Beauty, cosmetics, and personal care retailer Ulta Beauty (NASDAQ:ULTA) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 1.7% year on year to $2.53 billion. The company expects the full year’s revenue to be around $11.15 billion, close to analysts’ estimates. Its GAAP profit of $5.14 per share was 13.6% above analysts’ consensus estimates.

Is now the time to buy Ulta? Find out by accessing our full research report, it’s free.

Ulta (ULTA) Q3 CY2024 Highlights:

- Revenue: $2.53 billion vs analyst estimates of $2.50 billion (1.7% year-on-year growth, 1.3% beat)

- Adjusted EPS: $5.14 vs analyst estimates of $4.52 (13.6% beat)

- The company slightly lifted its revenue guidance for the full year to $11.15 billion at the midpoint from $11.1 billion

- The company lifted its EPS guidance for the full year to $23.48 billion at the midpoint from $23.05 billion, beating analyst estimates by 1.4%

- Operating Margin: 12.6%, in line with the same quarter last year

- Free Cash Flow was -$171.1 million compared to -$177.1 million in the same quarter last year

- Locations: 1,437 at quarter end, up from 1,374 in the same quarter last year

- Same-Store Sales were flat year on year (4.5% in the same quarter last year)

- Market Capitalization: $18.84 billion

Company Overview

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ:ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

Sales Growth

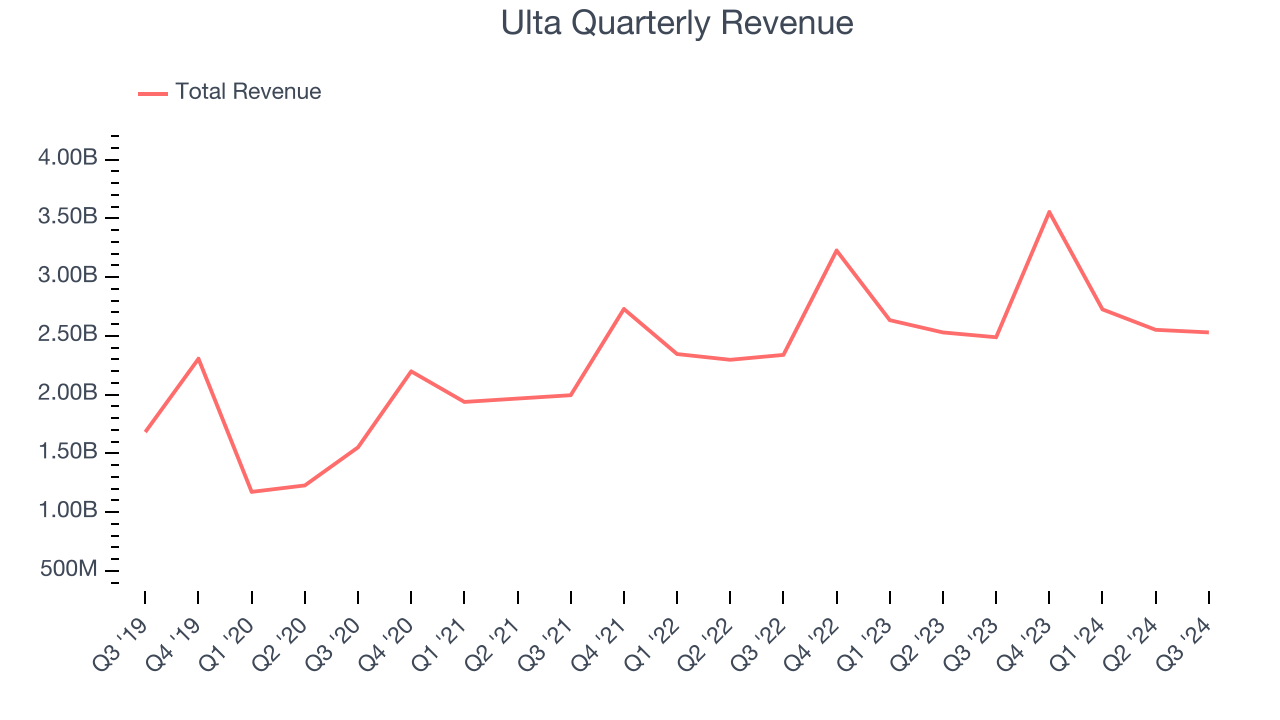

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Ulta is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Ulta’s sales grew at a mediocre 9.5% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts), but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, Ulta reported modest year-on-year revenue growth of 1.7% but beat Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last five years. This projection doesn't excite us and implies its products will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Store Performance

