Articles from Primerica, Inc.

Primerica, Inc. (NYSE: PRI), a leading provider of financial products and services in the U.S. and Canada, will kick off the new year on Jan. 7-8 with a virtual gathering of more than 1,000 of its top field leaders, the largest senior leadership gathering in the company’s history.

By Primerica, Inc. · Via Business Wire · January 2, 2026

The latest Primerica Household Budget Index™ (HBI™) data, a monthly economic metric that examines how inflation and wage trends impact the ability of middle-income families to afford life’s everyday necessities, is estimated at 100.7% in November, a slight increase of 0.2% from a year ago.

By Primerica, Inc. · Via Business Wire · December 30, 2025

Primerica, Inc. (NYSE: PRI) today announced that its Board of Directors has authorized a $475 million share repurchase program to occur through December 31, 2026. Share repurchases may be made from time to time through open market transactions, block trades and/or privately negotiated transactions and are subject to market conditions, as well as corporate, regulatory, and other considerations.

By Primerica, Inc. · Via Business Wire · November 19, 2025

The road to financial recovery may be long, but middle-income families are proving resilient as they adapt to higher costs and redefine their financial goals, according to a new special report from Primerica, Inc. (NYSE: PRI), a leading provider of financial products and services to middle-income families. Titled “The Inflation Hangover: Middle-Income Americans Build Resilience on the Long Road to Recovery,” the report offers an in-depth look at how middle-income households are adapting to the long-term effects of inflation and the factors that are helping them regain financial stability.

By Primerica, Inc. · Via Business Wire · November 18, 2025

Primerica, Inc. (NYSE: PRI) reported financial results for the quarter ended September 30, 2025. Total revenues were $839.9 million, an increase of 8% from the third quarter of 2024. Net income of $206.8 million increased 6% when compared to net income from continuing operations in the prior year period, while net earnings per diluted share of $6.35 increased 11% compared to net earnings per diluted share from continuing operations in the prior year period.

By Primerica, Inc. · Via Business Wire · November 5, 2025

Primerica, Inc. (NYSE:PRI) announced today that it will hold a webcast on Thursday, November 6, 2025, at 10:00 a.m. (ET) to discuss the Company’s results for the quarter ended September 30, 2025, as well as other business-related matters, including future expectations. A news release announcing the quarter’s results will be distributed after the close of the market on Wednesday, November 5, 2025.

By Primerica, Inc. · Via Business Wire · October 15, 2025

Middle-income Americans’ financial outlook has weakened under the weight of higher costs, according to the latest Primerica U.S. Middle‑Income Financial Security Monitor™ (FSM™) survey. The results, marking the fifth anniversary of the poll, reveal a steady decline in savings, a striking rise in credit card debt and a notable decrease in confidence in being able to retire.

By Primerica, Inc. · Via Business Wire · October 15, 2025

Middle-income Canadians are signaling a strong preference for human financial guidance over artificial intelligence, according to the latest data from Primerica Canada’s Financial Security Monitor™ (FSM™) survey.

By Primerica, Inc. · Via Business Wire · September 8, 2025

The latest Primerica Household Budget Index™ (HBI™) data, a monthly economic metric that examines how inflation and wage trends impact the ability of middle-income families to afford life’s everyday necessities, was 100.1% in July, a 0.1% increase from a month ago and up 1.0% from a year ago.

By Primerica, Inc. · Via Business Wire · August 27, 2025

Primerica, Inc. (NYSE: PRI) announced financial results for the quarter ended June 30, 2025. The Company reported total revenue of $793.3 million, net income of $178.3 million and net earnings per diluted share of $5.40 during the second quarter of 2025. During the second quarter of 2024, the Company reported total revenue of $791.0 million, net income from continuing operations of $209.3 million and net earnings per diluted share from continuing operations of $6.07. The comparable financial results presented in continuing operations in the second quarter of 2024 were impacted by two distinct non-recurring items: a $50 million gain from the receipt of proceeds from a Representation and Warranty insurance policy claim and the recognition of an $11 million valuation allowance for acquired state net operating loss deferred tax assets.

By Primerica, Inc. · Via Business Wire · August 6, 2025

The latest Primerica Household Budget Index™ (HBI™) data, a monthly economic metric that examines how inflation and wage trends impact the ability of middle-income families to afford life’s everyday necessities, was 100.0% in June, a 0.1% decrease from a month ago and up 1.3% from a year ago. Purchasing power was relatively unchanged in June.

By Primerica, Inc. · Via Business Wire · July 30, 2025

Primerica, Inc. (NYSE:PRI) announced today that it will hold a webcast on Thursday, August 7, 2025, at 10:00 a.m. (ET) to discuss the Company’s results for the quarter ended June 30, 2025, as well as other business-related matters, including future expectations. A news release announcing the quarter’s results will be distributed after the close of the market on Wednesday, August 6, 2025.

By Primerica, Inc. · Via Business Wire · July 16, 2025

Middle‑income Americans are still adjusting to a higher cost of living and ongoing financial pressures, according to the latest Primerica® U.S. Middle‑Income Financial Security Monitor™ (FSM™). The survey finds that 65% of middle-income Americans believe their income has not kept pace with rising expenses — a sentiment that has remained remarkably consistent for more than four years, highlighting the challenges families feel as prices outpace paychecks.

By Primerica, Inc. · Via Business Wire · July 15, 2025

The latest Primerica Household Budget Index™ (HBI™) data, a monthly economic metric that examines how inflation and wage trends impact the ability of middle-income families to afford life’s everyday necessities, was 100.1% in May, a 0.4% increase from a month ago and up 1.5% from a year ago. Purchasing power improved slightly in May as the average earned income of middle-income households rose more than the increase in the cost of necessity items.

By Primerica, Inc. · Via Business Wire · June 25, 2025

The latest Primerica Household Budget Index™ (HBI™) data, a monthly economic metric that examines how inflation and wage trends impact the ability of middle-income families to afford life’s everyday necessities, was 99.6% in April, unchanged from a month ago and up 1.7% from a year ago. Purchasing power held steady as the average earned income of middle-income households rose enough to offset the increase in the cost of necessity goods in April.

By Primerica, Inc. · Via Business Wire · May 30, 2025

Primerica, Inc. (NYSE: PRI) reported financial results for the quarter ended March 31, 2025. Total revenues were $804.8 million, an increase of 9% from the first quarter of 2024. Net income of $169.1 million increased 14% when compared to net income from continuing operations in the prior year period, while net earnings per diluted share of $5.05 increased 19% compared to net earnings per diluted share from continuing operations in the prior year period.

By Primerica, Inc. · Via Business Wire · May 7, 2025

The latest Primerica Household Budget Index™ (HBI™), a monthly economic snapshot measuring the impact of inflation on middle-income households alongside their earned income, found the average purchasing power for necessities rose to 99.6% in March, a 0.2% increase from a month ago and up 1.3% from a year ago.

By Primerica, Inc. · Via Business Wire · April 30, 2025

Primerica, Inc. (NYSE:PRI) announced today that it will hold a webcast on Thursday, May 8, 2025, at 10:00 a.m. (ET) to discuss the Company’s results for the quarter ended March 31, 2025, as well as other business-related matters, including future expectations. A news release announcing the quarter’s results will be distributed after the close of the market on Wednesday, May 7, 2025.

By Primerica, Inc. · Via Business Wire · April 16, 2025

Inflation continues to be the top concern of middle-income Americans, according to Primerica’s latest Financial Security Monitor™ (FSM™), with 62% reporting stress over finances, up from 57% during the fourth quarter of 2024. Forty-six percent (46%) expect to be worse off financially in the next year, up from 27% in December 2024.

By Primerica, Inc. · Via Business Wire · April 10, 2025

The latest Primerica Household Budget Index™ (HBI™), a monthly economic snapshot measuring the impact of inflation on middle-income households alongside their earned income, found the average purchasing power for necessities fell to 99.4% in February, a 0.3% decrease from a month ago but a 0.4% increase from a year ago. For households earning an annual income of around $60,000, the increase in necessity goods prices in February cost them about $110 more in total than in January. Uncertainty among middle-income households is being driven in part by the volatility in the cost of household necessities.

By Primerica, Inc. · Via Business Wire · March 26, 2025

The latest Primerica Household Budget Index™ (HBI™), a monthly economic snapshot measuring the impact of inflation on middle-income households alongside their wages, found the average purchasing power for necessities fell to 99.7% in January, a 0.6% decrease from a month ago but a 0.3% increase from a year ago.

By Primerica, Inc. · Via Business Wire · February 26, 2025

Primerica, Inc. (NYSE: PRI) today announced financial results for the quarter ended December 31, 2024. Total revenues of $788.1 million increased 12% compared to the fourth quarter of 2023. Net income from continuing operations of $167.7 million increased 9% while net earnings per diluted share from continuing operations of $4.98 increased 14% compared to the prior year period.

By Primerica, Inc. · Via Business Wire · February 11, 2025

Middle-income Americans remain concerned about inflation and the high cost of living, with many saying their income is not keeping pace, according to Primerica’s latest Financial Security Monitor™ (FSM™). While some respondents express signs of cautious optimism, the lingering effects of inflation continue to shape how middle-income families manage their money and plan for the future.

By Primerica, Inc. · Via Business Wire · January 31, 2025

Primerica, Inc. (NYSE:PRI) announced today that it will hold a webcast on Wednesday, February 12, 2025, at 10:00 a.m. ET to discuss the Company’s results for the quarter ended December 31, 2024, as well as other business-related matters, including future expectations. A news release announcing the quarter’s results will be distributed after the close of the market on Tuesday, February 11, 2025.

By Primerica, Inc. · Via Business Wire · January 28, 2025

Primerica, Inc. (NYSE: PRI), a leading provider of financial products and services in the United States and Canada, will kick off the new year with over 900 of its top field leaders meeting in Dallas, Texas on January 7-8, 2025. Along with discussing company-wide initiatives for 2025, the annual leadership meeting will celebrate 2024 milestones and discuss opportunities for the year ahead.

