Hayward trades at $15.10 per share and has stayed right on track with the overall market, gaining 12.3% over the last six months. At the same time, the S&P 500 has returned 13.5%.

Is there a buying opportunity in Hayward, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We don't have much confidence in Hayward. Here are three reasons why HAYW doesn't excite us and a stock we'd rather own.

Why Do We Think Hayward Will Underperform?

Credited with introducing the first variable-speed pool pump, Hayward (NYSE:HAYW) makes residential and commercial pool equipment and accessories.

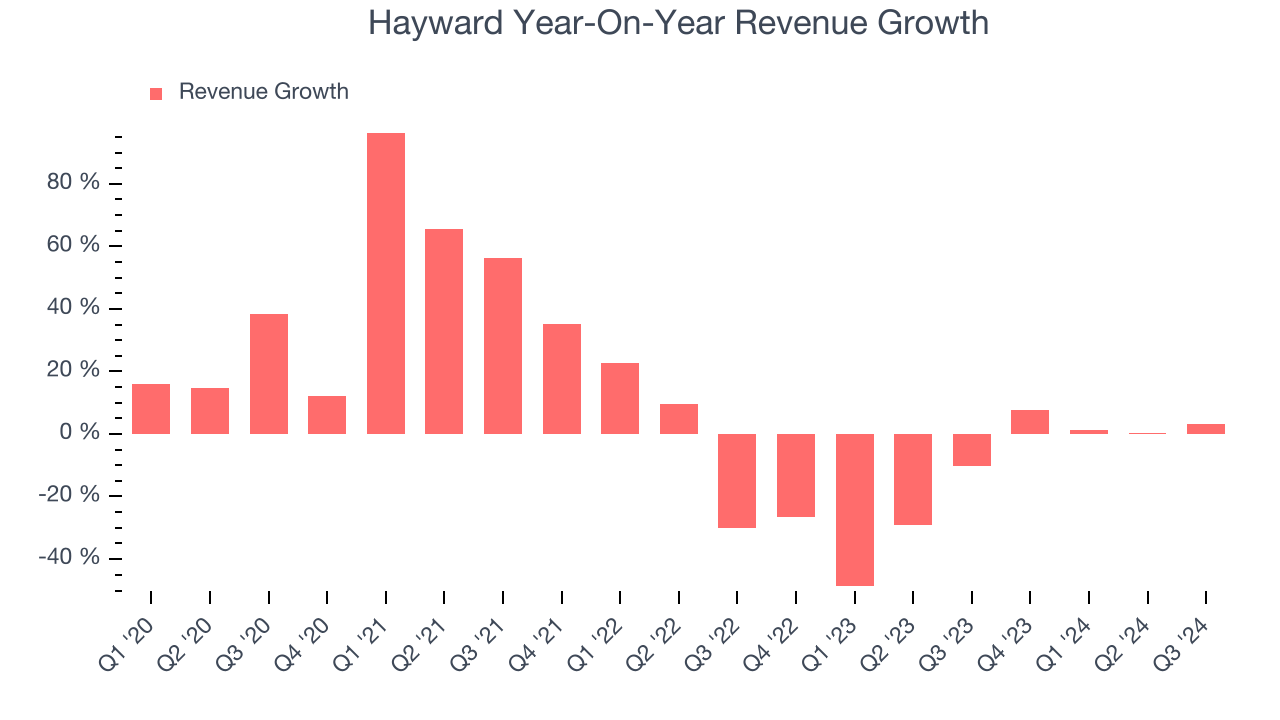

1. Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Hayward’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 15.6% over the last two years.

