Healthcare distributor and services company McKesson (NYSE:MCK) fell short of the market’s revenue expectations in Q4 CY2024, but sales rose 17.8% year on year to $95.29 billion. Its non-GAAP profit of $8.03 per share was in line with analysts’ consensus estimates.

Is now the time to buy McKesson? Find out by accessing our full research report, it’s free.

McKesson (MCK) Q4 CY2024 Highlights:

- Revenue: $95.29 billion vs analyst estimates of $95.99 billion (17.8% year-on-year growth, 0.7% miss)

- Adjusted EPS: $8.03 vs analyst expectations of $7.99 (in line)

- Management slightly raised its full-year Adjusted EPS guidance to $32.75 at the midpoint

- Operating Margin: 1.3%, in line with the same quarter last year

- Free Cash Flow was -$2.58 billion, down from $100 million in the same quarter last year

- Market Capitalization: $77.04 billion

Company Overview

Founded in 1833 as drug importer and wholesaler, McKesson (NYSE:MCK) today is a distributor and services company that supplies to pharmacies, hospitals, and other healthcare providers.

Healthcare Distribution & Related Services

Healthcare distributors operate scale-driven business models that thrive on high volumes. Their recurring revenue streams from contracts with hospitals, pharmacies, and healthcare providers provide stability, but profitability can be squeezed by powerful stakeholders on both sides (suppliers and customers), pricing pressures, and regulatory changes. Looking ahead, the sector is positioned for growth due to increasing demand for healthcare services driven by an aging population and advancements in medical technology. However, rising operational costs, potential drug pricing reforms, and supply chain vulnerabilities present potential headwinds. Additionally, the push for digitalization and value-based care creates opportunities for innovation but requires significant investment to remain competitive.

