Industrial distributor DXP Enterprises (NASDAQ:DXPE) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 12.8% year on year to $472.9 million. Its GAAP profit of $1.27 per share was also 33.7% above analysts’ consensus estimates.

Is now the time to buy DXP? Find out by accessing our full research report, it’s free.

DXP (DXPE) Q3 CY2024 Highlights:

- Revenue: $472.9 million vs analyst estimates of $443 million (6.8% beat)

- EPS: $1.27 vs analyst estimates of $0.95 (33.7% beat)

- EBITDA: $52.44 million vs analyst estimates of $47 million (11.6% beat)

- Gross Margin (GAAP): 30.9%, in line with the same quarter last year

- Operating Margin: 8.4%, in line with the same quarter last year

- EBITDA Margin: 11.1%, up from 9.2% in the same quarter last year

- Free Cash Flow Margin: 5.2%, down from 9.1% in the same quarter last year

- Market Capitalization: $795 million

David R. Little, Chairman and Chief Executive Officer commented, "The Company posted excellent third quarter financial results in a lessening inflationary and varied spending by end market, delivering solid sales, adjusted EBITDA, earnings per share and free cash flow. Third quarter results reflect the continued execution of our growth strategy and the impact of our acquisition program. We continue to set new high watermarks as DXPeople. We are pleased with our sequential sales growth and strong adjusted EBITDA margins. This resulted in operating leverage that produced earnings per share of $1.27. DXP’s third quarter 2024 sales were $472.9 million, or a 6.1 percent increase over the second quarter of 2024 and a 12.8 percent growth over the same period in 2023. Adjusted EBITDA grew $4.2 million, or 8.7 percent over the second quarter of 2024 to $52.4 million. During the third quarter of 2024, sales were $316.8 million for Service Centers, $89.8 million for Innovative Pumping Solutions, and $66.3 million for Supply Chain Services. Overall, we are very pleased with our performance and the progress DXP continues to make as a growth company. "

Company Overview

Founded during the emergence of Big Oil in Texas, DXP (NASDAQ:DXPE) provides pumps, valves, and other industrial components.

