Owens Corning trades at $200.21 per share and has stayed right on track with the overall market, gaining 13.5% over the last six months. At the same time, the S&P 500 has returned 13.5%.

Is now a good time to buy OC? Find out in our full research report, it’s free.

Why Does OC Stock Spark Debate?

Credited with the discovery of fiberglass, Owens Corning (NYSE:OC) supplies building and construction materials to the United States and international markets.

Two Positive Attributes:

1. Operating Margin Rising, Profits Up

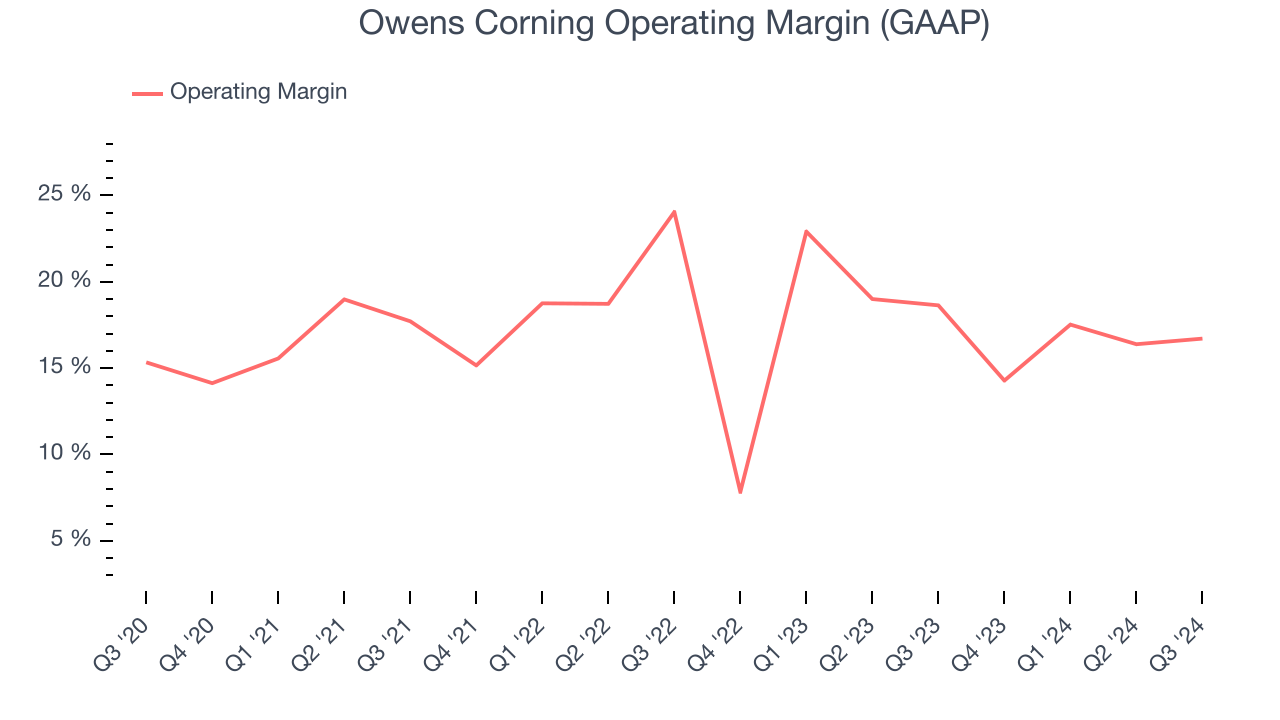

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Analyzing the trend in its profitability, Owens Corning’s operating margin rose by 19.8 percentage points over the last five years, as its sales growth gave it immense operating leverage. Its operating margin for the trailing 12 months was 16.3%.

