Medical device company Globus Medical (NYSE:GMED) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 1.4% year on year to $598.1 million. On the other hand, the company’s full-year revenue guidance of $2.85 billion at the midpoint came in 4.2% above analysts’ estimates. Its non-GAAP profit of $0.68 per share was 8.6% below analysts’ consensus estimates.

Is now the time to buy Globus Medical? Find out by accessing our full research report, it’s free.

Globus Medical (GMED) Q1 CY2025 Highlights:

- Revenue: $598.1 million vs analyst estimates of $627.6 million (1.4% year-on-year decline, 4.7% miss)

- Adjusted EPS: $0.68 vs analyst expectations of $0.74 (8.6% miss)

- Adjusted EBITDA: $177.8 million vs analyst estimates of $195.4 million (29.7% margin, 9% miss)

- The company lifted its revenue guidance for the full year to $2.85 billion at the midpoint from $2.68 billion, a 6.5% increase

- Management lowered its full-year Adjusted EPS guidance to $3.15 at the midpoint, a 8.7% decrease

- Operating Margin: 16.2%, up from 1.3% in the same quarter last year

- Free Cash Flow Margin: 23.6%, up from 3.9% in the same quarter last year

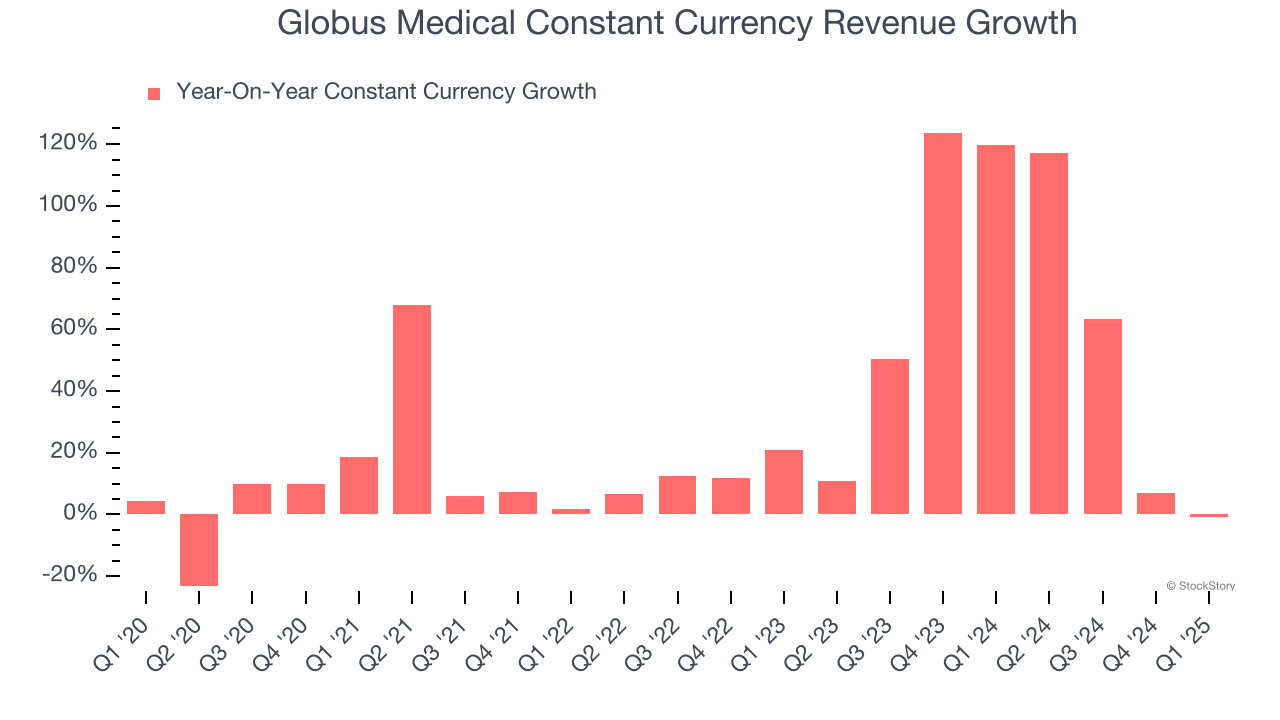

- Constant Currency Revenue was flat year on year (120% in the same quarter last year)

- Market Capitalization: $9.68 billion

Company Overview

With operations spanning 64 countries and a portfolio of over 10 new products launched in 2023 alone, Globus Medical (NYSE:GMED) develops and sells implantable devices, surgical instruments, and technology solutions for spine, orthopedic, and neurosurgical procedures.