By Primerica, Inc. · Via Business Wire · January 3, 2025

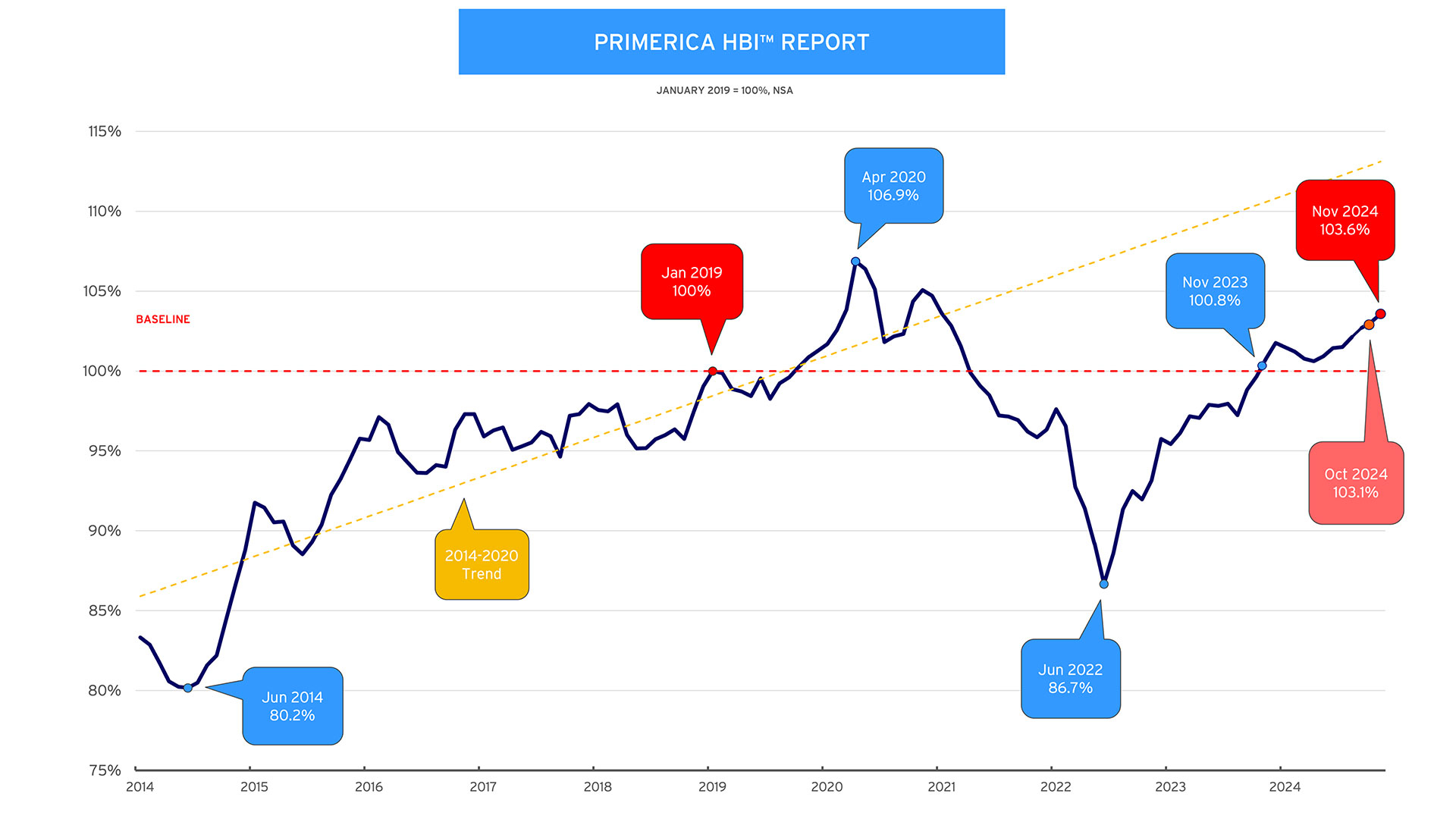

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with income between $30,000 and $130,000. In November 2024, the average purchasing power for middle-income families was 103.6%, up from 103.1% in October 2024. This marks the seventh consecutive month purchasing power rose for middle-income families. Spending power is at its highest level since January 2021 and is up 2.8% from a year ago. The recent recovery is driven primarily by gas prices continuing to fall in November while the cost of other necessity goods remained steady.

By Primerica, Inc. · Via Business Wire · December 30, 2024

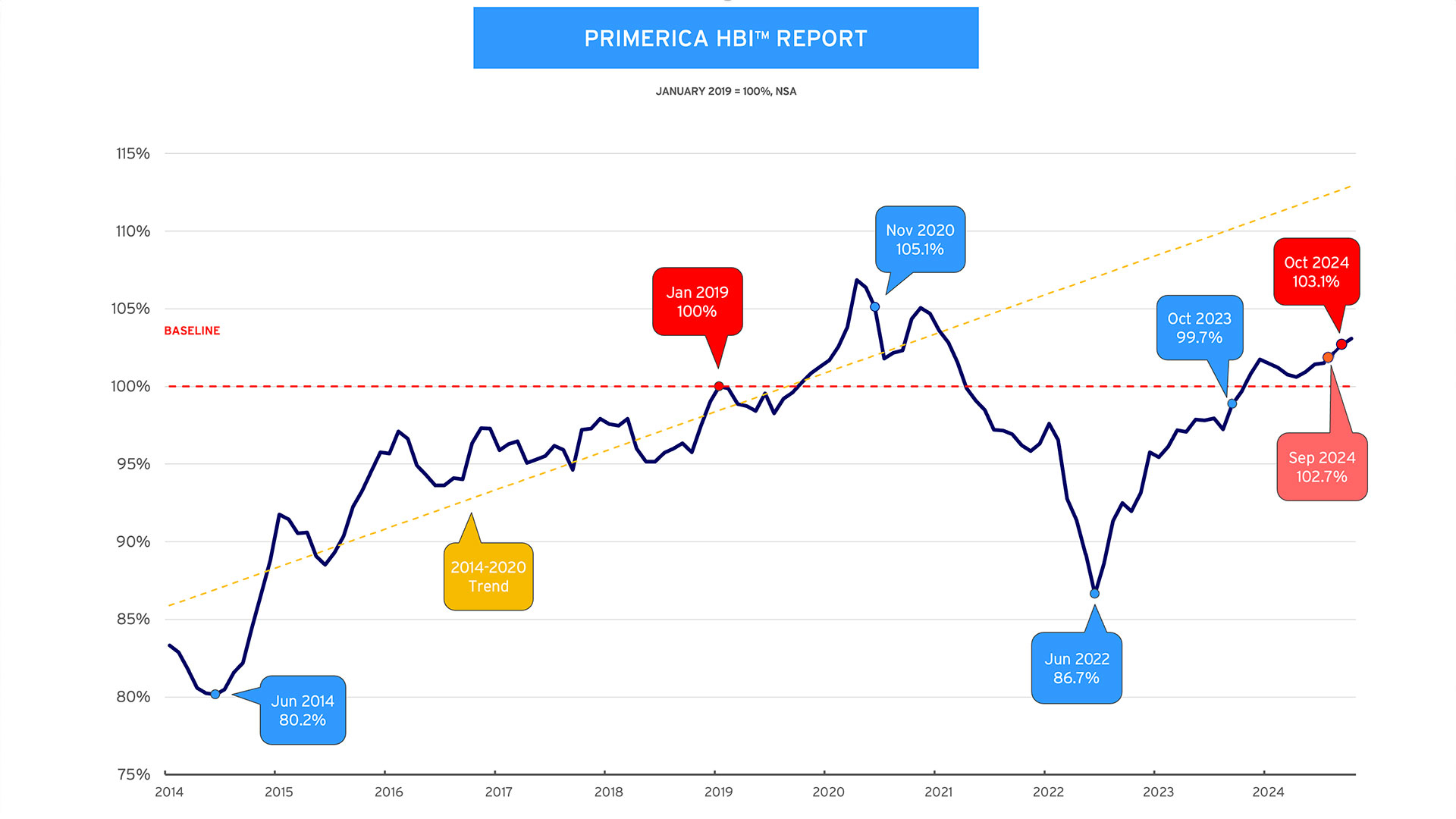

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with income between $30,000 and $130,000. In October 2024, the average purchasing power for middle-income families was 103.1%, up from 102.7% in September 2024. This marks the sixth consecutive month purchasing power rose for middle-income families. Spending power is at its highest level since January 2021 and is up 3.4% from a year ago. The recent recovery is driven primarily by gas prices continuing to fall in October.

By Primerica, Inc. · Via Business Wire · November 26, 2024

PFSL Fund Management Ltd. (PFSL) announced today that it has changed the risk rating for Primerica Income Fund (the Fund) from "low" to "low to medium”. The change is a result of the risk rating methodology mandated by the Canadian Securities Administrators and the periodic review by PFSL to determine the risk level of its publicly-offered mutual funds. No material changes have been made to the investment objective, strategies or management of the Fund as a result. The change of the risk rating will be reflected in the Fund’s offering documents, which will be completed in accordance with applicable securities laws.

By Primerica, Inc. · Via Business Wire · November 15, 2024

After reporting solid third quarter results, Primerica, Inc. (NYSE: PRI) today announced that its Board of Directors has authorized a $450 million share repurchase program to occur through December 31, 2025. Share repurchases may be made from time to time through open market transactions, block trades and/or privately negotiated transactions and are subject to market conditions, as well as corporate, regulatory, and other considerations.

By Primerica, Inc. · Via Business Wire · November 14, 2024

Primerica, Inc. (NYSE: PRI) today announced financial results for the quarter ended September 30, 2024. Total revenues of $774.1 million, increased 11% compared to the third quarter of 2023. Net income from continuing operations of $194.7 million increased 24%, while net earnings per diluted share from continuing operations of $5.72 increased 31% compared to the prior year period.

