Auto parts and accessories retailer AutoZone (NYSE:AZO) missed Wall Street’s revenue expectations in Q4 CY2024 as sales rose 2.1% year on year to $4.28 billion. Its GAAP profit of $32.52 per share was 3.3% below analysts’ consensus estimates.

Is now the time to buy AutoZone? Find out by accessing our full research report, it’s free.

AutoZone (AZO) Q4 CY2024 Highlights:

- Revenue: $4.28 billion vs analyst estimates of $4.31 billion (2.1% year-on-year growth, 0.6% miss)

- Adjusted EPS: $32.52 vs analyst expectations of $33.64 (3.3% miss)

- Adjusted EBITDA: $974.3 million vs analyst estimates of $975.7 million (22.8% margin, in line)

- Operating Margin: 19.7%, in line with the same quarter last year

- Free Cash Flow Margin: 13.2%, similar to the same quarter last year

- Locations: 7,387 at quarter end, up from 7,165 in the same quarter last year

- Same-Store Sales were flat year on year (3.4% in the same quarter last year)

- Market Capitalization: $56.19 billion

“I would like to thank all our AutoZoners across the globe for their efforts in helping us deliver solid first quarter results. We were pleased with the progress in our DIY same store sales result from the prior quarter as average ticket and traffic trends improved. Our domestic Commercial sales were up 3.2% and we were encouraged by the improving trends seen at the end of the quarter. Our international businesses continued to perform well with same store sales up just under 14% on a constant currency basis. While currency rate moves depressed reported sales and earnings growth, our international performance remains encouraging as we continue to focus on opening more stores in these markets. We feel we are well positioned for growth heading into the remainder of the fiscal year, as we believe the initiatives we have in place to improve customer service and grow market share are on track. As we continue to invest in our business, we remain committed to our disciplined approach of a focus on increasing earnings and operating cash flow, all while delivering strong shareholder value,” said Phil Daniele, President and Chief Executive Officer.

Company Overview

Aiming to be a one-stop shop for the DIY customer, AutoZone (NYSE:AZO) is an auto parts and accessories retailer that sells everything from car batteries to windshield wiper fluid to brake pads.

Auto Parts Retailer

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

AutoZone is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because it's harder to find incremental growth when you've penetrated most of the market.

