Over the past six months, NetApp’s shares (currently trading at $98.71) have posted a disappointing 15.8% loss while the S&P 500 was flat. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in NetApp, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think NetApp Will Underperform?

Even with the cheaper entry price, we're cautious about NetApp. Here are three reasons why we avoid NTAP and a stock we'd rather own.

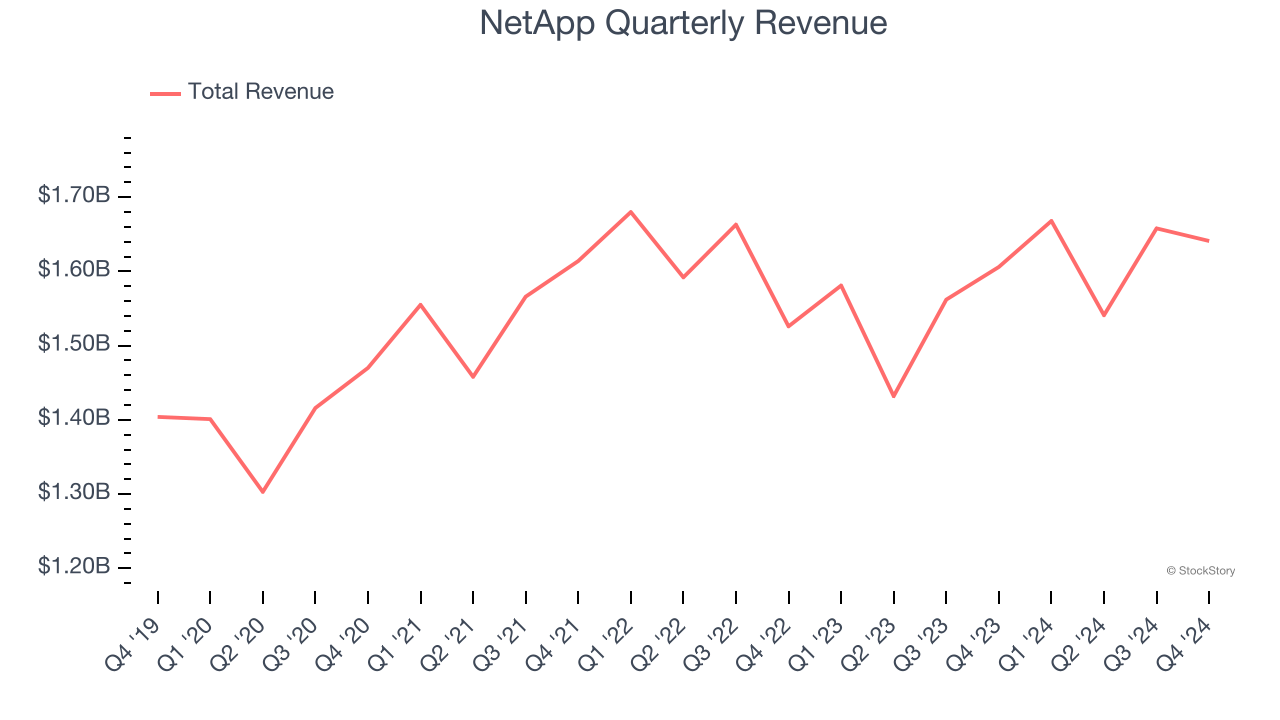

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, NetApp grew its sales at a tepid 3% compounded annual growth rate. This fell short of our benchmark for the business services sector.

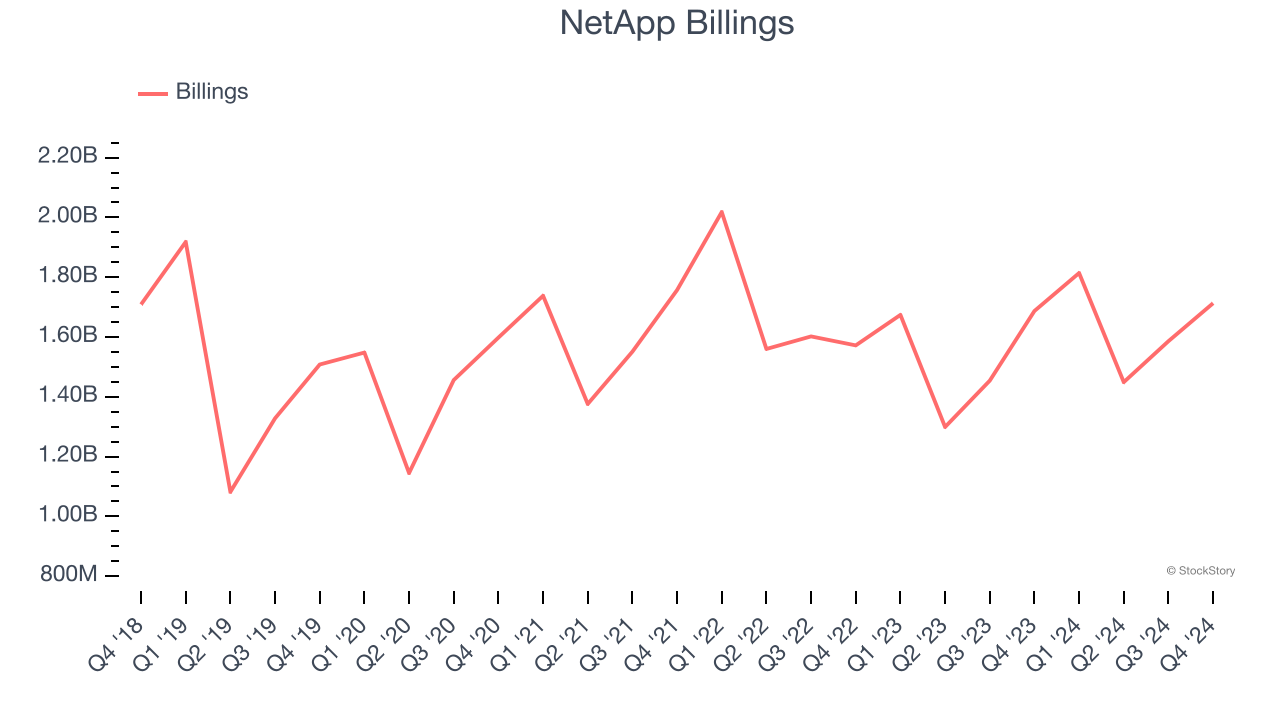

2. Billings Hit a Plateau

Billings is a non-GAAP metric that sheds light on NetApp’s demand characteristics. This metric is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period - different from reported revenue, which must be recognized in pieces over the length of a contract.

Over the last two years, NetApp failed to grow its billings, which came in at $1.71 billion in the latest quarter. This performance was underwhelming and shows the company faced challenges in acquiring and retaining customers. It also suggests it may need to improve its products, pricing, or go-to-market strategy.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect NetApp’s revenue to rise by 3.8%. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Final Judgment

NetApp doesn’t pass our quality test. Following the recent decline, the stock trades at 12.9× forward P/E (or $98.71 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are more exciting stocks to buy at the moment. We’d suggest looking at one of our top digital advertising picks.

Stocks We Like More Than NetApp

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.