Enterprise technology company Hewlett Packard Enterprise (NYSE:HPE) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 14.4% year on year to $9.68 billion. Next quarter’s revenue guidance of $9.2 billion underwhelmed, coming in 6.4% below analysts’ estimates. Its non-GAAP profit of $0.62 per share was 6.5% above analysts’ consensus estimates.

Is now the time to buy Hewlett Packard Enterprise? Find out by accessing our full research report, it’s free for active Edge members.

Hewlett Packard Enterprise (HPE) Q3 CY2025 Highlights:

- Revenue: $9.68 billion vs analyst estimates of $9.88 billion (14.4% year-on-year growth, 2% miss)

- Adjusted EPS: $0.62 vs analyst estimates of $0.58 (6.5% beat)

- Adjusted EBITDA: $1.07 billion vs analyst estimates of $1.73 billion (11% margin, 38.5% miss)

- Revenue Guidance for Q4 CY2025 is $9.2 billion at the midpoint, below analyst estimates of $9.83 billion

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.35 at the midpoint, missing analyst estimates by 1.1%

- Operating Margin: -0.1%, down from 8.2% in the same quarter last year

- Free Cash Flow Margin: 19.8%, up from 17.9% in the same quarter last year

- Market Capitalization: $29.37 billion

“HPE finished a transformative year with a strong fourth quarter of profitable growth and disciplined execution,” said Antonio Neri, president and CEO of HPE.

Company Overview

Born from the 2015 split of the iconic Silicon Valley pioneer Hewlett-Packard, Hewlett Packard Enterprise (NYSE:HPE) provides edge-to-cloud technology solutions that help businesses capture, analyze, and act upon their data across hybrid IT environments.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $34.3 billion in revenue over the past 12 months, Hewlett Packard Enterprise is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s challenging to maintain high growth rates when you’ve already captured a large portion of the addressable market. To expand meaningfully, Hewlett Packard Enterprise likely needs to tweak its prices, innovate with new offerings, or enter new markets.

