Internet of Things company Samsara (NYSE:IOT) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 35.6% year on year to $322 million. The company expects next quarter’s revenue to be around $335 million, close to analysts’ estimates. Its non-GAAP profit of $0.07 per share was 74.3% above analysts’ consensus estimates.

Is now the time to buy Samsara? Find out by accessing our full research report, it’s free.

Samsara (IOT) Q3 CY2024 Highlights:

- Revenue: $322 million vs analyst estimates of $310.6 million (35.6% year-on-year growth, 3.7% beat)

- Adjusted EPS: $0.07 vs analyst estimates of $0.04 (74.3% beat)

- Adjusted Operating Income: $33.92 million vs analyst estimates of $12.85 million (10.5% margin, significant beat)

- Revenue Guidance for Q4 CY2024 is $335 million at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $0.23 at the midpoint, a 32.4% increase

- Operating Margin: -14.7%, up from -23.1% in the same quarter last year

- Free Cash Flow Margin: 9.7%, up from 4.4% in the previous quarter

- Customers: 2,303 customers paying more than $100,000 annually

- Annual Recurring Revenue: $1.35 billion at quarter end, up 34.5% year on year

- Market Capitalization: $31.07 billion

“We achieved another strong quarter of durable and efficient growth at a greater scale,” said Sanjit Biswas, CEO and co-founder of Samsara.

Company Overview

One of the few public companies where Marc Andreessen is a Board member, Samsara (NYSE:IOT) provides software and hardware to track industrial equipment, assets, and fleets.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

Sales Growth

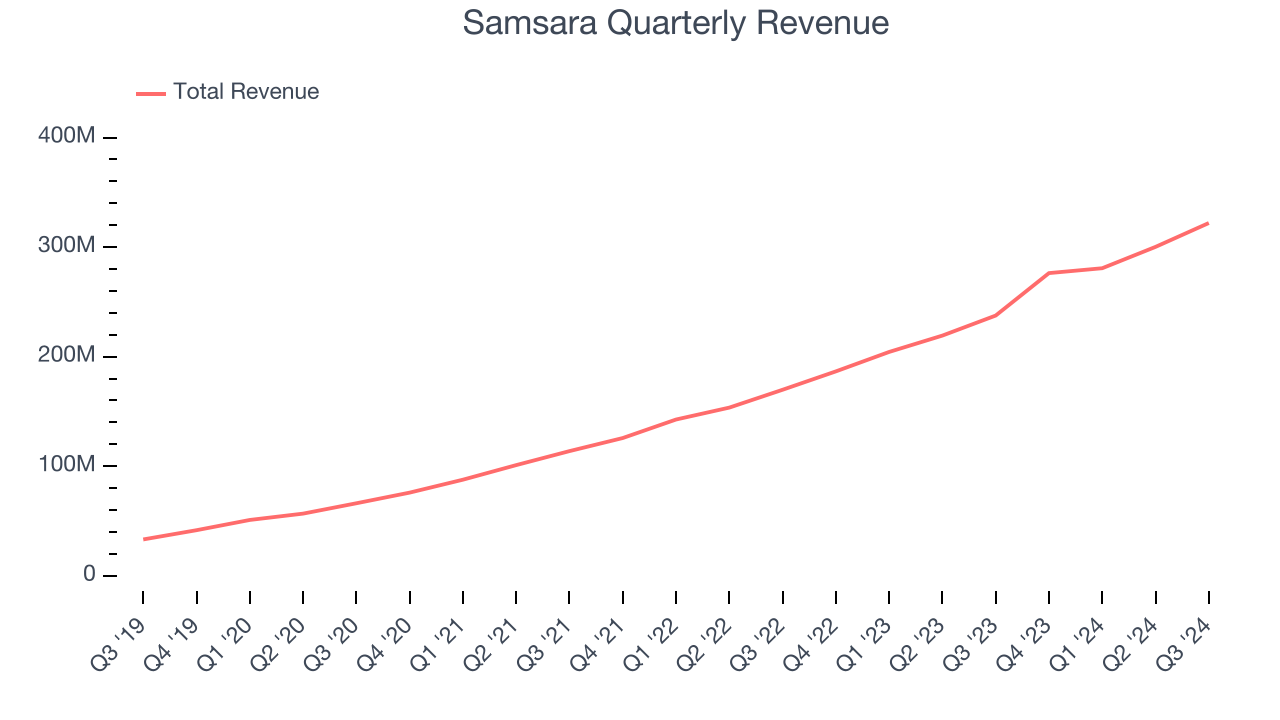

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Samsara’s sales grew at an incredible 46% compounded annual growth rate over the last three years. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Samsara reported wonderful year-on-year revenue growth of 35.6%, and its $322 million of revenue exceeded Wall Street’s estimates by 3.7%. Company management is currently guiding for a 21.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 22.5% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is admirable and implies the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Annual Recurring Revenue

