Waste Connections currently trades at $186.28 per share and has shown little upside over the past six months, posting a middling return of 1.5%.

Given the underwhelming price action, is now a good time to buy WCN? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does Waste Connections Spark Debate?

Operating a network of municipal solid waste landfills in the U.S. and Canada, Waste Connections (NYSE:WCN) is North America's third-largest waste management company providing collection, disposal, and recycling services.

Two Positive Attributes:

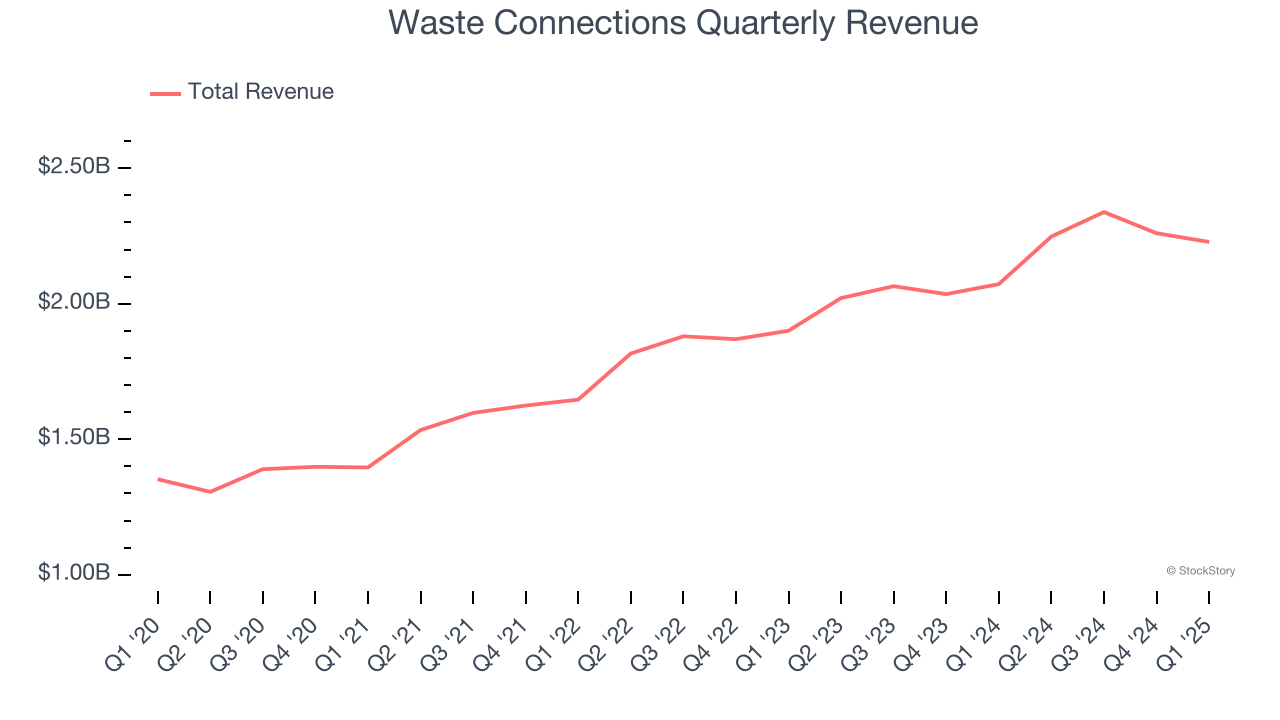

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Waste Connections’s 10.5% annualized revenue growth over the last five years was impressive. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

