Electrical energy control systems manufacturer Powell (NYSE:POWL) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 24.4% year on year to $241.4 million. Its GAAP profit of $2.86 per share was 9.4% above analysts’ consensus estimates.

Is now the time to buy Powell? Find out by accessing our full research report, it’s free.

Powell (POWL) Q4 CY2024 Highlights:

- Revenue: $241.4 million vs analyst estimates of $232.6 million (24.4% year-on-year growth, 3.8% beat)

- EPS (GAAP): $2.86 vs analyst estimates of $2.61 (9.4% beat)

- Adjusted EBITDA: $37.33 million vs analyst estimates of $43.61 million (15.5% margin, 14.4% miss)

- Operating Margin: 14.7%, up from 13.3% in the same quarter last year

- Backlog: $1.3 billion at quarter end

- Market Capitalization: $2.95 billion

Brett A. Cope, Powell’s Chairman and Chief Executive Officer, stated, “Powell recorded a strong start to Fiscal 2025 highlighted by new order growth of 36%. We saw strong order activity across each of our market sectors, as our Electric Utility and Oil & Gas markets continue to benefit from robust tailwinds that support our expectation for volume growth in 2025. We were awarded a large LNG project situated along the U.S. Gulf Coast during the quarter as we expect this market sector to see improved activity levels relative to Fiscal 2024. Revenue also grew 24% and we delivered earnings per diluted share of $2.86 despite what is typically a seasonally softer first quarter. Overall, we remain very encouraged by both our backlog as well as the volume and composition of projects in our pipeline.”

Company Overview

Originally a metal-working shop supporting local petrochemical facilities, Powell (NYSE:POWL) has grown from a small Houston manufacturer to a global provider of electrical systems.

