Social media management software company Sprout (NASDAQ:SPT) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 12.9% year on year to $109.3 million. Guidance for next quarter’s revenue was better than expected at $110.8 million at the midpoint, 0.7% above analysts’ estimates. Its non-GAAP profit of $0.22 per share was 48.4% above analysts’ consensus estimates.

Is now the time to buy Sprout Social? Find out by accessing our full research report, it’s free.

Sprout Social (SPT) Q1 CY2025 Highlights:

- Revenue: $109.3 million vs analyst estimates of $107.6 million (12.9% year-on-year growth, 1.6% beat)

- Adjusted EPS: $0.22 vs analyst estimates of $0.15 (48.4% beat)

- Adjusted Operating Income: $12.54 million vs analyst estimates of $9.02 million (11.5% margin, 39.1% beat)

- The company slightly lifted its revenue guidance for the full year to $451.4 million at the midpoint from $450.6 million

- Management raised its full-year Adjusted EPS guidance to $0.73 at the midpoint, a 5% increase

- Operating Margin: -10.2%, up from -13.7% in the same quarter last year

- Free Cash Flow Margin: 17.8%, up from 3% in the previous quarter

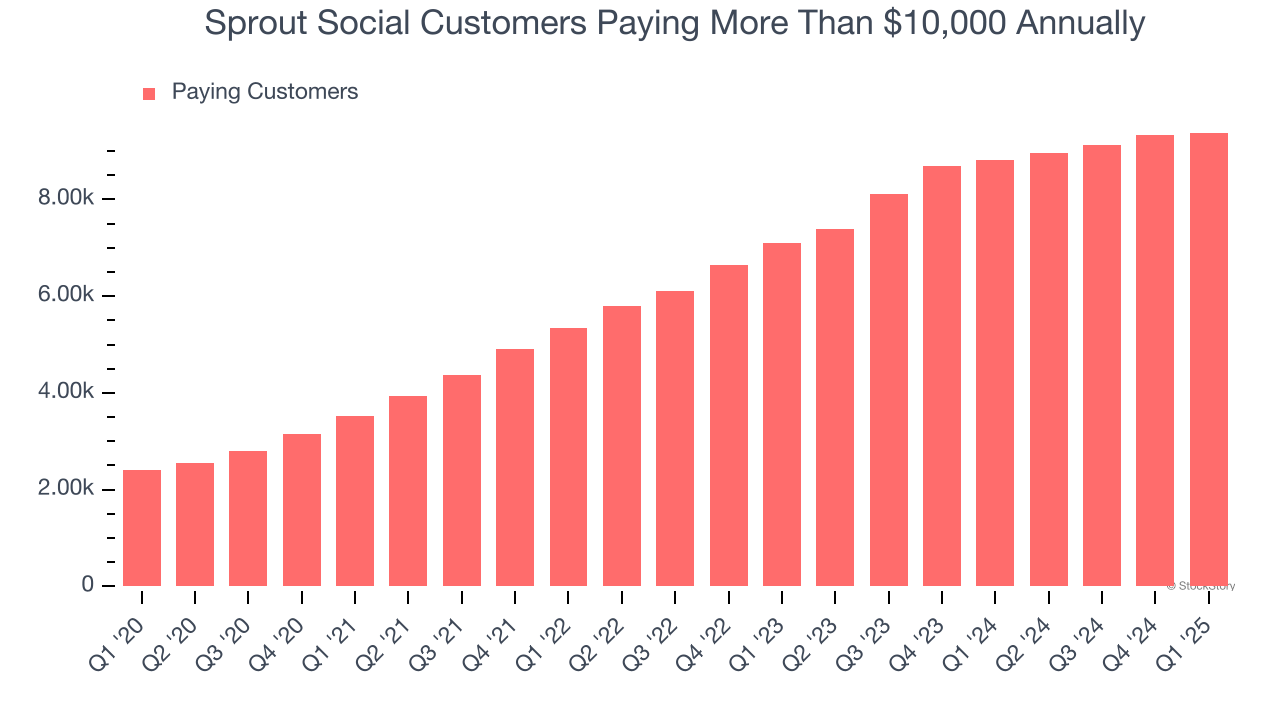

- Customers: 9,381

- Market Capitalization: $1.20 billion

“Our team delivered strong results in the first quarter, highlighted by 13% revenue growth, a 21% increase in cRPO, and profitability expansion,” said Ryan Barretto, CEO of Sprout Social.