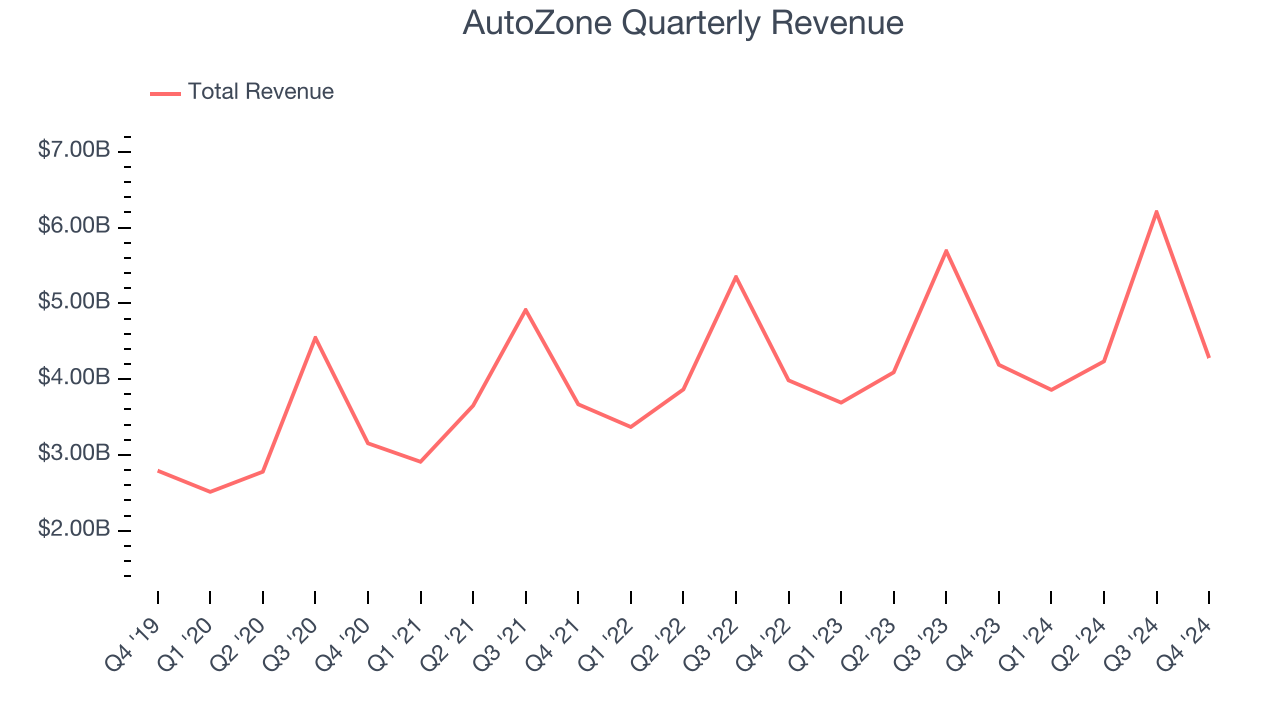

As you can see below, AutoZone’s 9.1% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre, but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, AutoZone’s revenue grew by 2.1% year on year to $4.28 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, a deceleration versus the last five years. This projection is underwhelming and indicates its products will face some demand challenges. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

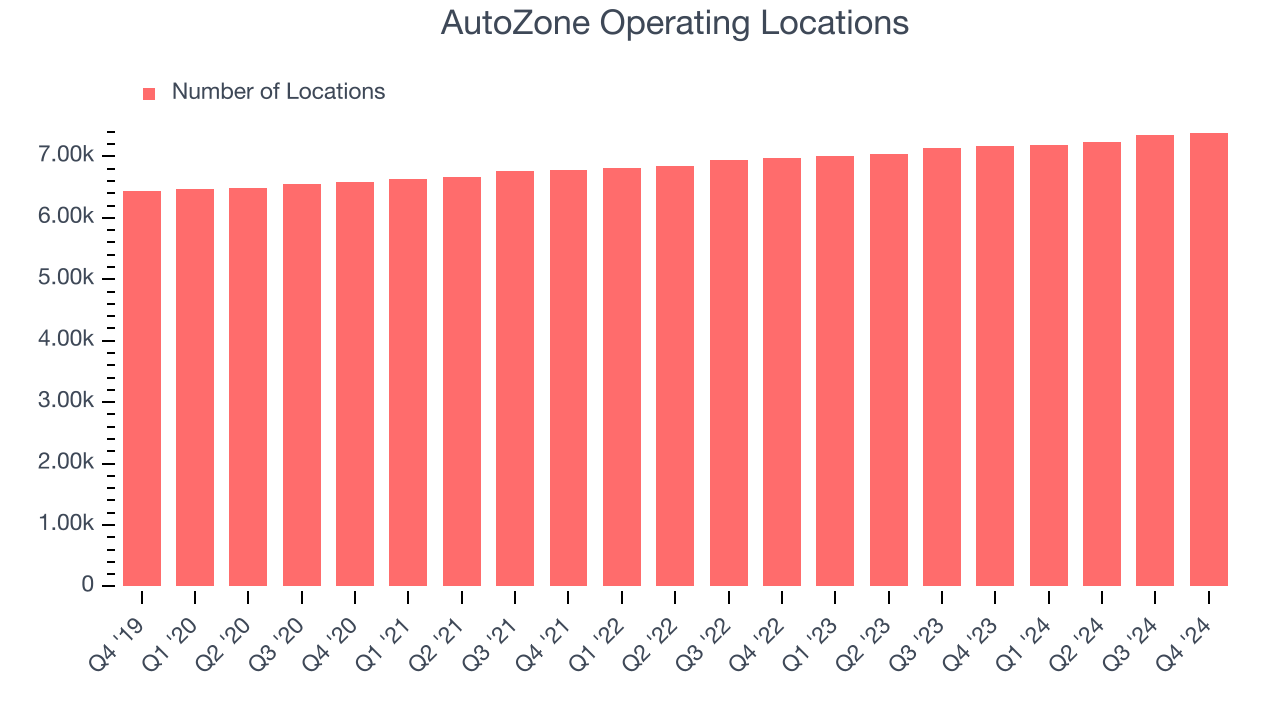

AutoZone operated 7,387 locations in the latest quarter. It has opened new stores quickly over the last two years by averaging 2.8% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