Sales Growth

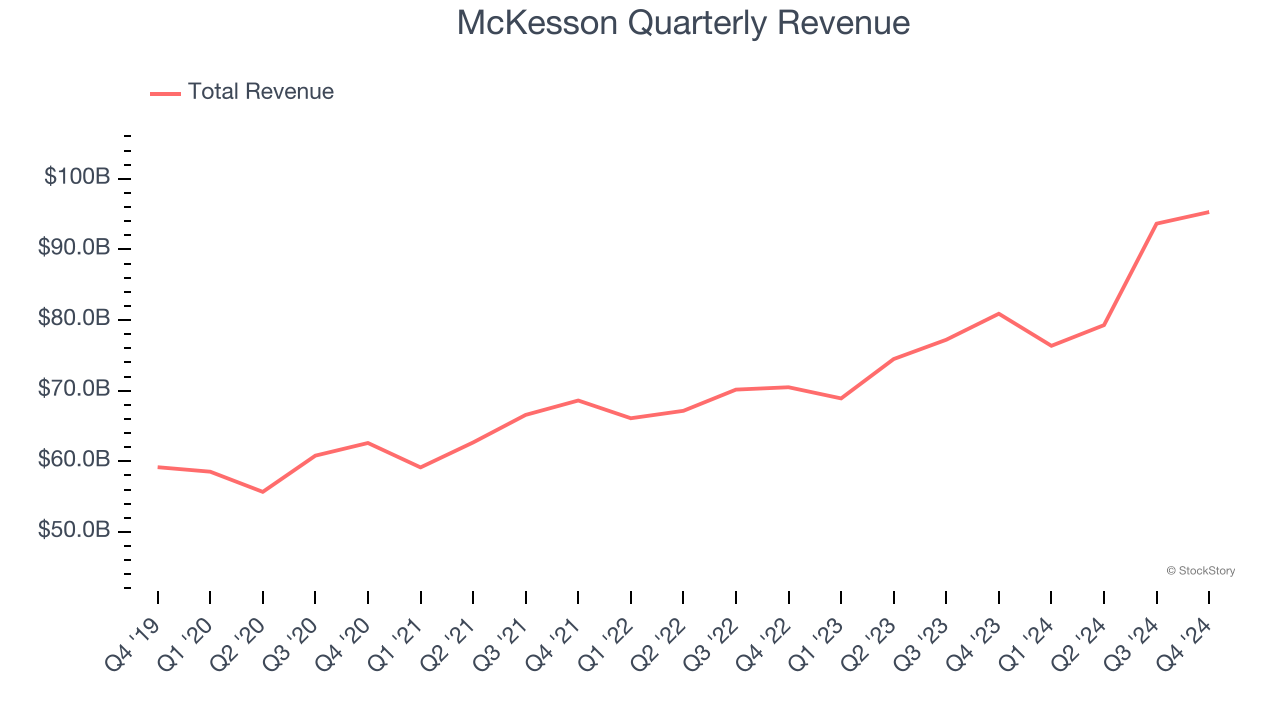

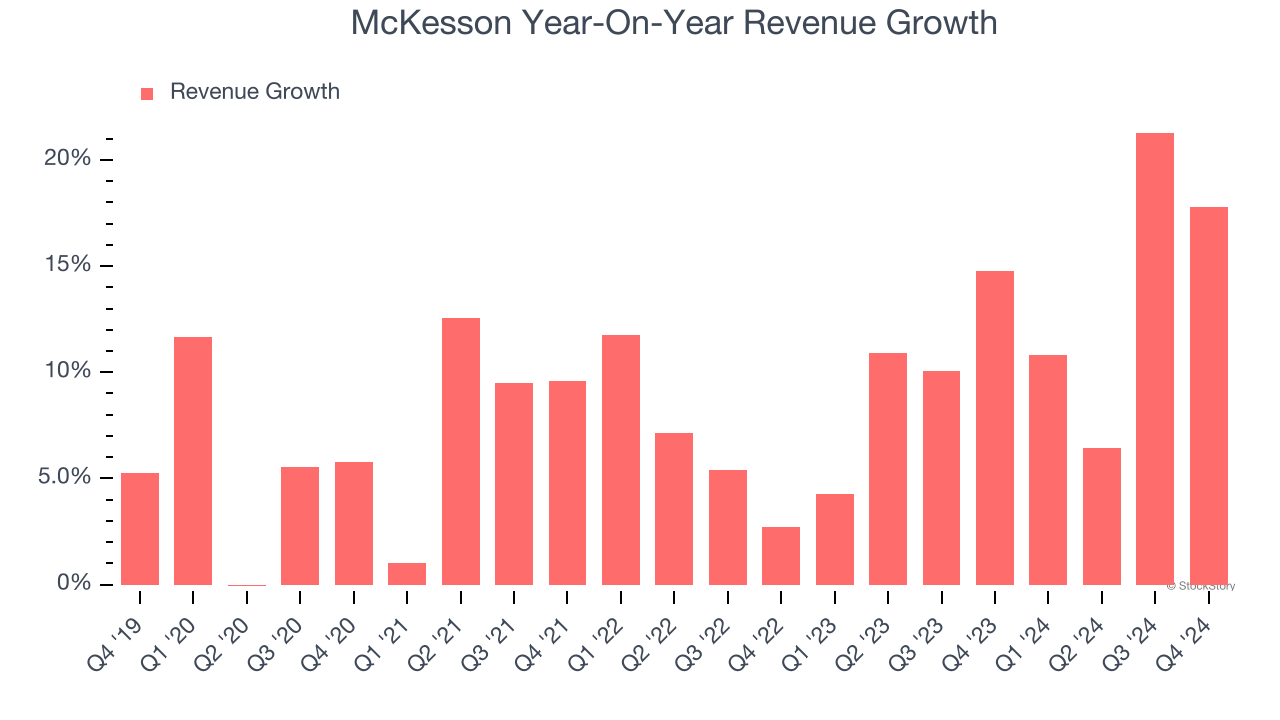

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, McKesson’s 8.9% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. McKesson’s annualized revenue growth of 12.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, U.S. Pharmaceutical . Over the last two years, McKesson’s U.S. Pharmaceutical revenue averaged 15.9% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, McKesson’s revenue grew by 17.8% year on year to $95.29 billion but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 12.2% over the next 12 months, similar to its two-year rate. This projection is particularly noteworthy for a company of its scale and indicates the market is factoring in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

