Pharmaceutical company Collegium Pharmaceutical (NASDAQ:COLL) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 22.7% year on year to $177.8 million. The company expects the full year’s revenue to be around $742.5 million, close to analysts’ estimates. Its non-GAAP profit of $1.49 per share was 2.8% above analysts’ consensus estimates.

Is now the time to buy Collegium Pharmaceutical? Find out by accessing our full research report, it’s free.

Collegium Pharmaceutical (COLL) Q1 CY2025 Highlights:

- Revenue: $177.8 million vs analyst estimates of $172.8 million (22.7% year-on-year growth, 2.9% beat)

- Adjusted EPS: $1.49 vs analyst estimates of $1.45 (2.8% beat)

- Adjusted EBITDA: $95.15 million vs analyst estimates of $96.5 million (53.5% margin, 1.4% miss)

- The company reconfirmed its revenue guidance for the full year of $742.5 million at the midpoint

- EBITDA guidance for the full year is $442.5 million at the midpoint, above analyst estimates of $438.5 million

- Operating Margin: 12.2%, down from 34.1% in the same quarter last year

- Market Capitalization: $869.2 million

“Collegium is off to a strong start in 2025. We have made significant progress towards our key strategic priorities including growing Jornay PM, maximizing our pain portfolio, and strategically deploying capital to further enhance shareholder value,” said Vikram Karnani, President and Chief Executive Officer.

Company Overview

Pioneering abuse-deterrent technology in a field plagued by addiction concerns, Collegium Pharmaceutical (NASDAQ:COLL) develops and markets specialty medications for treating moderate to severe pain, including abuse-deterrent opioid formulations.