By Primerica, Inc. · Via Business Wire · November 6, 2024

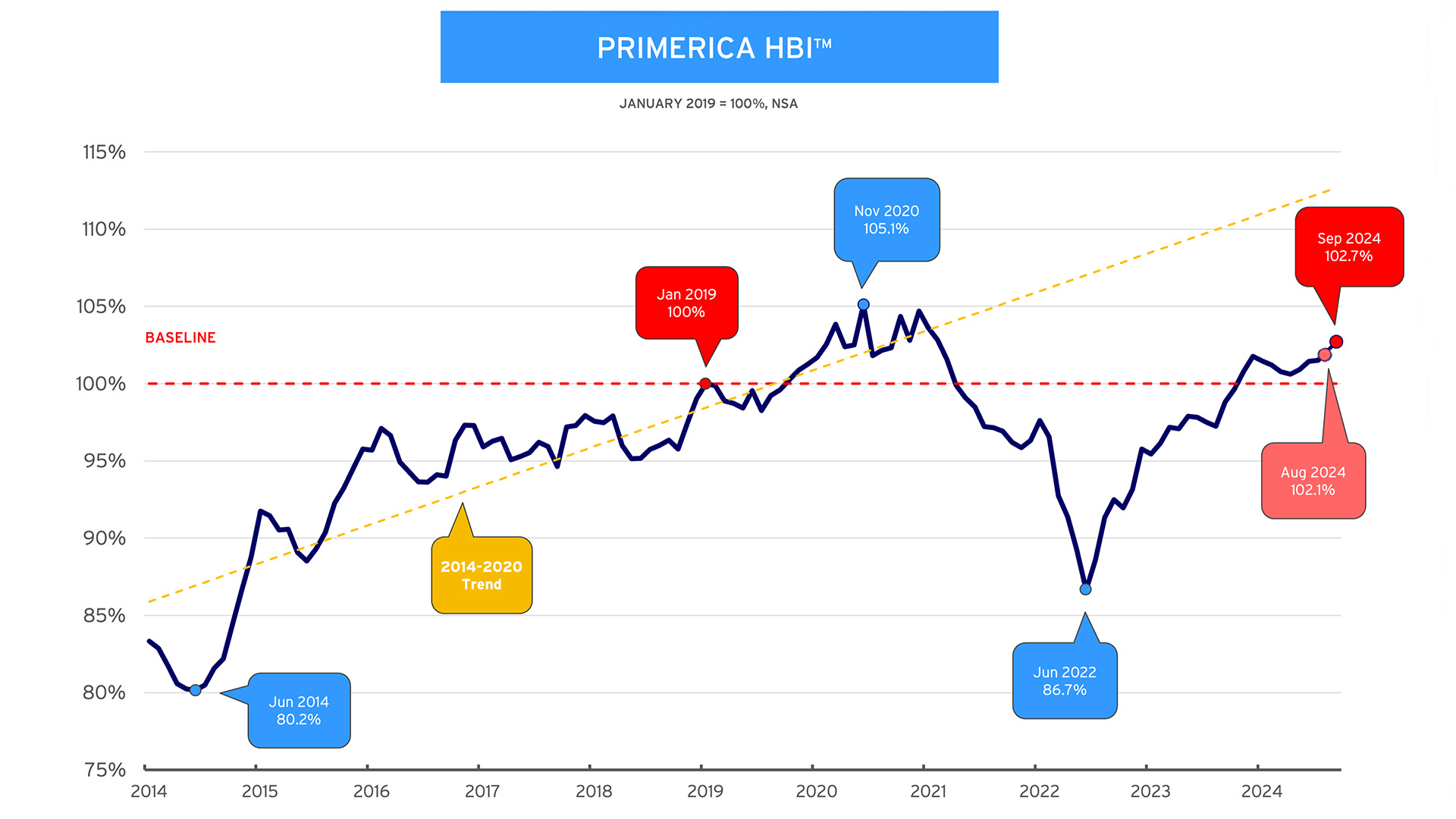

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with income between $30,000 and $130,000. In September 2024, the average purchasing power for middle-income families was 102.7%, up from 102.1% in August 2024. This marks the fifth consecutive month purchasing power rose for middle-income families. The sharp decline in gas prices was the primary driver for the modest improvements in spending power in September.

By Primerica, Inc. · Via Business Wire · October 31, 2024

Primerica, Inc. (NYSE:PRI) announced today that it will hold a webcast on Thursday, November 7, 2024, at 10:00 a.m. Eastern time to discuss the Company’s results for the quarter ended September 30, 2024, as well as other business-related matters, including future expectations. A news release announcing the quarter’s results will be distributed after the close of the market on Wednesday, November 6, 2024.

By Primerica, Inc. · Via Business Wire · October 23, 2024

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, released its Financial Security Monitor™ (FSM™) survey for the third quarter of 2024, revealing that a majority of middle-income Americans are feeling increasingly pessimistic about their personal finances, the economic health of their communities and their ability to save for the future.

By Primerica, Inc. · Via Business Wire · October 9, 2024

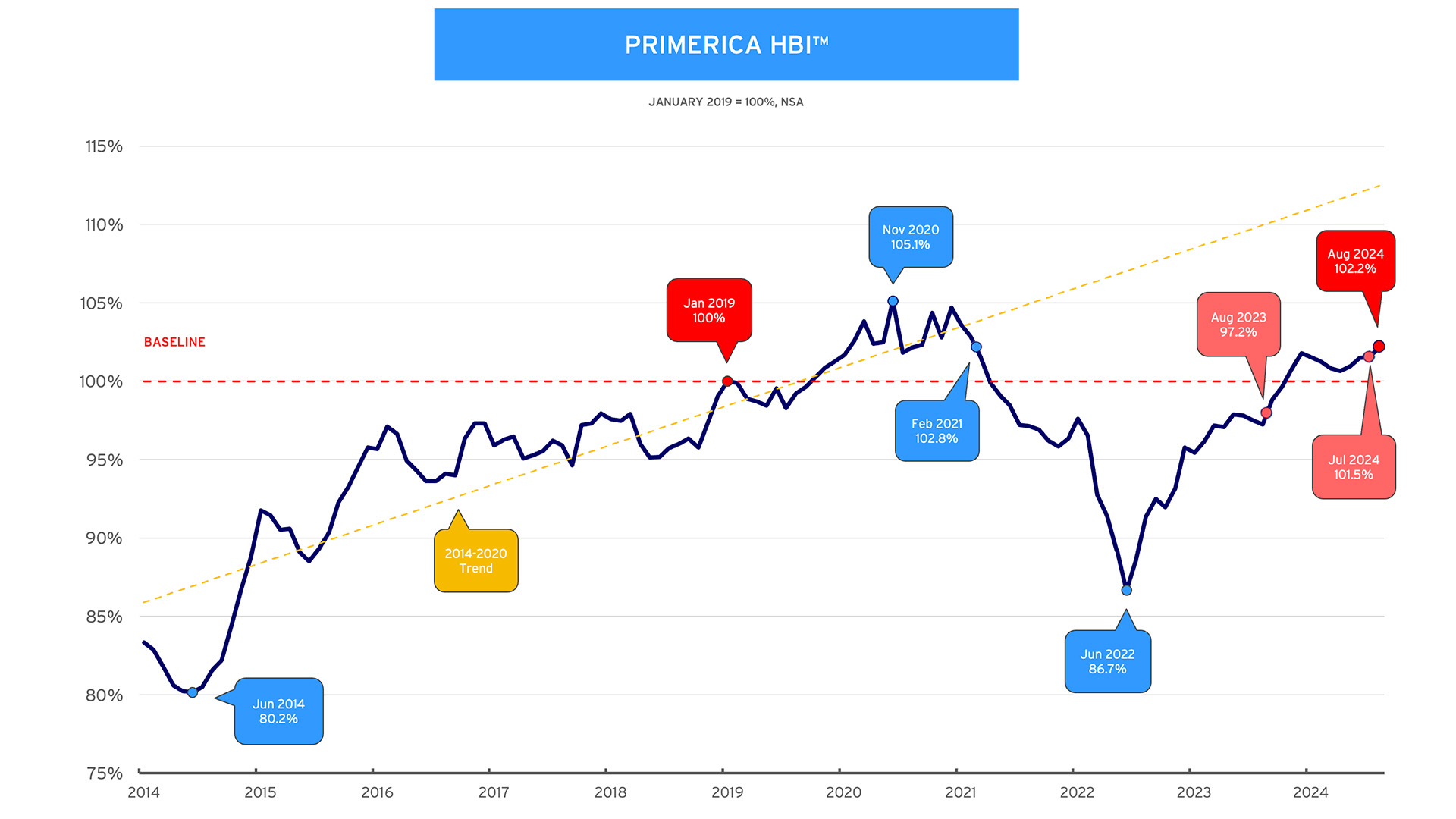

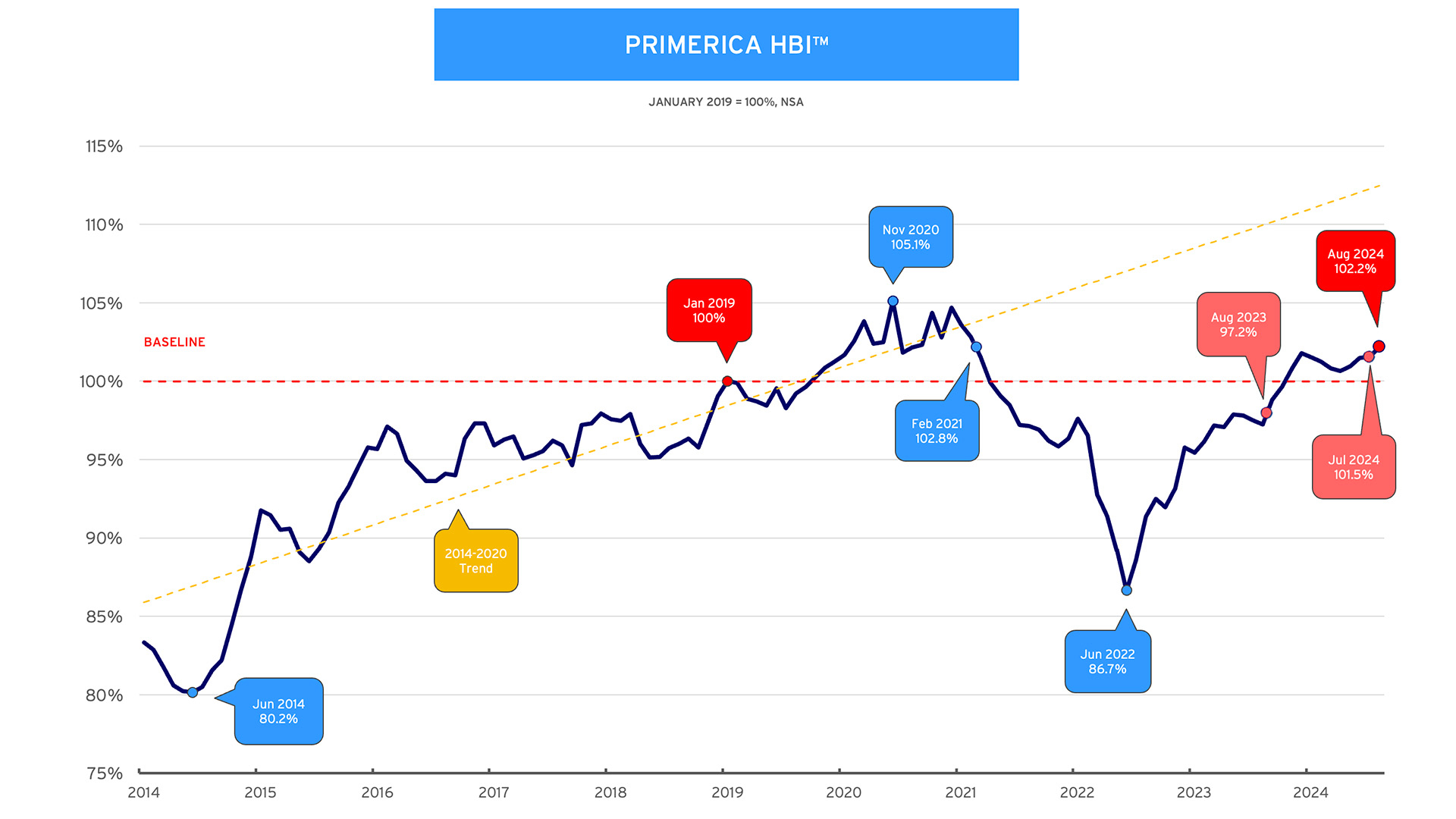

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with income between $30,000 and $130,000. In August 2024, the average purchasing power for middle-income families was 102.2%, up from 101.5% in July 2024. Spending power reached its highest level since February 2021 in August and was 5% higher than a year ago, when the index stood at 97.2%. Middle-income households benefited from falling gas and utilities prices along with steady food prices.

