Footwear conglomerate Wolverine Worldwide (NYSE:WWW) reported Q3 CY2024 results exceeding the market’s revenue expectations, but sales fell 7% year on year to $440.2 million. The company expects the full year’s revenue to be around $1.74 billion, close to analysts’ estimates. Its non-GAAP profit of $0.29 per share was also 34.2% above analysts’ consensus estimates.

Is now the time to buy Wolverine Worldwide? Find out by accessing our full research report, it’s free.

Wolverine Worldwide (WWW) Q3 CY2024 Highlights:

- Revenue: $440.2 million vs analyst estimates of $421.4 million (4.5% beat)

- Adjusted EPS: $0.29 vs analyst estimates of $0.22 (34.2% beat)

- EBITDA: $41.3 million vs analyst estimates of $40.1 million (3% beat)

- The company lifted its revenue guidance for the full year to $1.74 billion at the midpoint from $1.72 billion, a 1% increase

- Management raised its full-year Adjusted EPS guidance to $0.85 at the midpoint, a 6.3% increase

- Gross Margin (GAAP): 45.3%, up from 34% in the same quarter last year

- Operating Margin: 8%, up from 5.8% in the same quarter last year

- EBITDA Margin: 9.4%, up from 4.9% in the same quarter last year

- Free Cash Flow was $104.1 million, up from -$43.2 million in the same quarter last year

- Market Capitalization: $1.28 billion

“In the third quarter, we delivered better-than-expected revenue and earnings – led by Merrell and Saucony outpacing our forecast – as we continue to make progress on our plan to turnaround and transform the Company for the future,” said Chris Hufnagel, President and Chief Executive Officer of Wolverine Worldwide.

Company Overview

Founded in 1883, Wolverine Worldwide (NYSE:WWW) is a global footwear company with a diverse portfolio of brands including Merrell, Hush Puppies, and Saucony.

Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

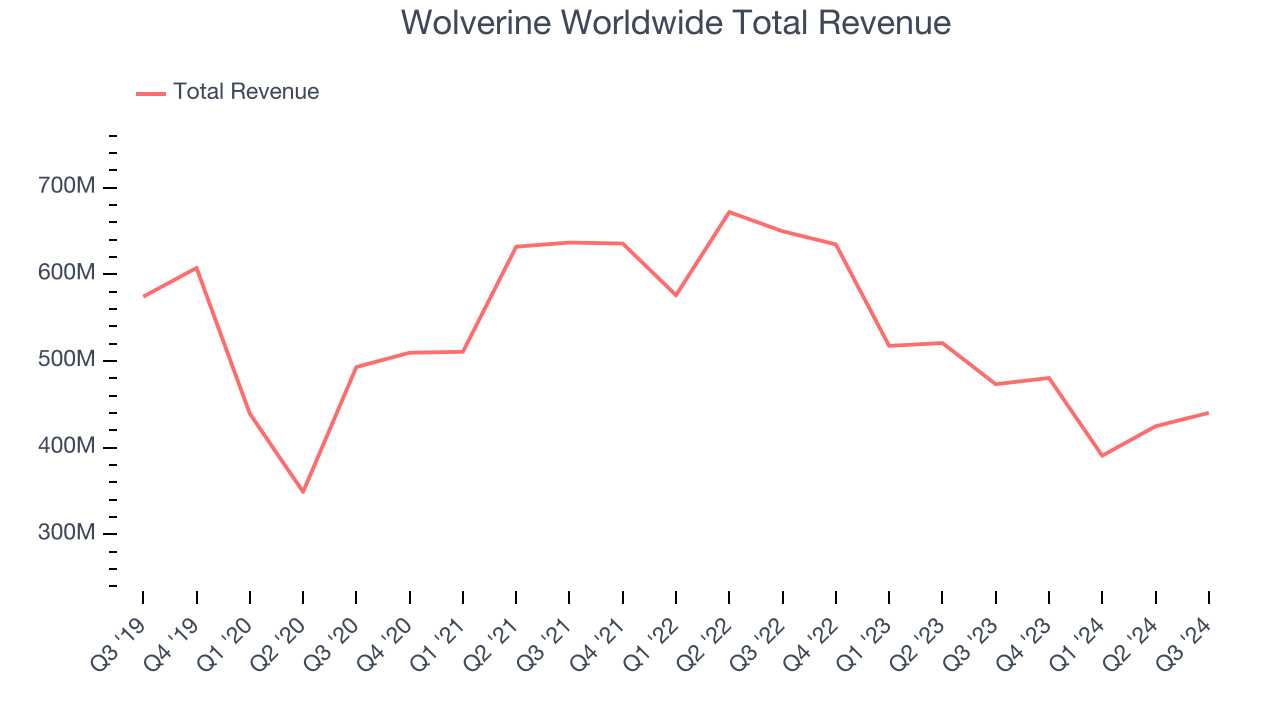

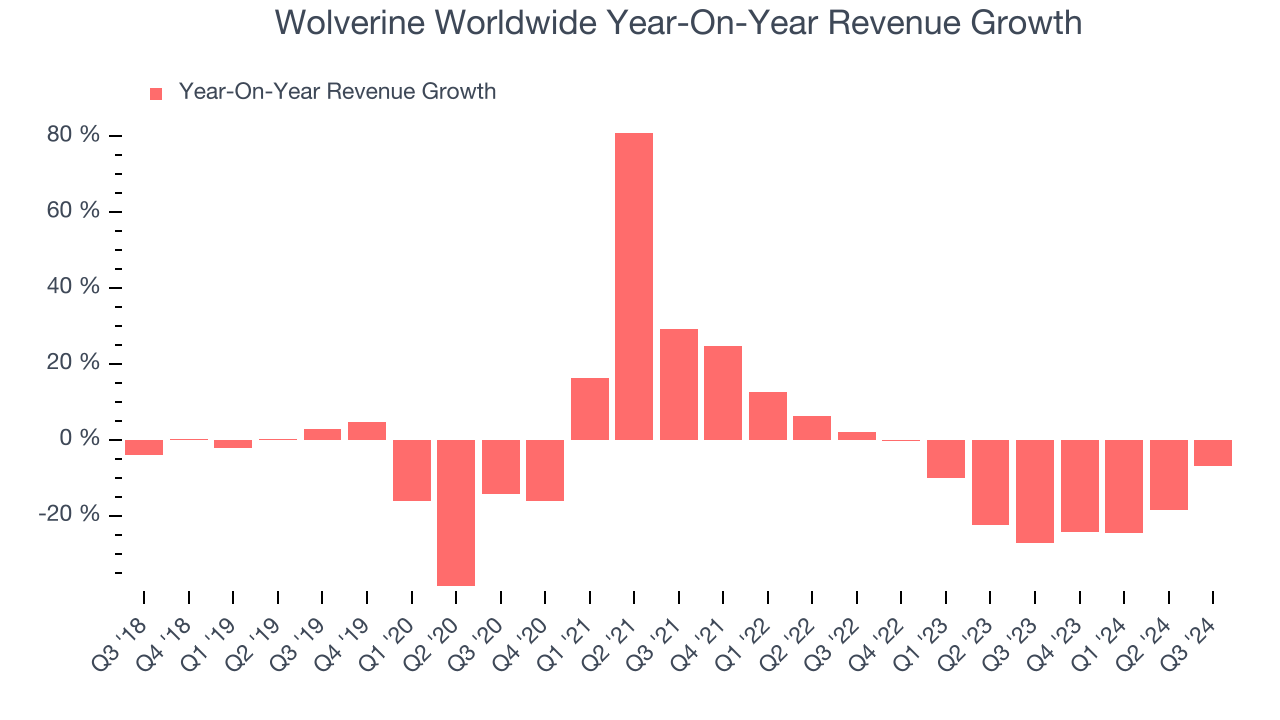

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Wolverine Worldwide’s revenue declined by 5% per year. This shows demand was weak, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Wolverine Worldwide’s recent history shows its demand has stayed suppressed as its revenue has declined by 17.2% annually over the last two years.

