Electronic components manufacturer Knowles (NYSE:KN) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 7.3% year on year to $152.9 million. Guidance for next quarter’s revenue was better than expected at $156 million at the midpoint, 1.1% above analysts’ estimates. Its non-GAAP profit of $0.33 per share was 7.3% above analysts’ consensus estimates.

Is now the time to buy Knowles? Find out by accessing our full research report, it’s free for active Edge members.

Knowles (KN) Q3 CY2025 Highlights:

- Revenue: $152.9 million vs analyst estimates of $149.1 million (7.3% year-on-year growth, 2.6% beat)

- Adjusted EPS: $0.33 vs analyst estimates of $0.31 (7.3% beat)

- Adjusted EBITDA: $39.5 million vs analyst estimates of $40 million (25.8% margin, 1.3% miss)

- Revenue Guidance for Q4 CY2025 is $156 million at the midpoint, above analyst estimates of $154.3 million

- Adjusted EPS guidance for Q4 CY2025 is $0.35 at the midpoint, above analyst estimates of $0.34

- Operating Margin: 16.9%, up from 14.2% in the same quarter last year

- Free Cash Flow Margin: 14%, down from 34.5% in the same quarter last year

- Market Capitalization: $1.99 billion

“We continued to deliver on expectations in the third quarter of 2025 with revenues, cash provided by operating activities, and non-GAAP diluted EPS from continuing operations all above the mid-point of our guided range. Our cash generated by operating activities in the quarter was again strong, allowing us to repurchase $20 million in shares and reduce debt by $15 million” commented Jeffrey Niew, President, and CEO of Knowles.

Company Overview

With roots dating back to 1946 and a focus on components that must perform flawlessly in critical situations, Knowles (NYSE:KN) designs and manufactures specialized electronic components like high-performance capacitors, microphones, and speakers for medical technology, defense, and industrial applications.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $573.5 million in revenue over the past 12 months, Knowles is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

