced secondary tariffs on buyers of Venezuelan oil.

Via Talk Markets · March 24, 2025

Copper prices soar above $10,000/MT on LME due to supply concerns and potential tariffs. U.S. imports of copper reach record levels.

Via Benzinga · March 20, 2025

Energy prices rose yesterday, with European gas leading the way, while copper tariff concerns continue to push prices higher.

Via Talk Markets · March 20, 2025