Denim clothing company Levi's (NYSE:LEVI) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 6.4% year on year to $1.45 billion. Its non-GAAP profit of $0.22 per share was 63.4% above analysts’ consensus estimates.

Is now the time to buy Levi's? Find out by accessing our full research report, it’s free.

Levi's (LEVI) Q2 CY2025 Highlights:

- Revenue: $1.45 billion vs analyst estimates of $1.37 billion (6.4% year-on-year growth, 5.8% beat)

- Adjusted EPS: $0.22 vs analyst estimates of $0.13 (63.4% beat)

- Adjusted EBITDA: $169.6 million vs analyst estimates of $127.2 million (11.7% margin, 33.4% beat)

- Management raised its full-year Adjusted EPS guidance to $1.28 at the midpoint, a 4.1% increase

- Operating Margin: 7.5%, up from 1.5% in the same quarter last year

- Free Cash Flow Margin: 10.1%, down from 16.4% in the same quarter last year

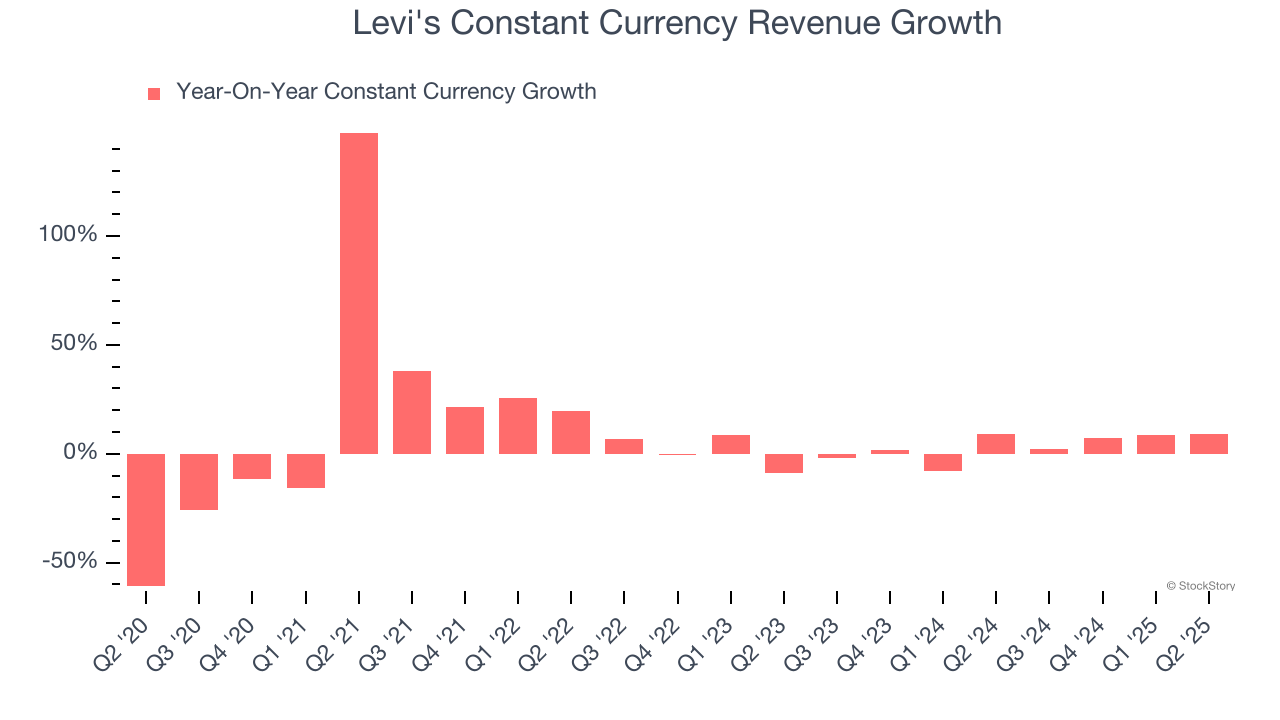

- Constant Currency Revenue rose 9% year on year, in line with the same quarter last year

- Market Capitalization: $7.67 billion

Company Overview

Credited for inventing the first pair of blue jeans in 1873, Levi's (NYSE:LEVI) is an apparel company renowned for its iconic denim products and classic American style.