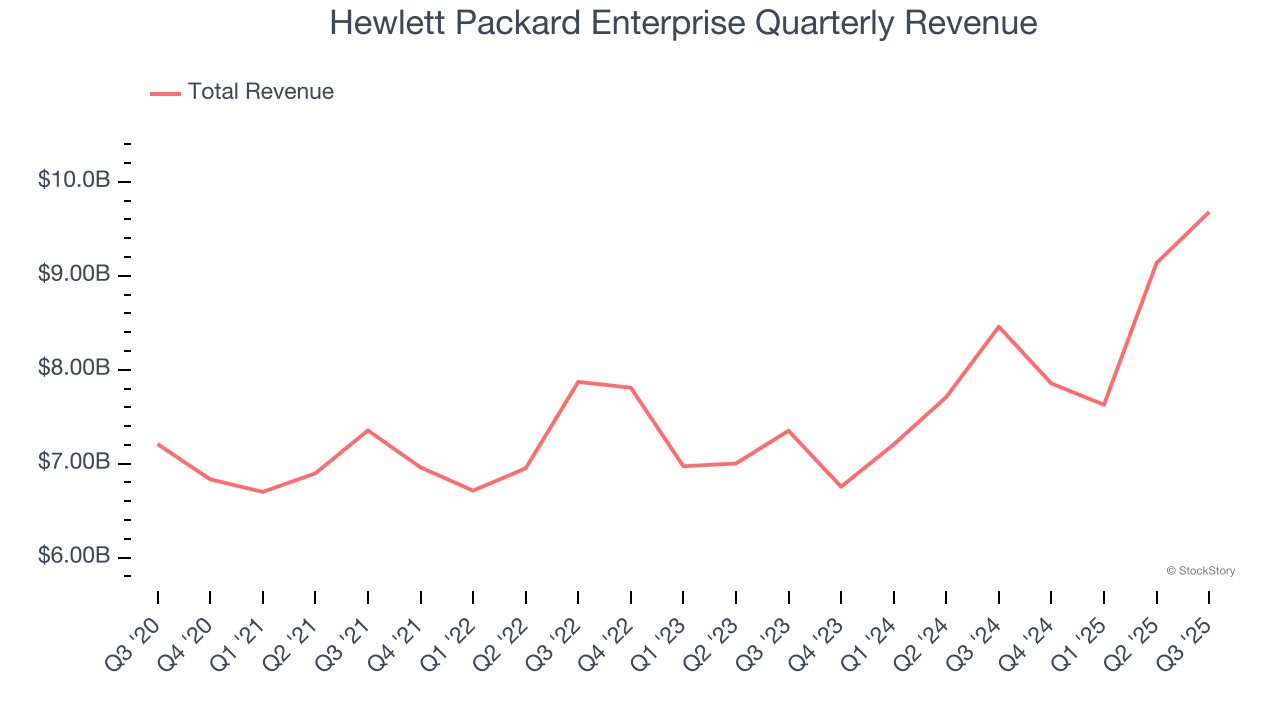

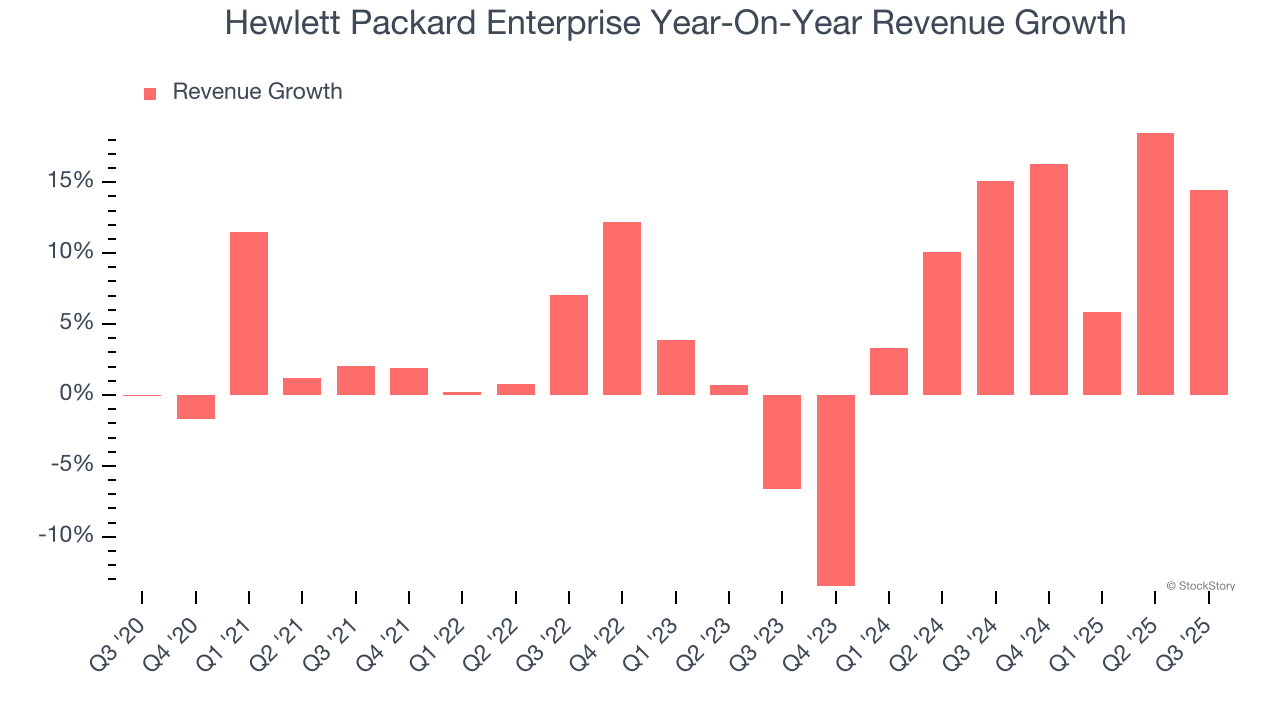

As you can see below, Hewlett Packard Enterprise’s 4.9% annualized revenue growth over the last five years was mediocre. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Hewlett Packard Enterprise’s annualized revenue growth of 8.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Hewlett Packard Enterprise’s revenue grew by 14.4% year on year to $9.68 billion but fell short of Wall Street’s estimates. Company management is currently guiding for a 17.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 18.2% over the next 12 months, an improvement versus the last two years. This projection is eye-popping for a company of its scale and implies its newer products and services will fuel better top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

