As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the marine transportation industry, including Kirby (NYSE:KEX) and its peers.

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for marine transportation companies. While ocean freight is more fuel efficient and therefore cheaper than its air and ground counterparts, it results in slower delivery times, presenting a trade off. To improve transit speeds, the industry continues to invest in digitization to optimize fleets and routes. However, marine transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins. Geopolitical tensions can also affect access to trade routes, and if certain countries are banned from using passageways like the Panama Canal, costs can spiral out of control.

The 5 marine transportation stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 5.3%.

In light of this news, share prices of the companies have held steady as they are up 1.5% on average since the latest earnings results.

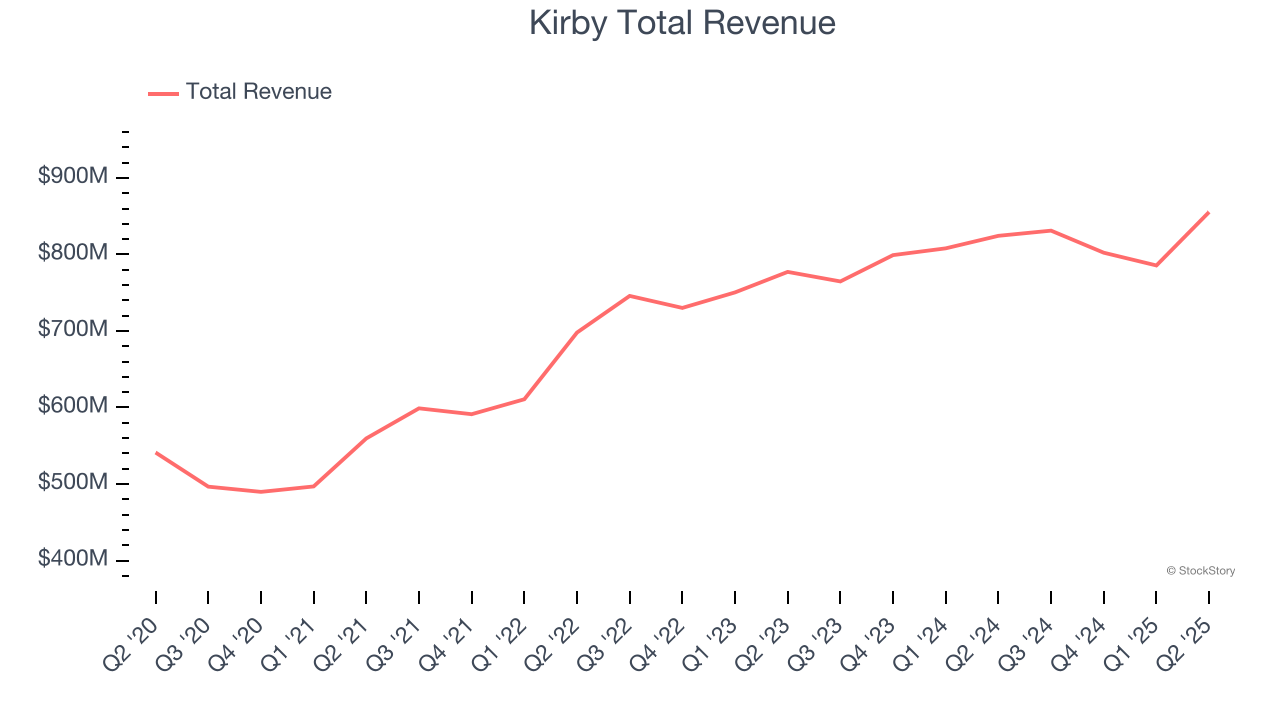

Kirby (NYSE:KEX)

Transporting goods along all U.S. coasts, Kirby (NYSE:KEX) provides inland and coastal marine transportation services.

Kirby reported revenues of $855.5 million, up 3.8% year on year. This print exceeded analysts’ expectations by 0.9%. Overall, it was a satisfactory quarter for the company.

David Grzebinski, Kirby’s Chief Executive Officer, commented, “Kirby delivered another solid quarter, with strong performance across both marine transportation and distribution and services. Our teams executed well in a dynamic environment, and we continued to benefit from healthy customer demand, disciplined pricing, and operational focus.”

The stock is down 25.8% since reporting and currently trades at $89.08.

Is now the time to buy Kirby? Access our full analysis of the earnings results here, it’s free.