Company Overview

Founded by Justyn Howard and Aaron Rankin in 2010, Sprout Social (NASDAQ:SPT) provides a software as a service platform that companies can use to schedule and respond to posts on major social media networks like Twitter, Facebook, Instagram, Youtube and LinkedIn.

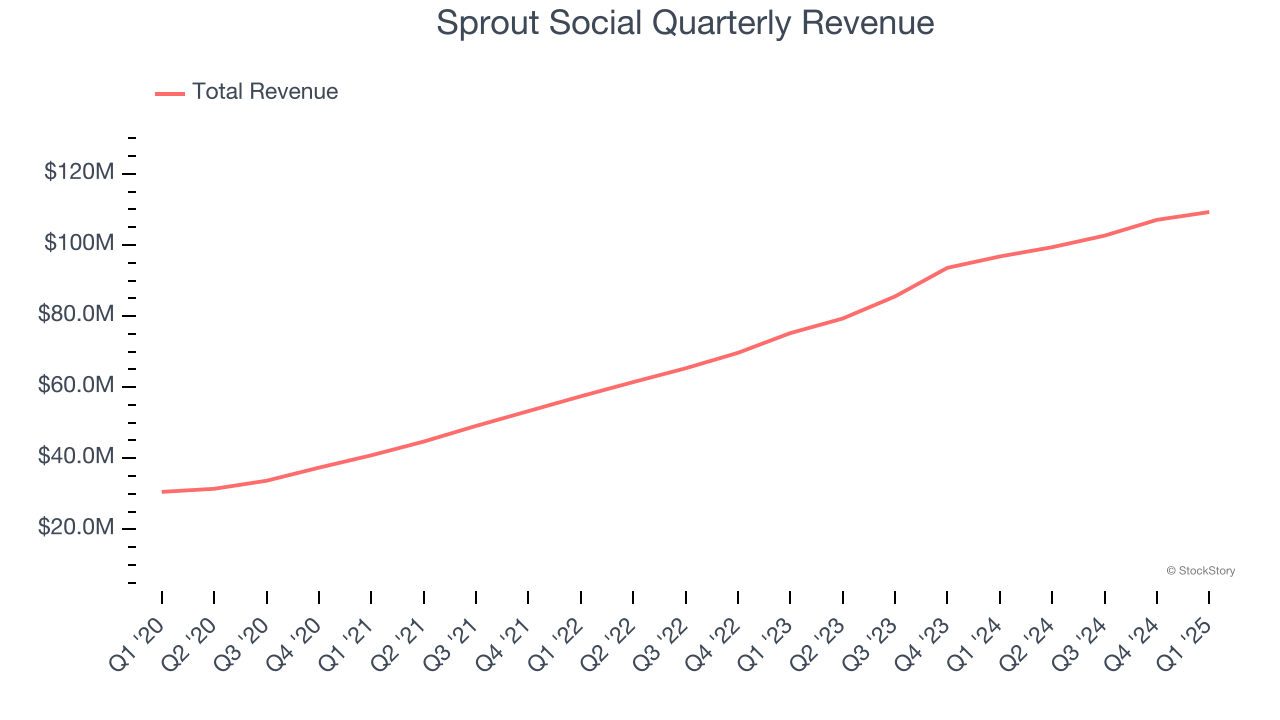

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Sprout Social grew its sales at a solid 27% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, Sprout Social reported year-on-year revenue growth of 12.9%, and its $109.3 million of revenue exceeded Wall Street’s estimates by 1.6%. Company management is currently guiding for a 11.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.2% over the next 12 months, a deceleration versus the last three years. Still, this projection is above average for the sector and implies the market sees some success for its newer products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Enterprise Customer Base

This quarter, Sprout Social reported 9,381 enterprise customers paying more than $10,000 annually, an increase of 54 from the previous quarter. That’s a bit fewer contract wins than last quarter and quite a bit below what we’ve observed over the previous year, suggesting its sales momentum with new enterprise customers is slowing. It also implies that Sprout Social will likely need to upsell its existing large customers or move down market to accelerate its top-line growth.

Key Takeaways from Sprout Social’s Q1 Results

We were impressed by Sprout Social’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $21.81 immediately after reporting.

Sprout Social had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.