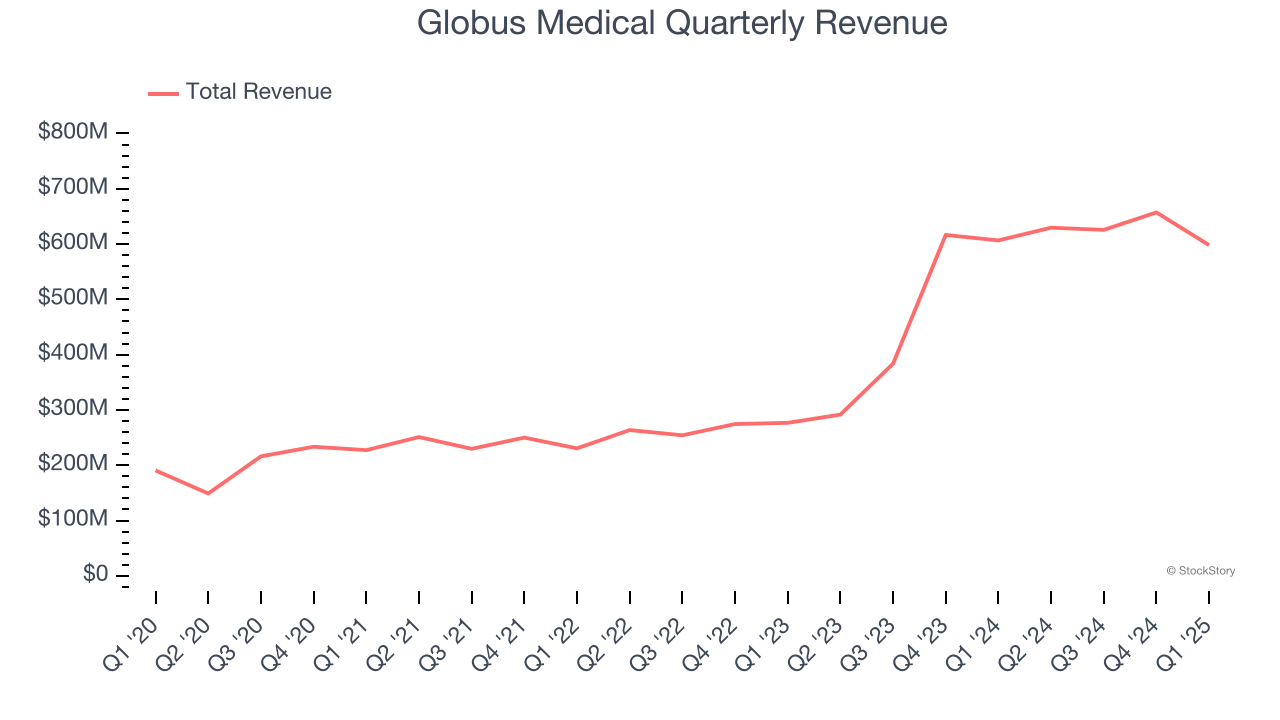

Sales Growth

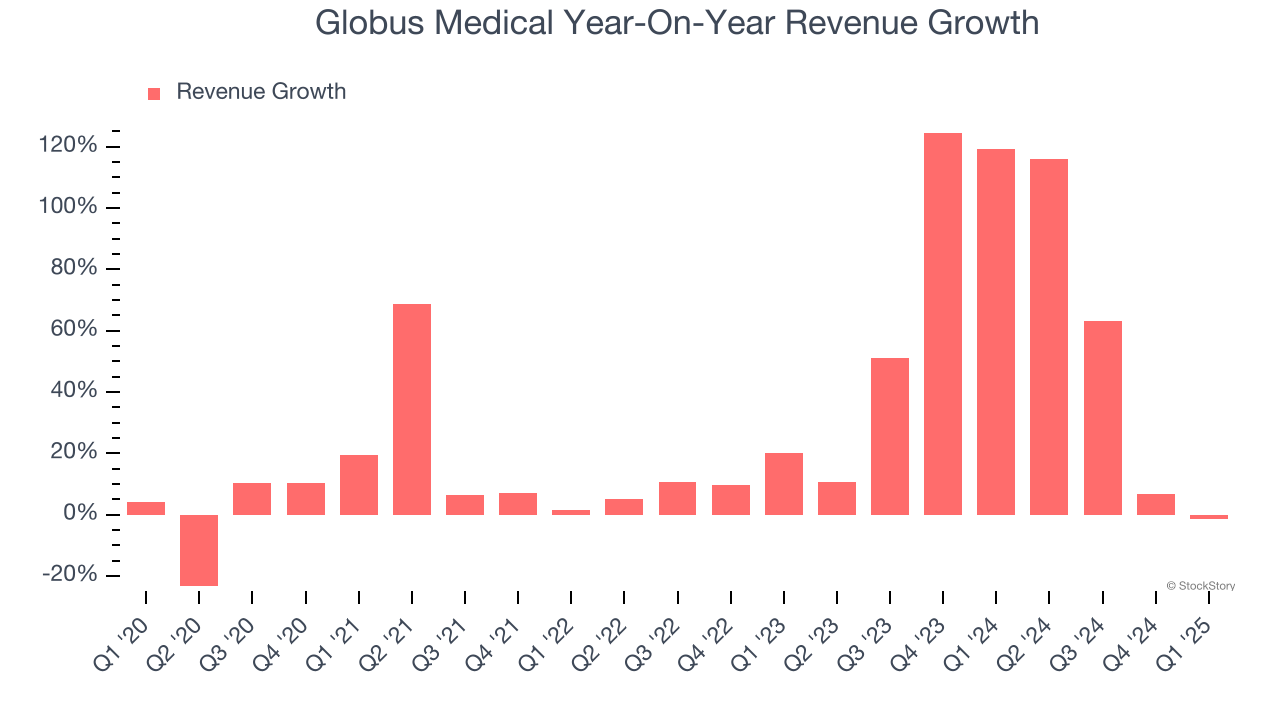

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Globus Medical’s sales grew at an exceptional 25.9% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Globus Medical’s annualized revenue growth of 53.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 61.4% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Globus Medical.

This quarter, Globus Medical missed Wall Street’s estimates and reported a rather uninspiring 1.4% year-on-year revenue decline, generating $598.1 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 11.7% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and implies the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

