As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at auto parts retailer stocks, starting with Advance Auto Parts (NYSE:AAP).

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

The 5 auto parts retailer stocks we track reported a softer Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 1.4% on average since the latest earnings results.

Weakest Q3: Advance Auto Parts (NYSE:AAP)

Founded in Virginia in 1932, Advance Auto Parts (NYSE:AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

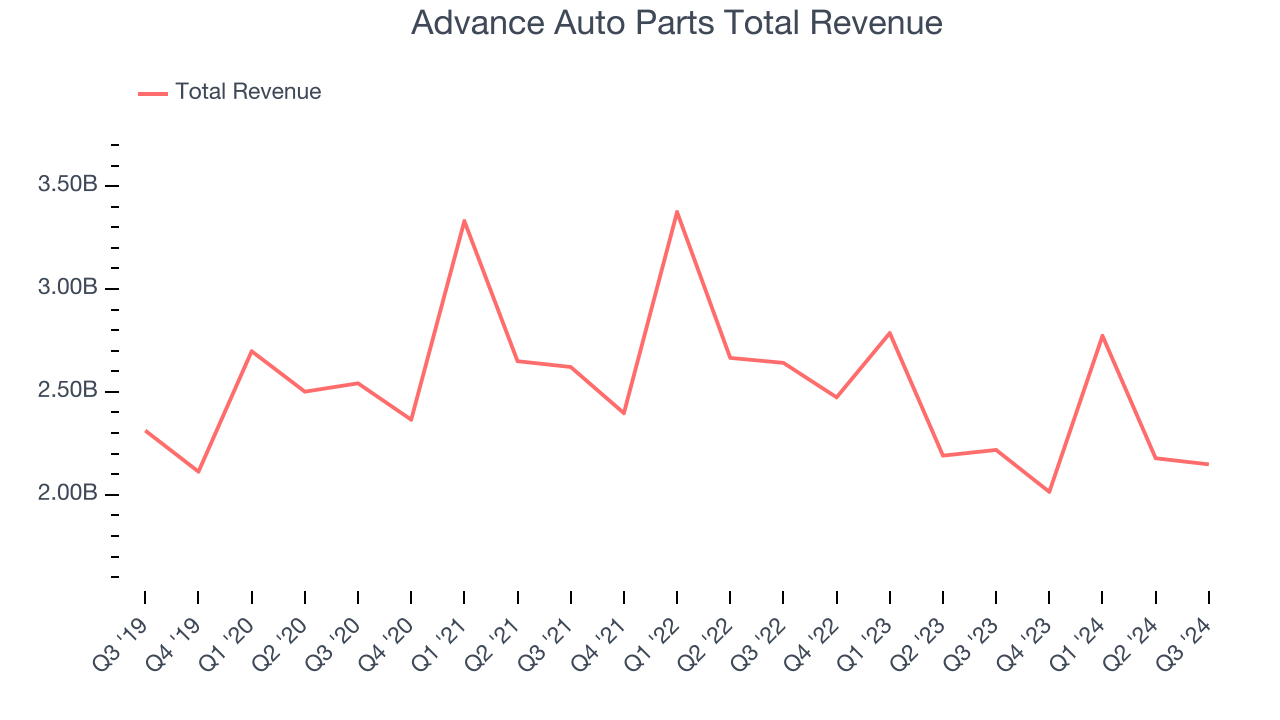

Advance Auto Parts reported revenues of $2.15 billion, down 3.2% year on year. This print fell short of analysts’ expectations by 1.1%. Overall, it was a disappointing quarter for the company with full-year revenue guidance missing analysts’ expectations.

"We are pleased to have made progress on our strategic actions, including the completion of the sale of Worldpac and a comprehensive operational productivity review of our business,” said Shane O’Kelly, president and chief executive officer.

Advance Auto Parts delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 8% since reporting and currently trades at $44.20.

Read our full report on Advance Auto Parts here, it’s free.

Best Q3: O'Reilly (NASDAQ:ORLY)

Serving both the DIY customer and professional mechanic, O’Reilly Automotive (NASDAQ:ORLY) is an auto parts and accessories retailer that sells everything from fuel pumps to car air fresheners to mufflers.