By Primerica, Inc. · Via Business Wire · September 30, 2024

Primerica, Inc. (NYSE:PRI), a leading provider of financial services and products to middle-income families in the United States and Canada, today announced the appointment of Robert H. Peterman Jr. to the role of Executive Vice President and Chief Operating Officer, reporting to the company’s Chief Executive Officer, Glenn Williams, beginning on October 1, 2024. Gregory C. Pitts, the Company’s current Executive Vice President and Chief Operating Officer, informed the Company of his intention to retire after forty years of service on or about April 1, 2025, and he will relinquish the Chief Operating Officer title effective October 1, 2024.

By Primerica, Inc. · Via Business Wire · September 24, 2024

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, released its report on Empowering Middle-Income Women’s Financial Decisions: Navigating Confidence, Opportunity and Representation in the Financial Services Industry.

By Primerica, Inc. · Via Business Wire · September 3, 2024

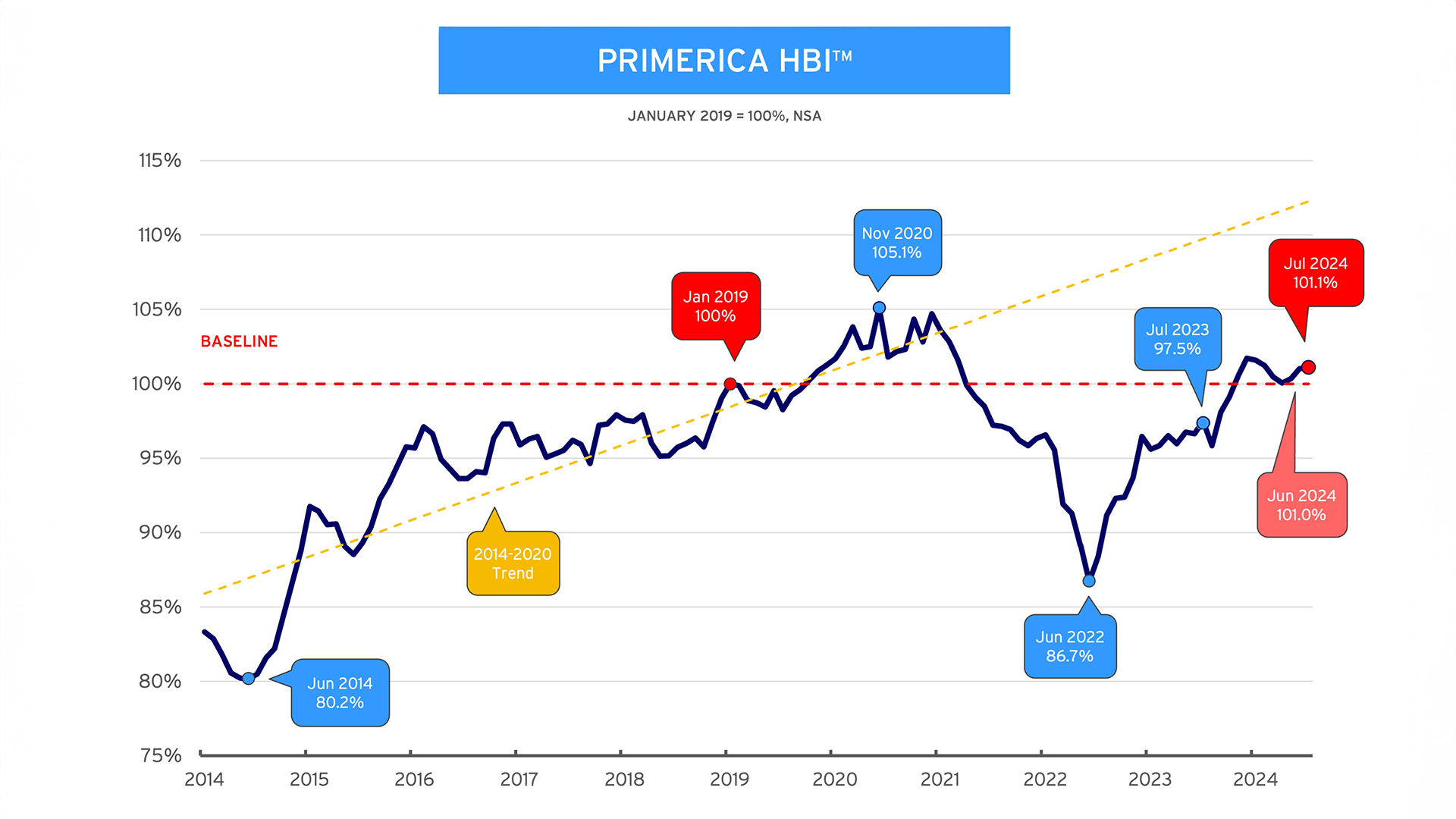

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with income between $30,000 and $130,000. In July 2024, the average purchasing power for middle-income households was 101.1%, relatively unchanged compared to 101.0% in June 2024. A year ago, the index stood at 97.5%.

By Primerica, Inc. · Via Business Wire · August 28, 2024

Primerica, Inc. (NYSE: PRI) today announced financial results for the quarter ended June 30, 2024. The Company’s previously announced decision to exit the Senior Health business and associated write-offs of non-cash items impacted GAAP earnings with net income ending at $1.2 million, or $0.03 per diluted share. Core business results from the quarter were strong. Adjusted net operating income of $162.7 million increased 12%, while adjusted operating earnings per diluted share of $4.71 grew 18% year-over-year. Total revenue of $803.4 million, which included $50 million in proceeds from payments under an insurance claim, increased 17% compared to the second quarter of 2023. Adjusted operating revenue of $753.3 million increased 9% year-over-year.

By Primerica, Inc. · Via Business Wire · August 7, 2024

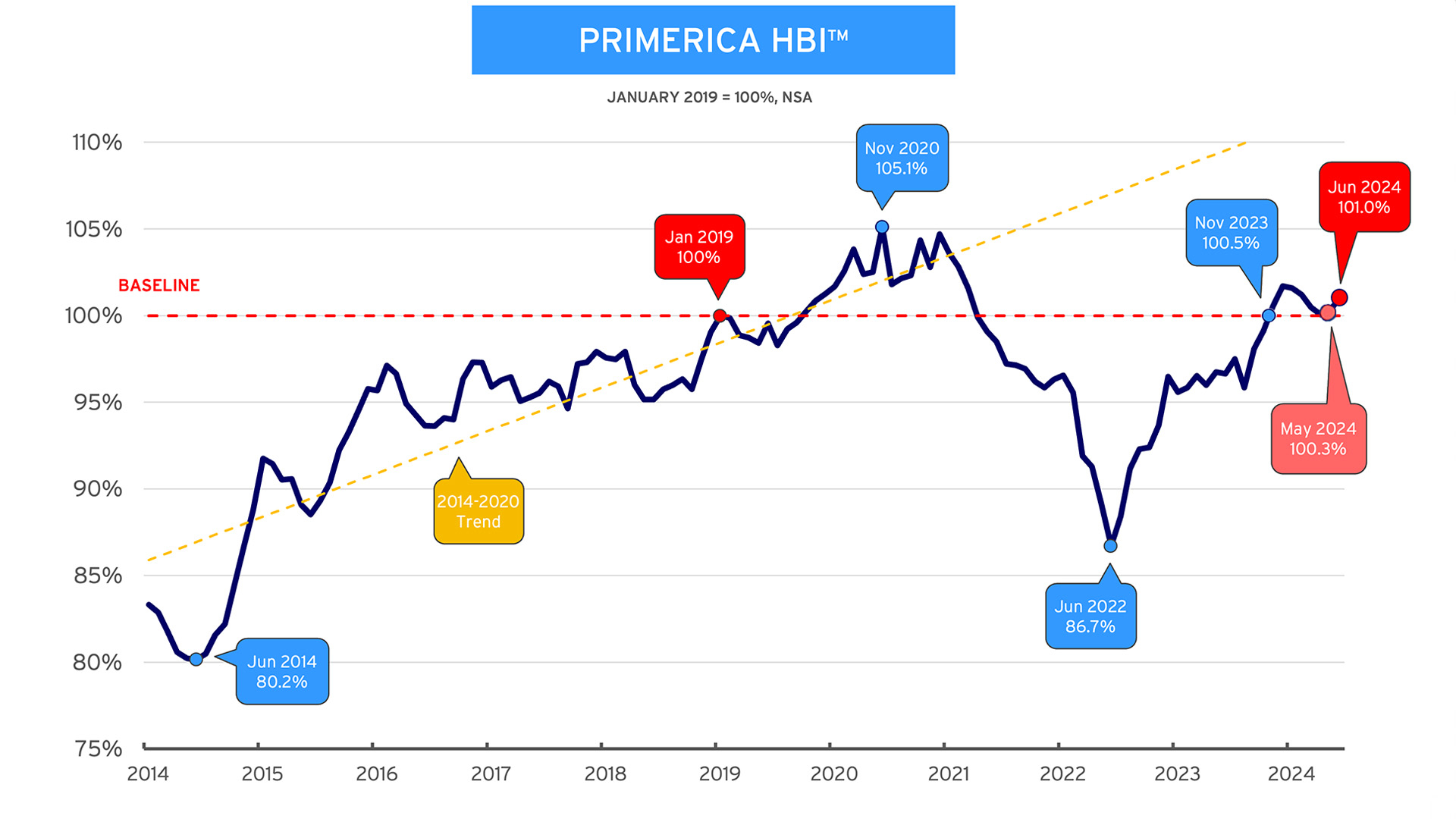

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with income between $30,000 and $130,000. In June 2024, the average purchasing power for middle-income households was 101.0%, up from 100.3% in May 2024. This marks the second consecutive month purchasing power rose for middle-income families. Declining gas and food prices while incomes continue to rise are the primary drivers for the modest improvements in spending power.

By Primerica, Inc. · Via Business Wire · July 31, 2024

Primerica, Inc. (NYSE:PRI) announced today that it will hold a webcast on Thursday, August 8, 2024, at 10:00 a.m. Eastern time to discuss the Company’s results for the quarter ended June 30, 2024, as well as other business-related matters, including future expectations. A news release announcing the quarter’s results will be distributed after the close of the market on Wednesday, August 7, 2024.