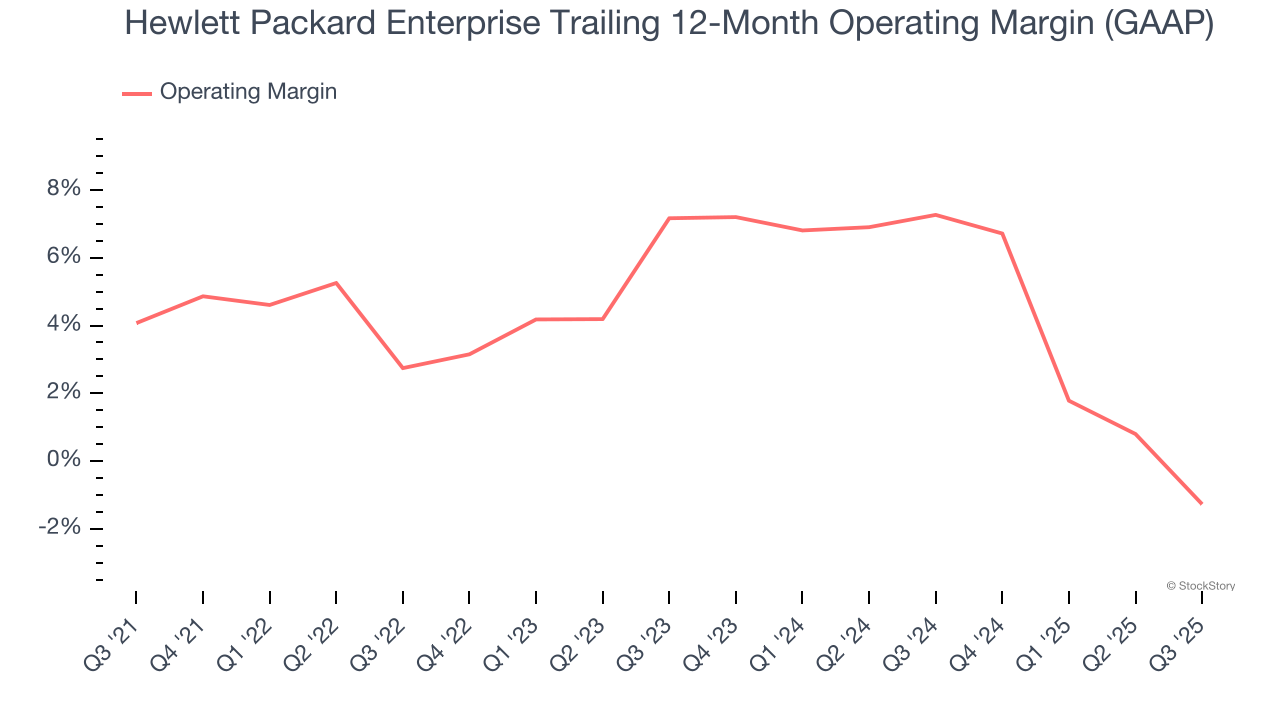

Hewlett Packard Enterprise was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.8% was weak for a business services business.

Looking at the trend in its profitability, Hewlett Packard Enterprise’s operating margin decreased by 5.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Hewlett Packard Enterprise’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Hewlett Packard Enterprise’s breakeven margin was down 8.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