Electrical Systems

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

Sales Growth

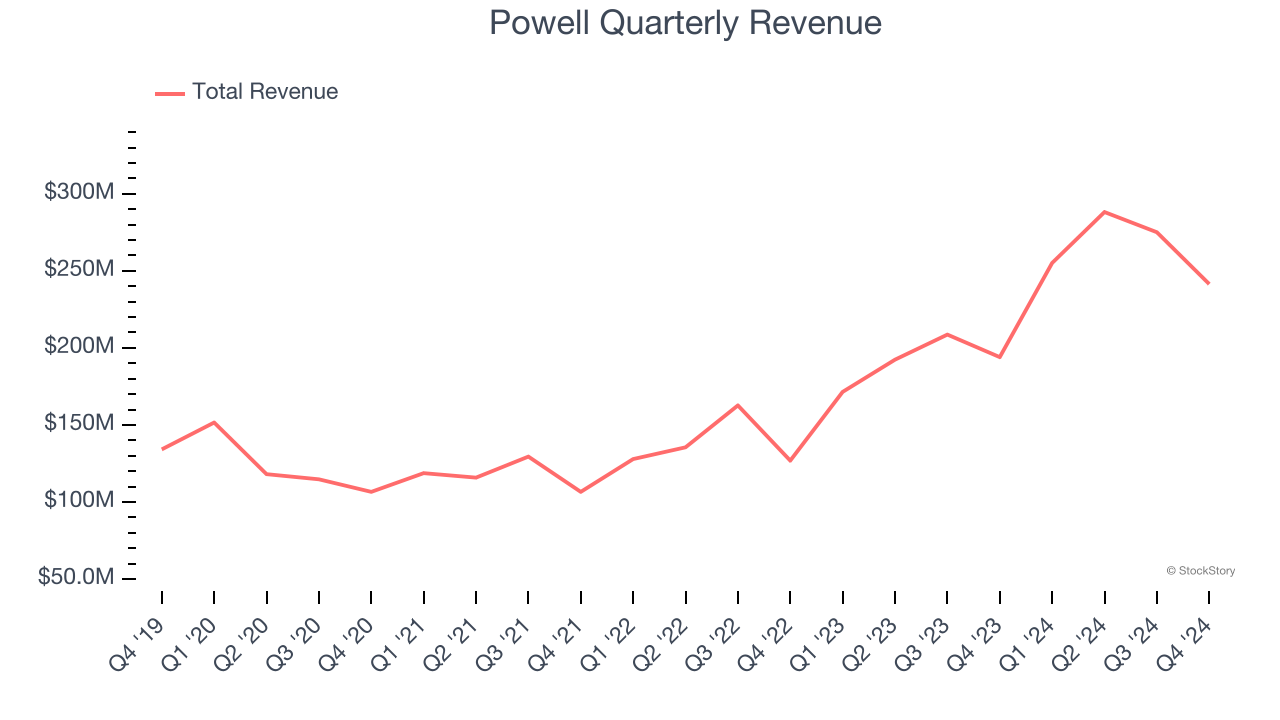

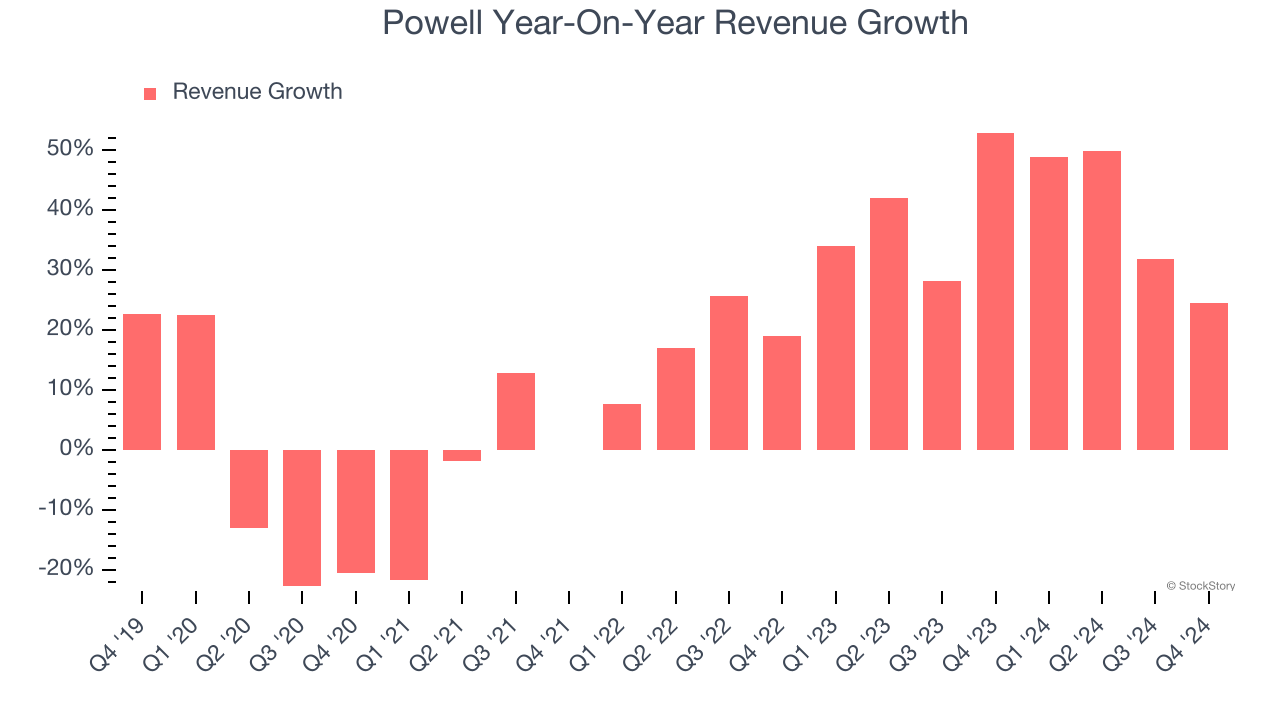

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Powell grew its sales at an exceptional 14.4% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Powell’s annualized revenue growth of 38.5% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Powell reported robust year-on-year revenue growth of 24.4%, and its $241.4 million of revenue topped Wall Street estimates by 3.8%.

Looking ahead, sell-side analysts expect revenue to grow 7.9% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and implies the market is factoring in some success for its newer products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