By Primerica, Inc. · Via Business Wire · July 24, 2024

Primerica, Inc. (NYSE:PRI) announced today that after carefully considering various options, the Board of Directors has opted to exit its senior health business by relinquishing ownership of e-TeleQuote Insurance, Inc. (e-TeleQuote). The senior health subsidiary, acquired in July 2021, does not have a clear path toward anticipated profitability within an acceptable timeframe in the increasingly challenging senior health distribution market. Further, the industry is facing an uncertain regulatory environment that could adversely impact the business.

By Primerica, Inc. · Via Business Wire · July 16, 2024

The 2024 Primerica International Convention, Atlanta’s largest corporate meeting with attendees from across the U.S. and Canada, returns to the city starting today through July 13. The event, hosted by Primerica, Inc. a leading provider of financial services and products, is estimated to draw as many as 40,000 members of its sales force with a projected economic impact of $46 million on the local economy.

By Primerica, Inc. · Via Business Wire · July 10, 2024

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, released its Financial Security Monitor™ (FSM™) survey for the second quarter of 2024. This national survey sheds light on the sentiments of consumers regarding their economic stability during this quarter finding that even amid reports of an improving economy they are not feeling the effects in their pocketbooks. Two-thirds of middle-income families reported they are falling behind the cost of living.

By Primerica, Inc. · Via Business Wire · June 27, 2024

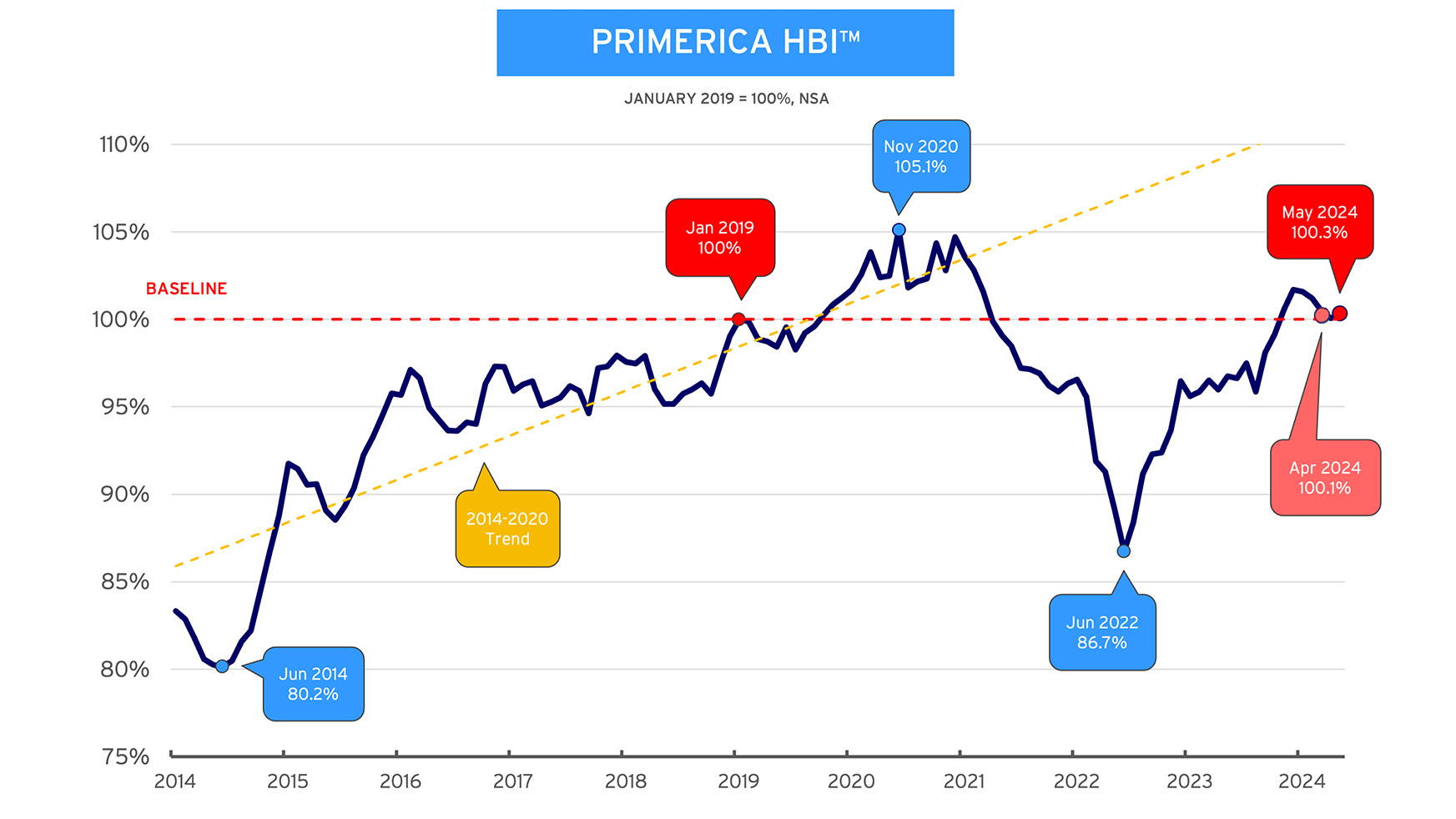

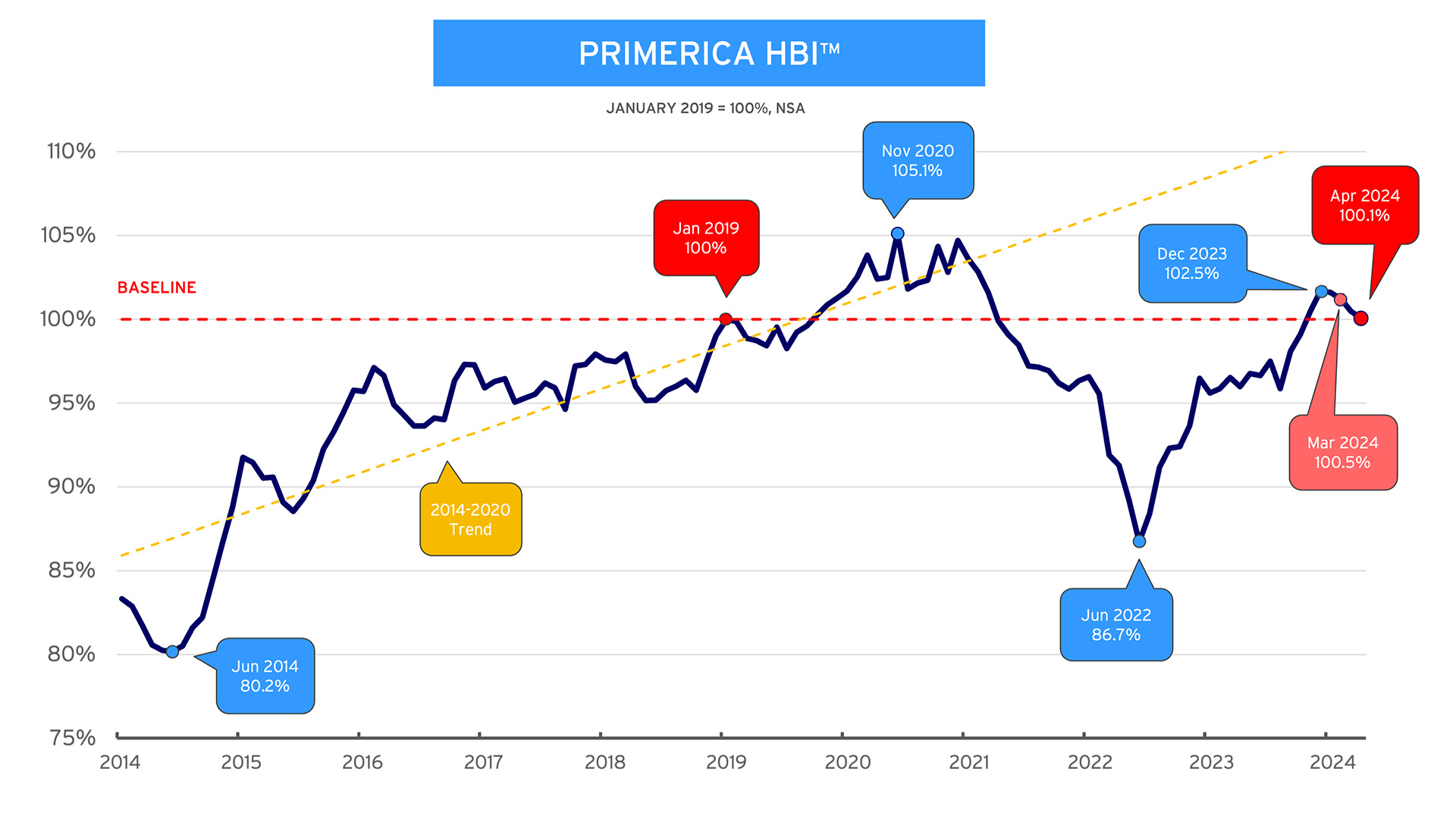

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with income between $30,000 and $130,000. In April 2024, the average purchasing power for middle-income households was 100.1%, down from 100.5% in March 2024. This marks the fourth month in a row that the index has declined from its recent high of 102.5% set in December 2023. The primary driver for the decline is the sharp rise in gas prices, which increased 12% cumulatively over the past two months.

By Primerica, Inc. · Via Business Wire · May 30, 2024

Primerica, Inc. (NYSE: PRI) today announced financial results for the quarter ended March 31, 2024. Total revenues of $742.8 million increased 8% compared to the first quarter of 2023. Net income of $137.9 million increased 8%, while earnings per diluted share of $3.93 increased 14% compared to the prior year period.

By Primerica, Inc. · Via Business Wire · May 6, 2024

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with income between $30,000 and $130,000. In March 2024, the average purchasing power for middle-income households was 100.5%, down from 101.2% in February 2024. This marks the third month in a row that the index has declined from its recent high of 102.5% set in December 2023.

By Primerica, Inc. · Via Business Wire · April 30, 2024

Primerica, Inc. (NYSE:PRI) announced today that it will hold a webcast on Tuesday, May 7, 2024, at 10:00 a.m. Eastern time to discuss the Company’s results for the quarter ended March 31, 2024, as well as other business-related matters, including future expectations. A news release announcing the quarter’s results will be distributed after the close of the market on Monday, May 6, 2024.

By Primerica, Inc. · Via Business Wire · April 22, 2024

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, today issued a statement in response to a blogger who published a misleading opinion about Primerica with the intent to drive down its stock price.

By Primerica, Inc. · Via Business Wire · April 18, 2024

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, released its Financial Security Monitor™ (FSM™) survey for the first quarter of 2024, revealing two-thirds (66%) of middle-income Americans feel their education did not adequately prepare them to manage their finances as adults, with a notable discrepancy across age groups.