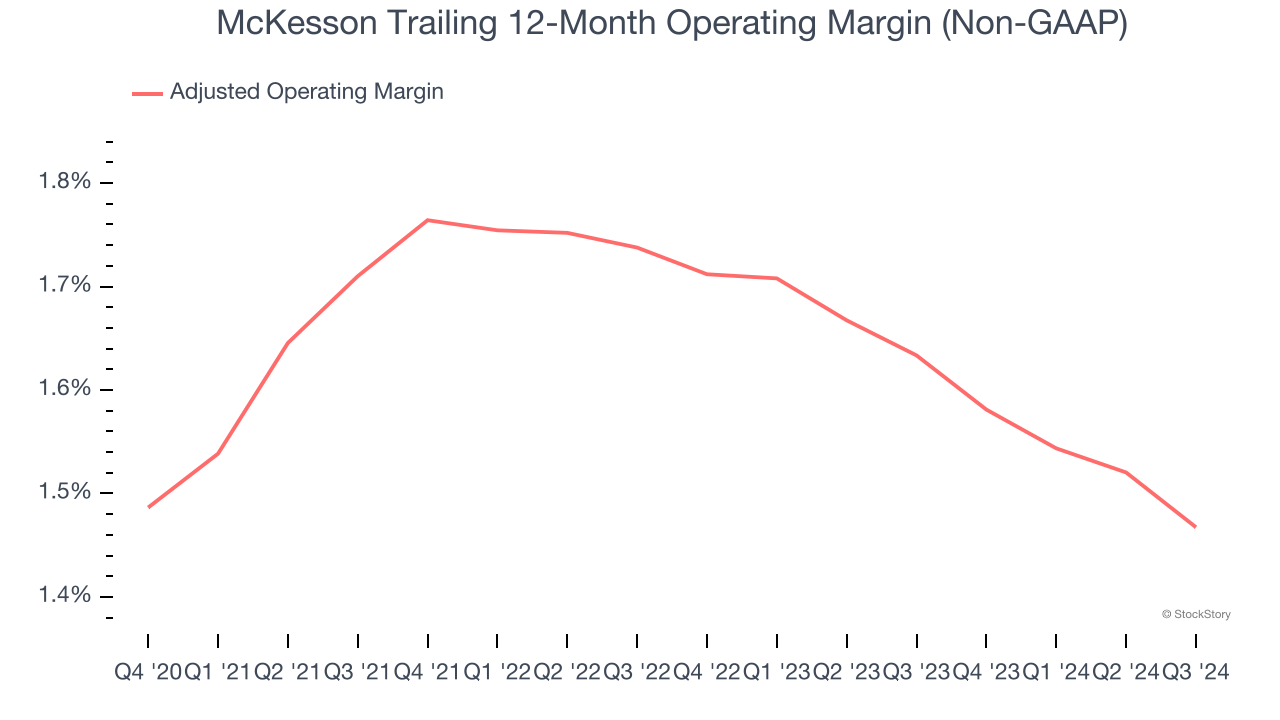

McKesson was profitable over the last five years but held back by its large cost base. Its average adjusted operating margin of 1.6% was weak for a healthcare business.

Looking at the trend in its profitability, McKesson’s adjusted operating margin might have seen some fluctuations but has generally stayed the same over the last five years, which doesn’t help its cause.