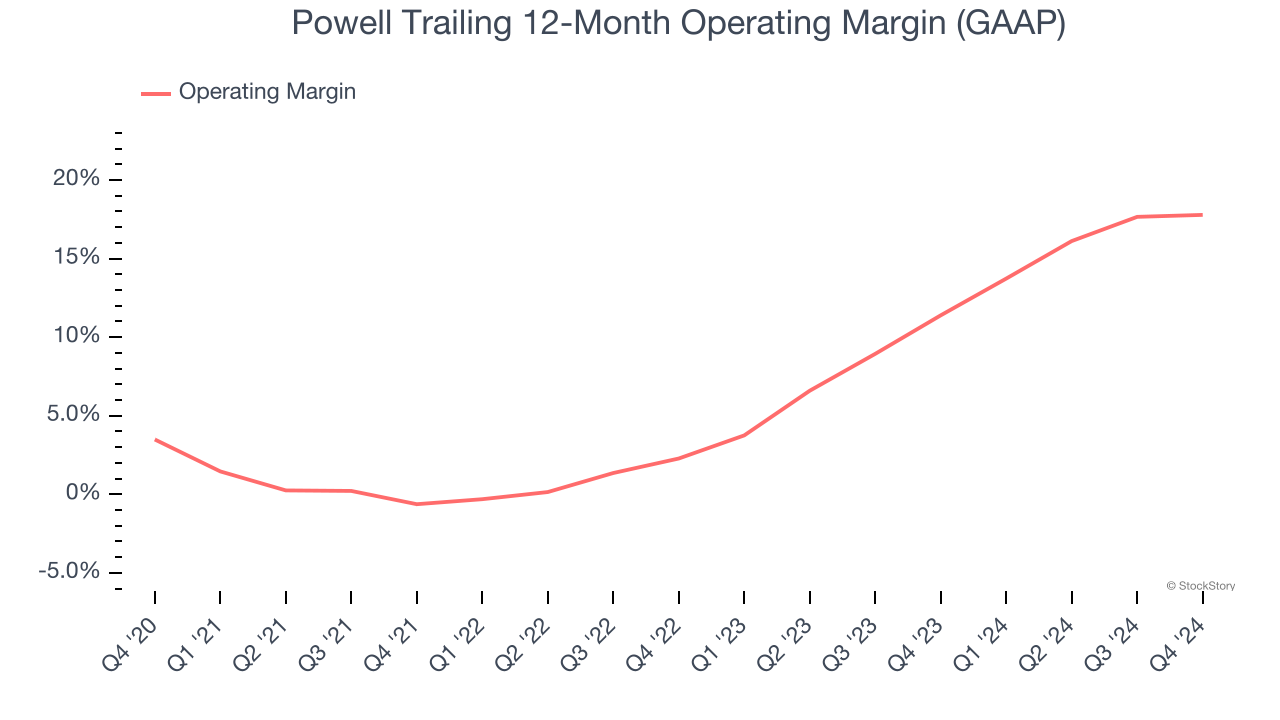

Powell has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.1%, higher than the broader industrials sector.

Looking at the trend in its profitability, Powell’s operating margin rose by 14.3 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Powell generated an operating profit margin of 14.7%, up 1.4 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

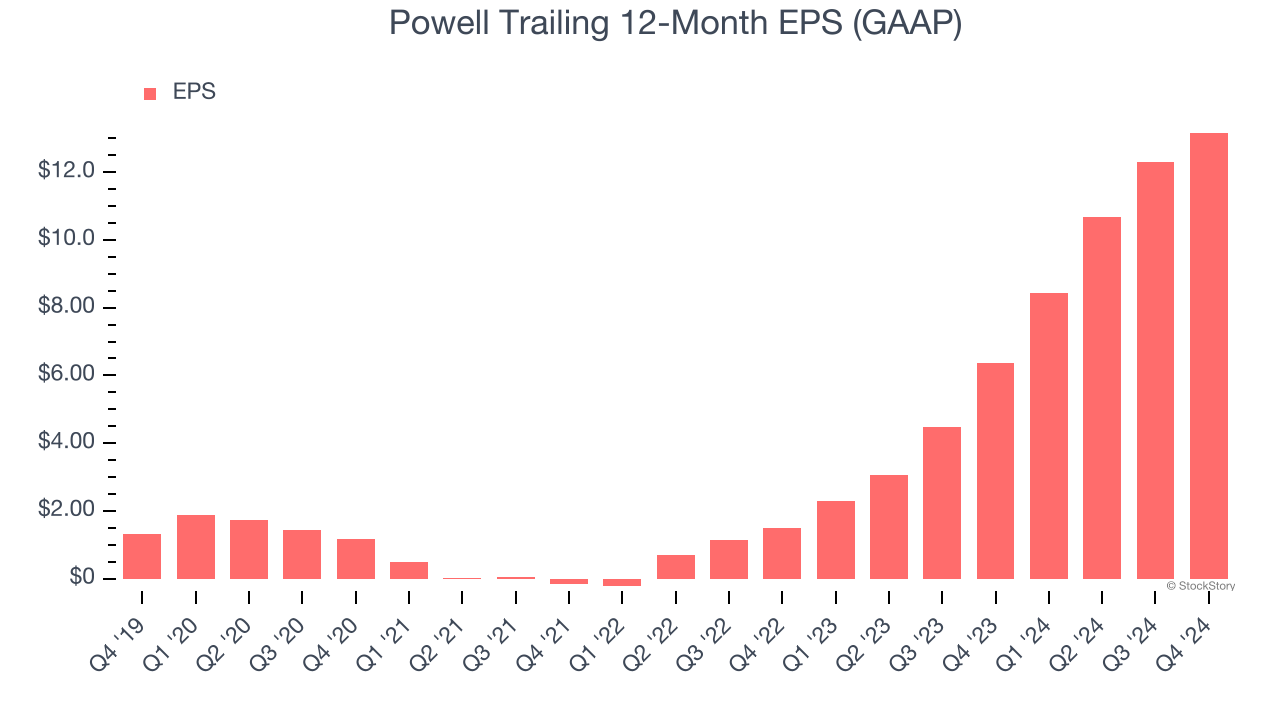

Powell’s EPS grew at an astounding 58.4% compounded annual growth rate over the last five years, higher than its 14.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Powell’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Powell’s operating margin expanded by 14.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Powell, its two-year annual EPS growth of 197% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Powell reported EPS at $2.86, up from $1.98 in the same quarter last year. This print beat analysts’ estimates by 9.4%. Over the next 12 months, Wall Street expects Powell’s full-year EPS of $13.17 to grow 8%.

Key Takeaways from Powell’s Q4 Results

We liked that Powell's revenue and EPS beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed. Overall, this quarter was mixed. The market seemed to focus on the negatives, and the stock traded down 6% to $229.86 immediately after reporting.

Big picture, is Powell a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.