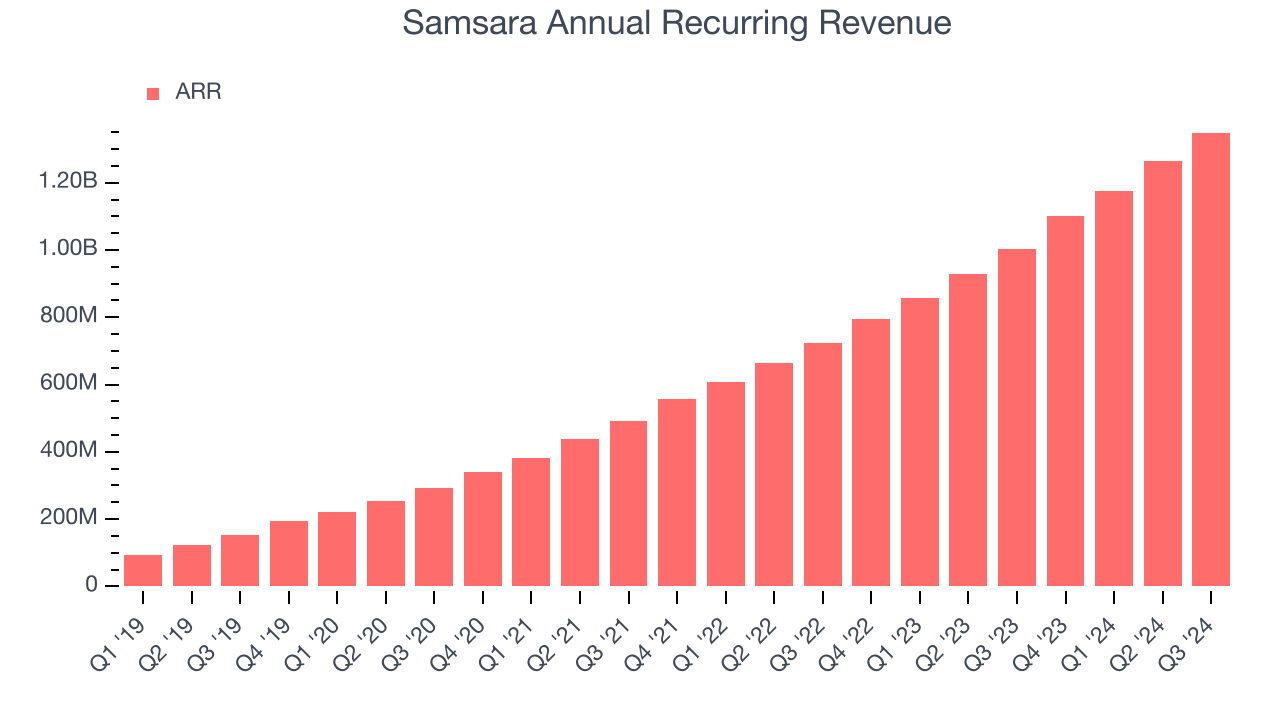

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Samsara’s ARR punched in at $1.35 billion in Q3, and over the last four quarters, its growth was fantastic as it averaged 36.6% year-on-year increases. This alternate topline metric grew slower than total sales, which likely means that the recurring portions of the business are growing slower than less predictable, choppier ones such as implementation fees. If this continues, the quality of its revenue base could decline.

Key Takeaways from Samsara’s Q3 Results

It was great to see Samsara raise its EPS guidance and beat analysts' revenue, EPS, and adjusted operating income estimates. On the other hand, its revenue guidance for next quarter met Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. However, Samsara was valued at ~22x forward sales going into the print - at frothy valuations like this, the market expects a beat and raise across the board. Shares traded down 9.4% to $50 immediately following the results because its quarterly revenue guidance failed to top expectations.

Big picture, is Samsara a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.