Biotech company 10x Genomics (NASDAQ:TXG) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 9.8% year on year to $154.9 million. On the other hand, next quarter’s revenue guidance of $140 million was less impressive, coming in 3.6% below analysts’ estimates. Its GAAP loss of $0.28 per share was 40.6% above analysts’ consensus estimates.

Is now the time to buy 10x Genomics? Find out by accessing our full research report, it’s free.

10x Genomics (TXG) Q1 CY2025 Highlights:

- Revenue: $154.9 million vs analyst estimates of $132.7 million (9.8% year-on-year growth, 16.7% beat)

- EPS (GAAP): -$0.28 vs analyst estimates of -$0.47 (40.6% beat)

- Revenue Guidance for Q2 CY2025 is $140 million at the midpoint, below analyst estimates of $145.2 million

- Operating Margin: -25.4%, up from -43.6% in the same quarter last year

- Market Capitalization: $1.02 billion

"Customer enthusiasm and improving consumables trends reinforce our conviction in our technology and in the potential of Single Cell and Spatial," said Serge Saxonov, Co-founder and CEO of 10x Genomics.

Company Overview

Founded in 2012 by scientists seeking to overcome limitations in traditional biological research methods, 10x Genomics (NASDAQ:TXG) develops instruments, consumables, and software that enable researchers to analyze biological systems at single-cell resolution and spatial context.

