Bullish Ordinary Shares (BLSH)

33.81

+2.42 (7.71%)

NYSE · Last Trade: Mar 2nd, 6:48 PM EST

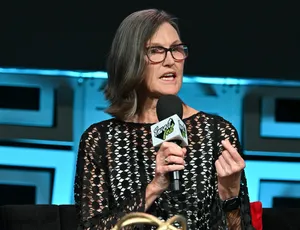

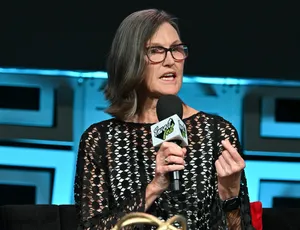

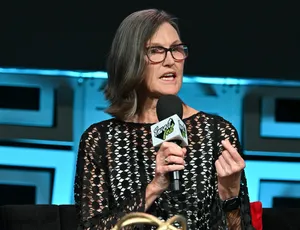

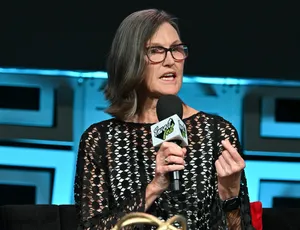

A well-known investor is bullish on Bullish stock.

Via The Motley Fool · February 13, 2026

Gemini CEO Tyler Winklevoss, Kraken Co-CEO Arjun Sethi, and Polymarket CEO Shayne Coplan remain from the previous committee.

Via Stocktwits · February 13, 2026

Ark Invest purchased over 74,000 shares of Bullish on Thursday, extending its buying streak to 10 consecutive days.

Via Stocktwits · February 13, 2026

Cathie Wood’s ARK Invest added Robinhood, Bullish, and Circle shares following a volatile trading session.

Via Stocktwits · February 12, 2026

Bullish (NYSE:BLSH) Reports Mixed Q4 2025 Results with Revenue Beat and EPS Misschartmill.com

Via Chartmill · February 5, 2026

Cathie Wood’s Ark Invest added another 57,000 shares of Bullish amid the rally on Monday.

Via Stocktwits · February 9, 2026

The digital asset landscape witnessed a seismic shift this week as Bullish (NYSE: BLSH), the institutional-grade crypto exchange, reported an explosive 70% year-over-year revenue growth in its latest quarterly earnings. Propelled by the meteoric rise of its newly launched options trading platform and a calculated expansion into the United States,

Via MarketMinute · February 9, 2026

Ark Invest added more than 716,000 shares of Bullish on Thursday, making it the firm’s only crypto-linked equity purchase that day.

Via Stocktwits · February 6, 2026

Bullish (BLSH) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 5, 2026

Other than both companies being in the cryptocurrency space, the shares of Circle and Bullish were trading below their IPO levels.

Via Stocktwits · February 5, 2026

Shares of Bullish rose in after-hours trading on Tuesday after ARK Invest disclosed its purchase.

Via Stocktwits · January 27, 2026

Crypto mining stocks lagged within crypto-linked equities, with MARA Holdings and Riot Platforms posting modest declines in after-hours trade.

Via Stocktwits · January 27, 2026

Bullish’s run in the red could see an end on Tuesday as investor sentiment surges ahead of market opening

Via Stocktwits · January 27, 2026

Kraken-linked SPAC KRAKacquisition files for a $250M Nasdaq IPO under KRAQU, with no merger target yet identified.

Via Stocktwits · January 13, 2026

MSTR Leads Crypto Stocks Rally Following MSCI Index Inclusion Update Even As Bitcoin Stalls At $93,000stocktwits.com

Via Stocktwits · January 6, 2026

As the final days of 2025 wind down, the digital asset landscape is bracing for its most significant milestone since the debut of the first Bitcoin ETFs. Kraken, one of the world’s oldest and most resilient cryptocurrency exchanges, has officially set its sights on a 2026 stock market listing.

Via MarketMinute · December 25, 2025

All crypto stocks rose on Monday’s pre-market trading, even as Citi lowered targets for the crypto equities.

Via Stocktwits · December 22, 2025

The famous investor's funds were active buyers in the run-up to the holidays.

Via The Motley Fool · December 20, 2025

Ethereum’s price continued to trade below $3,000 on Wednesday night, pressuring ETH-linked equities like BMNR.

Via Stocktwits · December 18, 2025

Via MarketBeat · December 17, 2025

On Thursday, Cathie Wood-led Ark Invest executed significant trades, including buying shares of Nvidia Corp (NASDAQ:NVDA) and selling shar

Via Benzinga · November 20, 2025

According to a CNBC report, Deutsche Bank upgraded the stock to ‘Buy’ from ‘Hold’ while lowering the price target slightly to $51 from $52.

Via Stocktwits · November 20, 2025

Thomas Farley, the CEO of Bullish, said on Wednesday, November 19, that the passage of the cryptocurrency market structure bill will be "great" for the company and the broader industry.

Via Benzinga · November 20, 2025

On Wednesday, Cathie Wood-led Ark Invest made notable trades involving Advanced Micro Devices Inc.

Via Benzinga · November 19, 2025

The third quarter 2025 earnings season has largely concluded, painting a picture of corporate resilience and strategic adaptation in the face of evolving economic conditions. Overall, the S&P 500 demonstrated robust performance, with earnings growth exceeding initial projections. However, the market's reaction was nuanced, reflecting a complex interplay of

Via MarketMinute · November 19, 2025