This quarter, Wolverine Worldwide’s revenue fell 7% year on year to $440.2 million but beat Wall Street’s estimates by 4.5%.

Looking ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months, an improvement versus the last two years. Although this projection shows the market thinks its newer products and services will fuel better performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

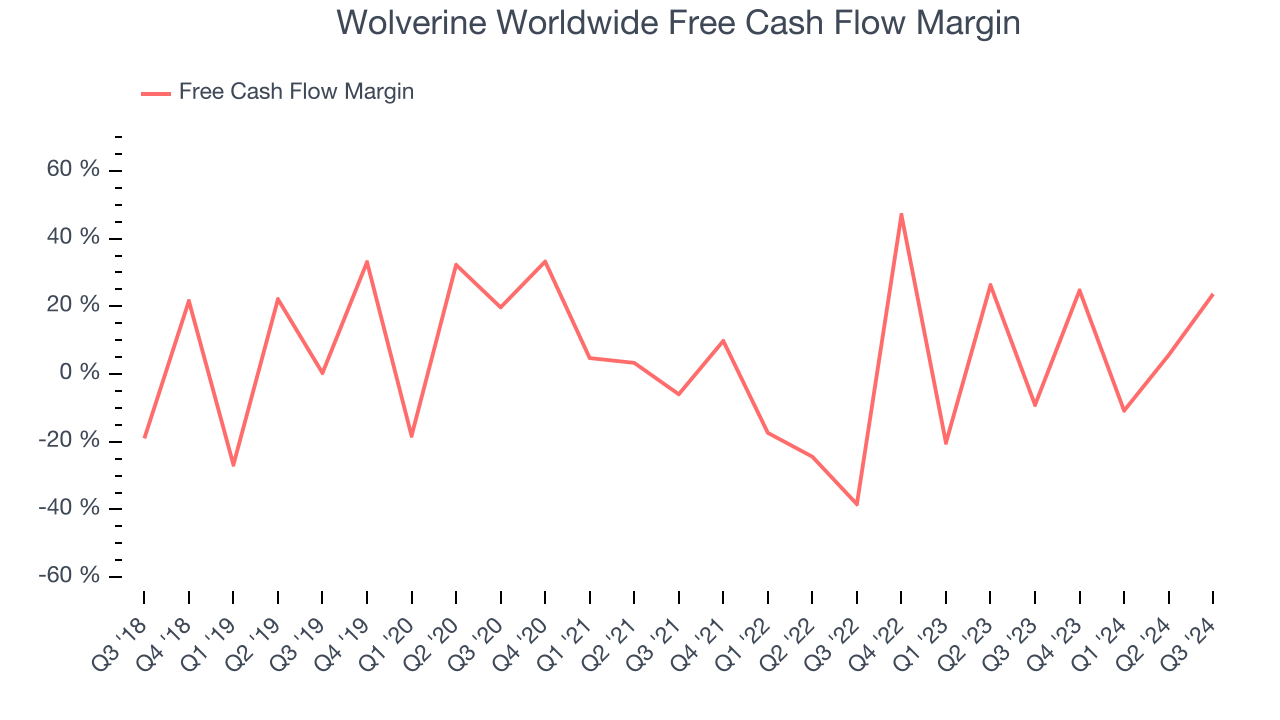

Wolverine Worldwide has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.6% over the last two years, slightly better than the broader consumer discretionary sector.

Wolverine Worldwide’s free cash flow clocked in at $104.1 million in Q3, equivalent to a 23.6% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Key Takeaways from Wolverine Worldwide’s Q3 Results

We were impressed by Wolverine Worldwide's beat-and-raise quarter - its revenue, EPS, and EBITDA topped expectations, and it lifted its full-year revenue and EPS guidance. The stock traded up 5.5% to $16.95 immediately following the results.

Wolverine Worldwide put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.