Sales Growth

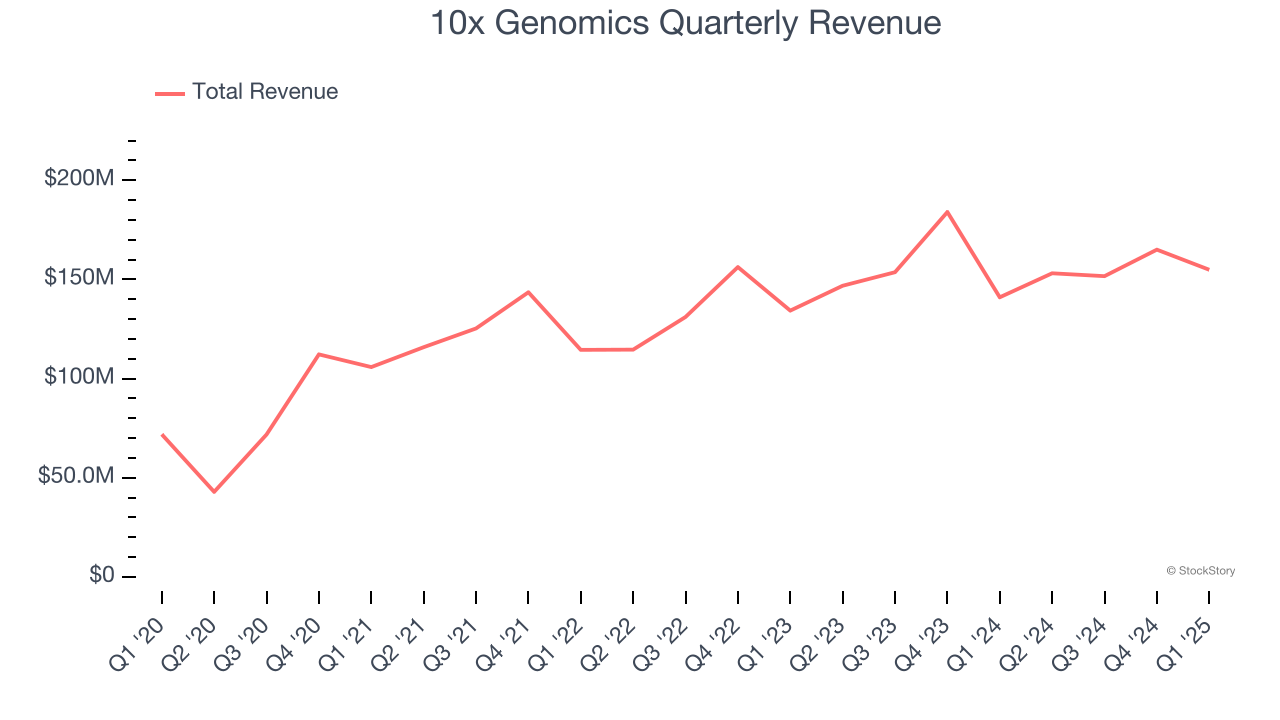

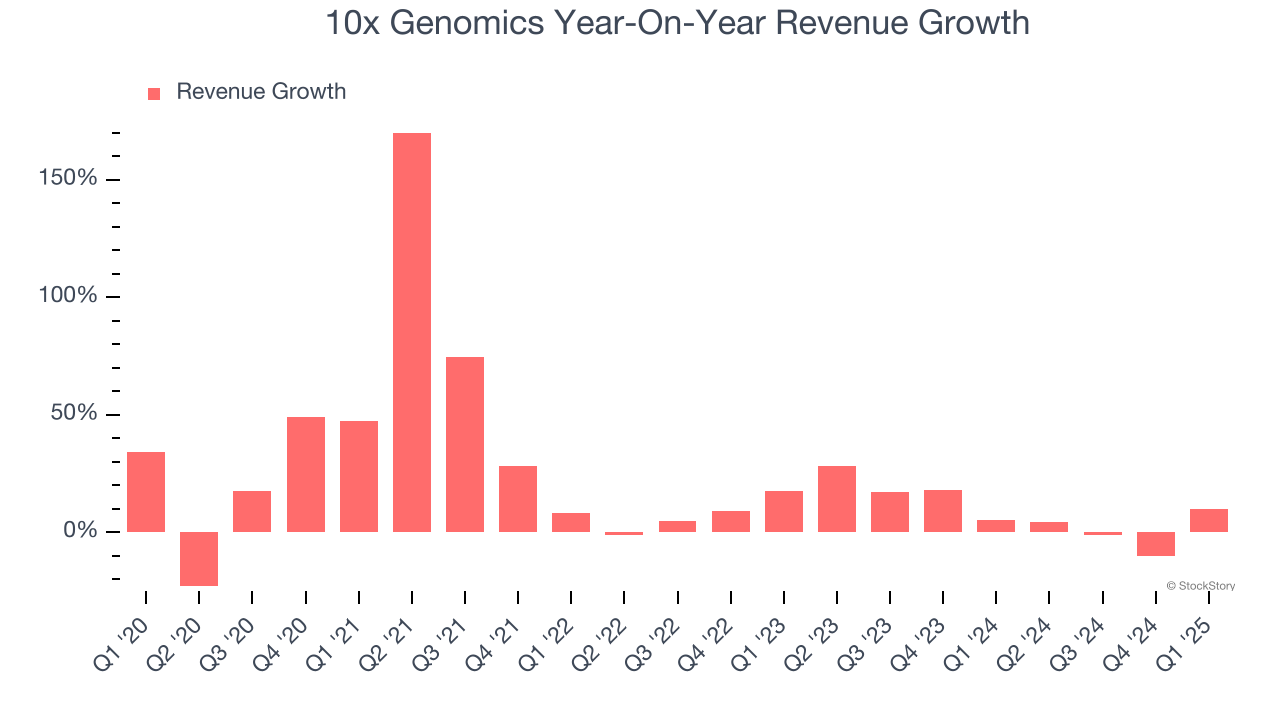

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, 10x Genomics grew its sales at an impressive 18.8% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. 10x Genomics’s annualized revenue growth of 7.9% over the last two years is below its five-year trend, but we still think the results were respectable.

We can better understand the company’s revenue dynamics by analyzing its most important segment, Consumables. Over the last two years, 10x Genomics’s Consumables revenue (recurring orders) averaged 5.6% year-on-year growth. This segment has lagged the company’s overall sales.

This quarter, 10x Genomics reported year-on-year revenue growth of 9.8%, and its $154.9 million of revenue exceeded Wall Street’s estimates by 16.7%. Company management is currently guiding for a 8.6% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