Number of Stores

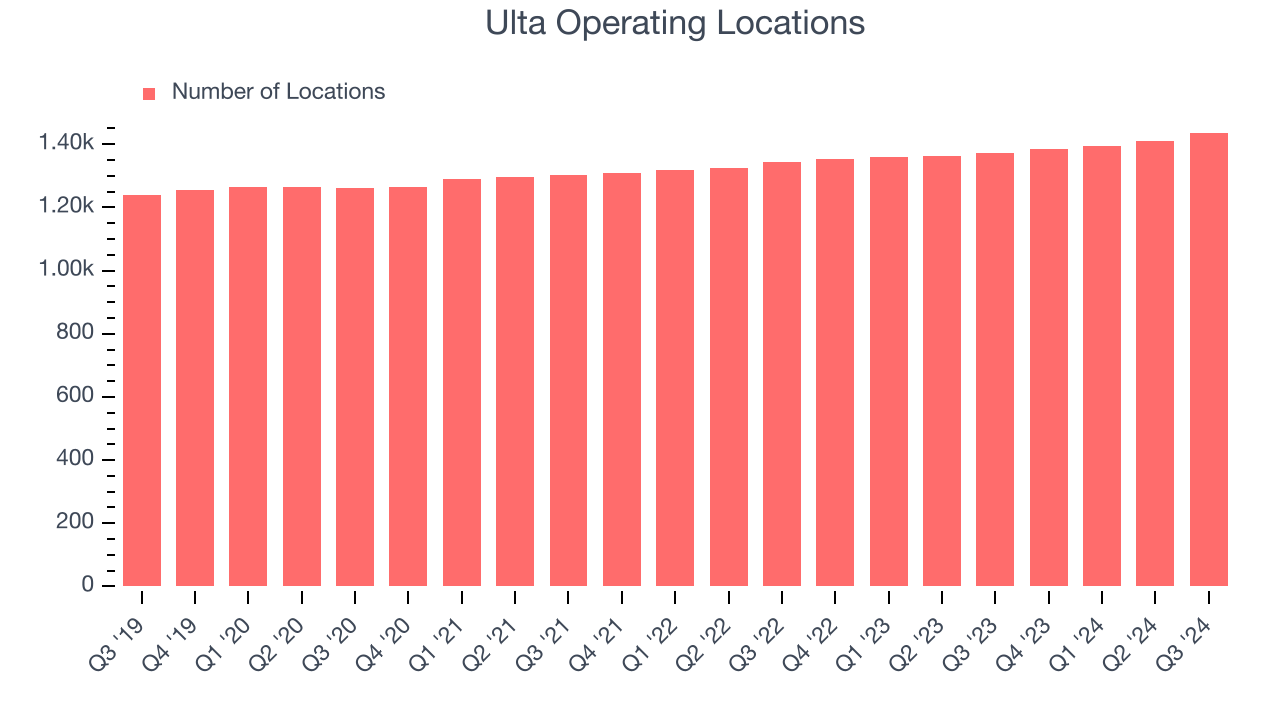

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Ulta sported 1,437 locations in the latest quarter. Over the last two years, it has opened new stores quickly, averaging 3.1% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

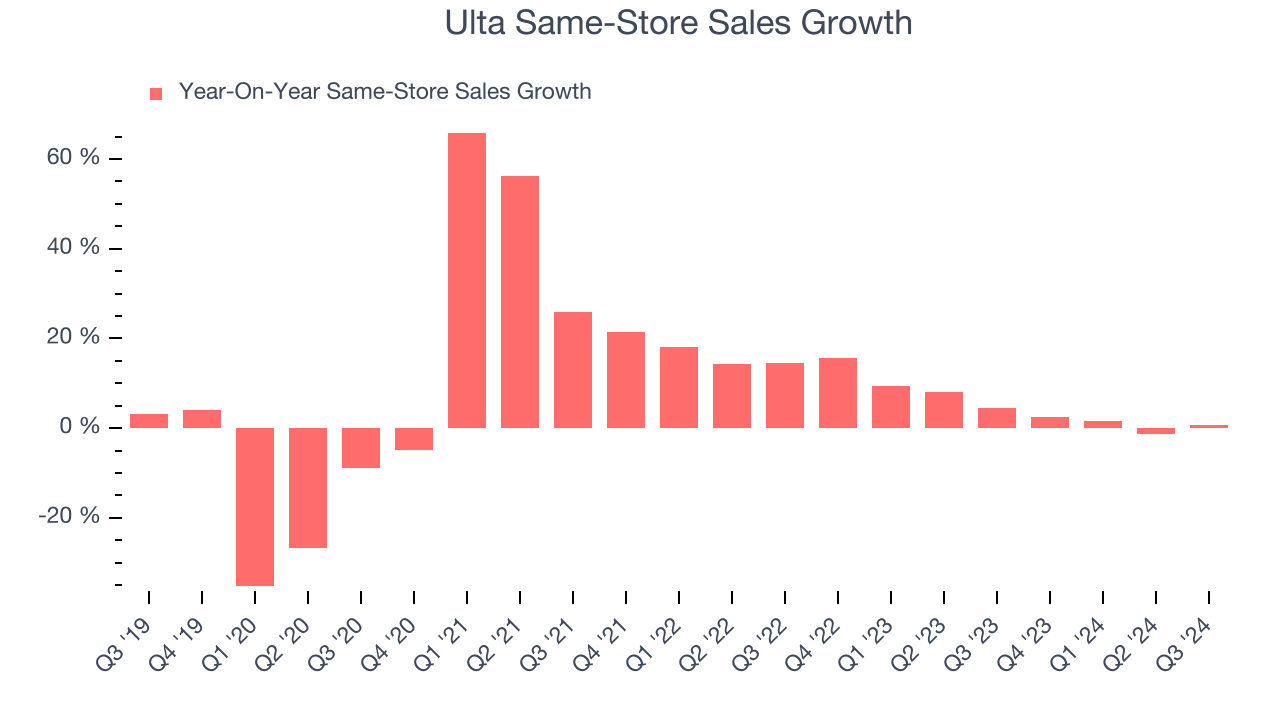

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Ulta has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 5.1%. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Ulta multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Ulta’s year on year same-store sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Ulta can reaccelerate growth.

Key Takeaways from Ulta’s Q3 Results

We were impressed by that Ulta handily beat analysts’ same-store sales expectations this quarter, leading to a nice EPS beat. That the company lifted full year guidance for revenue and EPS is also a good sign. Overall, we think this was a solid quarter. The stock traded up 9.1% to $428.29 immediately following the results.

Ulta may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.