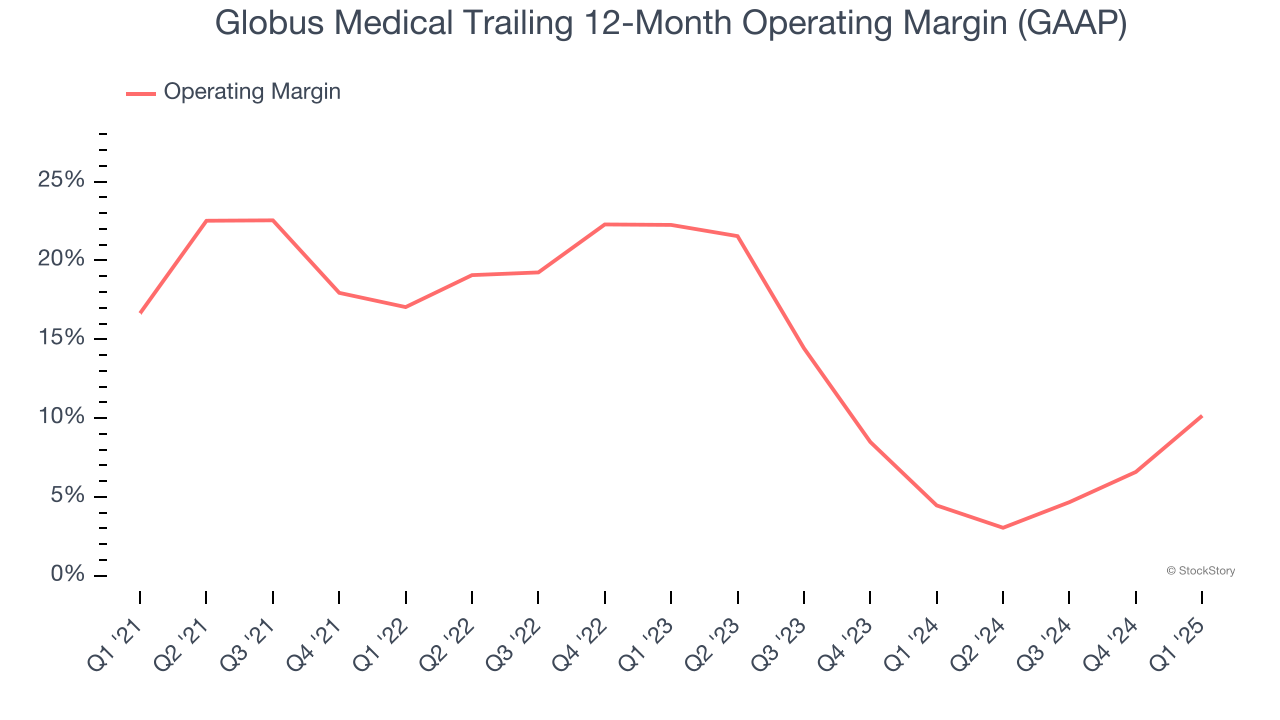

Globus Medical has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 12.1%, higher than the broader healthcare sector.

Looking at the trend in its profitability, Globus Medical’s operating margin decreased by 6.5 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 12.1 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Globus Medical generated an operating profit margin of 16.2%, up 14.9 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

