Since May 2025, SouthState has been in a holding pattern, posting a small loss of 2.4% while floating around $85.75. The stock also fell short of the S&P 500’s 13.7% gain during that period.

Is now the time to buy SSB? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On SSB?

With roots dating back to the Great Depression era of 1933, SouthState (NYSE:SSB) is a financial holding company that provides banking services, wealth management, and correspondent banking services across six southeastern states.

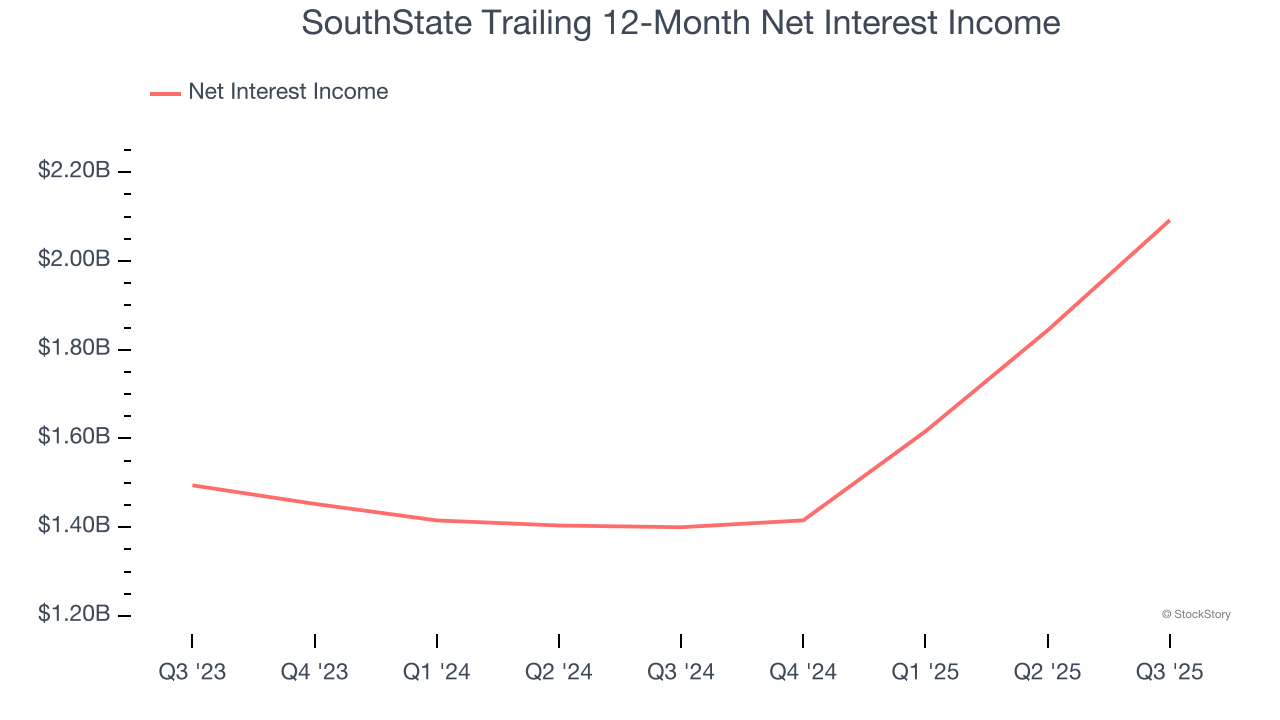

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

SouthState’s net interest income has grown at a 24.9% annualized rate over the last five years, much better than the broader banking industry and faster than its total revenue. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

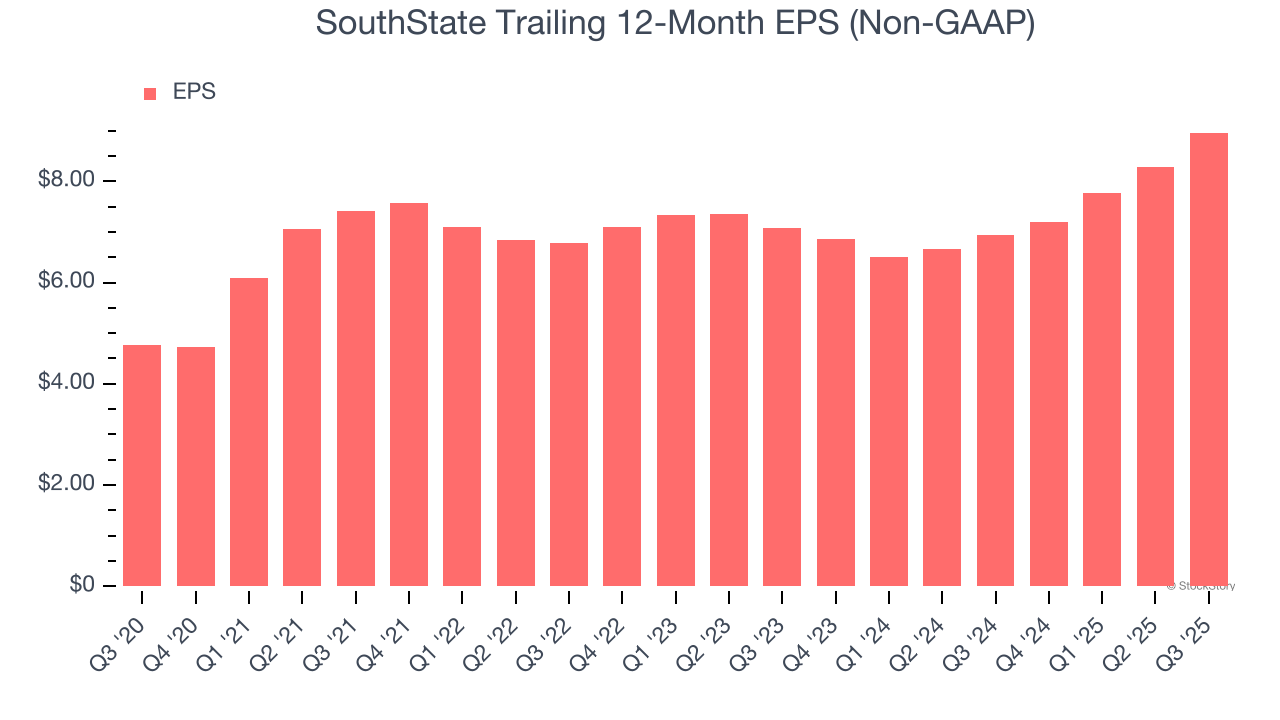

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

SouthState’s EPS grew at an astounding 13.4% compounded annual growth rate over the last five years. This performance was better than most banking businesses.

Final Judgment

These are just a few reasons SouthState is a rock-solid business worth owning. With its shares underperforming the market lately, the stock trades at 1× forward P/B (or $85.75 per share). Is now a good time to buy? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than SouthState

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.