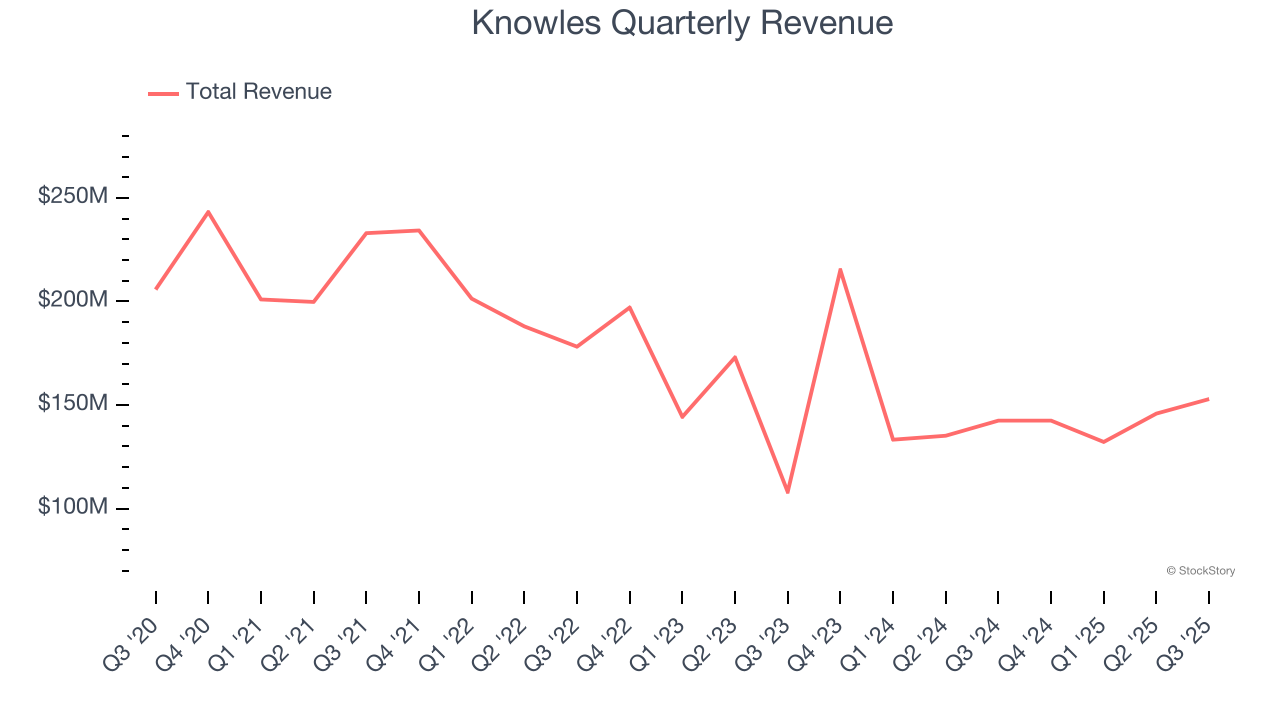

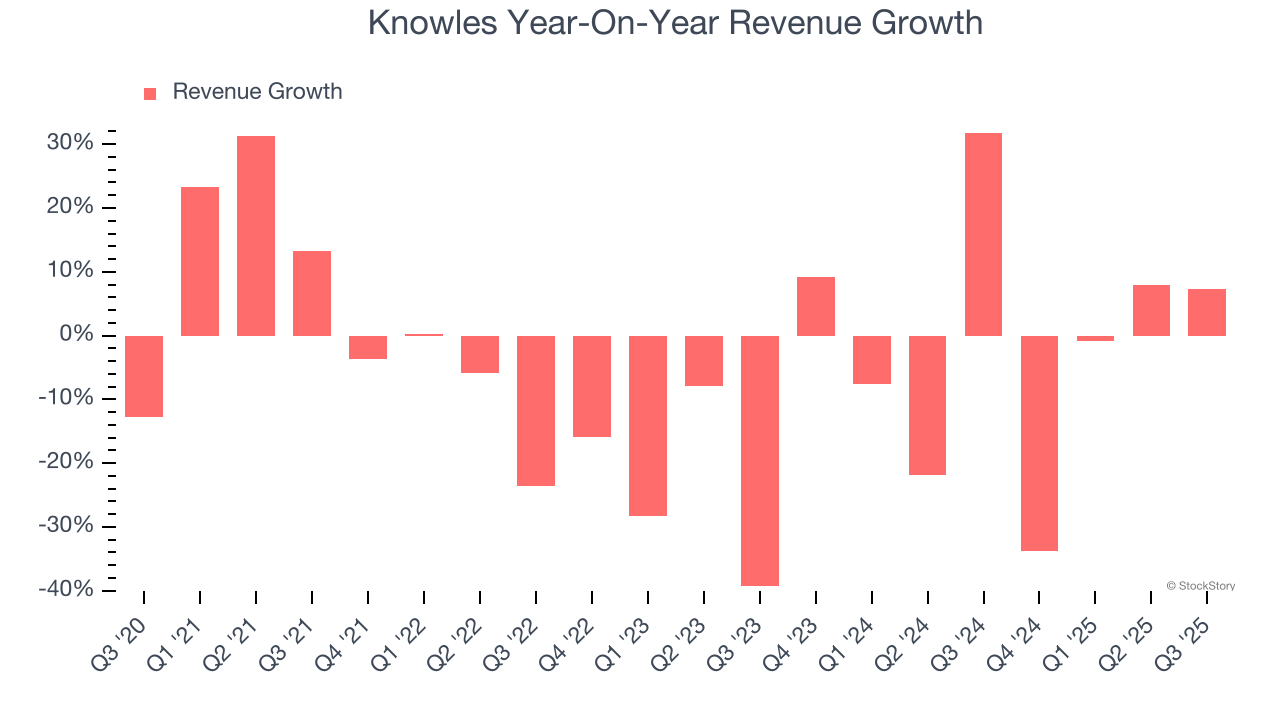

As you can see below, Knowles struggled to generate demand over the last five years. Its sales dropped by 3.7% annually, a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Knowles’s annualized revenue declines of 4% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.

This quarter, Knowles reported year-on-year revenue growth of 7.3%, and its $152.9 million of revenue exceeded Wall Street’s estimates by 2.6%. Company management is currently guiding for a 9.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and suggests its newer products and services will catalyze better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