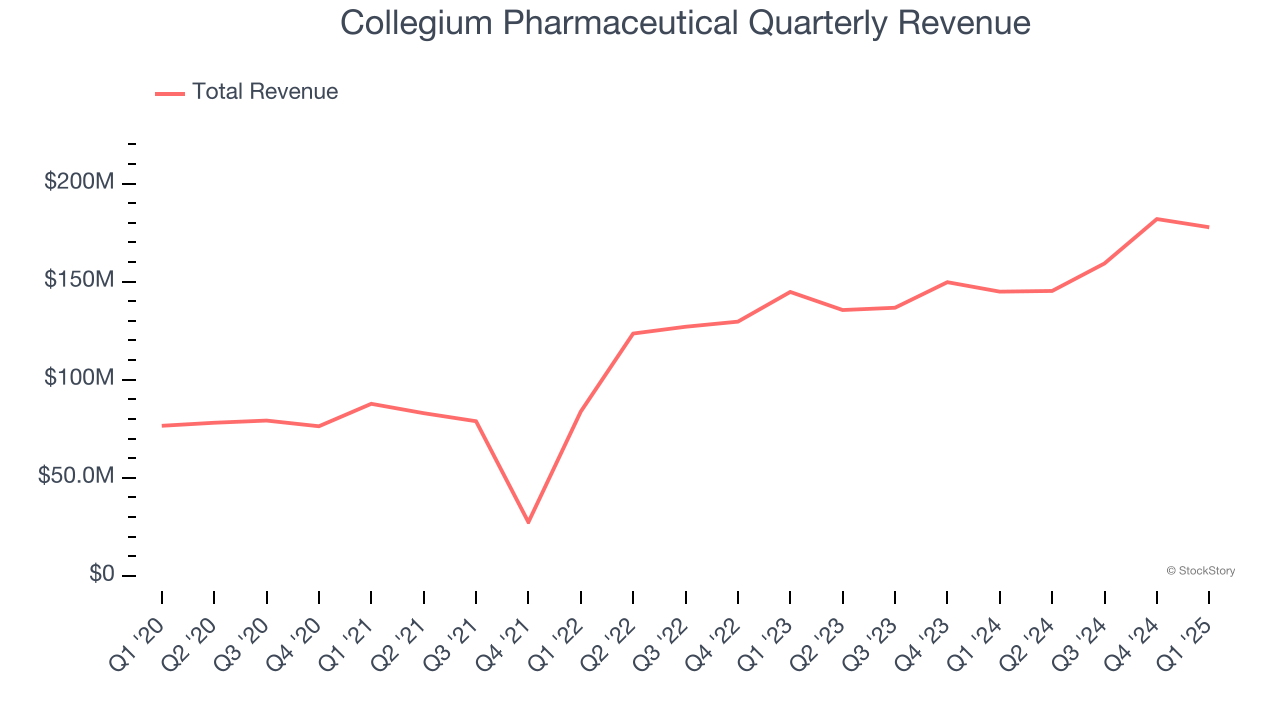

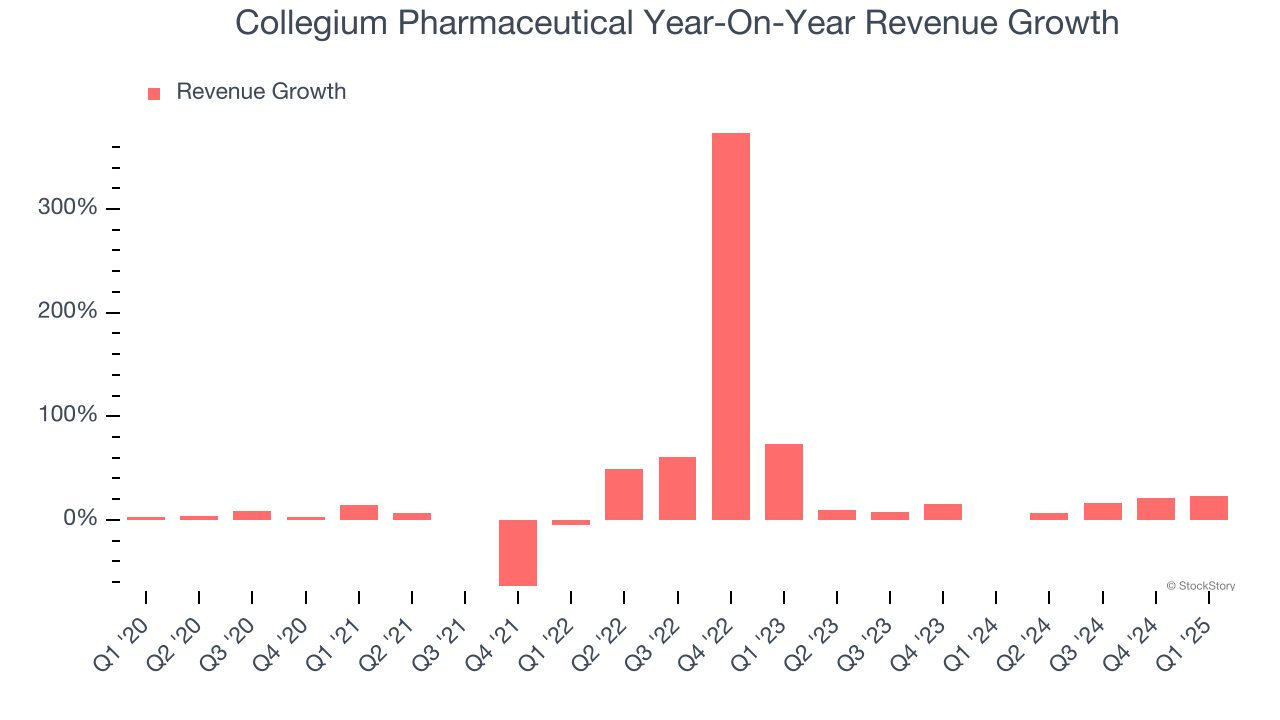

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Collegium Pharmaceutical grew its sales at an impressive 17.3% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Collegium Pharmaceutical’s annualized revenue growth of 12.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Collegium Pharmaceutical reported robust year-on-year revenue growth of 22.7%, and its $177.8 million of revenue topped Wall Street estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to grow 13.2% over the next 12 months, similar to its two-year rate. This projection is admirable and suggests the market sees success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

