Sigma Lithium Corporation - common shares (SGML)

13.16

+0.33 (2.53%)

NASDAQ · Last Trade: Feb 18th, 1:41 PM EST

Detailed Quote

| Previous Close | 12.83 |

|---|---|

| Open | 13.19 |

| Bid | 13.14 |

| Ask | 13.17 |

| Day's Range | 12.40 - 13.25 |

| 52 Week Range | 4.250 - 16.87 |

| Volume | 794,519 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 3,804,041 |

Chart

About Sigma Lithium Corporation - common shares (SGML)

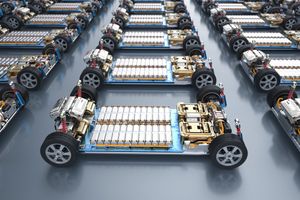

Sigma Lithium Corp is a leading company focused on the sustainable exploration and development of lithium resources, primarily for the growing electric vehicle and battery markets. The company is dedicated to producing high-quality lithium products while prioritizing environmentally responsible practices throughout its operations. By leveraging advanced mining technologies and sustainable methods, Sigma Lithium aims to meet the increasing global demand for lithium, which is essential for the transition to cleaner energy solutions and the future of transportation. Read More

News & Press Releases

NEW YORK, Feb. 17, 2026 (GLOBE NEWSWIRE) -- Pomerantz LLP is investigating claims on behalf of investors of Sigma Lithium Corporation (“Sigma Lithium” or the “Company”) (NASDAQ: SGML). Such investors are advised to contact Danielle Peyton at newaction@pomlaw.com or 646-581-9980, ext. 7980.

By Pomerantz LLP · Via GlobeNewswire · February 17, 2026

NEW YORK, Feb. 03, 2026 (GLOBE NEWSWIRE) -- Pomerantz LLP is investigating claims on behalf of investors of Sigma Lithium Corporation (“Sigma Lithium” or the “Company”) (NASDAQ: SGML). Such investors are advised to contact Danielle Peyton at newaction@pomlaw.com or 646-581-9980, ext. 7980.

By Pomerantz LLP · Via GlobeNewswire · February 3, 2026

NEW YORK, Jan. 27, 2026 (GLOBE NEWSWIRE) -- Pomerantz LLP is investigating claims on behalf of investors of Sigma Lithium Corporation (“Sigma Lithium” or the “Company”) (NASDAQ: SGML). Such investors are advised to contact Danielle Peyton at newaction@pomlaw.com or 646-581-9980, ext. 7980.

By Pomerantz LLP · Via GlobeNewswire · January 27, 2026

The market is filled with gapping stocks in Friday's session.chartmill.com

Via Chartmill · January 23, 2026

The future continues to look very bright for the company's material of choice.

Via The Motley Fool · January 20, 2026

NEW YORK, Jan. 20, 2026 (GLOBE NEWSWIRE) -- Pomerantz LLP is investigating claims on behalf of investors of Sigma Lithium Corporation (“Sigma Lithium” or the “Company”) (NASDAQ: SGML). Such investors are advised to contact Danielle Peyton at newaction@pomlaw.com or 646-581-9980, ext. 7980.

By Pomerantz LLP · Via GlobeNewswire · January 20, 2026

More than one factor is motivating investors to click the sell button today.

Via The Motley Fool · January 16, 2026

NEW YORK, Jan. 13, 2026 (GLOBE NEWSWIRE) -- Pomerantz LLP is investigating claims on behalf of investors of Sigma Lithium Corporation (“Sigma Lithium” or the “Company”) (NASDAQ: SGML). Such investors are advised to contact Danielle Peyton at newaction@pomlaw.com or 646-581-9980, ext. 7980.

By Pomerantz LLP · Via GlobeNewswire · January 13, 2026

Is what's good for lithium prices good for all lithium producers -- or only Albemarle?

Via The Motley Fool · January 12, 2026

While higher lithium prices are a boon for all lithium miners, Sigma Lithium stock could be one of the biggest winners.

Via The Motley Fool · December 22, 2025

A future deficit in lithium supply just got a little more likely.

Via The Motley Fool · December 17, 2025

The lithium stock could be a winner in 2026 and beyond, given the solid tailwinds behind it.

Via The Motley Fool · December 12, 2025

The lithium miner's cost-cutting efforts could pay off handsomely amid the ongoing surge in lithium prices.

Via The Motley Fool · December 9, 2025

The miner received good news on the prospects for lithium prices.

Via The Motley Fool · November 21, 2025

Via Benzinga · November 20, 2025

Looking for insights into the US markets one hour before the close of the markets on Wednesday? Delve into the top gainers and losers of today's session and gain valuable market intelligence.

Via Chartmill · November 19, 2025

Looking for insights into the US markets in the middle of the day on Wednesday? Delve into the top gainers and losers of today's session and gain valuable market intelligence.

Via Chartmill · November 19, 2025

In today's session, there are notable price gaps in the US markets on Wednesday. Take a closer look at the stocks that are gap up and gap down.

Via Chartmill · November 19, 2025

Lithium carbonate prices have jumped in recent weeks, driven by stronger demand amid the rapid expansion of AI data centers, which is boosting the energy storage sector.

Via Stocktwits · November 19, 2025

Looking for insights into the US markets one hour before the close of the markets on Monday? Delve into the top gainers and losers of today's session and gain valuable market intelligence.

Via Chartmill · November 17, 2025

Higher lithium prices couldn't have come at a better time for Sigma Lithium stock.

Via The Motley Fool · November 17, 2025

Via Benzinga · November 17, 2025

Let's have a look at what is happening on the US markets in the middle of the day on Monday. Below you can find the top gainers and losers in today's session.

Via Chartmill · November 17, 2025

Via Benzinga · November 17, 2025

In today's session, there are notable price gaps in the US markets on Monday. Take a closer look at the stocks that are gap up and gap down.

Via Chartmill · November 17, 2025