CACI has gotten torched over the last six months - since October 2024, its stock price has dropped 23.8% to $390.23 per share. This may have investors wondering how to approach the situation.

Following the drawdown, is this a buying opportunity for CACI? Find out in our full research report, it’s free.

Why Does CACI Spark Debate?

Founded to commercialize SIMSCRIPT, CACI International (NYSE:CACI) offers defense, intelligence, and IT solutions to support national security and government transformation efforts.

Two Positive Attributes:

1. Surging Backlog Locks In Future Sales

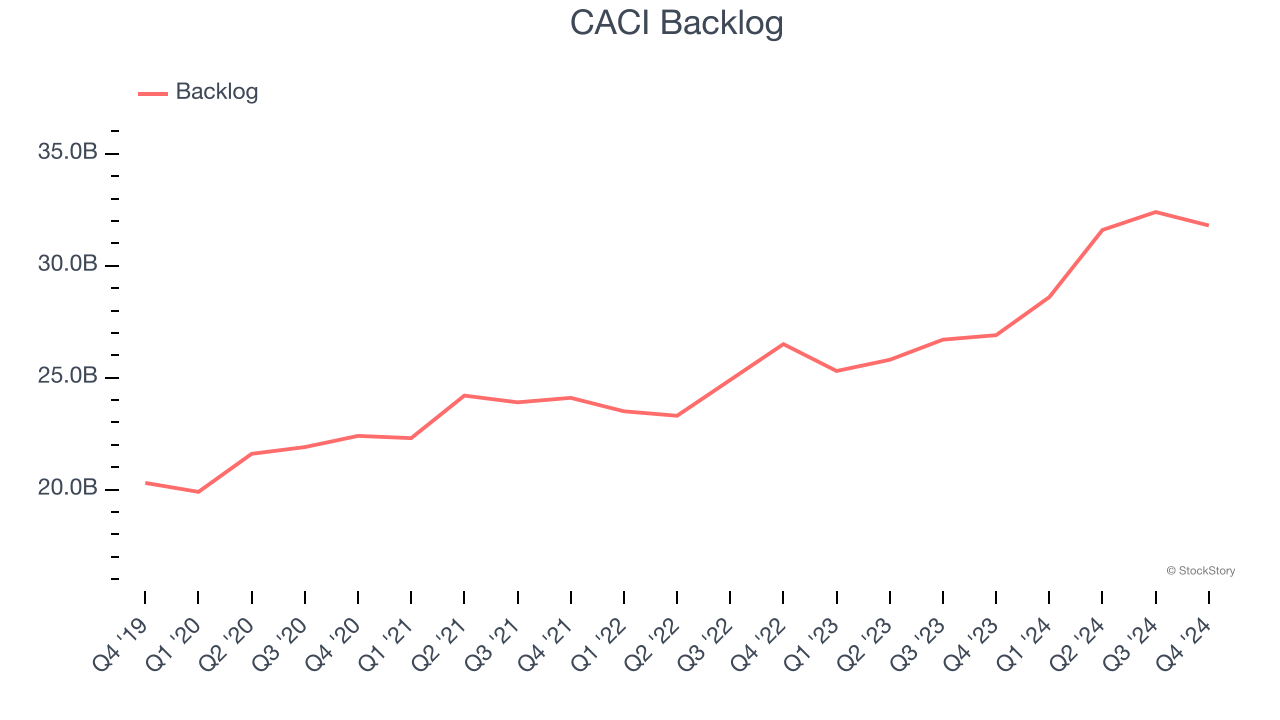

In addition to reported revenue, backlog is a useful data point for analyzing Defense Contractors companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into CACI’s future revenue streams.

CACI’s backlog punched in at $31.8 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 12.8%. This performance was impressive and shows the company has a robust sales pipeline because it is accumulating more orders than it can fulfill. Its growth also suggests that customers are committing to CACI for the long term, enhancing the business’s predictability.

