Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Beyond Meat (NASDAQ:BYND) and the best and worst performers in the perishable food industry.

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

The 11 perishable food stocks we track reported a slower Q1. As a group, revenues beat analysts’ consensus estimates by 1.4%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

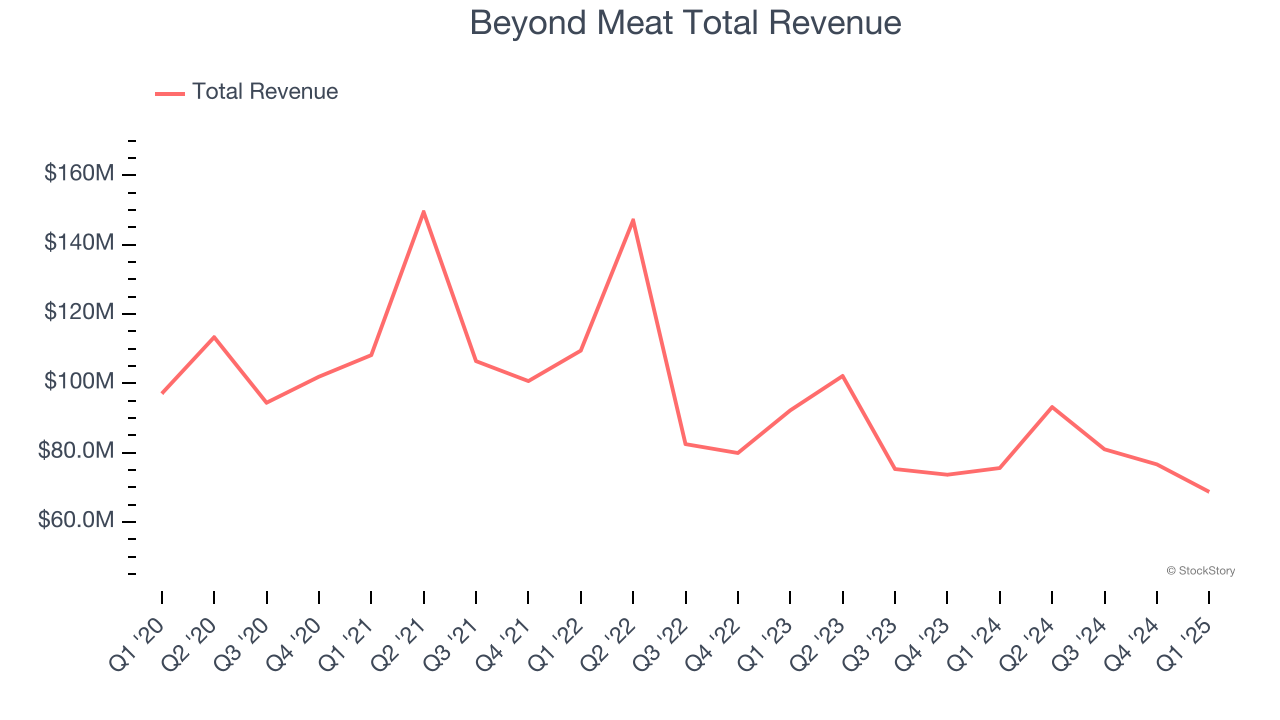

Weakest Q1: Beyond Meat (NASDAQ:BYND)

A pioneer at the forefront of the plant-based protein revolution, Beyond Meat (NASDAQ:BYND) is a food company specializing in alternatives to traditional meat products.

Beyond Meat reported revenues of $68.73 million, down 9.1% year on year. This print fell short of analysts’ expectations by 8.3%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

Beyond Meat President and CEO Ethan Brown commented, “As the first quarter of 2025 progressed to a close, we saw a slowdown in consumption as the uncertain macroeconomic environment likely exacerbated category challenges. Nevertheless, we drove year-over-year reductions in operating expenses, notwithstanding the impact of certain transitory items, to partially offset disappointing net revenues and gross profit.”

Beyond Meat delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Interestingly, the stock is up 28.2% since reporting and currently trades at $3.27.

Read our full report on Beyond Meat here, it’s free.