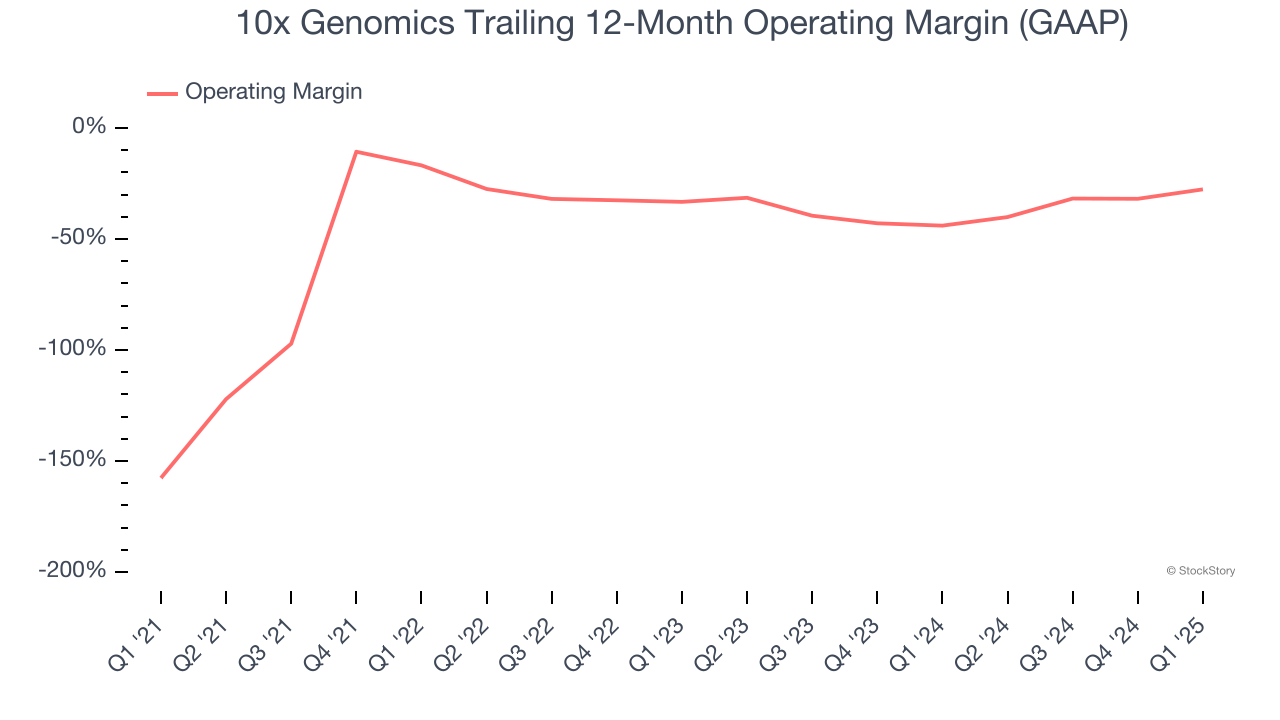

10x Genomics’s high expenses have contributed to an average operating margin of negative 47.1% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, 10x Genomics’s operating margin rose over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 5.6 percentage points on a two-year basis.

This quarter, 10x Genomics generated a negative 25.4% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

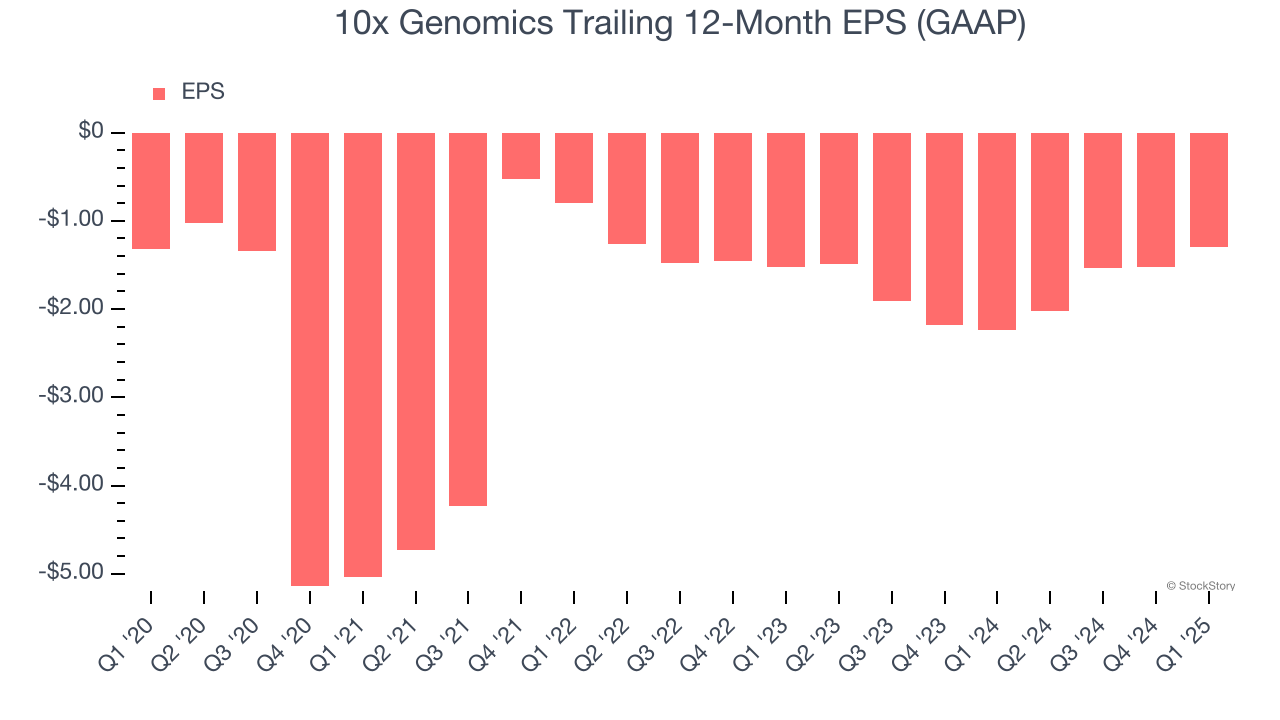

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

10x Genomics’s full-year EPS was flat over the last five years. This performance was underwhelming across the board.

In Q1, 10x Genomics reported EPS at negative $0.28, up from negative $0.50 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects 10x Genomics to perform poorly. Analysts forecast its full-year EPS of negative $1.30 will tumble to negative $1.40.

Key Takeaways from 10x Genomics’s Q1 Results

We were impressed by how significantly 10x Genomics blew past analysts’ revenue and EPS expectations this quarter. On the other hand, its revenue guidance for next quarter missed significantly. Zooming out, we think this quarter was mixed. The stock traded up 4.5% to $9 immediately following the results.

10x Genomics had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.