Autonomous driving technology company Mobileye (NASDAQ:MBLY) beat Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 9% year on year to $446 million. On the other hand, the company’s full-year revenue guidance of $1.94 billion at the midpoint came in 3% below analysts’ estimates. Its non-GAAP profit of $0.06 per share was in line with analysts’ consensus estimates.

Is now the time to buy Mobileye? Find out by accessing our full research report, it’s free.

Mobileye (MBLY) Q4 CY2025 Highlights:

- Revenue: $446 million vs analyst estimates of $432.4 million (9% year-on-year decline, 3.1% beat)

- Adjusted EPS: $0.06 vs analyst estimates of $0.06 (in line)

- Adjusted EBITDA: -$30 million vs analyst estimates of $58.45 million (-6.7% margin, significant miss)

- Operating Margin: -31.4%, down from -17.6% in the same quarter last year

- Free Cash Flow Margin: 19.3%, down from 39% in the same quarter last year

- Market Capitalization: $8.85 billion

Company Overview

With its EyeQ chips installed in over 200 million vehicles worldwide, Mobileye (NASDAQ:MBLY) develops advanced driver assistance systems and autonomous driving technologies that help vehicles detect and respond to road conditions.

Revenue Growth

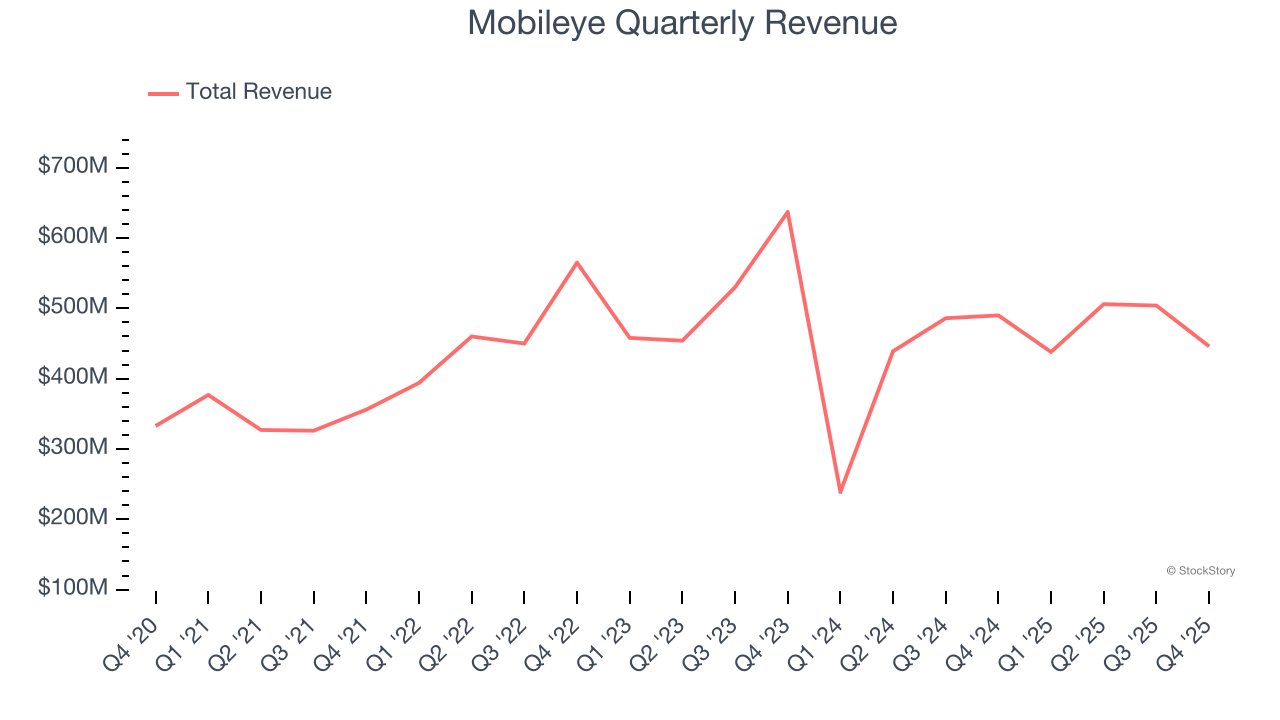

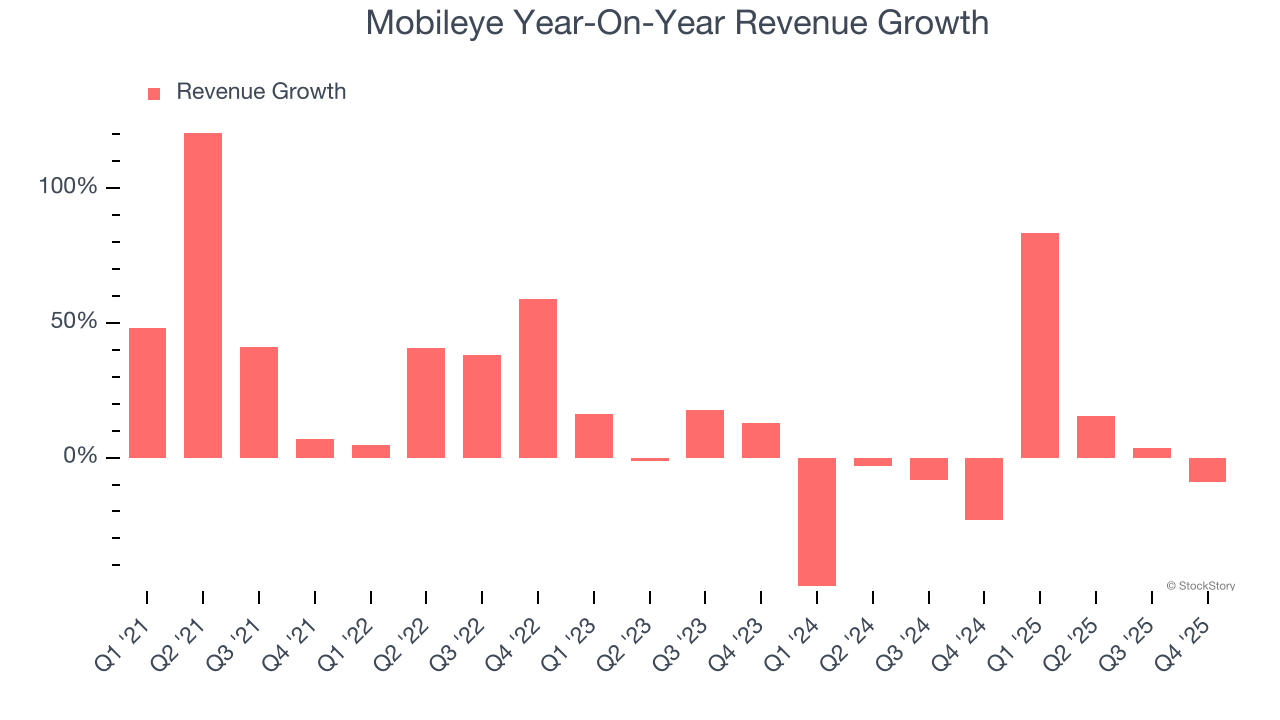

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Mobileye’s 14.4% annualized revenue growth over the last five years was exceptional. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Mobileye’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 4.6% over the last two years. Mobileye isn’t alone in its struggles as the Automobile Manufacturing industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Mobileye’s revenue fell by 9% year on year to $446 million but beat Wall Street’s estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