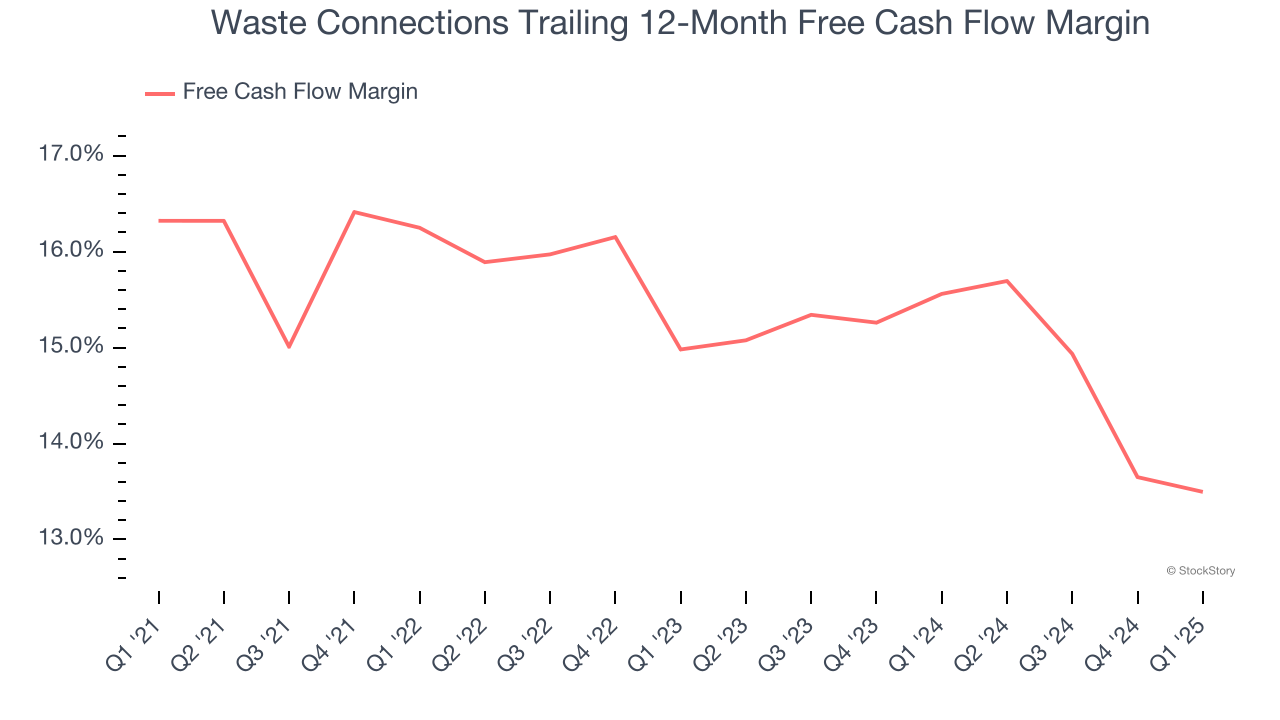

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Waste Connections has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 15.2% over the last five years.

One Reason to be Careful:

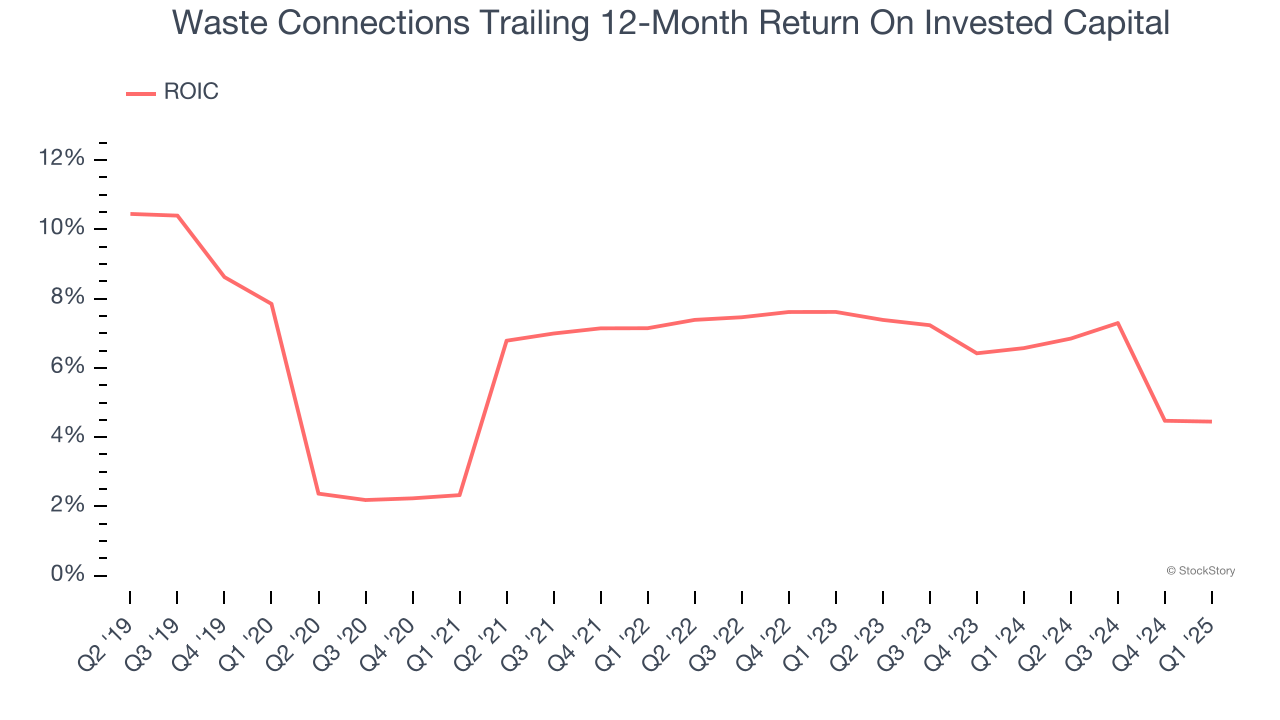

Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Waste Connections has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.6%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

Waste Connections’s merits more than compensate for its flaws, but at $186.28 per share (or 34.4× forward P/E), is now the right time to buy the stock? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Waste Connections

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.