3D printing company Stratasys (NASDAQ:SSYS) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 2.2% year on year to $137 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $555 million at the midpoint. Its non-GAAP profit of $0.02 per share was $0.02 above analysts’ consensus estimates.

Is now the time to buy Stratasys? Find out by accessing our full research report, it’s free for active Edge members.

Stratasys (SSYS) Q3 CY2025 Highlights:

- Revenue: $137 million vs analyst estimates of $136.6 million (2.2% year-on-year decline, in line)

- Adjusted EPS: $0.02 vs analyst estimates of $0 ($0.02 beat)

- Adjusted EBITDA: $5.04 million vs analyst estimates of $5.39 million (3.7% margin, 6.5% miss)

- The company reconfirmed its revenue guidance for the full year of $555 million at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $0.15 at the midpoint

- EBITDA guidance for the full year is $31 million at the midpoint, above analyst estimates of $30.43 million

- Operating Margin: -16.6%, up from -18.2% in the same quarter last year

- Market Capitalization: $811.8 million

"Our third quarter results demonstrate the resilience of our business model that enabled us to deliver solid operating cash flow and positive adjusted earnings per share, through the combination of strong recurring revenues, disciplined cost management and operational excellence," said Dr. Yoav Zeif, CEO of Stratasys.

Company Overview

Born from the Founder’s idea of making a toy frog with a glue gun, Stratasys (NASDAQ:SSYS) offers 3D printers and related materials, software, and services to many industries.