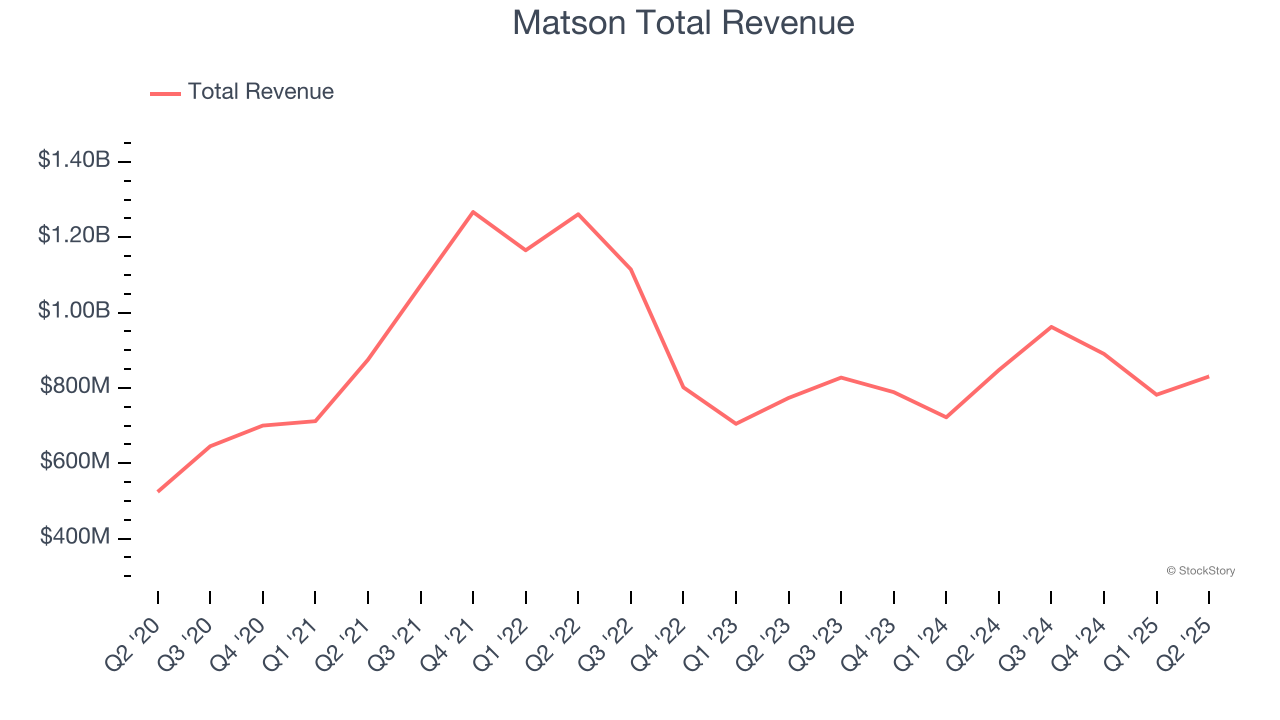

Best Q2: Matson (NYSE:MATX)

Founded by a Swedish orphan, Matson (NYSE:MATX) is a provider of ocean transportation and logistics services.

Matson reported revenues of $830.5 million, down 2% year on year, outperforming analysts’ expectations by 2.6%. The business had a stunning quarter with a beat of analysts’ EPS and EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 1.2% since reporting. It currently trades at $105.56.

Is now the time to buy Matson? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Genco (NYSE:GNK)

Headquartered in NYC, Genco (NYSE:GNK) is a shipping company that transports dry bulk cargo along worldwide maritime routes.

Genco reported revenues of $48.91 million, down 35.9% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ EPS and EBITDA estimates.

Genco delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 5.6% since the results and currently trades at $17.66.

Read our full analysis of Genco’s results here.

Scorpio Tankers (NYSE:STNG)

Operating one of the youngest fleets in the industry, Scorpio Tankers (NYSE: STNG) is an international provider of marine transportation services, specializing in the shipment of refined petroleum.

Scorpio Tankers reported revenues of $222.8 million, down 40.4% year on year. This result topped analysts’ expectations by 1.7%. Overall, it was a stunning quarter as it also produced a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Scorpio Tankers had the slowest revenue growth among its peers. The stock is up 17% since reporting and currently trades at $52.78.

Read our full, actionable report on Scorpio Tankers here, it’s free.

Pangaea (NASDAQ:PANL)

Established in 1996, Pangaea Logistics (NASDAQ:PANL) specializes in global logistics and transportation services, focusing on the shipment of dry bulk cargoes.

Pangaea reported revenues of $156.7 million, up 19.2% year on year. This number surpassed analysts’ expectations by 21.2%. It was an exceptional quarter as it also recorded EPS in line with analysts’ estimates and a decent beat of analysts’ EBITDA estimates.

Pangaea achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 11.8% since reporting and currently trades at $5.40.

Read our full, actionable report on Pangaea here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.