The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Movado (NYSE:MOV) and the rest of the apparel and accessories stocks fared in Q4.

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel and accessories stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 16.5% since the latest earnings results.

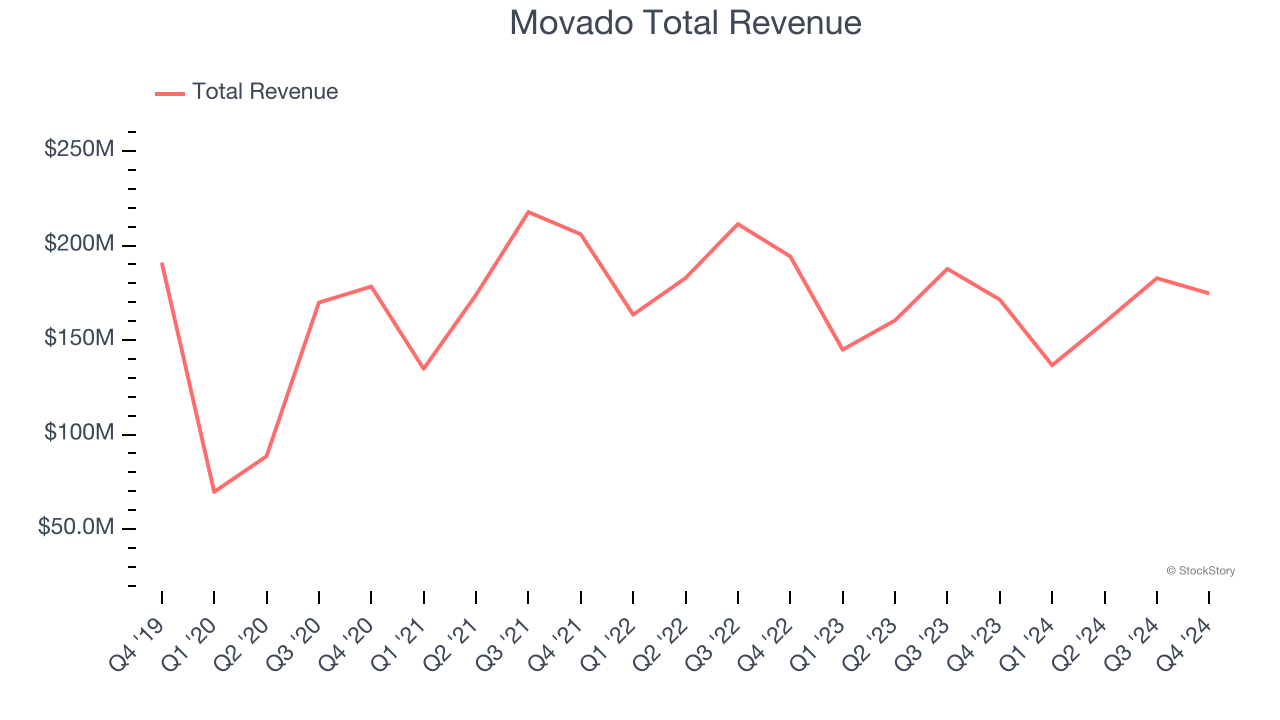

Slowest Q4: Movado (NYSE:MOV)

With its watches displayed in 20 museums around the world, Movado (NYSE:MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Movado reported revenues of $174.7 million, up 1.9% year on year. This print fell short of analysts’ expectations by 3.8%. Overall, it was a disappointing quarter for the company with a miss of analysts’ EPS estimates.

Efraim Grinberg, Chairman and Chief Executive Officer, stated: “Despite a challenging macroeconomic backdrop, we delivered net sales growth in the fourth quarter and also expanded gross profit margin while increasing marketing spend in support of future growth. As we communicated when reporting third quarter results in December, we increased our focus on reducing go-forward operating expenses. As of our fiscal year end, we had already implemented actions that are expected to deliver $10 million in annualized savings while increasing efficiency across our enterprise in order to generate higher productivity and profitability. Additionally, we will bring our marketing spend to be more in line with sales in fiscal 2026, with planned spend being reduced by a range of $15 million to $20 million relative to fiscal 2025.”

Movado delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 2.7% since reporting and currently trades at $13.35.

Read our full report on Movado here, it’s free.