By Primerica, Inc. · Via Business Wire · April 9, 2024

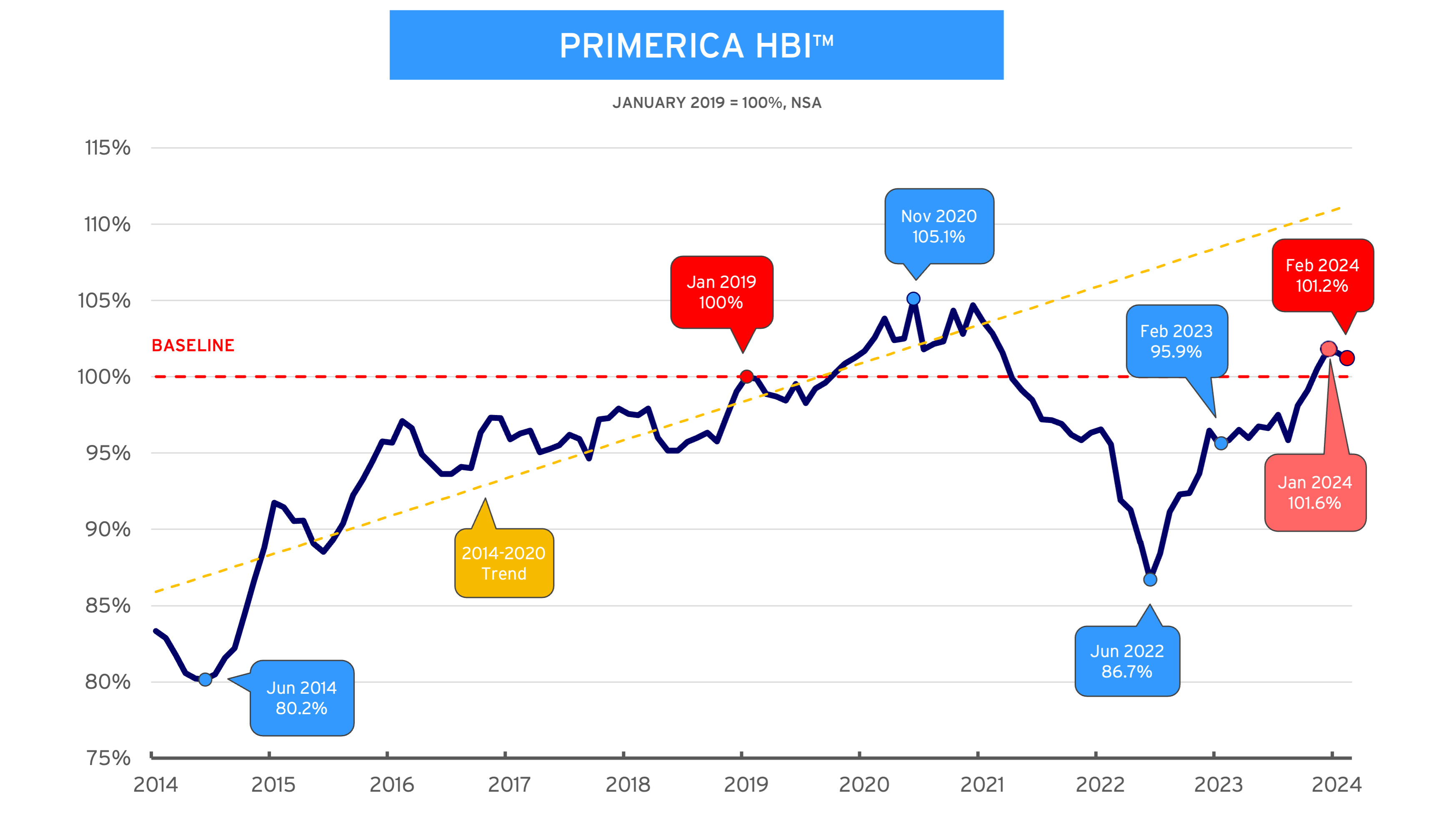

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with income between $30,000 and $130,000. In February 2024, the average purchasing power for middle-income households was 101.2%, slightly down from 101.6% in January 2024. The fast rise in gas prices, a 4.3% increase since the beginning of the year, impacted purchasing power for middle-income families in February. A year ago, the index stood at 95.9%.

By Primerica, Inc. · Via Business Wire · March 27, 2024

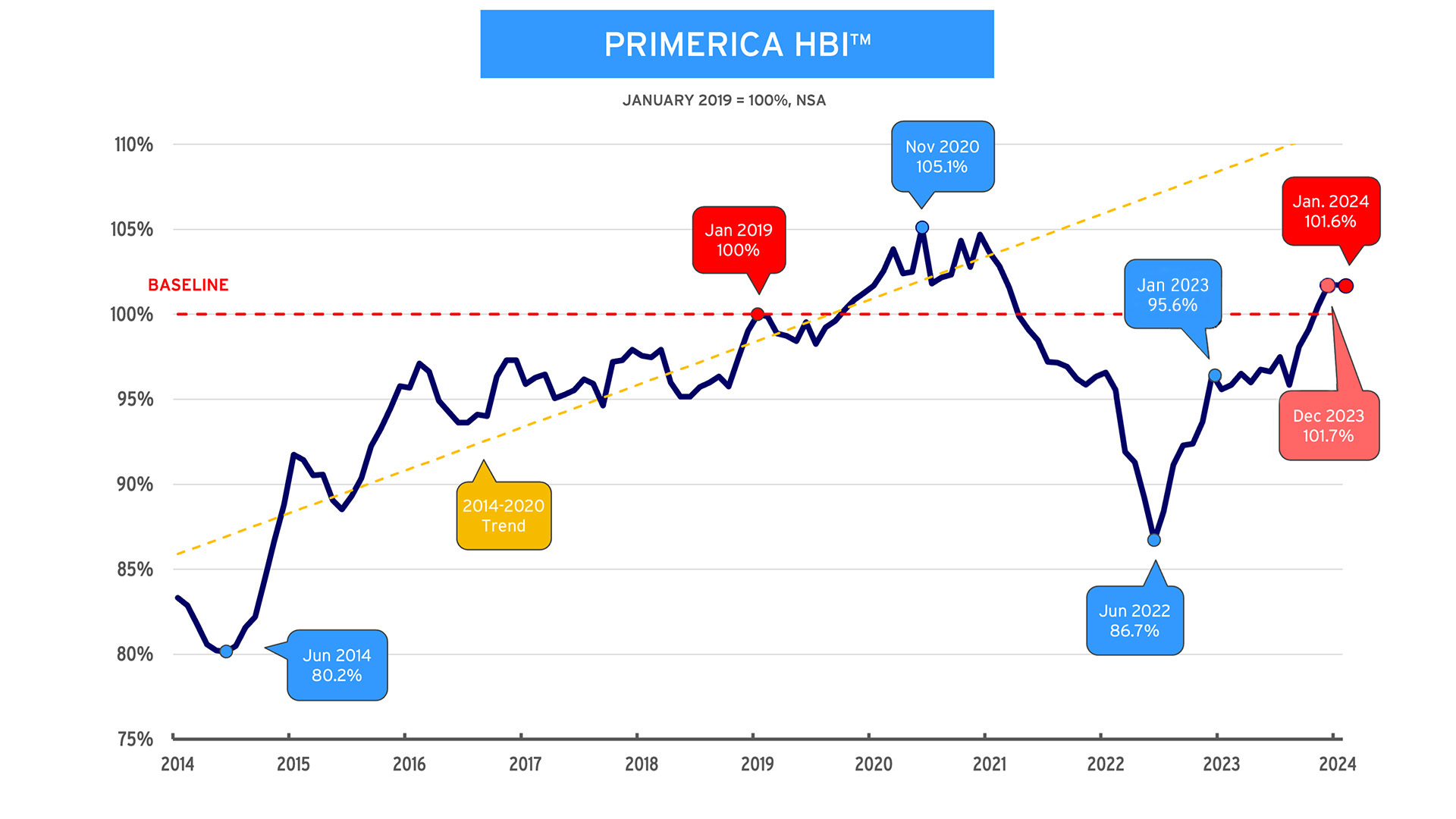

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with income between $30,000 and $130,000. In January 2024, the average purchasing power for middle-income households was 101.6%, relatively unchanged compared to 101.7% in December 2023. A year ago, the index stood at 95.6%.

By Primerica, Inc. · Via Business Wire · February 29, 2024

Primerica, Inc. (NYSE: PRI) today announced financial results for the quarter ended December 31, 2023. Total revenues of $726.3 million increased 6% compared to the fourth quarter of 2022. Net income of $151.9 million increased 4%, while earnings per diluted share of $4.30 increased 9% compared to the prior year period.

By Primerica, Inc. · Via Business Wire · February 13, 2024

Primerica, Inc. (NYSE:PRI) announced today that the Board of Directors has approved a 15% increase in stockholder dividend for the first quarter of 2024 to $0.75 per share. The dividend is payable on March 12, 2024, to stockholders of record on February 21, 2024.

