Five Point Holdings, LLC Class A Common Shares (FPH)

5.4000

+0.00 (0.00%)

NYSE · Last Trade: Feb 17th, 7:31 AM EST

Five Point Holdings (NYSE:FPH) meets key CANSLIM criteria with explosive earnings growth, strong relative strength, and reasonable valuation. A technical setup suggests potential entry points.

Via Chartmill · June 2, 2025

Via Benzinga · April 22, 2025

A fundamental and technical analysis of (NYSE:FPH): Why FIVE POINT HOLDINGS LLC-CL A (NYSE:FPH) is Poised for High Growth.

Via Chartmill · March 12, 2025

Wondering how the US markets performed in the middle of the day on Friday? Discover the movers and shakers of today's session in our comprehensive analysis.

Via Chartmill · January 24, 2025

Via Benzinga · November 7, 2024

Five Point Holdings just reported results for the second quarter of 2024.

Via InvestorPlace · July 18, 2024

Five Point Holdings just reported results for the first quarter of 2024.

Via InvestorPlace · April 18, 2024

Five Point Holdings (NYSE:FPH) meets key CANSLIM criteria with explosive earnings growth, strong relative strength, and solid fundamentals, making it a stock to watch for growth investors.

Via Chartmill · July 15, 2025

Five Point Holdings (NYSE:FPH) meets Minervini’s Trend Template with strong technicals and high growth fundamentals, making it a candidate for momentum investors.

Via Chartmill · July 11, 2025

Five Point Holdings (NYSE:FPH) meets key CANSLIM criteria with strong earnings growth, solid fundamentals, and high relative strength, making it a candidate for growth investors.

Via Chartmill · June 23, 2025

In today's session, there are notable price gaps in the US markets on Friday. Take a closer look at the stocks that are gap up and gap down.

Via Chartmill · January 24, 2025

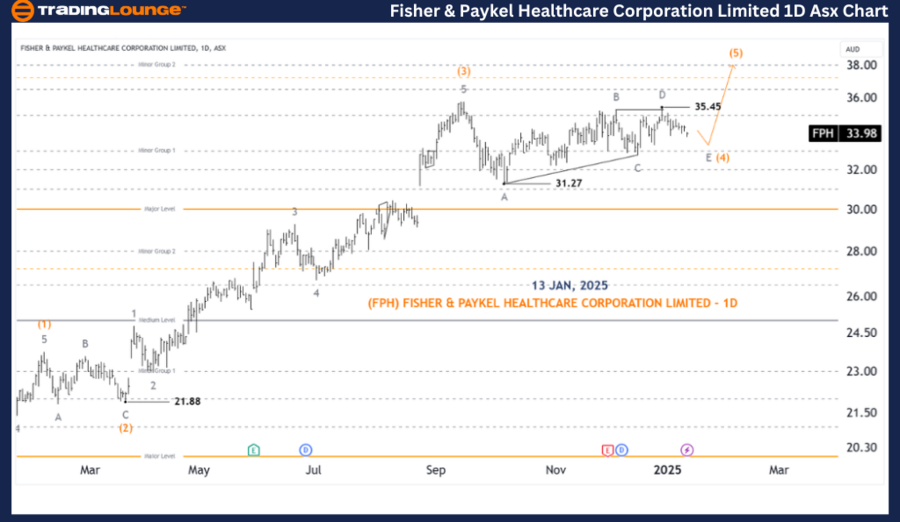

Wave count is changed to maximize the probability. Wave (4)-orange is probably developing as a Triangle, and needs a little more time to complete, then wave (5)-orange will unfold to push higher.

Via Talk Markets · January 13, 2025

Companies Reporting Before The Bell • Addex Therapeutics (NASDAQ:ADXN) is estimated to report earnings for its fourth quarter.

Via Benzinga · April 18, 2024

Five Point Holdings (FPH) witnesses a meteoric 11% stock surge post-reporting Q4 FY23 results. Led by substantial land sales, the company's $118.8 million revenues, notably from Valencia and Great Park Venture, showcase a formidable performance. CEO Dan Hedigan highlights a resilient strategy in navigating economic challenges and a housing shortage.

Via Benzinga · January 19, 2024

Companies Reporting Before The Bell • Taiwan Semiconductor (NYSE:TSM) is estimated to report quarterly earnings at $1.37 per share on revenue of $19.45 billion.

Via Benzinga · January 18, 2024