Revenue Growth

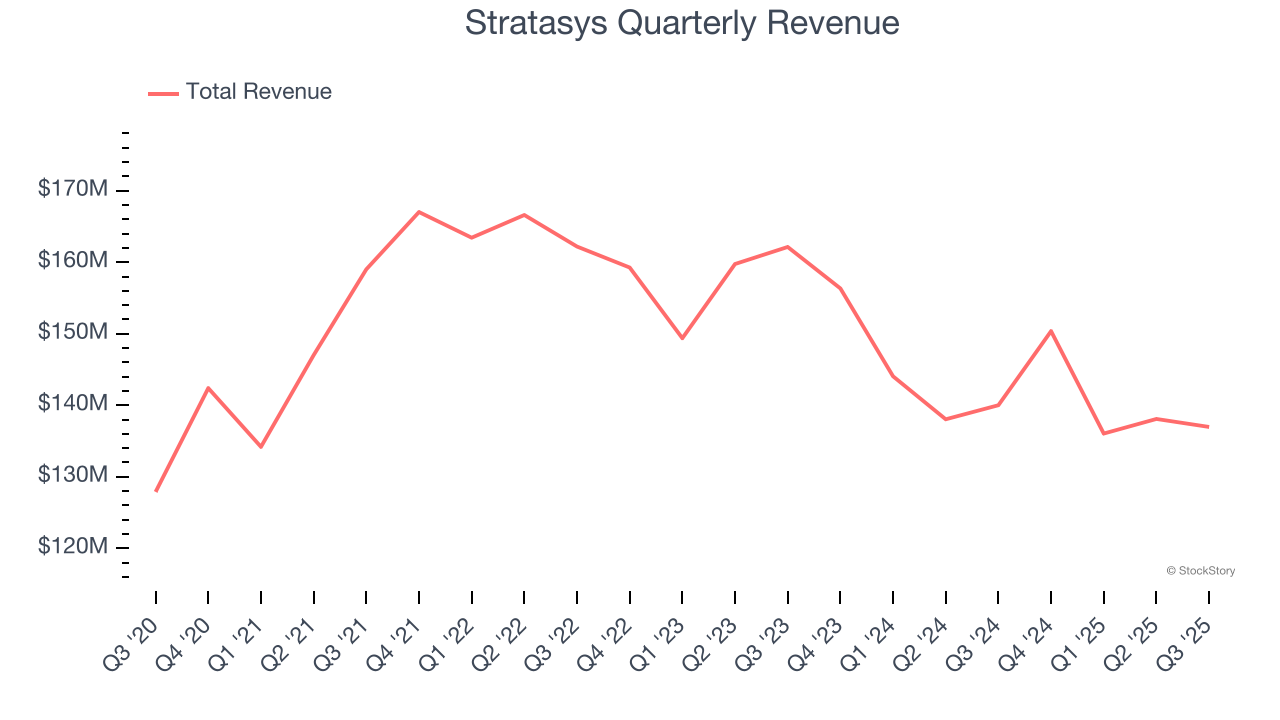

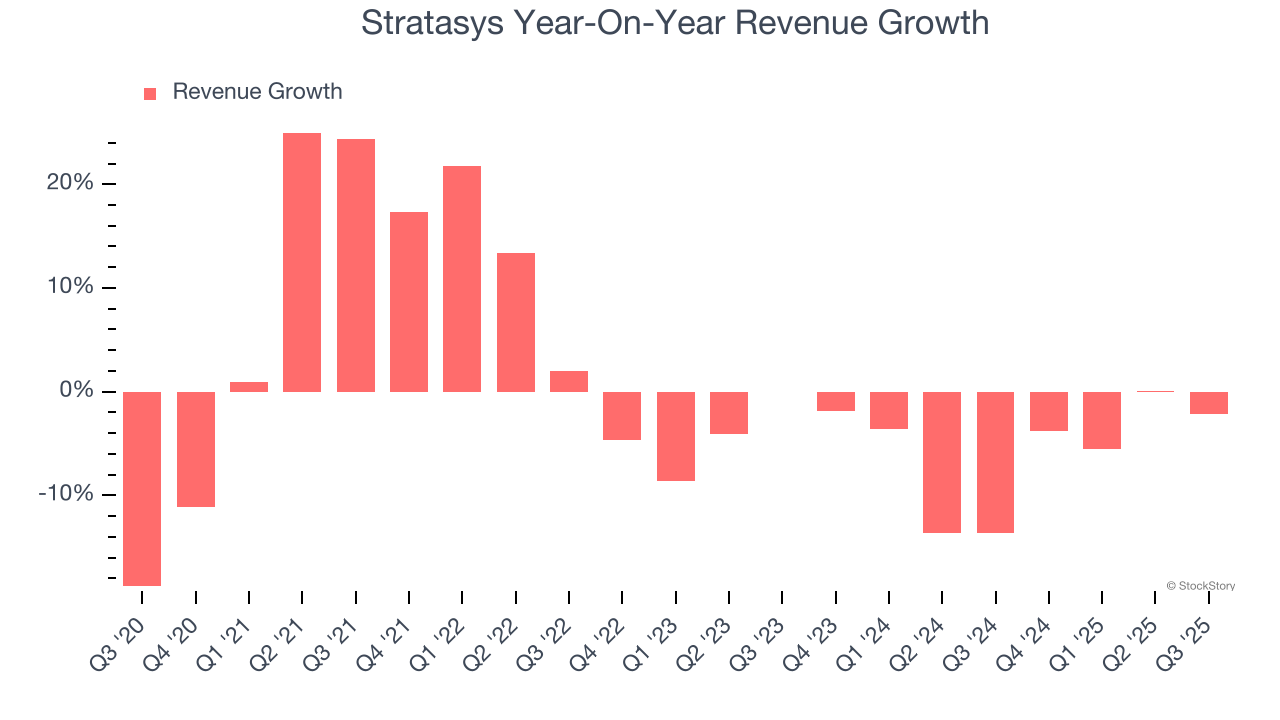

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Stratasys struggled to consistently increase demand as its $561.5 million of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a low quality business.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Stratasys’s recent performance shows its demand remained suppressed as its revenue has declined by 5.6% annually over the last two years.

This quarter, Stratasys reported a rather uninspiring 2.2% year-on-year revenue decline to $137 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