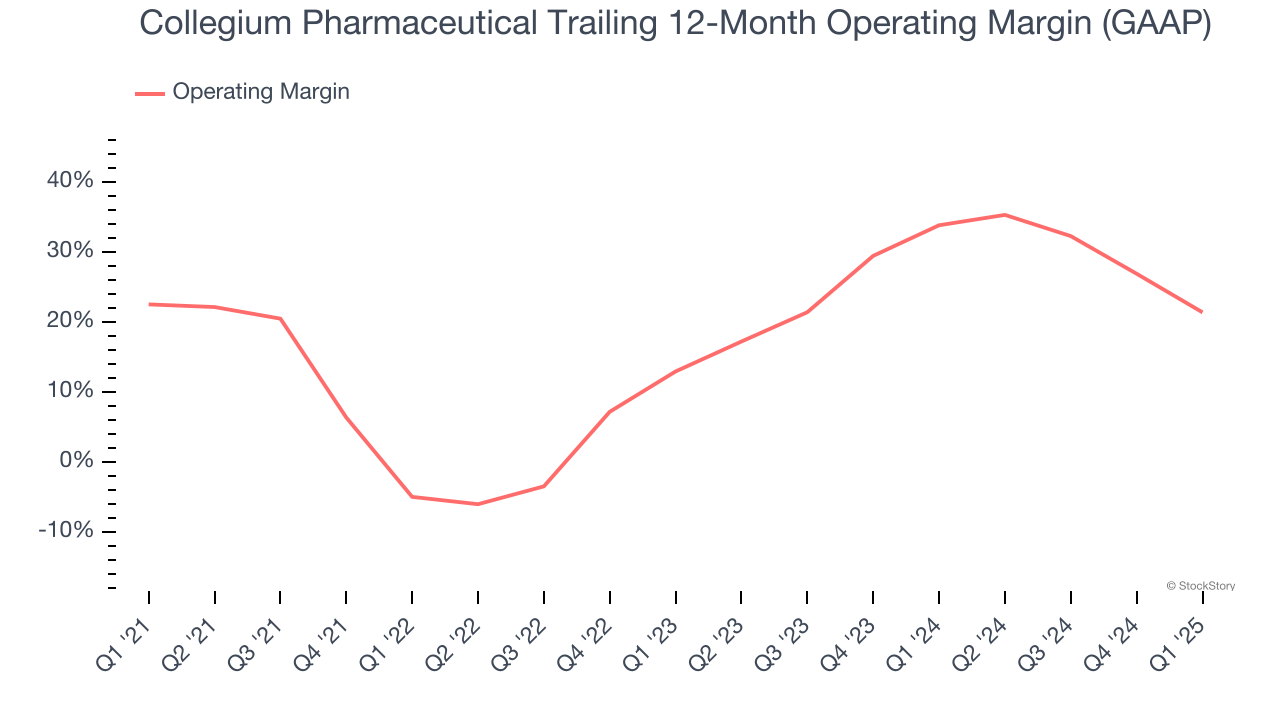

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Collegium Pharmaceutical has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 19.6%.

Looking at the trend in its profitability, Collegium Pharmaceutical’s operating margin decreased by 1.1 percentage points over the last five years, but it rose by 8.4 percentage points on a two-year basis. Still, shareholders will want to see Collegium Pharmaceutical become more profitable in the future.

In Q1, Collegium Pharmaceutical generated an operating profit margin of 12.2%, down 21.9 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