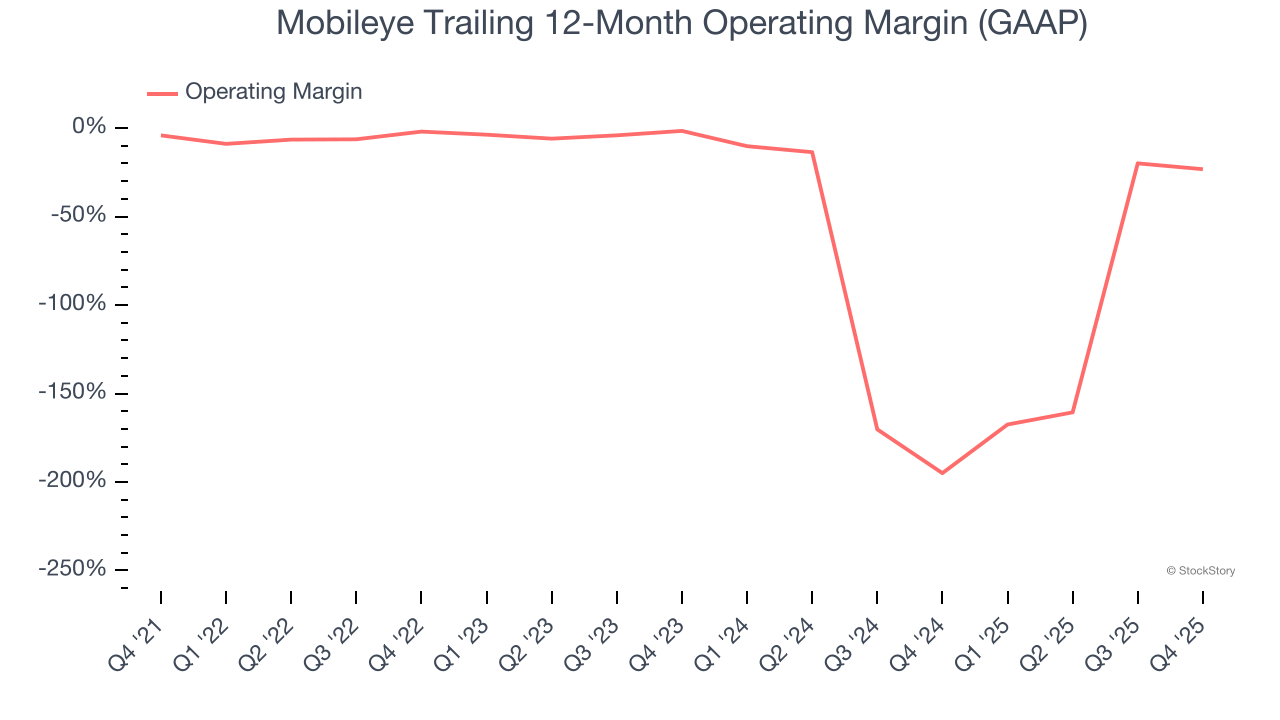

Mobileye’s high expenses have contributed to an average operating margin of negative 42.7% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Mobileye’s operating margin decreased by 19.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. We’ve noticed many Automobile Manufacturing companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction, but Mobileye’s performance was poor no matter how you look at it. It shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Mobileye generated a negative 31.4% operating margin.

Cash Is King

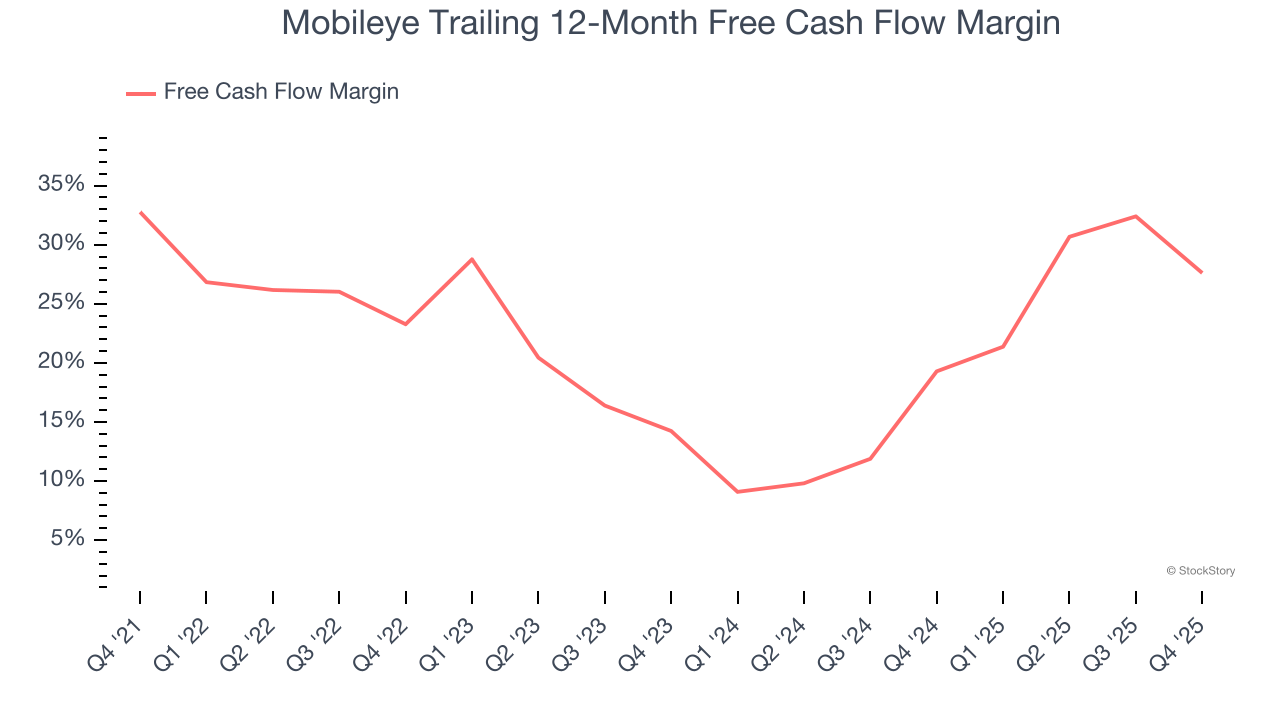

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Mobileye has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 22.8% over the last five years. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Mobileye’s margin dropped by 5.2 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal it is in the middle of an investment cycle.

Mobileye’s free cash flow clocked in at $86 million in Q4, equivalent to a 19.3% margin. The company’s cash profitability regressed as it was 19.7 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from Mobileye’s Q4 Results

We enjoyed seeing Mobileye beat analysts’ revenue expectations this quarter. We were also glad its EPS was in line with Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.7% to $10.49 immediately after reporting.

Mobileye’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).