Since July 2020, the S&P 500 has delivered a total return of 95.7%. But one standout stock has more than doubled the market - over the past five years, JPMorgan Chase has surged 208% to $292.13 per share. Its momentum hasn’t stopped as it’s also gained 20.1% in the last six months thanks to its solid quarterly results, beating the S&P by 15.2%.

Is now still a good time to buy JPM? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does JPMorgan Chase Spark Debate?

Tracing its roots back to 1799 when its earliest predecessor was founded by Aaron Burr, JPMorgan Chase (NYSE:JPM) is a leading financial services company offering investment banking, consumer banking, commercial banking, and asset management services globally.

Two Positive Attributes:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

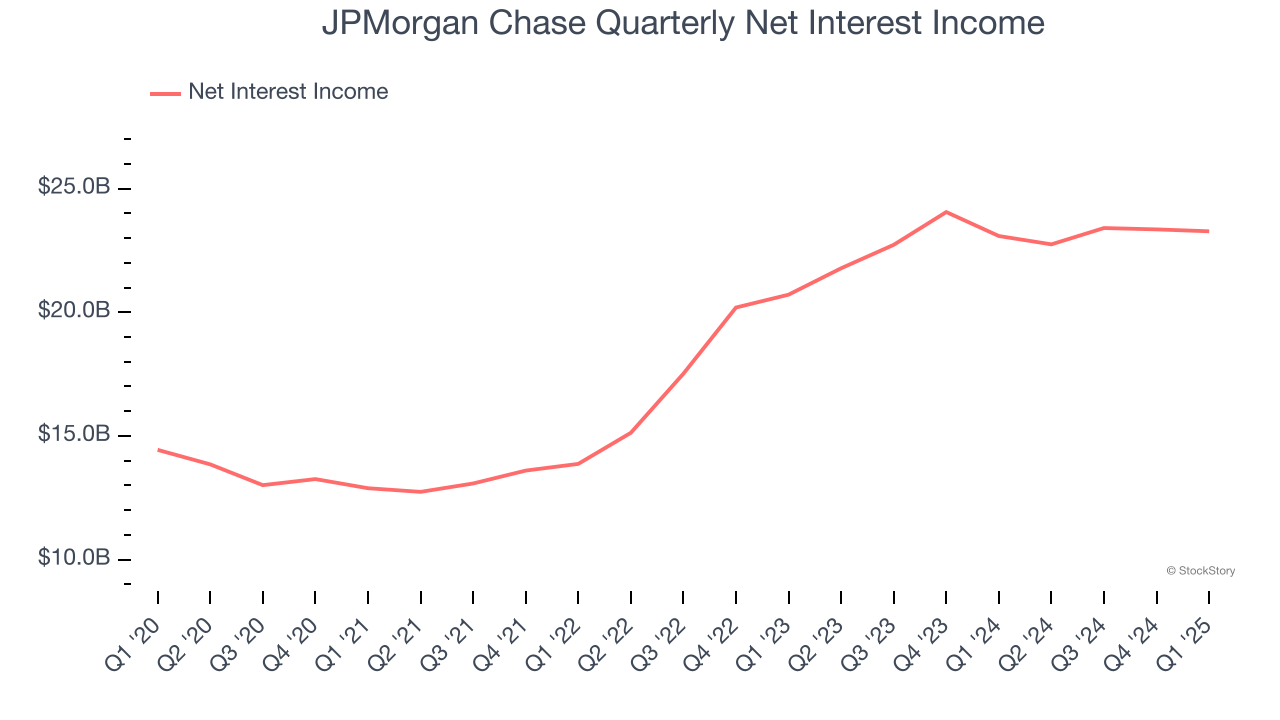

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

JPMorgan Chase’s net interest income has grown at a 15% annualized rate over the last four years, better than the broader bank industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