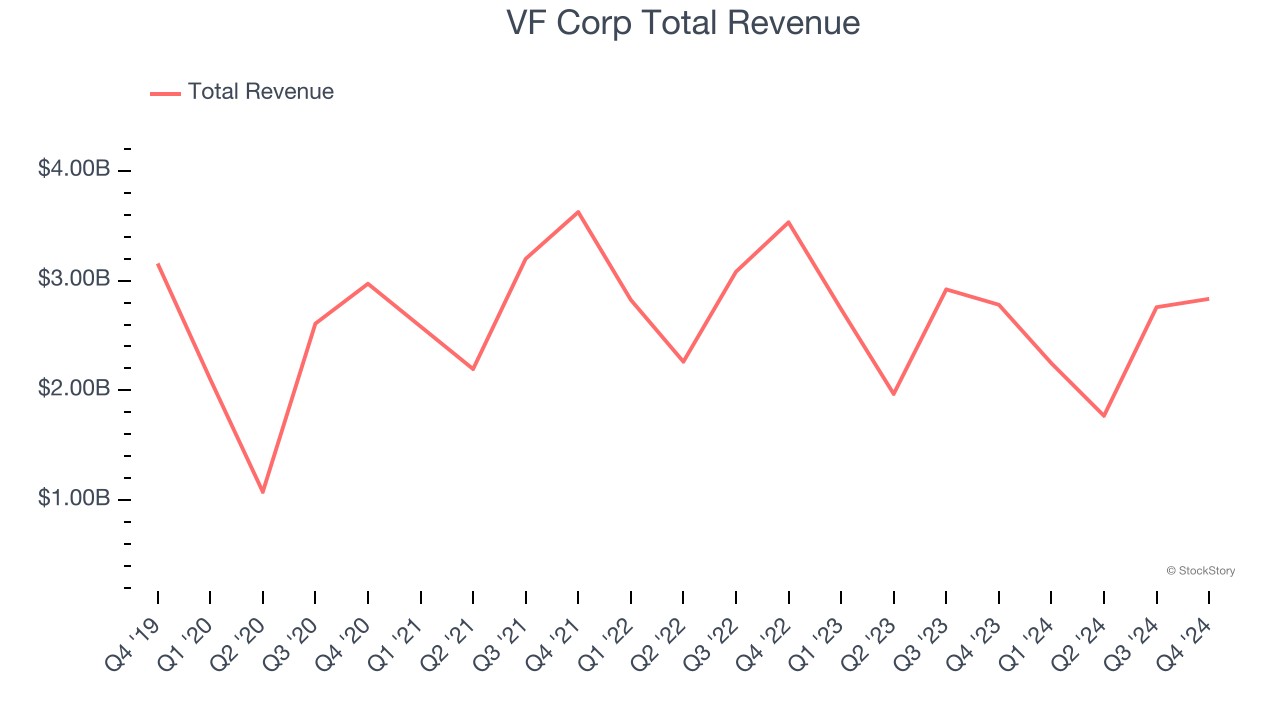

Best Q4: VF Corp (NYSE:VFC)

Owner of The North Face, Vans, and Supreme, VF Corp (NYSE:VFC) is a clothing conglomerate specializing in branded lifestyle apparel, footwear, and accessories.

VF Corp reported revenues of $2.83 billion, up 1.9% year on year, outperforming analysts’ expectations by 1.2%. The business had a stunning quarter with a solid beat of analysts’ constant currency revenue and EPS estimates.

The stock is down 60.5% since reporting. It currently trades at $10.49.

Is now the time to buy VF Corp? Access our full analysis of the earnings results here, it’s free.

Columbia Sportswear (NASDAQ:COLM)

Originally founded as a hat store in 1938, Columbia Sportswear (NASDAQ:COLM) is a manufacturer of outerwear, sportswear, and footwear designed for outdoor enthusiasts.

Columbia Sportswear reported revenues of $1.10 billion, up 3.5% year on year, exceeding analysts’ expectations by 1.4%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations and a miss of analysts’ EPS estimates.

As expected, the stock is down 23.7% since the results and currently trades at $65.52.

Read our full analysis of Columbia Sportswear’s results here.

Levi's (NYSE:LEVI)

Credited for inventing the first pair of blue jeans in 1873, Levi's (NYSE:LEVI) is an apparel company renowned for its iconic denim products and classic American style.

Levi's reported revenues of $1.53 billion, up 3.1% year on year. This number came in 0.8% below analysts' expectations. Zooming out, it was actually a very strong quarter as it logged an impressive beat of analysts’ constant currency revenue and EPS estimates.

The stock is up 9.1% since reporting and currently trades at $14.70.

Read our full, actionable report on Levi's here, it’s free.

Under Armour (NYSE:UAA)

Founded in 1996 by a former University of Maryland football player, Under Armour (NYSE:UAA) is an apparel brand specializing in sportswear designed to improve athletic performance.

Under Armour reported revenues of $1.40 billion, down 5.7% year on year. This print beat analysts’ expectations by 4.5%. Overall, it was an exceptional quarter as it also produced a solid beat of analysts’ constant currency revenue estimates and an impressive beat of analysts’ EPS estimates.

Under Armour had the slowest revenue growth among its peers. The stock is down 29.4% since reporting and currently trades at $5.82.

Read our full, actionable report on Under Armour here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.