As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the consumer finance industry, including Nelnet (NYSE:NNI) and its peers.

Consumer finance companies provide loans and credit products to individuals. Growth drivers include increasing consumer spending, financial inclusion initiatives in developing markets, and digital lending platforms reducing distribution costs. Challenges include credit risk during economic downturns, regulatory scrutiny of lending practices, and intensifying competition from traditional banks and fintech firms offering innovative credit solutions.

The 20 consumer finance stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.8%.

While some consumer finance stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.5% since the latest earnings results.

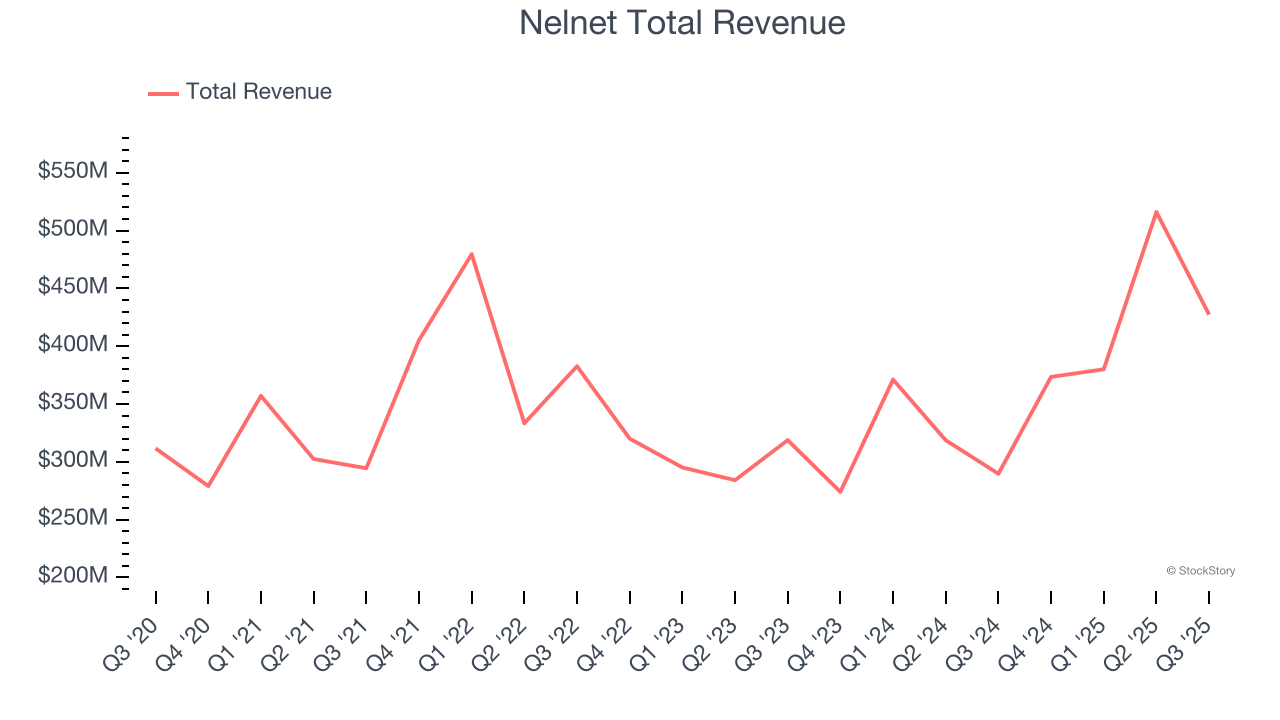

Nelnet (NYSE:NNI)

Starting as a student loan servicer in the 1970s and evolving through the changing landscape of education finance, Nelnet (NYSE:NNI) provides student loan servicing, education technology, payment processing, and banking services while managing a portfolio of education loans.

Nelnet reported revenues of $427.4 million, up 47.5% year on year. This print exceeded analysts’ expectations by 14.9%. Overall, it was an incredible quarter for the company with a beat of analysts’ EPS and revenue estimates.

"Strong results this quarter were driven by ongoing strength across our core businesses in loan servicing, consumer lending, payments, and technology along with some one-time transactions that had a positive impact," said Jeff Noordhoek, chief executive officer of Nelnet.

Unsurprisingly, the stock is down 3.9% since reporting and currently trades at $124.77.