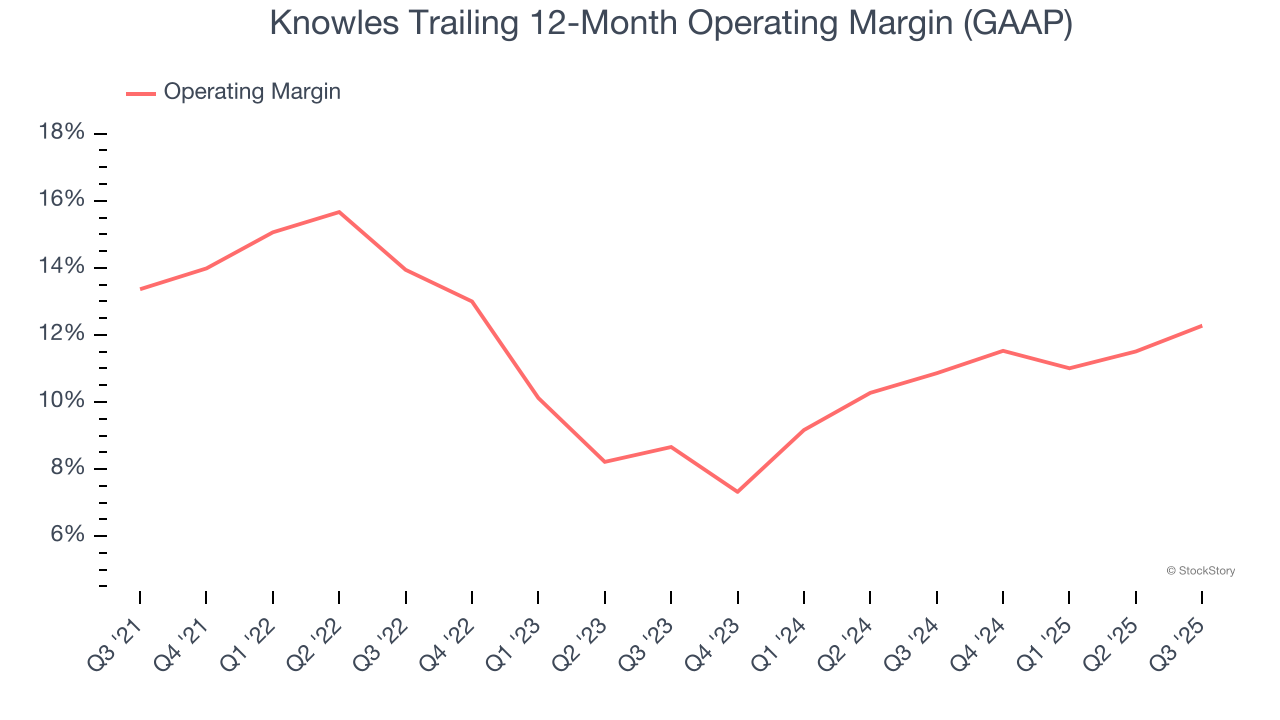

Knowles has managed its cost base well over the last five years. It demonstrated solid profitability for a business services business, producing an average operating margin of 12%.

Analyzing the trend in its profitability, Knowles’s operating margin decreased by 1.1 percentage points over the last five years. Even though its historical margin was healthy, shareholders will want to see Knowles become more profitable in the future.

In Q3, Knowles generated an operating margin profit margin of 16.9%, up 2.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