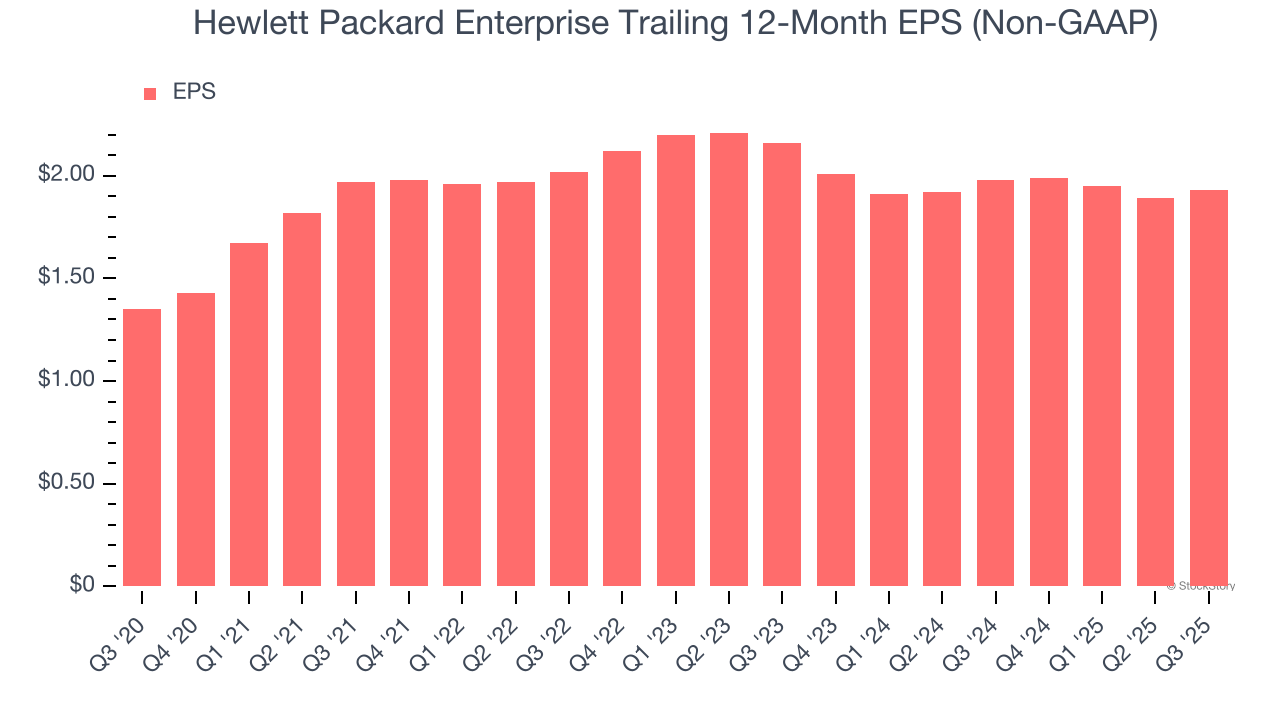

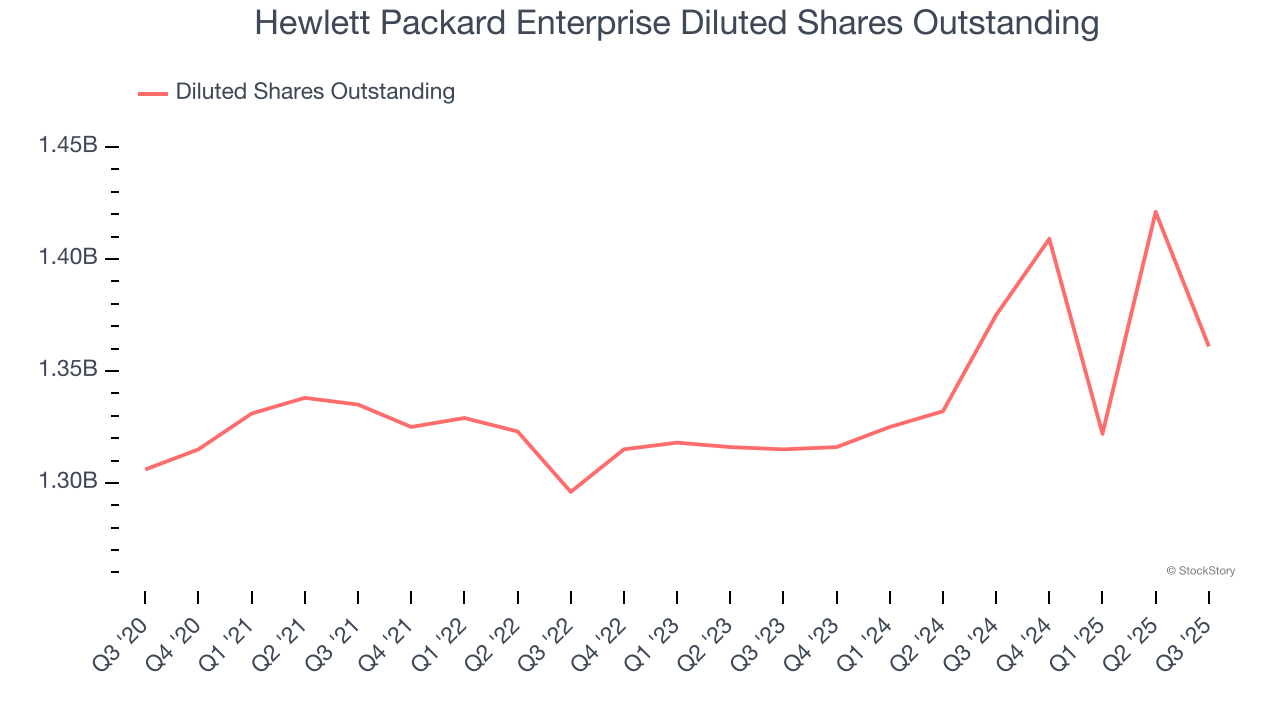

Hewlett Packard Enterprise’s EPS grew at an unimpressive 7.4% compounded annual growth rate over the last five years. This performance was better than its flat revenue, but we take it with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Hewlett Packard Enterprise’s two-year annual EPS declines of 5.5% were bad and lower than its 8.5% two-year revenue growth.

Diving into the nuances of Hewlett Packard Enterprise’s earnings can give us a better understanding of its performance. Hewlett Packard Enterprise’s operating margin has declined over the last two yearswhile its share count has grown 3.5%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Hewlett Packard Enterprise reported adjusted EPS of $0.62, up from $0.58 in the same quarter last year. This print beat analysts’ estimates by 6.5%. Over the next 12 months, Wall Street expects Hewlett Packard Enterprise’s full-year EPS of $1.93 to grow 20.6%.

Key Takeaways from Hewlett Packard Enterprise’s Q3 Results

We were impressed by how significantly Hewlett Packard Enterprise blew past analysts’ EPS guidance for next quarter expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 5.6% to $21.61 immediately following the results.

Hewlett Packard Enterprise’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.