Invesco S&P 500 High Beta ETF (SPHB)

122.07

-1.15 (-0.93%)

NYSE · Last Trade: Jan 25th, 1:11 PM EST

Wall Street buzzes as the court blocks Trump's tariffs, Nvidia reports strong earnings, and U.S.-EU tariff battle calms.

Via Benzinga · May 29, 2025

Investors ditched worries, boosting ETFs like VanEck SMH (+13%) on chip stock rally, Virtus BBC (+7%) on biotech hope, Simplify TESL (+31%) on Musk's focus, Invesco SPHB (+11.5%) on risk appetite, iShares IBIT (+9.2%) on crypto optimism. Market sentiment received boost from easing US-China trade tensions and news of no Fed Chair firing. S&P 500 recovered 80% of its post-April 2 sell-off, but warning signs remain with slowing private sector growth, declining consumer sentiment, and rising inflation expectations. ServiceNow (+20%) and Northrop Grumman (-15%) had divergent earnings, while Tesla (+31%) surged on Musk's promise to focus on making EVs. This week's action will be crucial.

Via Benzinga · April 28, 2025

Certain ETFs are best suited for when markets are rebounding, while others, like Invesco QQQ Trust, are for those who prefer to play it safe.

Via Benzinga · April 15, 2025

In China, the prospect of the next round of stimulus is the exclusive driver for equities.

Via Talk Markets · March 17, 2025

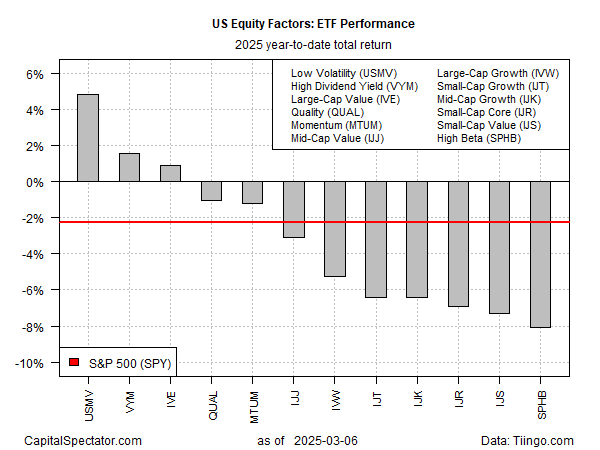

The US stock market has turned negative on the year, but you wouldn’t know it by looking at results for the low-volatility equity risk factor.

Via Talk Markets · March 7, 2025

Allegro MicroSystems receives offer from ON Semiconductor for $35.10/share, with an implied EV of $6.9B. Allegro deemed onsemi's proposal inadequate.

Via Benzinga · March 6, 2025

On February 18, 2025, I walked through a signal I got back on Valentine's Day. Now, it's just deciding whether to roll your put hedges down, close your VIX volatility spread, and begin to dip your toes in the water.

Via Talk Markets · March 3, 2025

In a bear market you would expect staples which are defensive to beat the S&P 500.

Via Talk Markets · January 12, 2025

The big index was up nicely today. Verizon (VZ) and Nvidia led the way as Apple (AAPL) failed to dazzle with its product-line reveal.

Via Talk Markets · September 10, 2024

The S&P 500 is on fire, rallying for eight straight days and soaring over 9.5% since the August 5 low.

Via Talk Markets · August 19, 2024

High beta technology shares surged today as energy and Low volatility headed lower.

Via Talk Markets · August 21, 2023

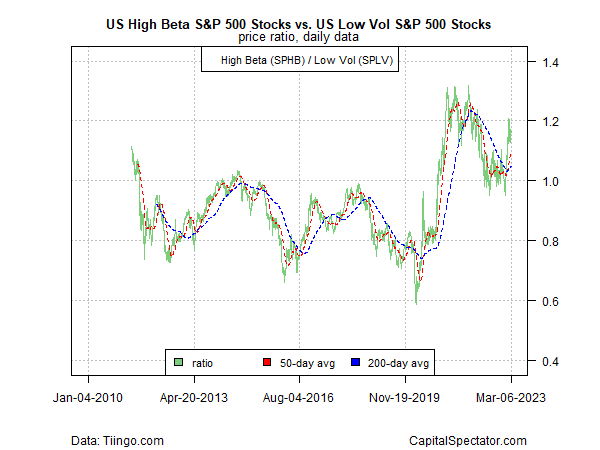

The recent rally in risk assets has confounded some analysts, but right or wrong the revival in animal spirits still has momentum, based on several proxies of market behavior via ETF pairs through yesterday’s close.