Revenue Growth

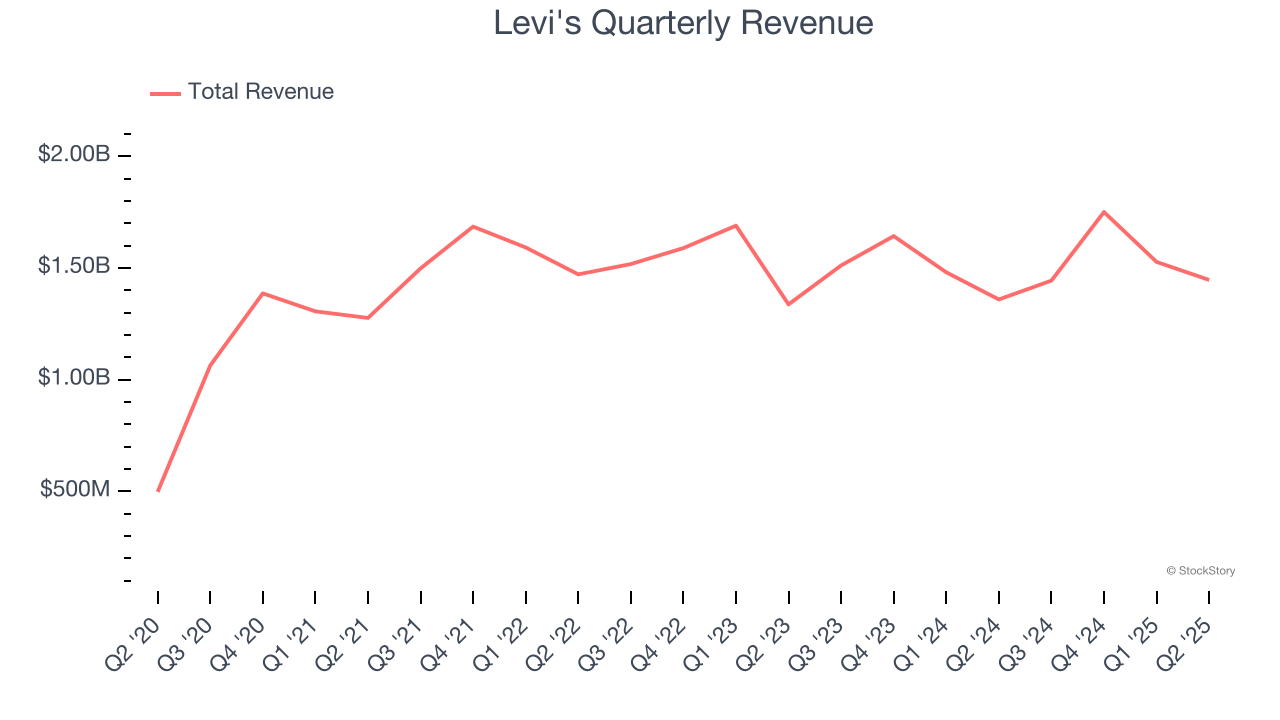

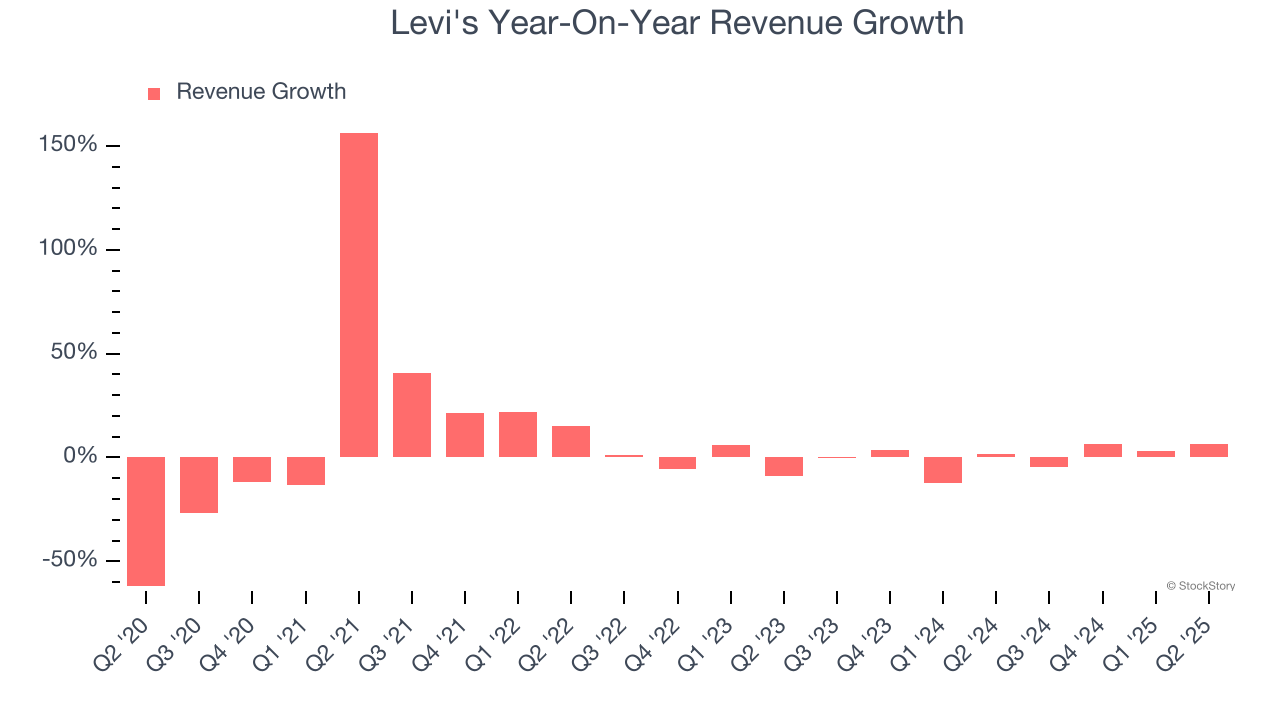

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Levi’s sales grew at a sluggish 4.2% compounded annual growth rate over the last five years. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Levi’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 3.5% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Levi's.

This quarter, Levi's reported year-on-year revenue growth of 6.4%, and its $1.45 billion of revenue exceeded Wall Street’s estimates by 5.8%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection doesn't excite us and implies its newer products and services will not catalyze better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