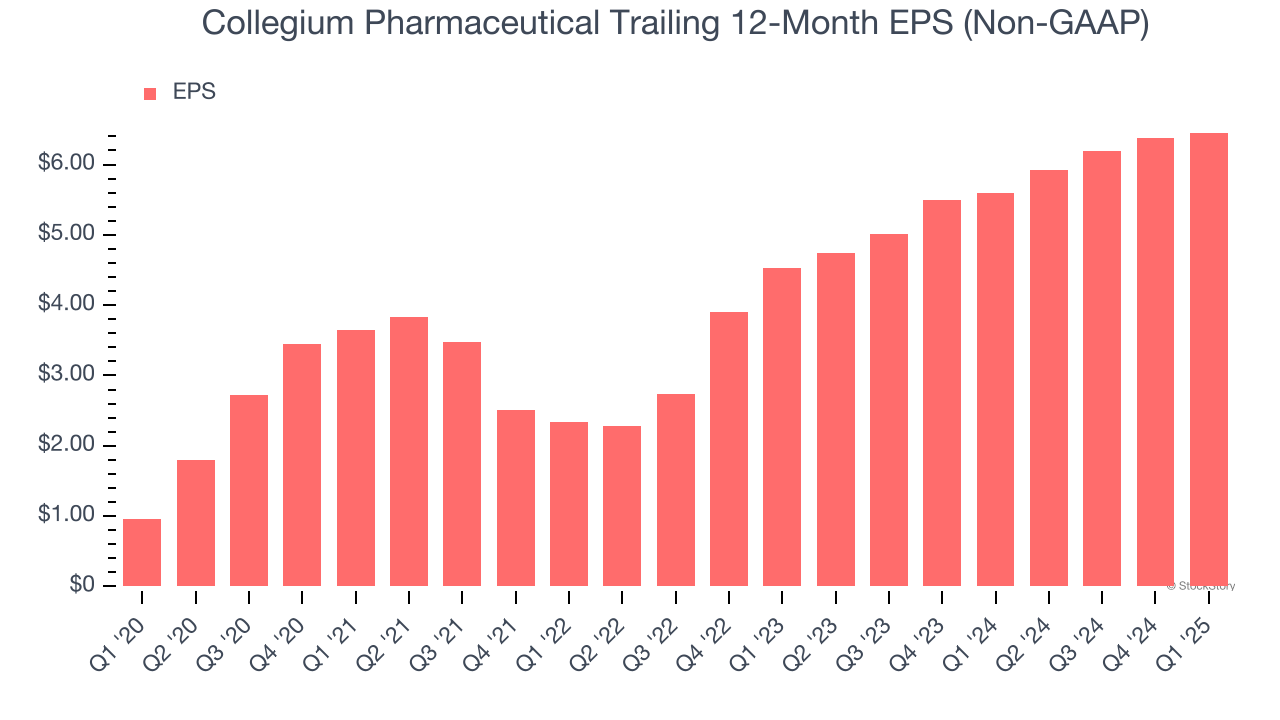

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Collegium Pharmaceutical’s EPS grew at an astounding 46.4% compounded annual growth rate over the last five years, higher than its 17.3% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

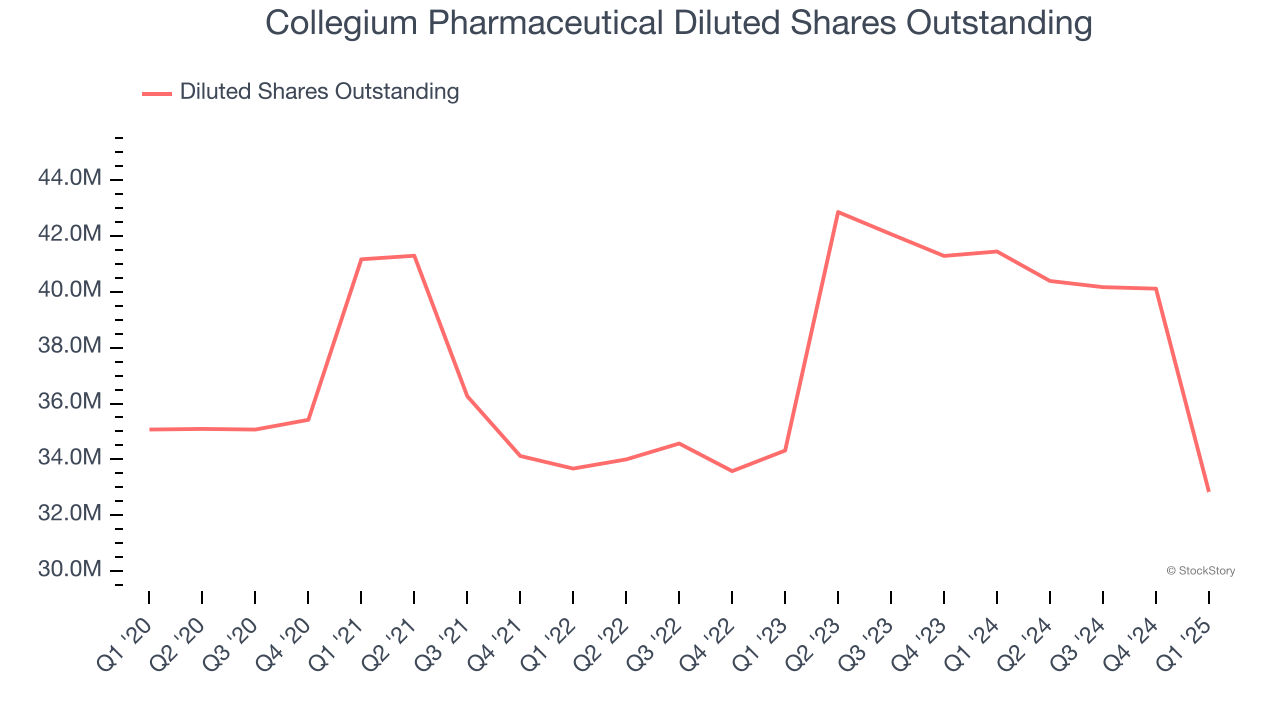

Diving into Collegium Pharmaceutical’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Collegium Pharmaceutical has repurchased its stock, shrinking its share count by 6.4%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q1, Collegium Pharmaceutical reported EPS at $1.49, up from $1.42 in the same quarter last year. This print beat analysts’ estimates by 2.8%. Over the next 12 months, Wall Street expects Collegium Pharmaceutical’s full-year EPS of $6.45 to grow 11.4%.

Key Takeaways from Collegium Pharmaceutical’s Q1 Results

We enjoyed seeing Collegium Pharmaceutical beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $27.27 immediately following the results.

So should you invest in Collegium Pharmaceutical right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.