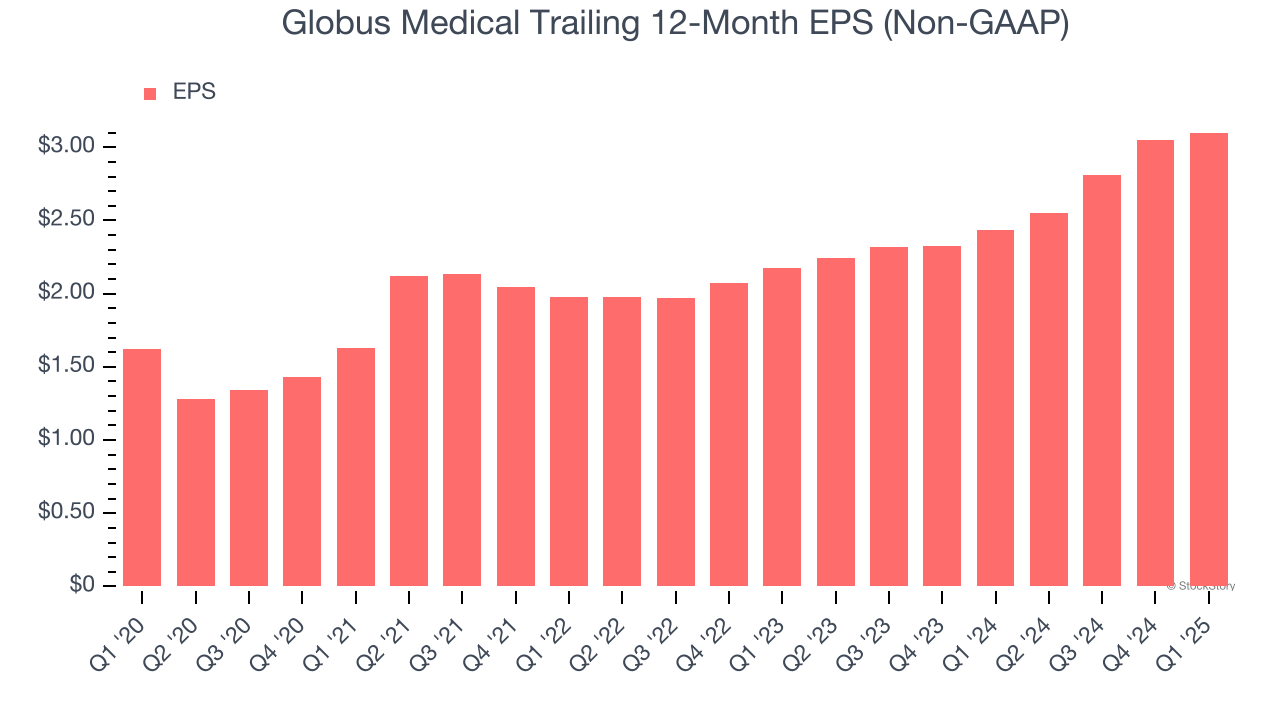

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

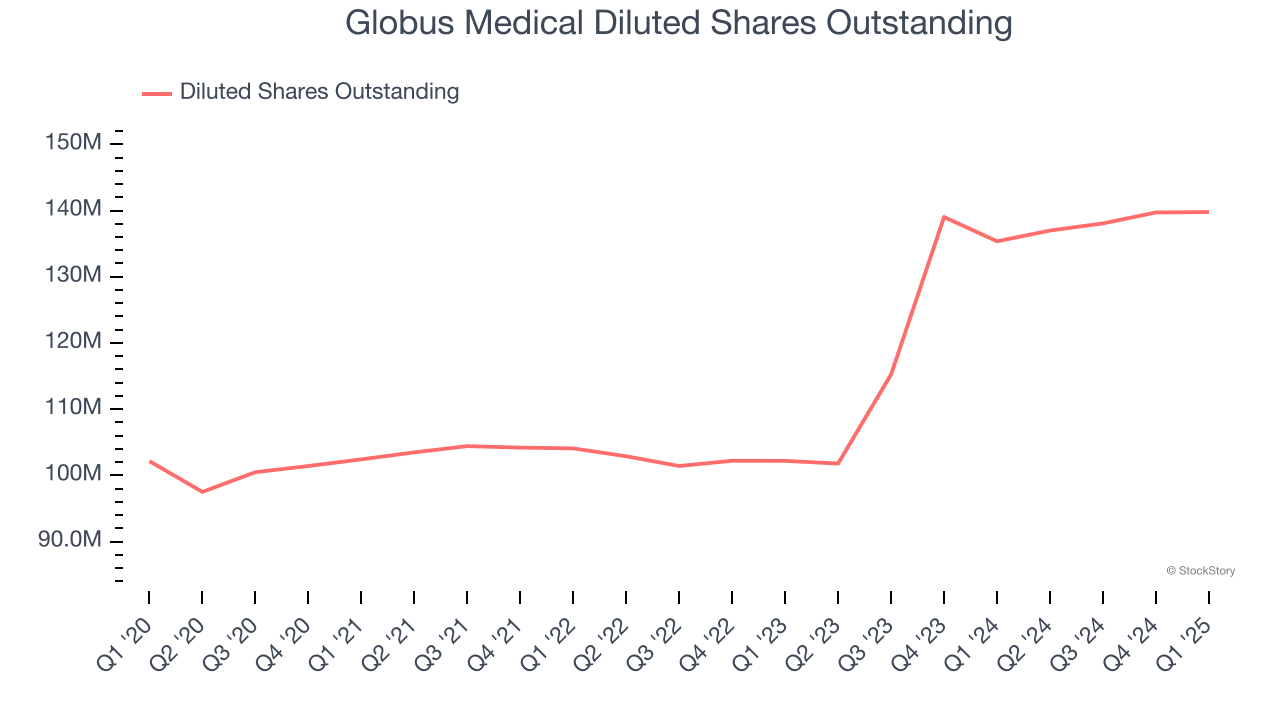

Globus Medical’s EPS grew at a spectacular 13.8% compounded annual growth rate over the last five years. However, this performance was lower than its 25.9% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Globus Medical’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Globus Medical’s operating margin improved this quarter but declined by 6.5 percentage points over the last five years. Its share count also grew by 36.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q1, Globus Medical reported EPS at $0.68, up from $0.63 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Globus Medical’s full-year EPS of $3.10 to grow 14%.

Key Takeaways from Globus Medical’s Q1 Results

We were impressed by Globus Medical’s optimistic full-year revenue guidance, which blew past analysts’ expectations. On the other hand, its full-year EPS guidance missed along with its revenue, EPS, and EBITDA. Overall, this was a softer quarter. The stock traded down 17.1% to $60 immediately following the results.

The latest quarter from Globus Medical’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.