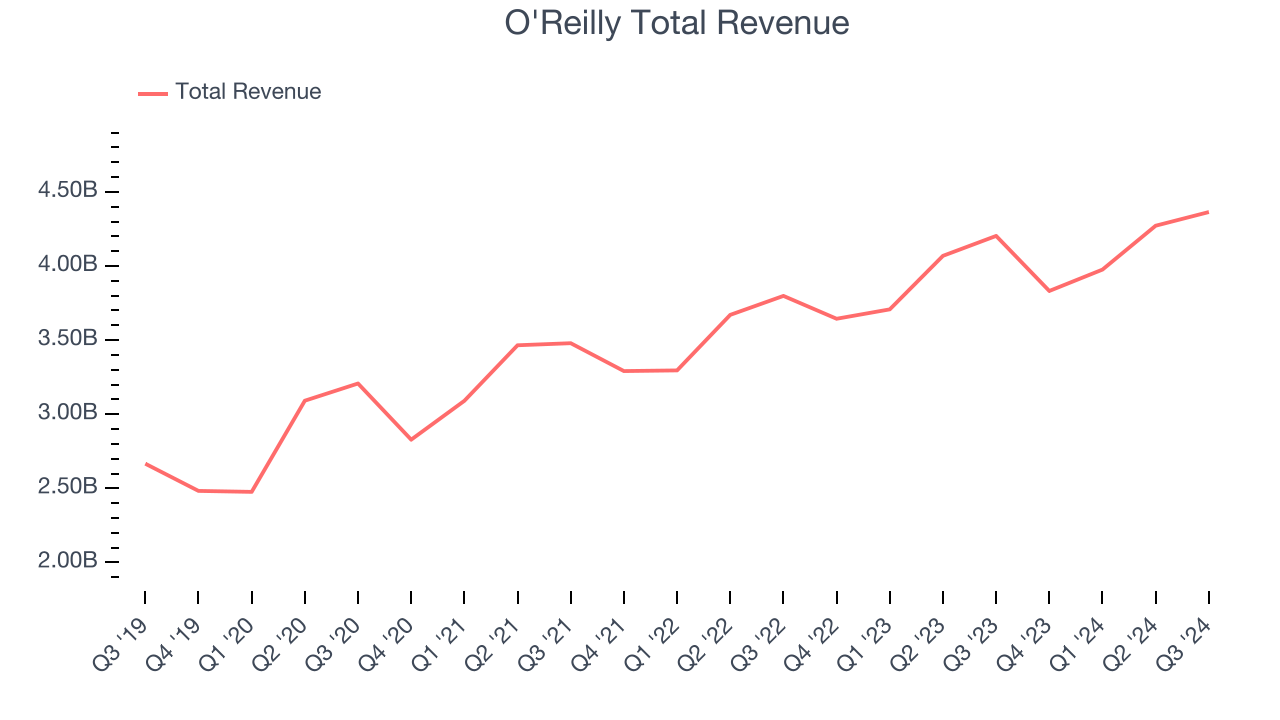

O'Reilly reported revenues of $4.36 billion, up 3.8% year on year, falling short of analysts’ expectations by 1.3%. The business performed better than its peers, but it was unfortunately a mixed quarter with a solid beat of analysts’ EBITDA estimates but full-year EPS guidance slightly missing analysts’ expectations.

O'Reilly achieved the highest full-year guidance raise among its peers. The market seems content with the results as the stock is up 3.4% since reporting. It currently trades at $1,240.

Is now the time to buy O'Reilly? Access our full analysis of the earnings results here, it’s free.

Monro (NASDAQ:MNRO)

Started as a single location in Rochester, New York, Monro (NASDAQ:MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

Monro reported revenues of $301.4 million, down 6.4% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and gross margin estimates.

Monro delivered the biggest analyst estimates beat but had the slowest revenue growth in the group. Interestingly, the stock is up 3.2% since the results and currently trades at $27.63.

Read our full analysis of Monro’s results here.

Genuine Parts (NYSE:GPC)

Largely targeting the professional customer, Genuine Parts (NYSE:GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

Genuine Parts reported revenues of $5.97 billion, up 2.5% year on year. This number was in line with analysts’ expectations. Taking a step back, it was a softer quarter as it logged full-year EPS guidance missing analysts’ expectations.

The stock is down 12% since reporting and currently trades at $125.89.

Read our full, actionable report on Genuine Parts here, it’s free.

AutoZone (NYSE:AZO)

Aiming to be a one-stop shop for the DIY customer, AutoZone (NYSE:AZO) is an auto parts and accessories retailer that sells everything from car batteries to windshield wiper fluid to brake pads.

AutoZone reported revenues of $6.21 billion, up 9% year on year. This result met analysts’ expectations. Zooming out, it was a slower quarter as it logged a miss of analysts’ EBITDA and EPS estimates.

AutoZone scored the fastest revenue growth among its peers. The stock is up 4.5% since reporting and currently trades at $3,190.

Read our full, actionable report on AutoZone here, it’s free.

Market Update

In response to the Fed's rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed's 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.