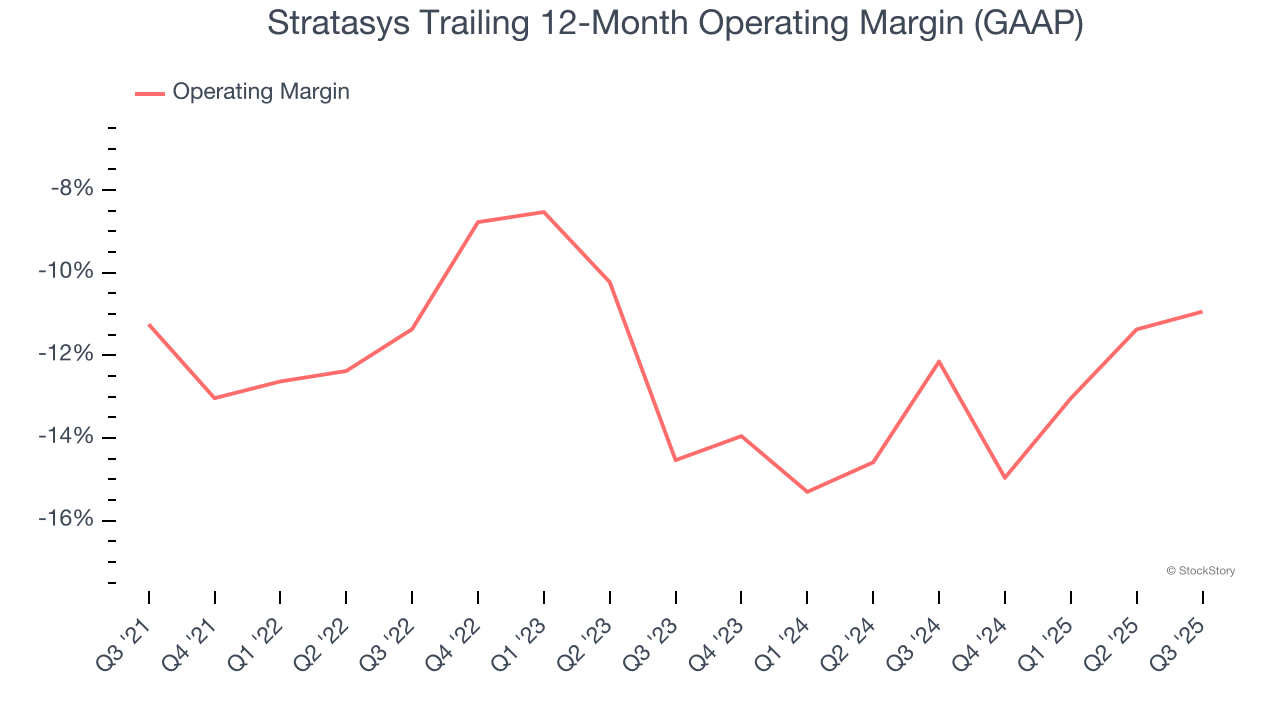

Operating Margin

Stratasys’s operating margin has risen over the last 12 months, but it still averaged negative 12.1% over the last five years. This is due to its large expense base and inefficient cost structure.

Analyzing the trend in its profitability, Stratasys’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business model to change.

Stratasys’s operating margin was negative 16.6% this quarter. The company's consistent lack of profits raise a flag.

Earnings Per Share

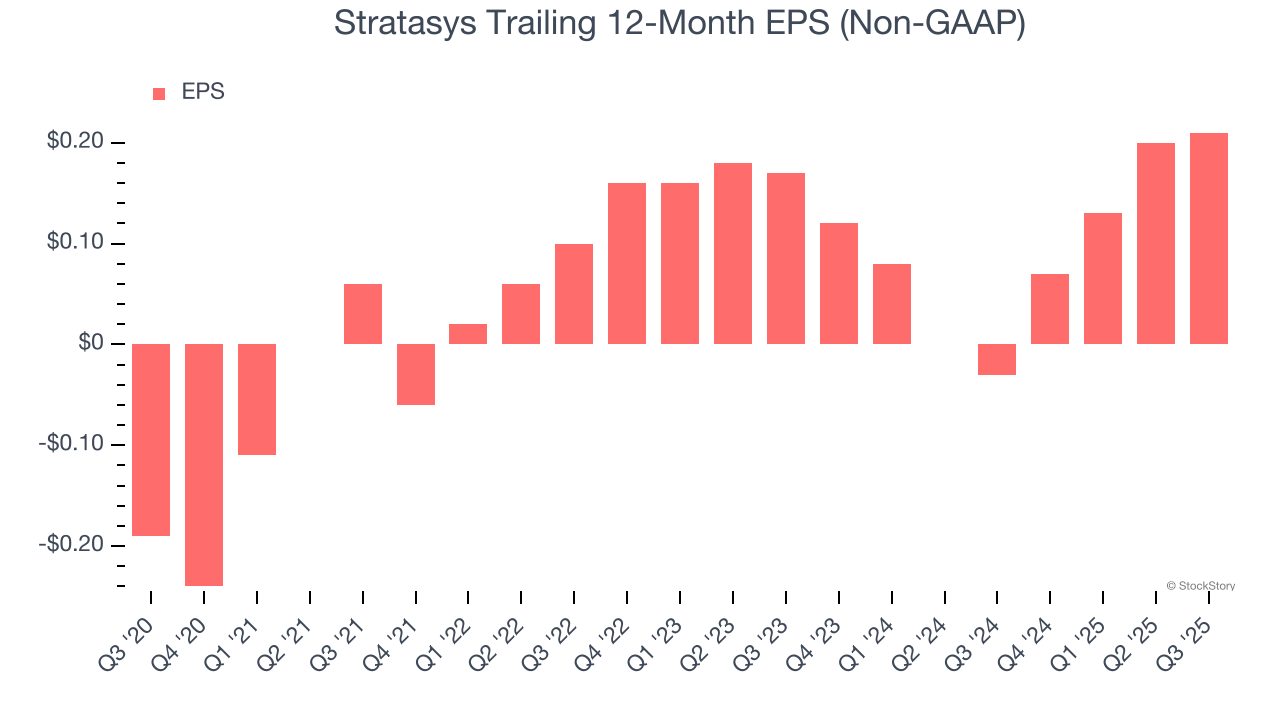

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Stratasys’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Stratasys’s EPS grew at a solid 11.1% compounded annual growth rate over the last two years, higher than its 5.6% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

Diving into the nuances of Stratasys’s earnings can give us a better understanding of its performance. Stratasys’s operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Stratasys reported adjusted EPS of $0.02, up from $0.01 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Stratasys’s full-year EPS of $0.21 to grow 5.2%.

Key Takeaways from Stratasys’s Q3 Results

It was good to see Stratasys beat analysts’ EPS expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its EBITDA missed. Overall, this print had some key positives. The stock traded up 3.8% to $9.89 immediately following the results.

So should you invest in Stratasys right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.