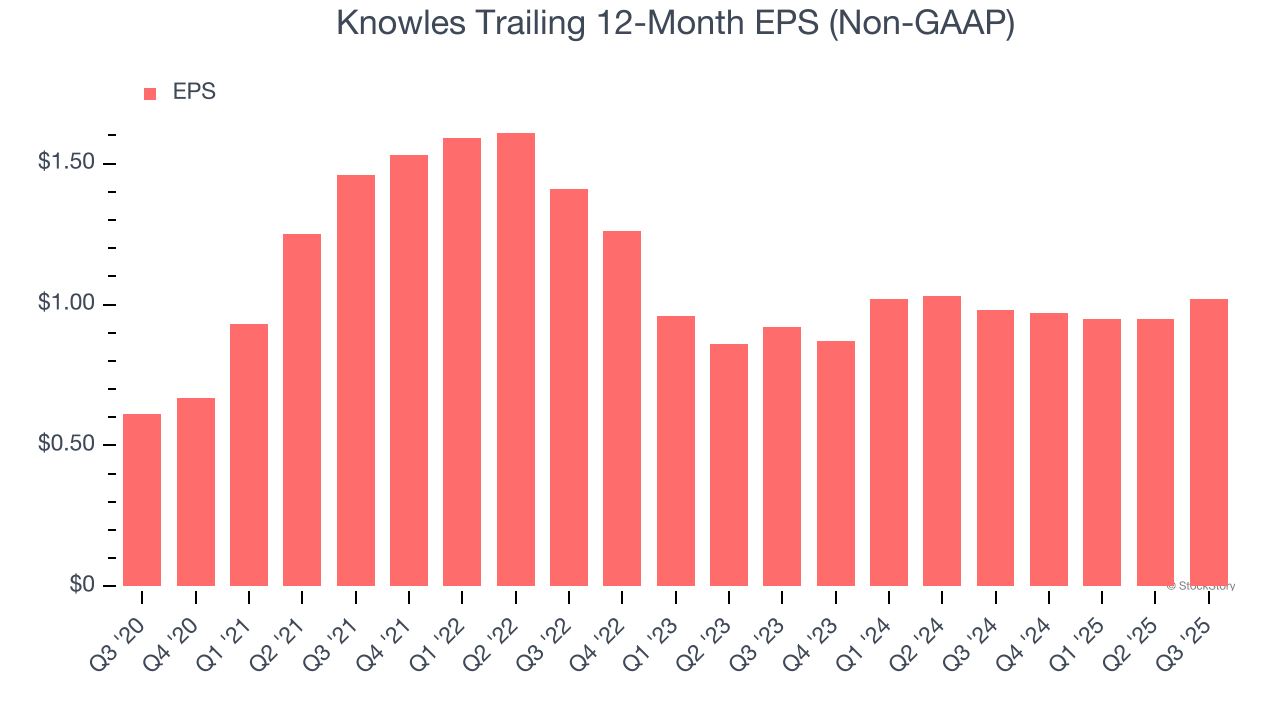

Knowles’s EPS grew at a remarkable 10.8% compounded annual growth rate over the last five years, higher than its 3.7% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

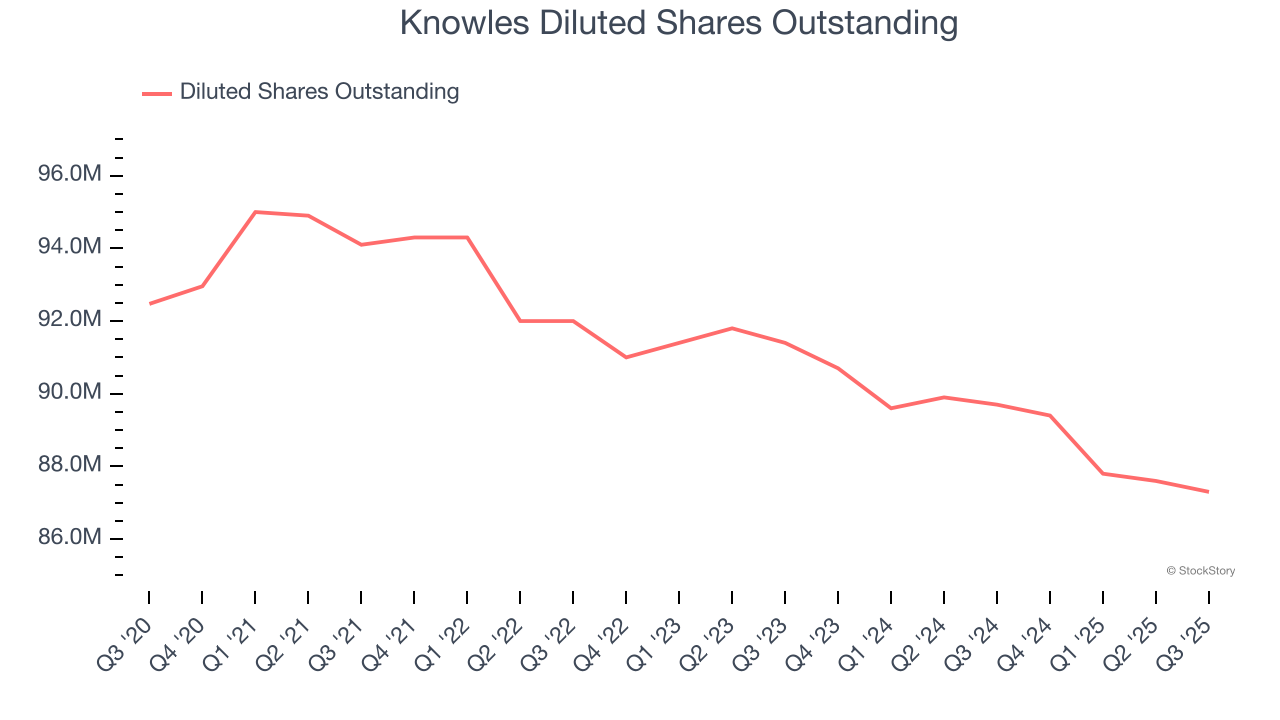

Diving into Knowles’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Knowles has repurchased its stock, shrinking its share count by 5.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Knowles, its two-year annual EPS growth of 5.3% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Knowles reported adjusted EPS of $0.33, up from $0.26 in the same quarter last year. This print beat analysts’ estimates by 7.3%. Over the next 12 months, Wall Street expects Knowles’s full-year EPS of $1.02 to grow 21.1%.

Key Takeaways from Knowles’s Q3 Results

We enjoyed seeing Knowles beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 1.9% to $23.56 immediately following the results.

So do we think Knowles is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.