2. Outstanding Long-Term EPS Growth

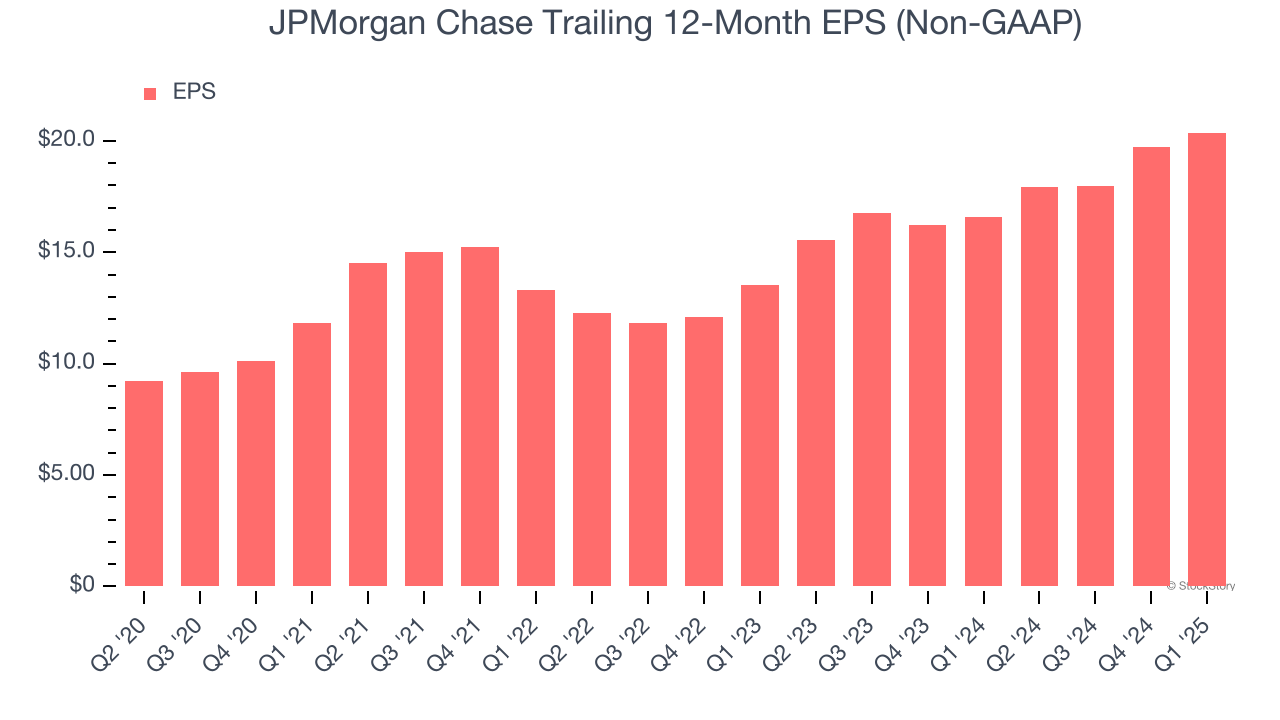

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

JPMorgan Chase’s EPS grew at an astounding 11.9% compounded annual growth rate over the last five years, higher than its 9.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Efficiency Ratio Expected to Falter

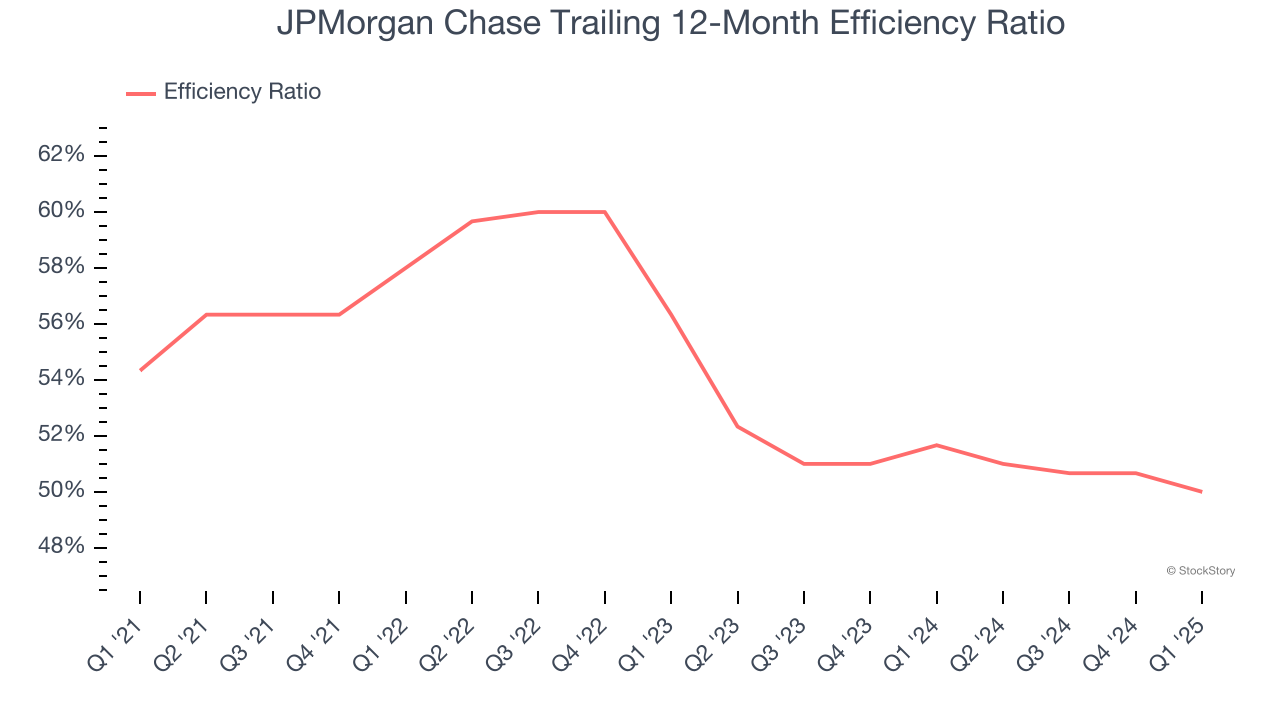

Topline growth is certainly important, but the overall profitability of this growth matters for the bottom line. For banks, we look at efficiency ratio, which is non-interest expense (salaries, rent, IT, marketing, excluding interest paid out to depositors) as a percentage of total revenue.

Markets understand that a bank’s expense base depends on its revenue mix and what mostly drives share price performance is the change in this ratio, rather than its absolute value. It’s somewhat counterintuitive, but a lower efficiency ratio is better.

For the next 12 months, Wall Street expects JPMorgan Chase to become less profitable as it anticipates an efficiency ratio of 54.6% compared to 50% over the past year.

Final Judgment

JPMorgan Chase’s merits more than compensate for its flaws, and with its shares topping the market in recent months, the stock trades at 2.3× forward P/B (or $292.13 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than JPMorgan Chase

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.