2. Outstanding Long-Term EPS Growth

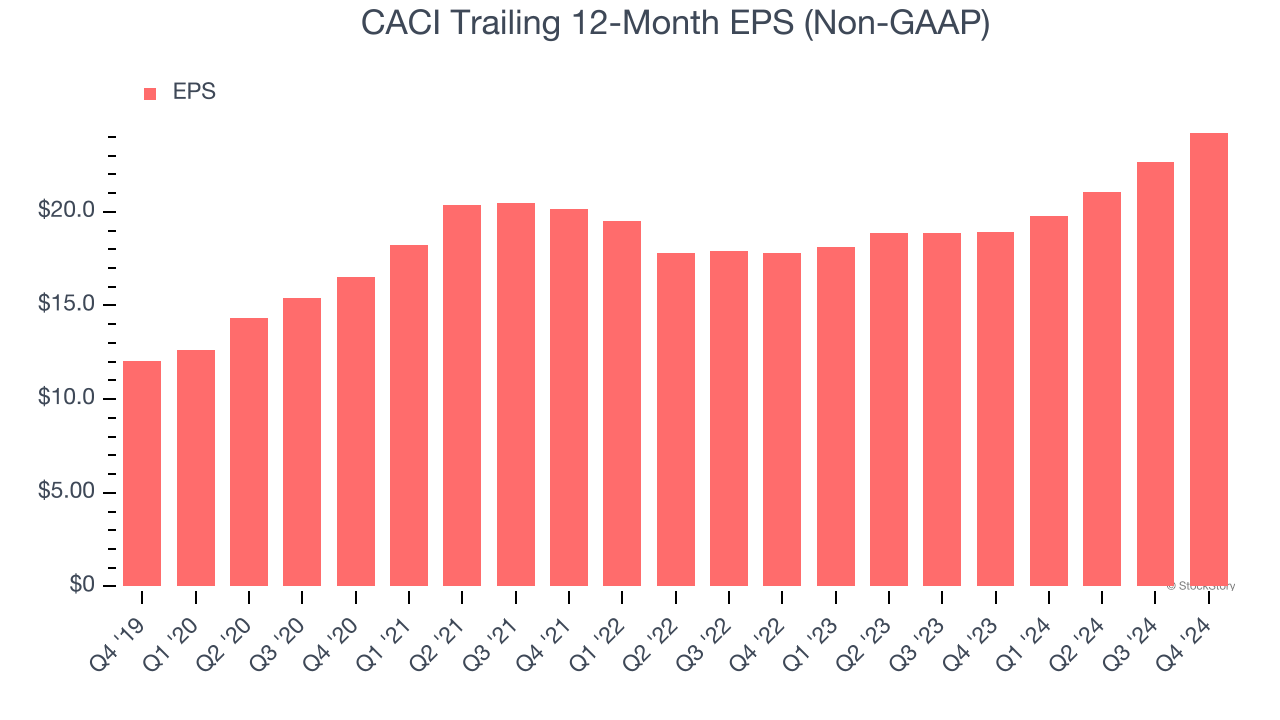

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

CACI’s EPS grew at a spectacular 15% compounded annual growth rate over the last five years, higher than its 8.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Free Cash Flow Margin Dropping

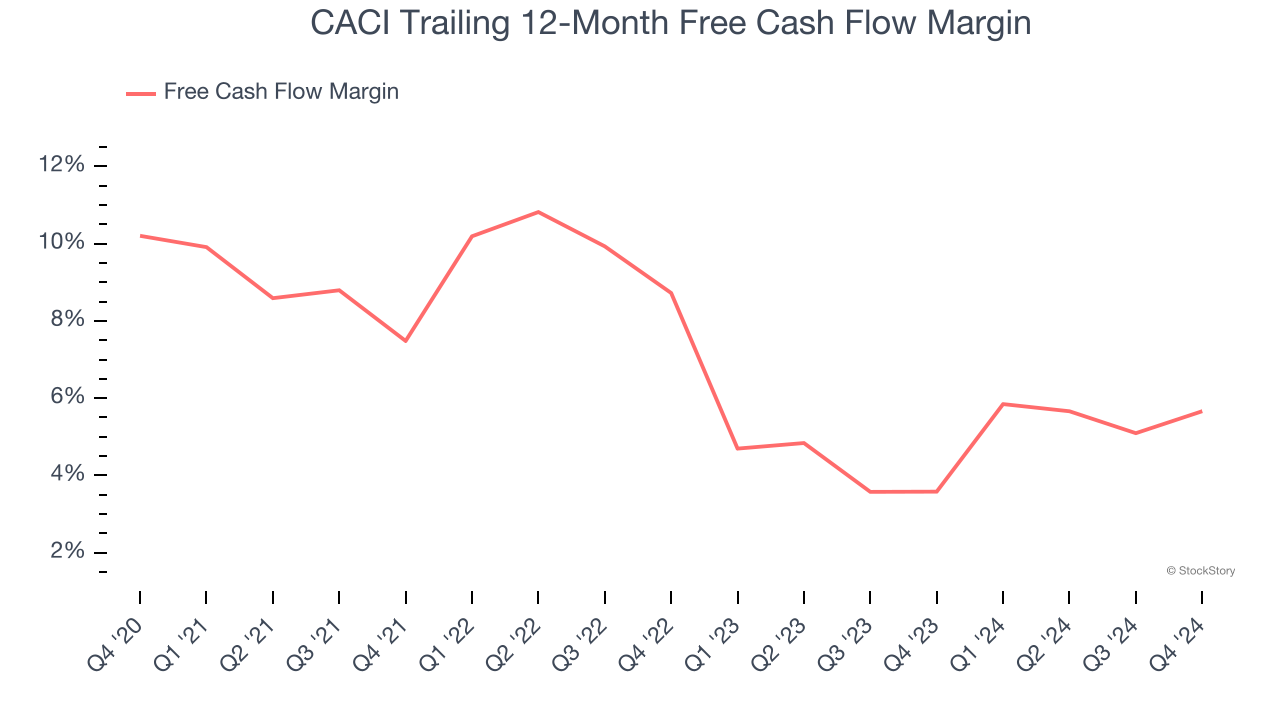

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, CACI’s margin dropped by 4.5 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. CACI’s free cash flow margin for the trailing 12 months was 5.7%.

Final Judgment

CACI’s merits more than compensate for its flaws. After the recent drawdown, the stock trades at 15.1× forward price-to-earnings (or $390.23 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than CACI

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.