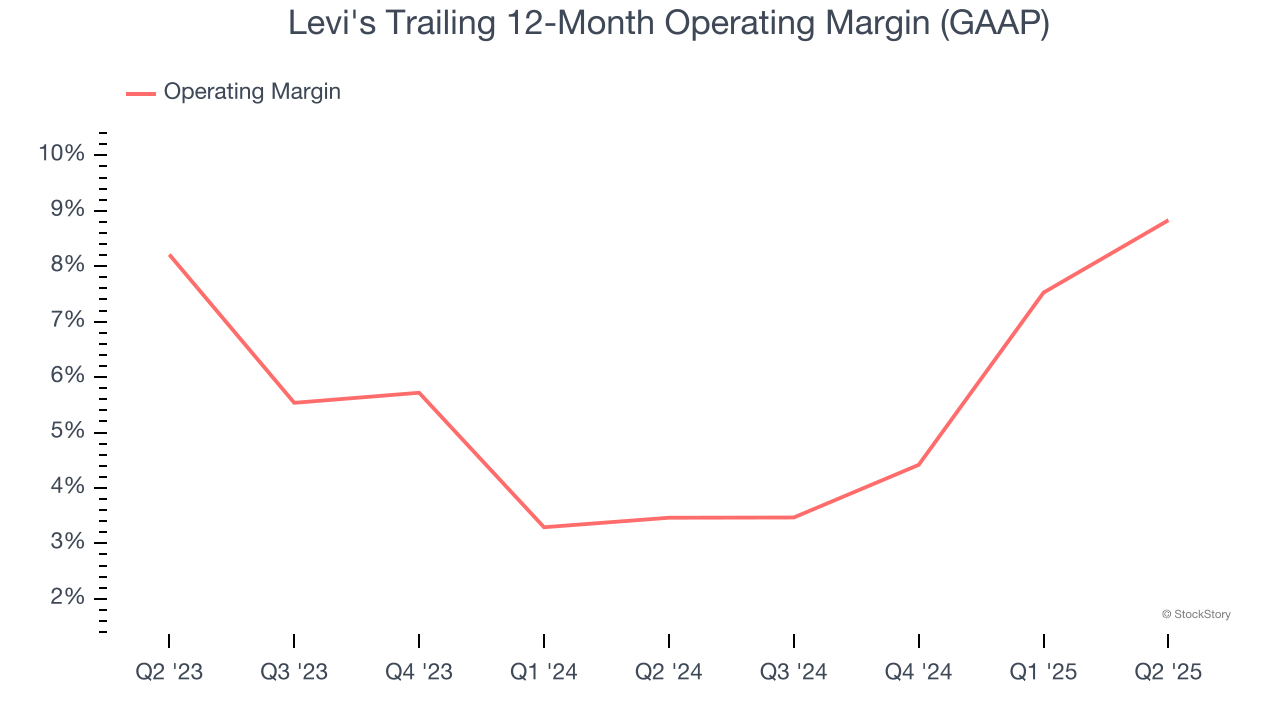

Operating Margin

Levi’s operating margin has been trending up over the last 12 months and averaged 6.2% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports paltry profitability for a consumer discretionary business.

This quarter, Levi's generated an operating margin profit margin of 7.5%, up 5.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

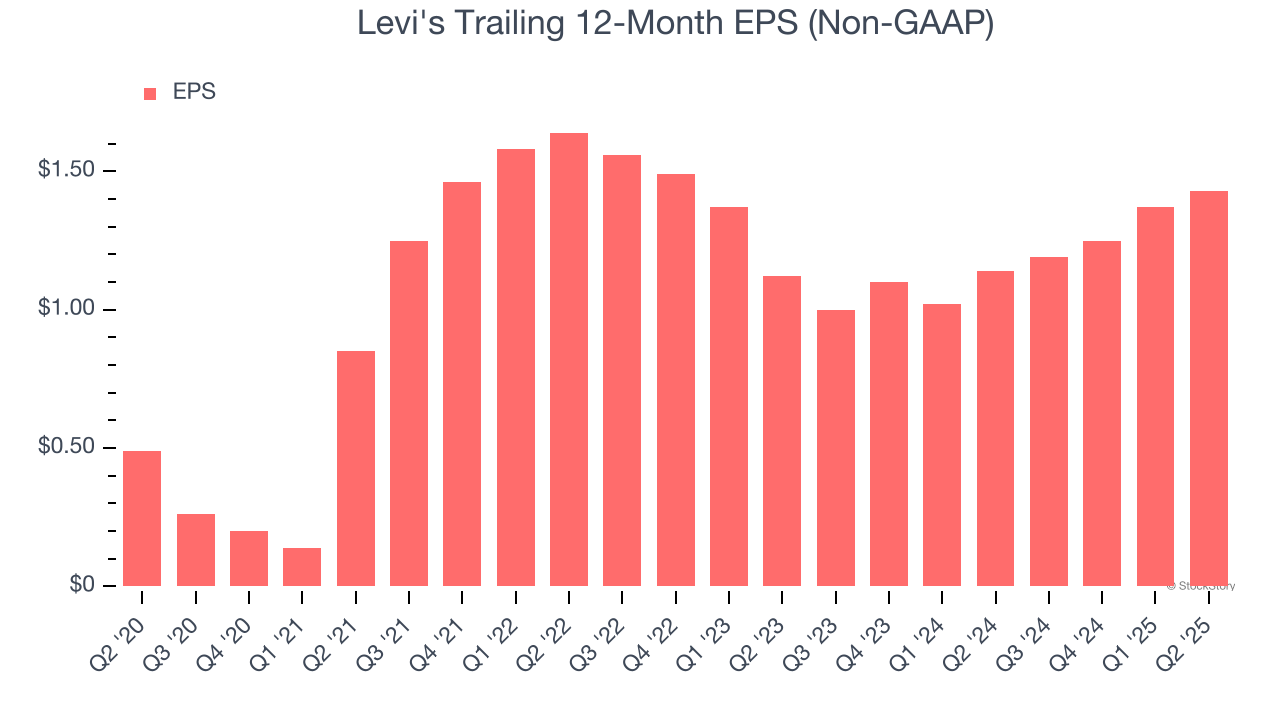

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Levi’s EPS grew at a spectacular 23.9% compounded annual growth rate over the last five years, higher than its 4.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q2, Levi's reported EPS at $0.22, up from $0.16 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Levi’s full-year EPS of $1.43 to shrink by 11.2%.

Key Takeaways from Levi’s Q2 Results

We were impressed by how significantly Levi's blew past analysts’ constant currency revenue, EPS, and EBITDA expectations this quarter. We were also excited it raised its full-year EPS guidance. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 7.9% to $21.30 immediately following the results.

Indeed, Levi's had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.