Intuitive Surgical (ISRG)

485.84

+7.24 (1.51%)

NASDAQ · Last Trade: Feb 15th, 1:35 AM EST

The stocks listed here have tremendous growth prospects, and their valuations are more modest than Palantir's.

Via The Motley Fool · February 11, 2026

In the past 12 months, shares of Intuitive Surgical have fallen by around 16%.

Via The Motley Fool · February 9, 2026

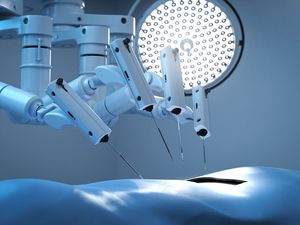

As of February 9, 2026, the medtech landscape is witnessing a pivotal shift centered around the long-awaited return of robotics to the heart of the operating room. Intuitive Surgical, Inc. (NASDAQ: ISRG), the undisputed pioneer of robotic-assisted surgery (RAS), recently secured a landmark FDA clearance for its next-generation da Vinci 5 platform, specifically for use [...]

Via Finterra · February 9, 2026

Intuitive Surgical's flagship product helps surgeons with a broad range of procedures.

Via The Motley Fool · February 8, 2026

There's a bright future ahead for both, but it's important to be patient.

Via The Motley Fool · February 7, 2026

Intuitive Surgical's stock is prone to drawdowns, and January could be an opening for long-term growth investors.

Via The Motley Fool · February 7, 2026

This "Rule Breaker Investing" mailbag brings together beautiful questions and stories to start the new year.

Via The Motley Fool · February 6, 2026

NICE delivers AI-driven cloud platforms for enterprises, focusing on digital business, compliance, and fraud prevention solutions.

Via The Motley Fool · February 2, 2026

While the S&P 500 (^GSPC) includes industry leaders, not every stock in the index is a winner.

Some companies are past their prime, weighed down by poor execution, weak financials, or structural headwinds.

Via StockStory · February 1, 2026

Intuitive Surgical's 2025 earnings were strong, and the future remains bright, with valuation as the only big concern for investors.

Via The Motley Fool · January 31, 2026

Patient investors who ride out the storm could be rewarded down the road.

Via The Motley Fool · January 31, 2026

Artificial intelligence isn't performing surgery yet, but if (when?) it does, these two companies are likely to be at the heart of it.

Via The Motley Fool · January 30, 2026

Risk gets talked about a lot in investing -- and often defined poorly.

Via The Motley Fool · January 30, 2026

Intuitive Surgical’s fourth quarter saw results above Wall Street’s expectations, driven by increased global procedure volumes and demand for the new da Vinci 5 system. Management highlighted continued adoption across multiple specialties, particularly in international markets, and noted that procedure growth was especially robust in Europe and Asia. CEO David Rosa pointed to the expansion of the da Vinci 5 in new geographies and indications as a key contributor, as well as growing use in ambulatory surgery centers (ASCs). While the company benefitted from broader system placements and higher recurring revenue, management also acknowledged ongoing pressures from tariffs and a more competitive landscape in China.

Via StockStory · January 29, 2026

The National Health Service (NHS) in England has officially entered a new era of oncology with the launch of a revolutionary "ultra-early" lung cancer detection trial. Integrating advanced artificial intelligence with robotic-assisted surgery, the pilot program—headquartered at Guy’s and St Thomas’ NHS Foundation Trust as of January 2026—seeks to transform the diagnostic pathway from a [...]

Via TokenRing AI · January 28, 2026

NEW BRUNSWICK, N.J. — Johnson & Johnson (NYSE: JNJ) has officially closed the chapter on a year many analysts described as "transitional," reporting full-year 2025 earnings that met expectations while setting a bold trajectory for the year ahead. In its January 21, 2026, earnings call, the healthcare titan revealed it is

Via MarketMinute · January 27, 2026

This company's surgical robots already use AI, and the future could be even more exciting.

Via The Motley Fool · January 27, 2026

Growth is oxygen.

But when it evaporates, the consequences can be severe - ask anyone who bought Cisco in the Dot-Com Bubble or newer investors who lived through the 2020 to 2022 COVID cycle.

Via StockStory · January 25, 2026

Via MarketBeat · January 25, 2026

This robotic surgical systems pioneer is dealing with a few issues, but its opportunities remain promising.

Via The Motley Fool · January 24, 2026

Artificial intelligence may be all the rage in the technology sector, but it's also having a huge impact on healthcare.

Via The Motley Fool · January 23, 2026

Following a resilient performance throughout 2025, healthcare giant Johnson & Johnson (NYSE: JNJ) has officially set its sights on a historic milestone for 2026. In its latest earnings report released on January 21, 2026, the New Brunswick-based titan signaled a definitive pivot toward high-growth markets in oncology and cardiovascular technology. Despite

Via MarketMinute · January 23, 2026

Via MarketBeat · January 23, 2026

As of January 23, 2026, Johnson & Johnson (NYSE:JNJ) finds itself at a historic crossroads. After spending much of 2025 navigating the "patent cliff" of its blockbuster drug Stelara and finalizing its transition into a pure-play healthcare giant, the company has emerged with a leaner, more aggressive growth profile. Analysts

Via MarketMinute · January 23, 2026

Medical technology company Intuitive Surgical (NASDAQ:ISRG) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 18.8% year on year to $2.87 billion. Its non-GAAP profit of $2.53 per share was 11.6% above analysts’ consensus estimates.

Via StockStory · January 23, 2026