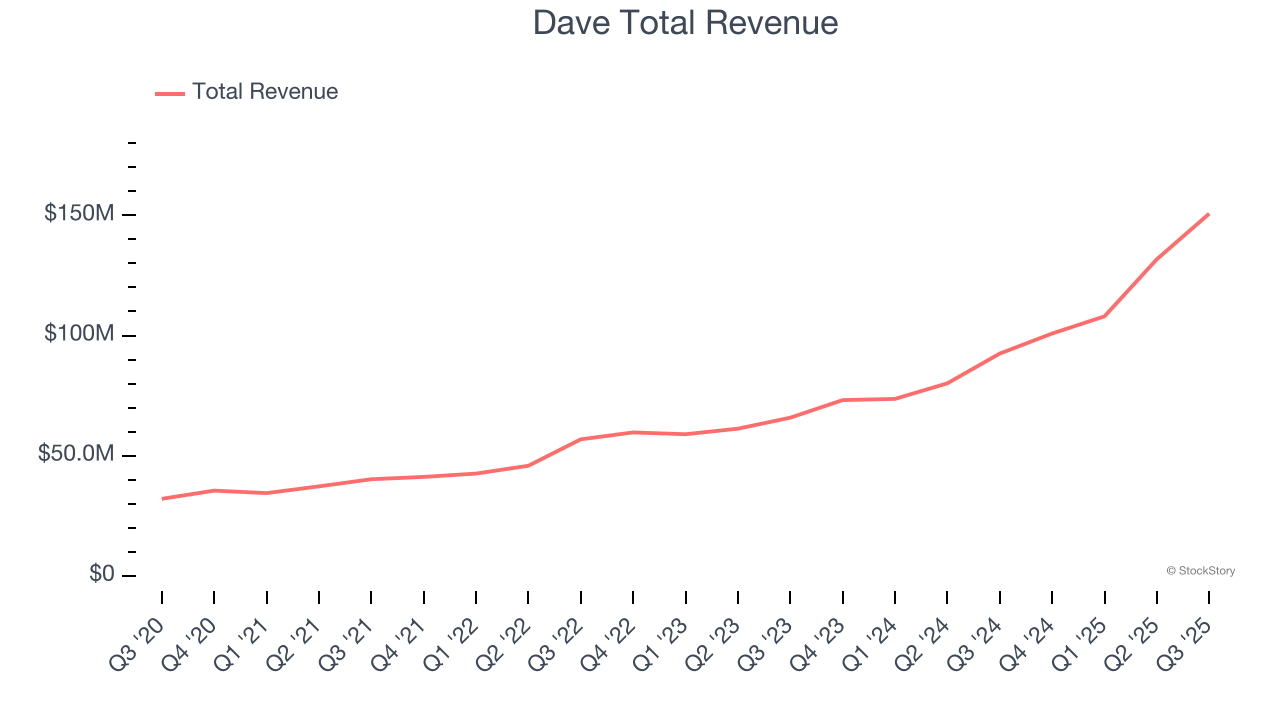

Dave (NASDAQ:DAVE)

Named after the biblical David fighting financial Goliaths, Dave (NASDAQ:DAVE) is a digital financial services platform that helps Americans living paycheck to paycheck with cash advances, banking services, and tools to improve their financial health.

Dave reported revenues of $150.7 million, up 63% year on year, outperforming analysts’ expectations by 12.9%. The business had an incredible quarter with a beat of analysts’ EPS and revenue estimates.

Dave pulled off the highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 20% since reporting. It currently trades at $192.01.

Is now the time to buy Dave? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Navient (NASDAQ:NAVI)

Spun off from Sallie Mae in 2014 to handle the company's loan servicing and collection operations, Navient (NASDAQ:NAVI) provides education loan servicing and business processing solutions that help manage federal student loans, private education loans, and government services.

Navient reported revenues of $169 million, down 62.6% year on year, exceeding analysts’ expectations by 3.8%. Still, it was a slower quarter as it posted a significant miss of analysts’ EPS estimates and a slight miss of analysts’ net interest income estimates.

Navient delivered the slowest revenue growth in the group. As expected, the stock is down 11.5% since the results and currently trades at $11.45.

Read our full analysis of Navient’s results here.

Sezzle (NASDAQ:SEZL)

Founded in 2016 as an alternative to traditional credit cards for younger shoppers, Sezzle (NASDAQ:SEZL) provides a payment platform that allows consumers to split purchases into four interest-free installments over six weeks at participating retailers.

Sezzle reported revenues of $116.8 million, up 67% year on year. This result topped analysts’ expectations by 11.5%. Overall, it was a stunning quarter as it also recorded an impressive beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

Sezzle achieved the fastest revenue growth among its peers. The stock is down 21.8% since reporting and currently trades at $51.82.

Read our full, actionable report on Sezzle here, it’s free for active Edge members.

Ally Financial (NYSE:ALLY)

Born from the former GMAC (General Motors Acceptance Corporation) and rebranded in 2010, Ally Financial (NYSE:ALLY) operates a digital-first bank offering auto financing, insurance, mortgage lending, and investment services to consumers and commercial clients.

Ally Financial reported revenues of $2.17 billion, up 1.5% year on year. This number surpassed analysts’ expectations by 2.6%. It was a very strong quarter as it also produced a beat of analysts’ EPS estimates and a decent beat of analysts’ revenue estimates.

The stock is down 1.7% since reporting and currently trades at $37.80.

Read our full, actionable report on Ally Financial here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.