By Primerica, Inc. · Via Business Wire · February 8, 2024

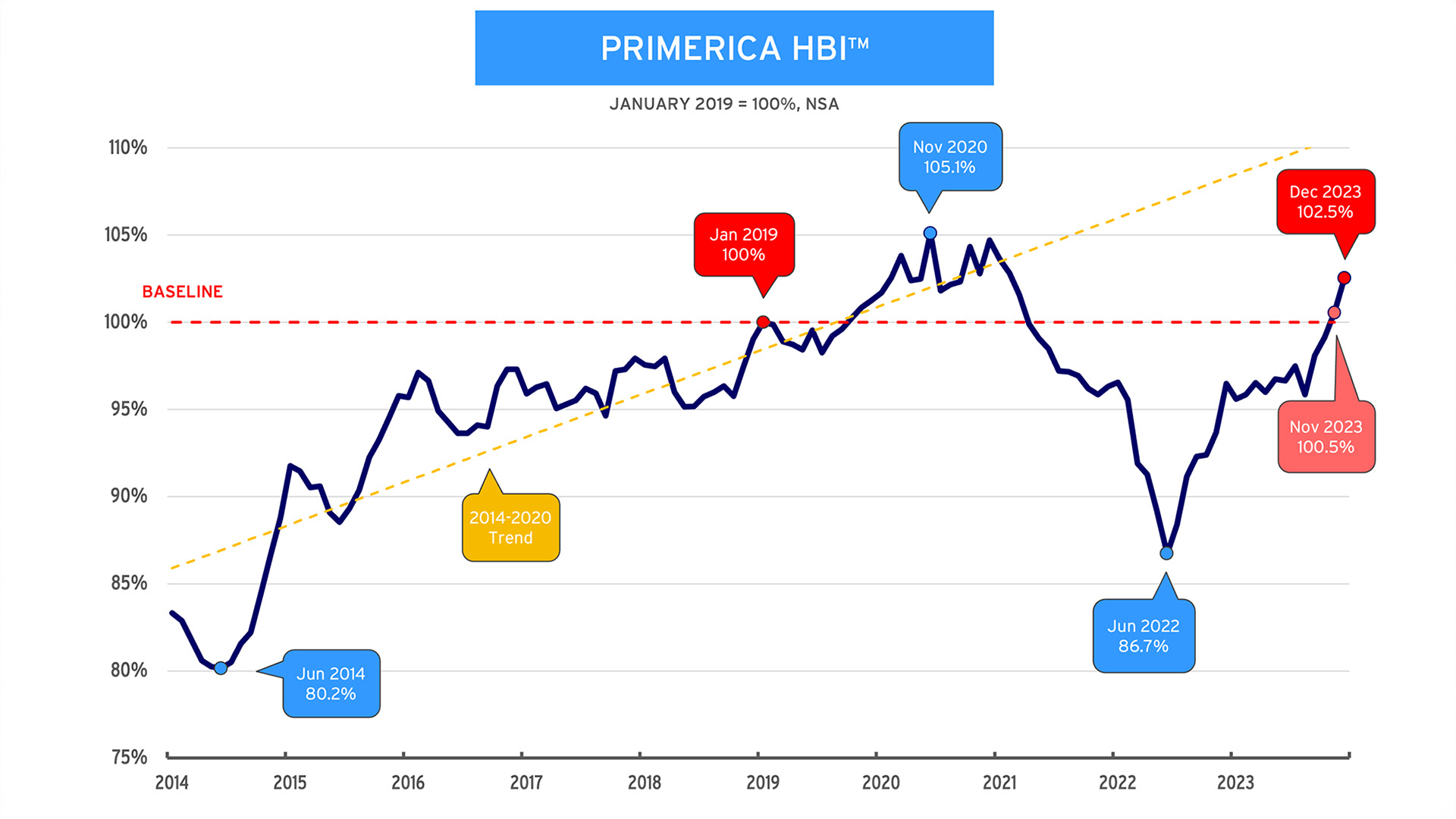

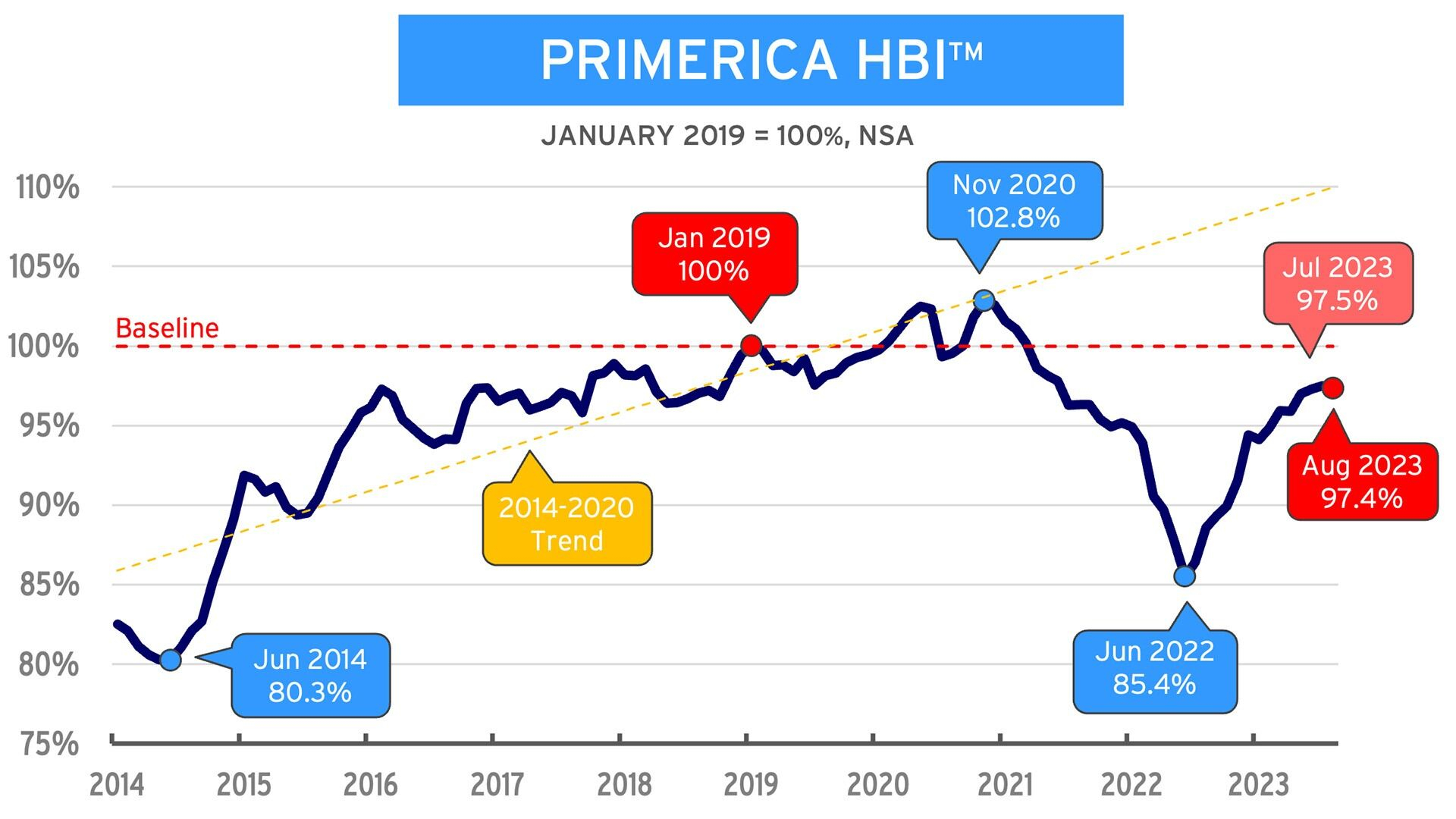

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, released its Financial Security Monitor™ (FSM™) survey for the fourth quarter of 2023 showing middle-income Americans evenly split on the outlook for their personal finances. The FSM™ coincides with the simultaneous release of Primerica’s Household Budget Index™ (HBI™), which indicates middle-income households saw gains in purchasing power that outpaced inflation at levels not seen since February 2022 having reached 102.5% in December, up from 100.5% in November and 96.5% the same time a year ago.

By Primerica, Inc. · Via Business Wire · January 31, 2024

Primerica, Inc. (NYSE:PRI) announced today that it will hold a webcast on Wednesday, February 14, 2024, at 10:00 a.m. Eastern time to discuss the Company’s results for the quarter ended December 31, 2023, as well as other business-related matters, including future expectations. A news release announcing the quarter’s results will be distributed after the close of the market on Tuesday, February 13, 2024.

By Primerica, Inc. · Via Business Wire · January 30, 2024

Primerica, Inc. (NYSE: PRI), a leading provider of financial products and services in the United States and Canada, will kick off the new year with over 800 of its top field leaders meeting in Dallas, Texas on January 4-5, 2024. Along with discussing company-wide initiatives for 2024, the annual leadership meeting will celebrate 2023 milestones and discuss opportunities ahead for the year.

By Primerica, Inc. · Via Business Wire · January 4, 2024

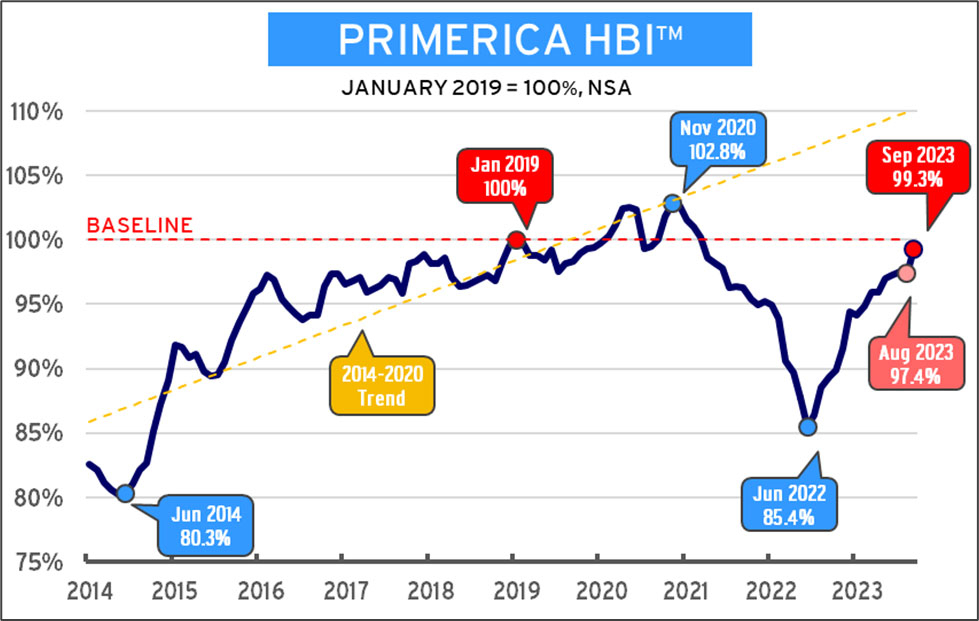

Primerica, Inc. (NYSE: PRI), a leading provider of financial services in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with incomes between $30,000 and $130,000. In November 2023, the average purchasing power for middle-income households was 100.5%, up from 99.1% in October. A year ago, the index stood at 93.7%.

By Primerica, Inc. · Via Business Wire · December 29, 2023

Primerica, Inc. (NYSE:PRI), a leading provider of financial products and services to middle-income families in the United States and Canada, today announced the promotion of Tracy Tan, Executive Vice President of Finance, to the position of Chief Financial Officer, effective December 20, 2023. It was previously announced that Ms. Tan would be the successor to the Company’s Chief Financial Officer, Alison Rand, no later than April 1, 2024. As the Chief Financial Officer, Ms. Tan has been appointed as the Company’s principal financial officer, effective December 20, 2023.

By Primerica, Inc. · Via Business Wire · December 18, 2023

Primerica, Inc. (NYSE: PRI), a leading provider of financial services in the United States and Canada, released a special report titled, “Perception vs. Reality: Examining Middle-Income Households’ Financial Outlook Heading into 2024.”

By Primerica, Inc. · Via Business Wire · December 12, 2023

Primerica, Inc. (NYSE:PRI) today announced the election of Darryl L. Wilson to fill the vacancy in the Company’s Board of Directors. His term will begin on February 17, 2024.