in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

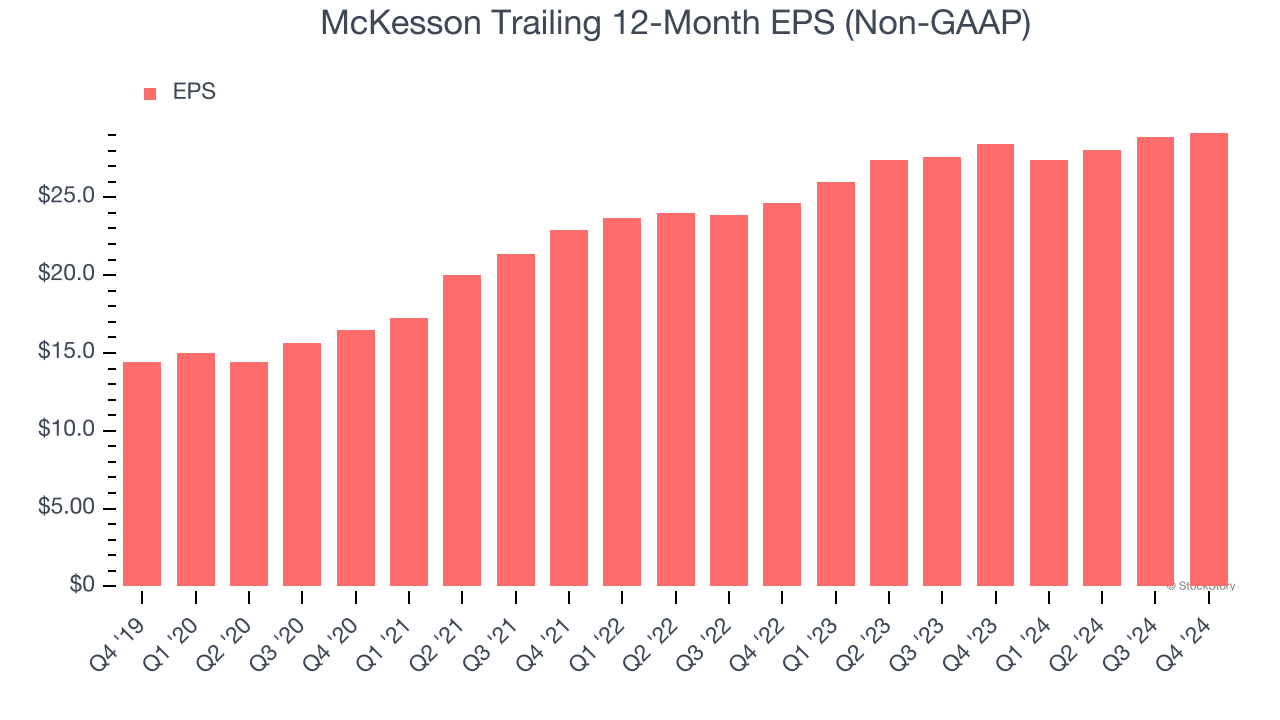

McKesson’s EPS grew at an astounding 15.1% compounded annual growth rate over the last five years, higher than its 8.9% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its adjusted operating margin didn’t expand.

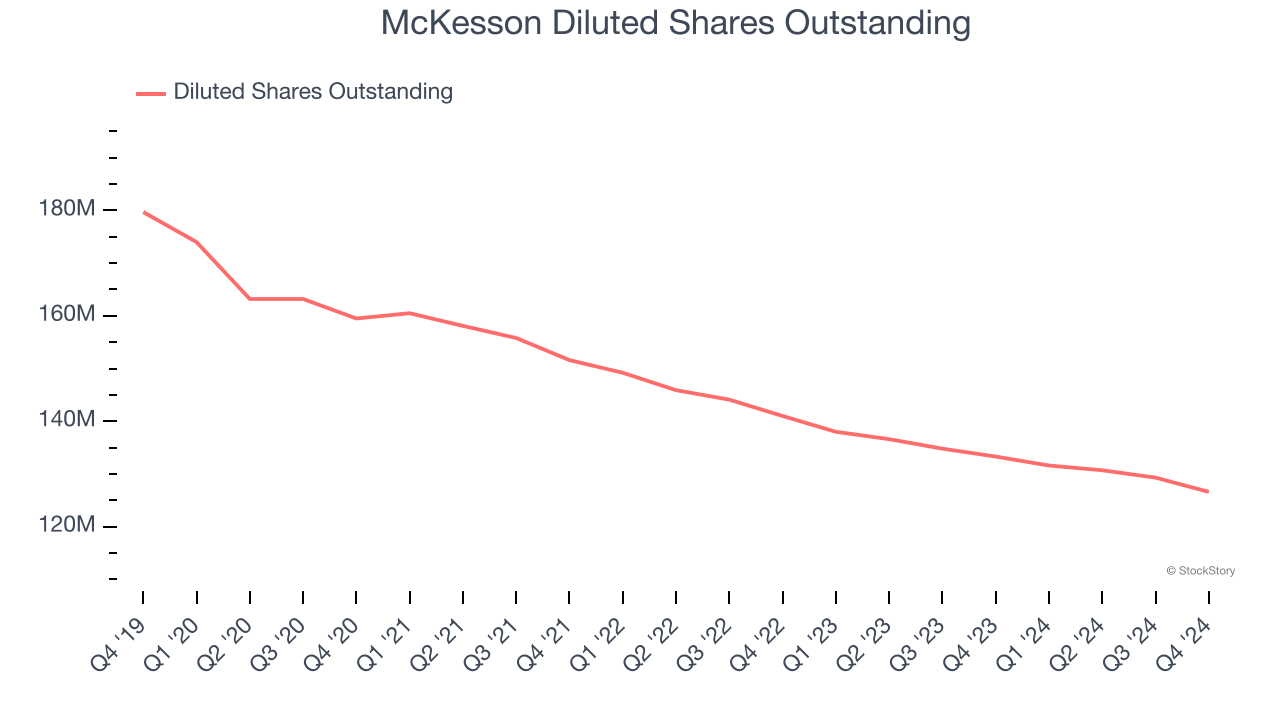

Diving into the nuances of McKesson’s earnings can give us a better understanding of its performance. A five-year view shows that McKesson has repurchased its stock, shrinking its share count by 29.5%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, McKesson reported EPS at $8.03, up from $7.74 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects McKesson’s full-year EPS of $29.16 to grow 24.9%.

Key Takeaways from McKesson’s Q4 Results

We struggled to find many positives in these results. Its EPS was in line and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.9% to $583 immediately after reporting.

The latest quarter from McKesson’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.