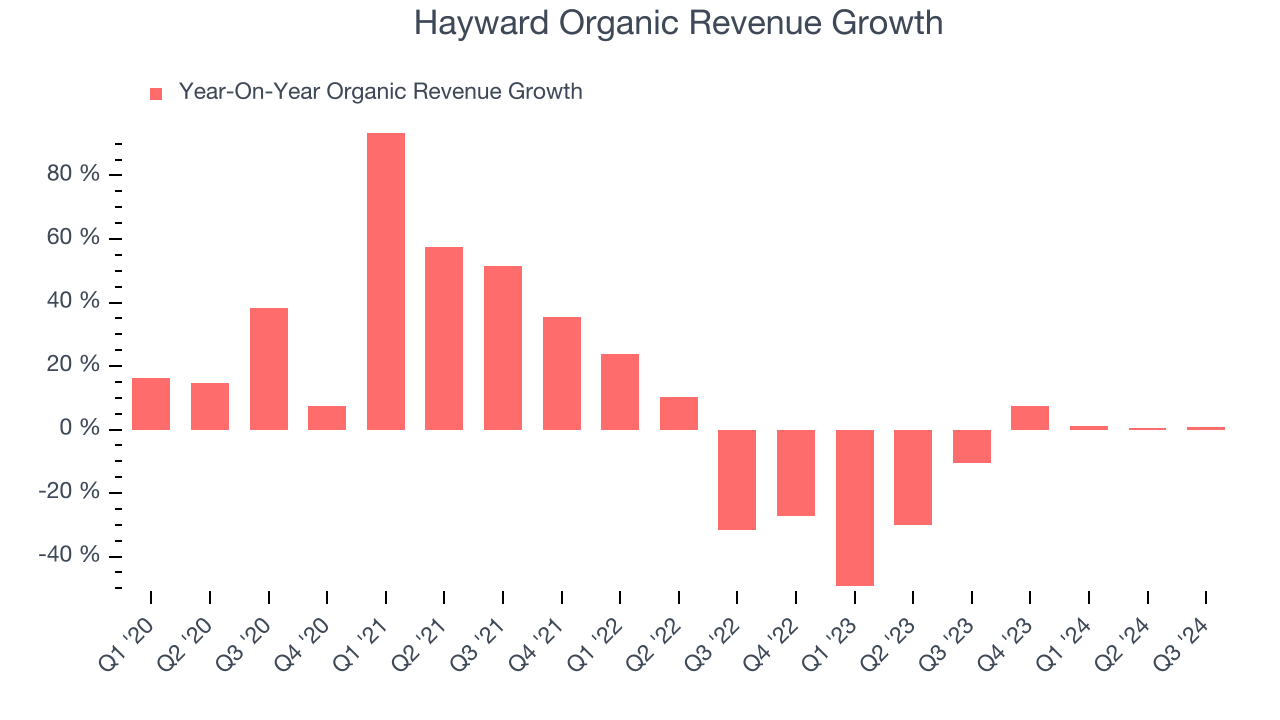

2. Core Business Falling Behind as Demand Declines

We can better understand Home Construction Materials companies by analyzing their organic revenue. This metric gives visibility into Hayward’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Hayward’s organic revenue averaged 13.4% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Hayward might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

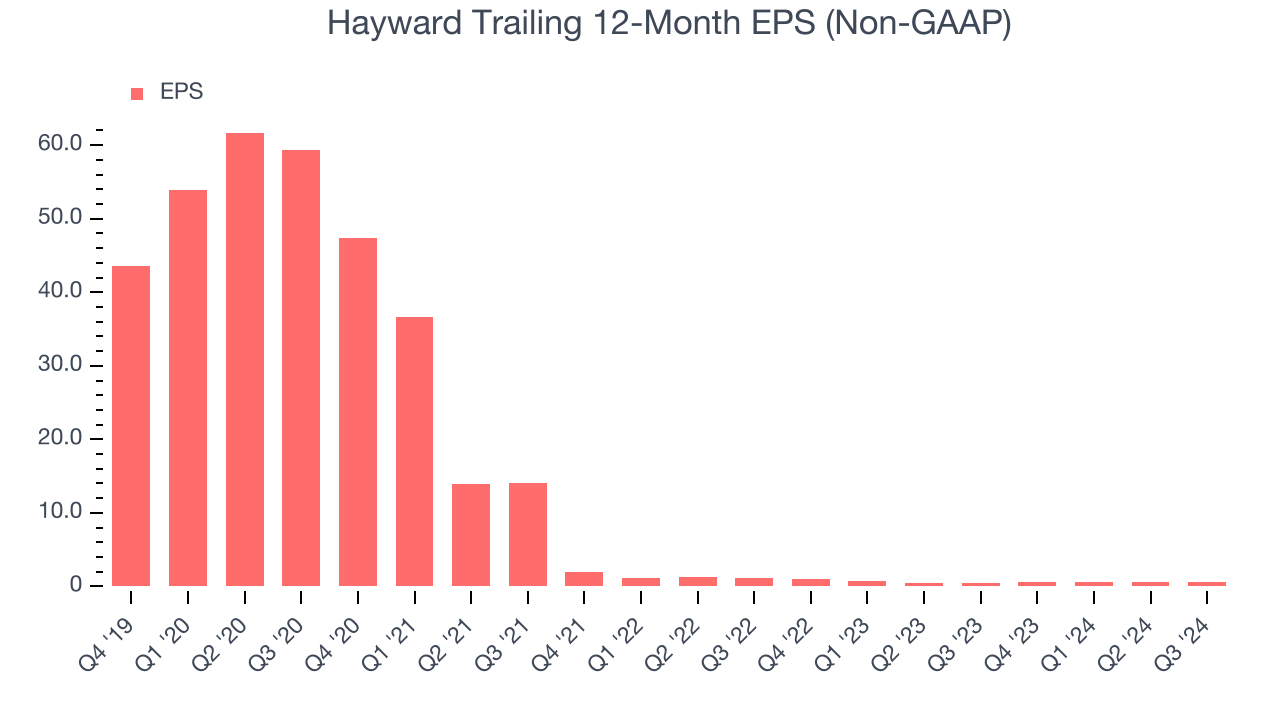

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Hayward, its EPS declined by 53.9% annually over the last five years while its revenue grew by 7.7%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Hayward doesn’t pass our quality test. That said, the stock currently trades at 21.8× forward price-to-earnings (or $15.10 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Like More Than Hayward

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.