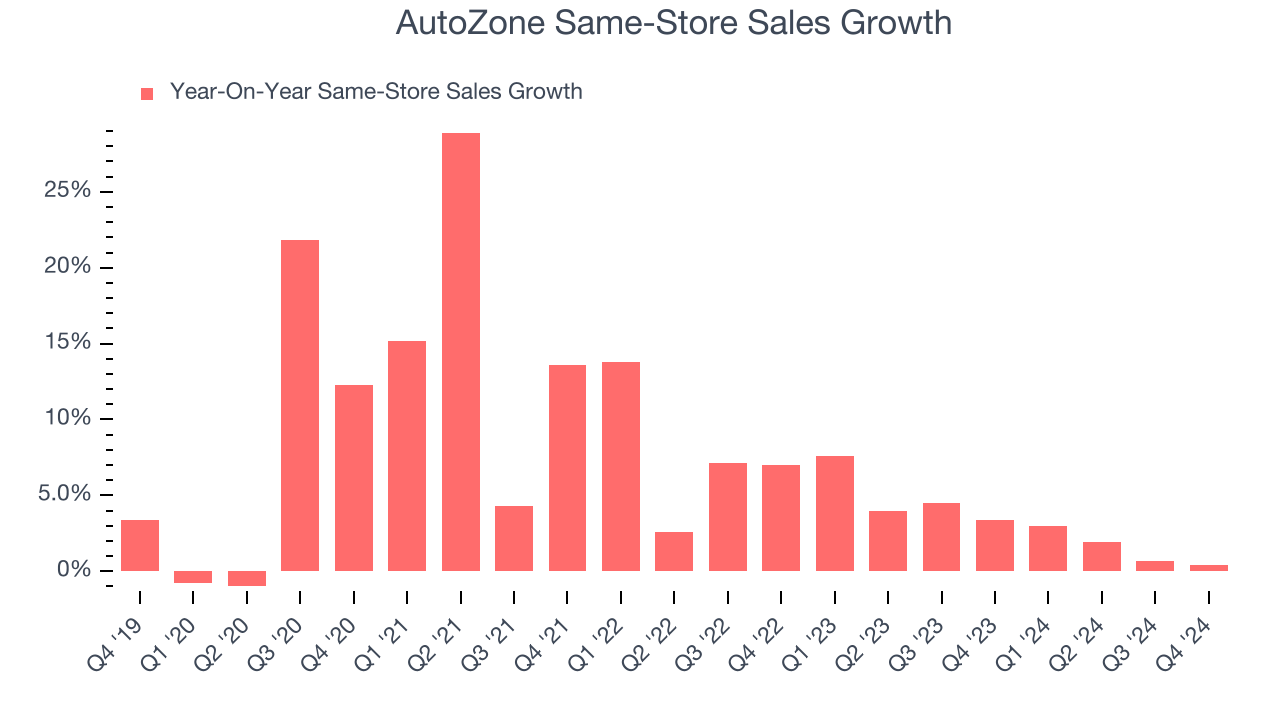

AutoZone’s demand has been healthy for a retailer over the last two years. On average, the company has grown its same-store sales by a robust 3.2% per year. This performance suggests its rollout of new stores could be beneficial for shareholders. When a retailer has demand, more locations should help it reach more customers and boost revenue growth.

In the latest quarter, AutoZone’s year on year same-store sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if AutoZone can reaccelerate growth.

Key Takeaways from AutoZone’s Q4 Results

We struggled to find many resounding positives in these results. Its revenue slightly missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $3,304 immediately following the results.

Is AutoZone an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.