Via Talk Markets · August 9, 2023

One of Wall Street’s famous maxims is that bull markets climb a wall of worry. On that score there’s no shortage of real and potential hazards lurking.

Via Talk Markets · July 18, 2023

Yesterday’s news that US companies accelerated hiring in June strengthens confidence that the Federal Reserve will continue to lift interest rates to tame inflation.

Via Talk Markets · July 7, 2023

Looking at the stock market’s momentum bias via a pair of ETFs suggests that the bulls are still driving the trend.

Via Talk Markets · June 27, 2023

Projections that foreign, small-cap, and value stocks are set to outperform their broad US, large-cap, and growth counterparts are facing new headwinds this year.

Via Talk Markets · March 28, 2023

In the incessant chatter about inflation, interest rates and recession, continued job growth and the onward march of technology somehow seems to get lost in the discussion.

Via Talk Markets · March 9, 2023

Market sentiment has improved recently, climbing a wall of worry and suggesting that investors are presuming that the worst has passed for the world economy, based on various ETF pairs.

Via Talk Markets · March 7, 2023

The strong outperformance of high-beta stocks shows no sign of relinquishing leadership in the US equities market this year, based on a set of ETF proxies.

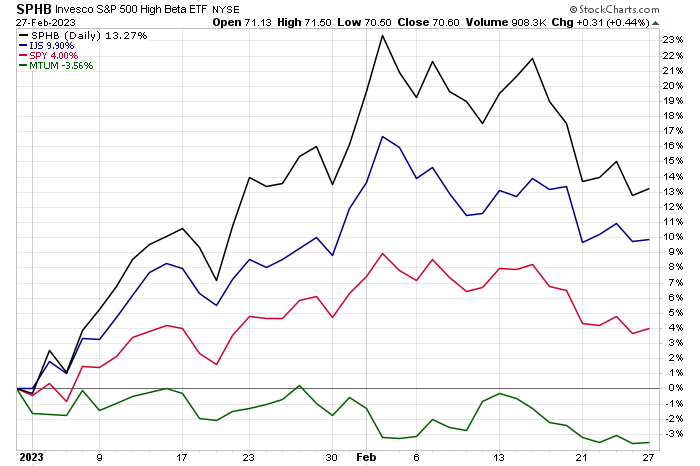

Via Talk Markets · February 28, 2023

Just six months ago, the market slaughter of the first six months of 2022 was followed by a strong upsurge in the first six weeks of 2022 led by beaten-up growth stocks. It didn’t last.

Via Talk Markets · February 27, 2023

With the latest read on inflation coming next week, in the form of CPI, here are the key stock market developments to monitor.

Via Talk Markets · February 10, 2023

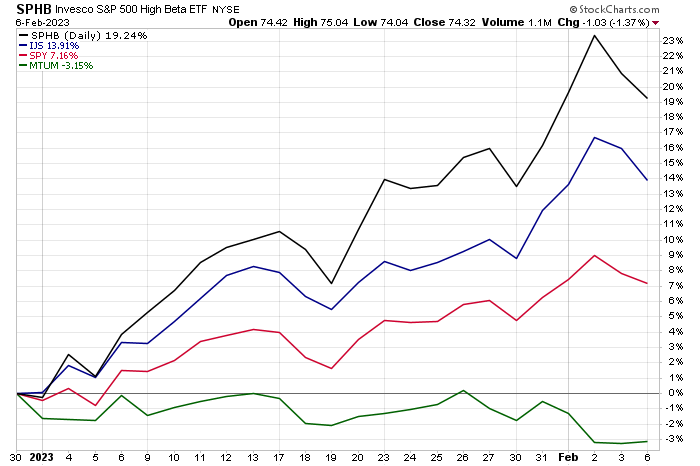

This year’s rebound in asset prices around the world suggests that investor sentiment is shifting to risk-on after a year of playing defense.

Via Talk Markets · February 9, 2023

The US stock market rally this year continues to be led by so-called high-beta stocks, which are outperforming the broad market by a wide margin.

Via Talk Markets · February 7, 2023

How do the charts look after Friday's way-above-expectations jobs report? This week's video looks at a wide variety of charts, ratios, and data sets to assess risk vs. reward in the stock market.

Via Talk Markets · February 4, 2023

The bear market rally continues as Technology, Communications and Cyclicals power higher ahead of the Federal Reserve announcement next week.

Via Talk Markets · January 23, 2023