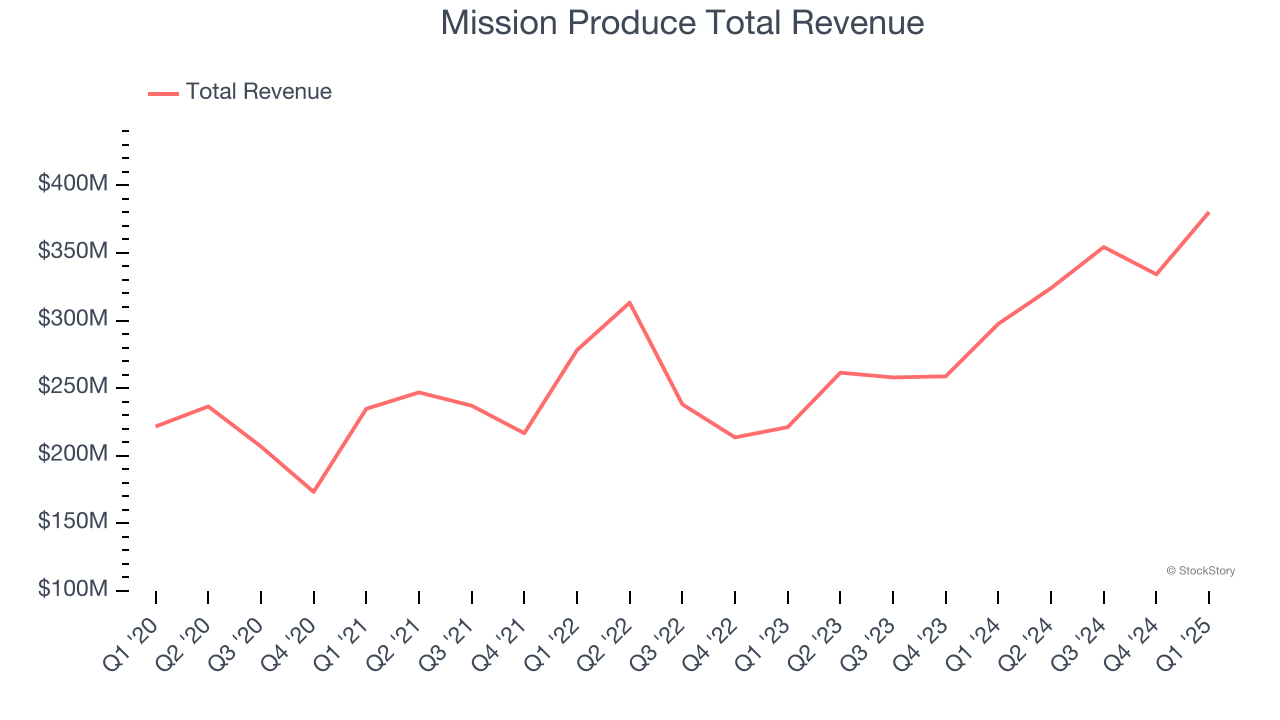

Best Q1: Mission Produce (NASDAQ:AVO)

Founded in 1983 in California, Mission Produce (NASDAQ:AVO) grows, packages, and distributes avocados.

Mission Produce reported revenues of $380.3 million, up 27.8% year on year, outperforming analysts’ expectations by 28.4%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Mission Produce scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 13.8% since reporting. It currently trades at $11.99.

Is now the time to buy Mission Produce? Access our full analysis of the earnings results here, it’s free.

Calavo (NASDAQ:CVGW)

A trailblazer in the avocado industry, Calavo Growers (NASDAQ:CVGW) is a pioneering California-based provider of high-quality avocados and other fresh food products.

Calavo reported revenues of $190.5 million, up 3.3% year on year, falling short of analysts’ expectations by 1.1%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ gross margin estimates.

As expected, the stock is down 5.1% since the results and currently trades at $26.23.

Read our full analysis of Calavo’s results here.

Flowers Foods (NYSE:FLO)

With Wonder Bread as its premier brand, Flower Foods (NYSE:FLO) is a packaged foods company that focuses on bakery products such as breads, buns, and cakes.

Flowers Foods reported revenues of $1.55 billion, down 1.4% year on year. This result came in 2.7% below analysts' expectations. Overall, it was a softer quarter as it also produced a miss of analysts’ EBITDA estimates and a miss of analysts’ EPS estimates.

The stock is down 9.4% since reporting and currently trades at $15.46.

Read our full, actionable report on Flowers Foods here, it’s free.

Pilgrim's Pride (NASDAQ:PPC)

Offering everything from pre-marinated to frozen chicken, Pilgrim’s Pride (NASDAQ:PPC) produces, processes, and distributes chicken products to retailers and food service customers.

Pilgrim's Pride reported revenues of $4.46 billion, up 2.3% year on year. This print lagged analysts' expectations by 1.6%. It was a softer quarter as it also logged a miss of analysts’ EBITDA estimates and a miss of analysts’ gross margin estimates.

The stock is down 17.8% since reporting and currently trades at $44.89.

Read our full, actionable report on Pilgrim's Pride here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.