2. Outstanding Long-Term EPS Growth

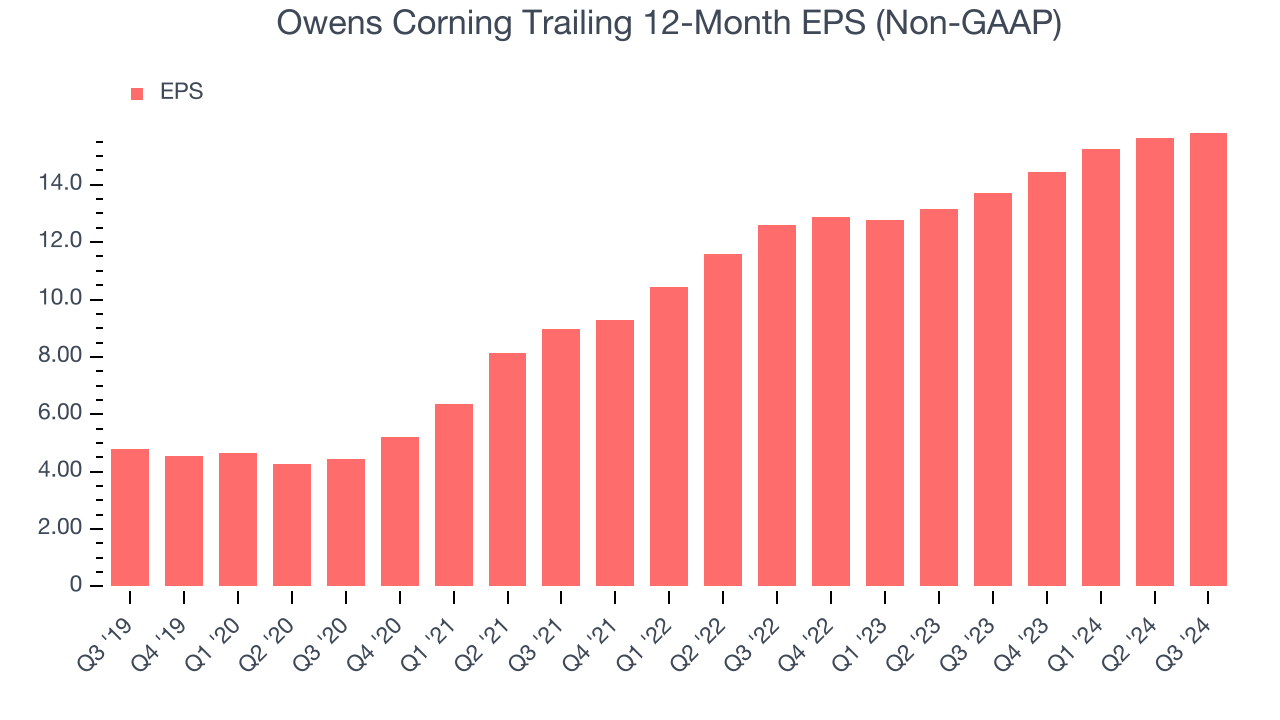

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Owens Corning’s EPS grew at an astounding 27% compounded annual growth rate over the last five years, higher than its 7.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Core Business Falling Behind as Demand Declines

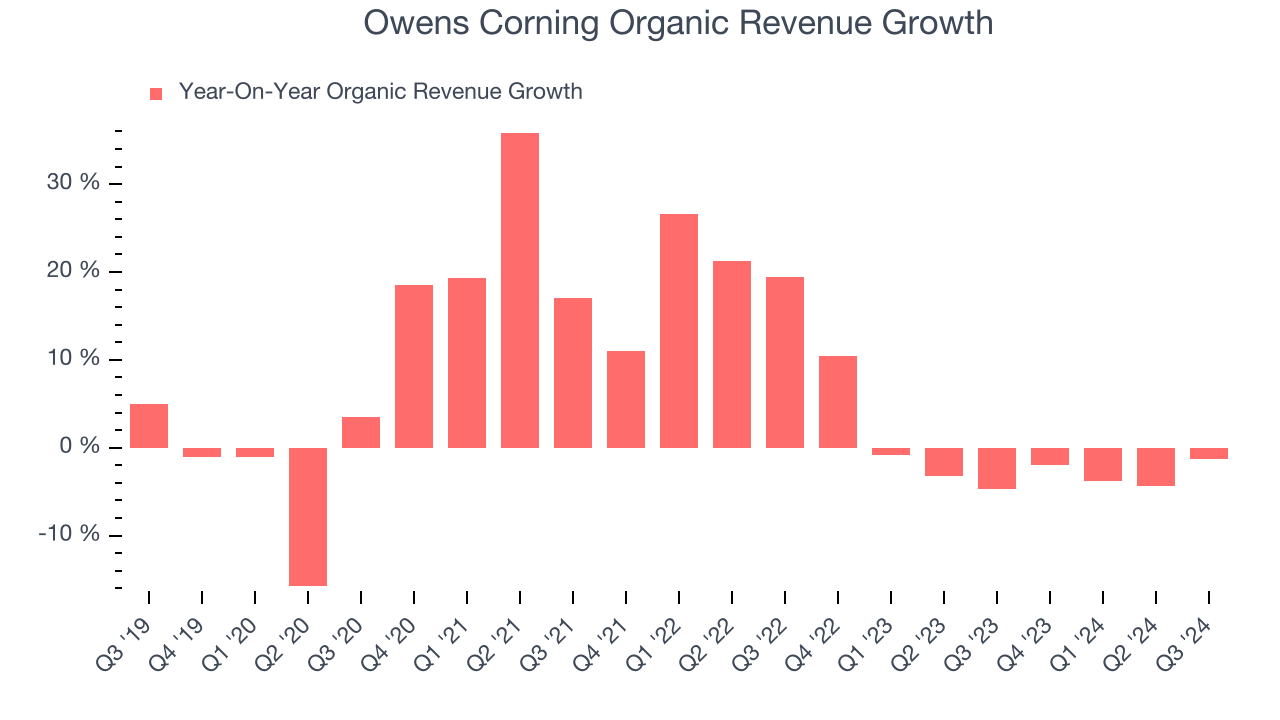

In addition to reported revenue, organic revenue is a useful data point for analyzing Home Construction Materials companies. This metric gives visibility into Owens Corning’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Owens Corning’s organic revenue averaged 1.2% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Owens Corning might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

Final Judgment

Owens Corning has huge potential even though it has some open questions, but at $200.21 per share (or 12.7× forward price-to-earnings), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Owens Corning

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.