By Primerica, Inc. · Via Business Wire · December 6, 2023

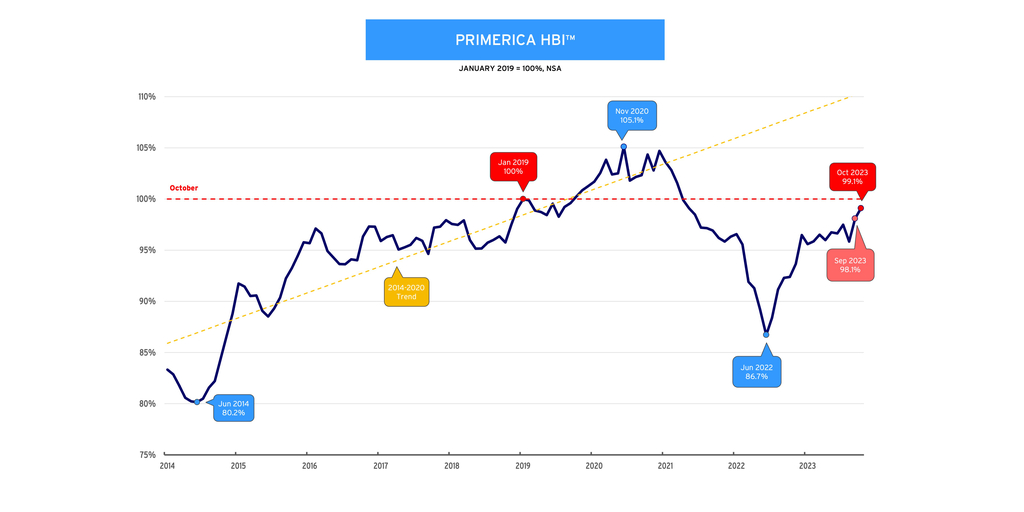

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with incomes between $30,000 and $130,000. In October 2023, the average purchasing power for middle-income households was 99.1%, up from 98.1% in September. A year ago, the index stood at 92.4%.

By Primerica, Inc. · Via Business Wire · November 30, 2023

After reporting solid third quarter results, Primerica, Inc. (NYSE: PRI) today announced that its Board of Directors has authorized a $425 million share repurchase program to occur through December 31, 2024. Share repurchases may be made from time to time through open market transactions, block trades and/or privately negotiated transactions and are subject to market conditions, as well as corporate, regulatory, and other considerations.

By Primerica, Inc. · Via Business Wire · November 16, 2023

Primerica, Inc. (NYSE: PRI) today announced financial results for the quarter ended September 30, 2023. Total revenues of $710.9 million increased 6% compared to the third quarter of 2022. Net income of $152.1 million increased 91%, while earnings per diluted share of $4.23 doubled compared to the same period in the prior year. The prior year period results included a non-cash goodwill impairment charge of $60.0 million, or $1.59 per diluted share. ROE was 28.1% for the current period.

By Primerica, Inc. · Via Business Wire · November 7, 2023

Primerica, Inc. (NYSE: PRI), a leading provider of financial services in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with incomes between $30,000 and $130,000. In September 2023, the average purchasing power for middle-income households was 99.3%, up from 97.4% in August. In September 2022, the index stood at 89.3%.

By Primerica, Inc. · Via Business Wire · October 30, 2023

Primerica, Inc. (NYSE:PRI) announced today that it will hold a webcast on Wednesday, November 8, 2023, at 10:00 a.m. Eastern time to discuss the Company’s results for the quarter ended September 30, 2023, as well as other business-related matters, including future expectations. A news release announcing the quarter’s results will be distributed after the close of the market on Tuesday, November 7, 2023.

By Primerica, Inc. · Via Business Wire · October 24, 2023

Primerica, Inc. (NYSE: PRI), a leading provider of financial services in the United States and Canada, released the Middle-Income Financial Security Monitor™ (FSM™) for the third quarter of 2023 — a national survey that measures changes in the sentiments of middle-income families in the U.S. about their finances.

By Primerica, Inc. · Via Business Wire · October 12, 2023

Primerica, Inc. (NYSE: PRI), a leading provider of financial services in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of U.S. middle-income households with incomes between $30,000 and $130,000. In August 2023, the average purchasing power for U.S. middle-income households was 97.4%, down from 97.5% in July 2023. A year ago, in August 2022, the index stood at 88.6%. The slight decrease this month shows that middle-income budgets are still stressed and saving for the future, while eliminating debt remains a challenge.

By Primerica, Inc. · Via Business Wire · September 28, 2023

Primerica, Inc. (NYSE:PRI), a leading provider of financial services to middle-income families in the United States and Canada, today announced the appointment of Tracy Tan to the role of Executive Vice President, Finance reporting to the company’s Chief Executive Officer, Glenn Williams beginning on October 16, 2023. Tan will assume the role of Chief Financial Officer as of the date that the Company’s existing Chief Financial Officer relinquishes that title, which shall occur no later than April 1, 2024.

By Primerica, Inc. · Via Business Wire · September 14, 2023

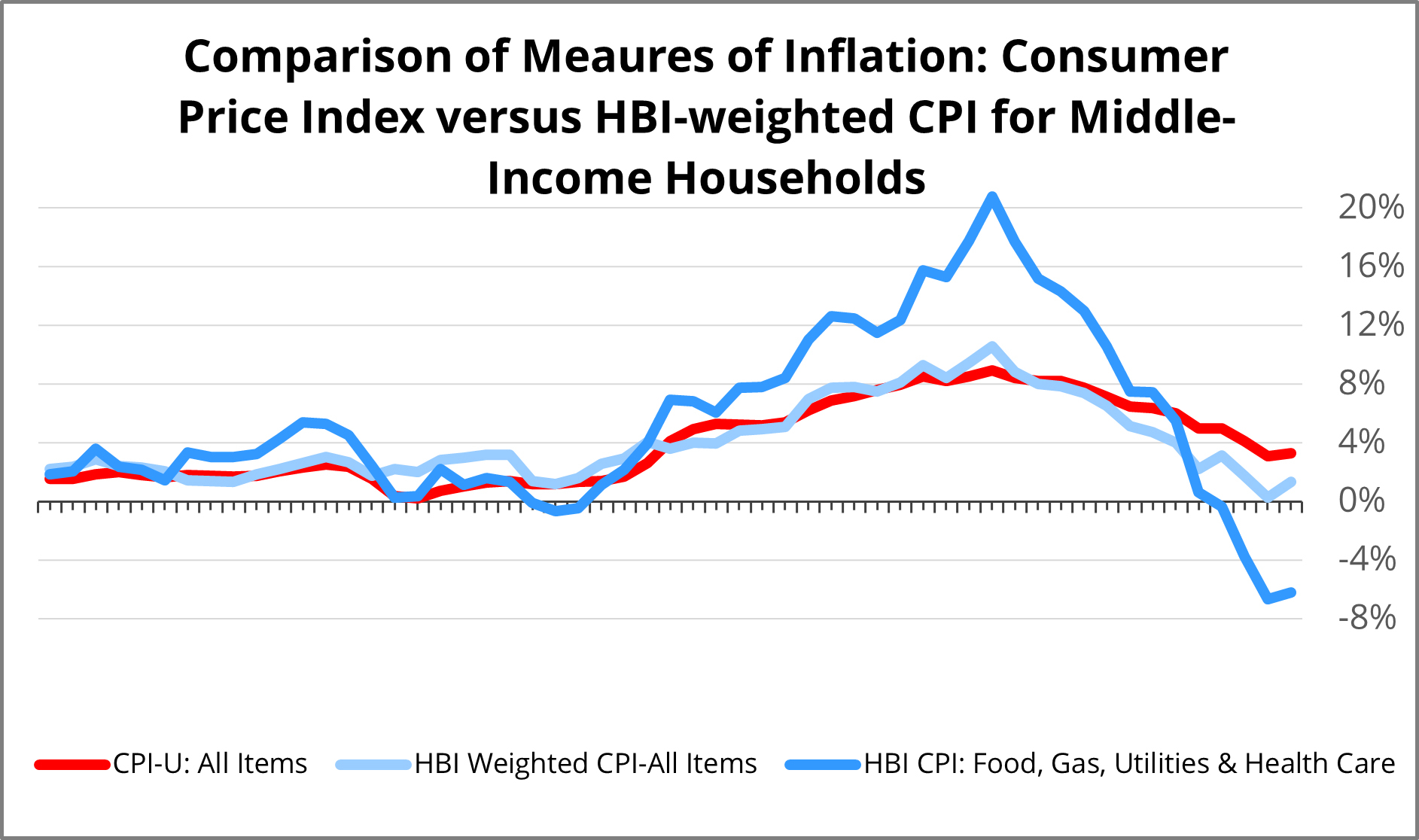

Primerica, Inc. (NYSE: PRI), a leading provider of financial services in the United States and Canada, announced today the release of its inaugural Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of middle-income households with incomes between $30,000 and $130,000. The HBI™ looks at the difference between the growth in earned income and the change in the costs for necessities like food, utilities, health care, and gasoline to understand how the current economy is impacting middle-income households’ ability to maintain a budget. It also evaluates whether there are opportunities for middle-income families to save money or pay down debt versus use savings or increase debt.

By Primerica, Inc. · Via Business Wire · August 22, 2023

Primerica, Inc. (NYSE: PRI) today announced financial results for the quarter ended June 30, 2023. Total revenues of $688.4 million increased 3% compared to the second quarter of 2022. Net income attributable to Primerica of $144.5 million increased 13%, while earnings per diluted share of $3.97 increased 20% compared to the same period in the prior year. ROE was 29.2% for the quarter.

By Primerica, Inc. · Via Business Wire · August 7, 2023

Primerica, Inc. (NYSE:PRI), a leading provider of financial services to middle-income families in the United States and Canada, has been named by Forbes as one of the Best Employers for Women five years in a row.

By Primerica, Inc. · Via Business Wire · July 25, 2023

Primerica, Inc. (NYSE:PRI) announced today that it will hold a webcast on Tuesday, August 8, 2023, at 10:00 a.m. Eastern time to discuss the Company’s results for the quarter ended June 30, 2023, as well as other business-related matters, including future expectations. A news release announcing the quarter’s results will be distributed after the close of the market on Monday, August 7, 2023.

By Primerica, Inc. · Via Business Wire · July 24, 2023

Primerica, Inc. (NYSE:PRI), a leading provider of financial products to middle- income households in North America, announced today that its top securities leaders will gather on July 19-20 at the Mohegan Sun in Uncasville, CT. During the meeting, leaders will discuss the first half of 2023 and review opportunities that exist around growing the securities business.

By Primerica, Inc. · Via Business Wire · July 19, 2023

Primerica, Inc. (NYSE: PRI), a leading provider of financial services in the United States and Canada, released the Middle-Income Financial Security Monitor for the second quarter of 2023 — a national survey that measures changes in the sentiments of middle-income families in the U.S. about their finances.

By Primerica, Inc. · Via Business Wire · July 12, 2023

Primerica, Inc. (NYSE: PRI), a leading provider of financial services in Canada and the United States, released a special report titled “Balancing Act: Enhancing Regulation without Compromising Financial Access in Canada.”

By Primerica, Inc. · Via Business Wire · May 11, 2023