Although Airbnb (currently trading at $121.60 per share) has gained 6.7% over the last six months, it has trailed the S&P 500’s 24.7% return during that period. This might have investors contemplating their next move.

Given the relatively weaker price action, is now a good time to buy ABNB? Find out in our full research report, it’s free.

Why Is ABNB a Good Business?

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ:ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

1. Nights and Experiences Booked Drive Additional Growth Opportunities

As an online travel company, Airbnb generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Airbnb’s nights and experiences booked, a key performance metric for the company, increased by 10% annually to 134.4 million in the latest quarter. This growth rate is solid for a consumer internet business and indicates people are excited about its offerings.

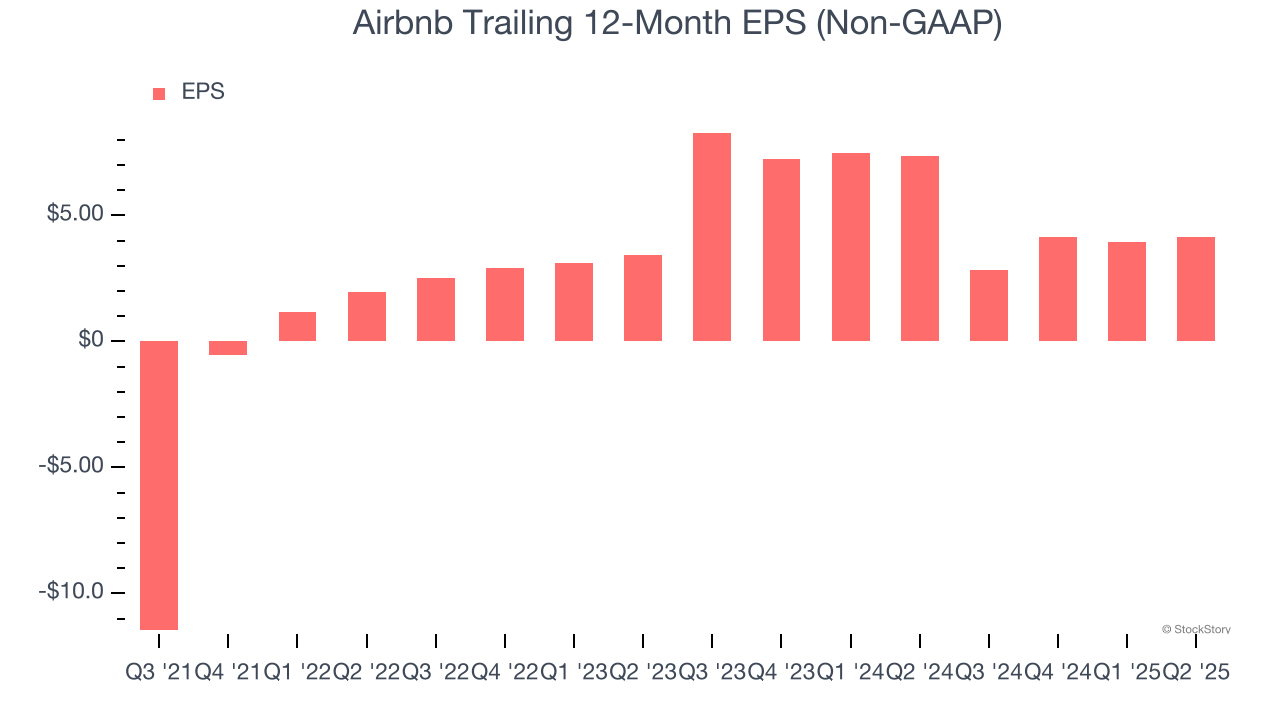

2. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Airbnb’s EPS grew at an astounding 28.4% compounded annual growth rate over the last three years, higher than its 16.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

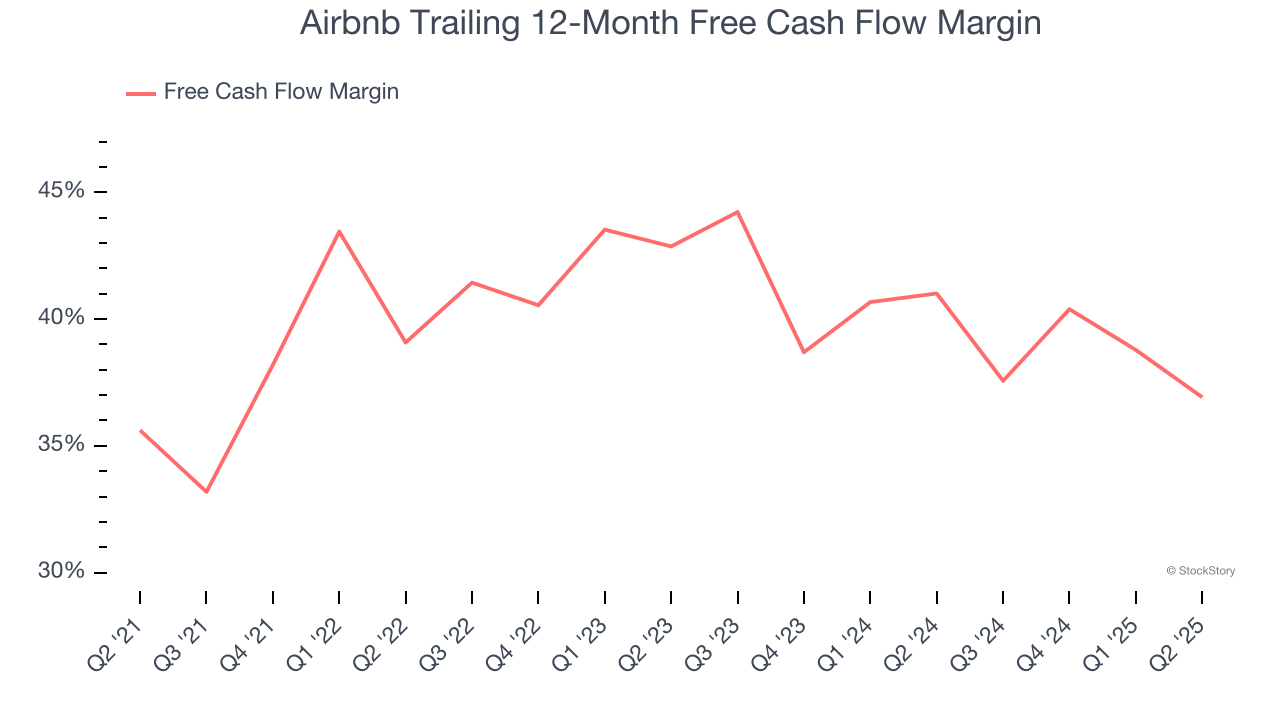

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Airbnb has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging an eye-popping 38.9% over the last two years.

Final Judgment

These are just a few reasons why Airbnb ranks highly on our list. With its shares lagging the market recently, the stock trades at 17.5× forward EV/EBITDA (or $121.60 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.