Maintenance and Repair Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

Sales Growth

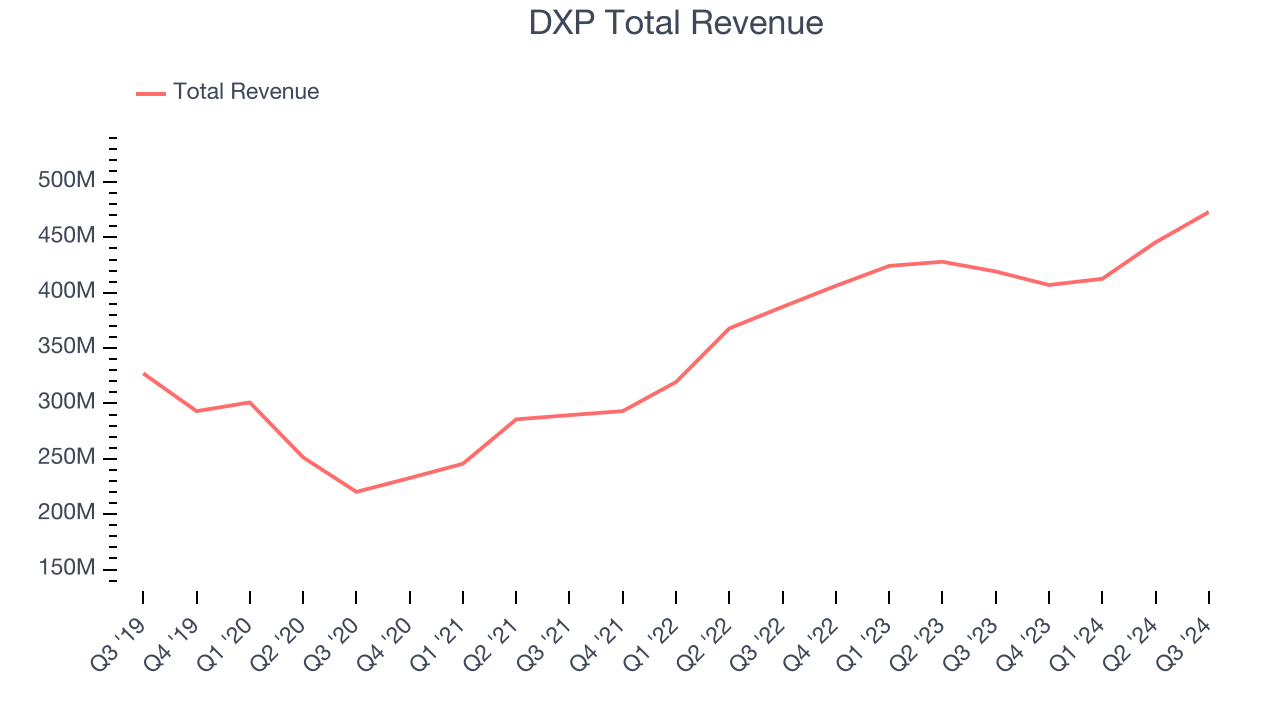

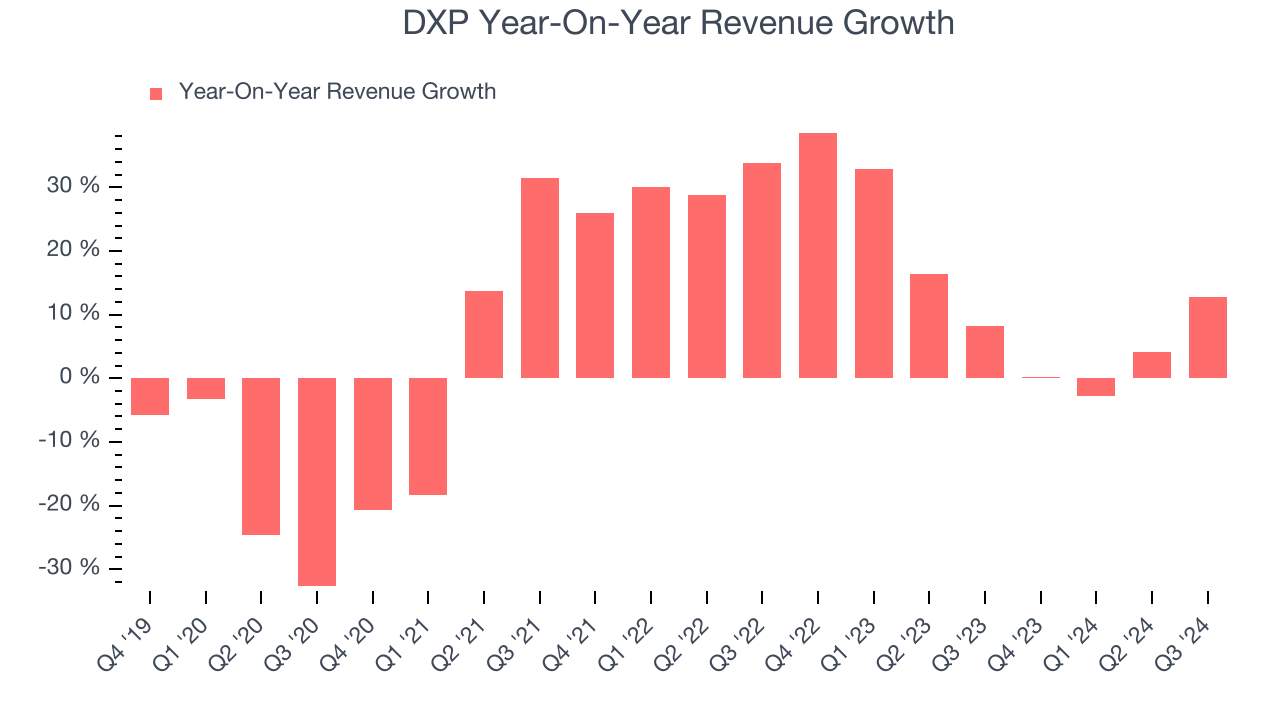

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, DXP’s 6.3% annualized revenue growth over the last five years was mediocre. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. DXP’s annualized revenue growth of 12.7% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, DXP reported year-on-year revenue growth of 12.8%, and its $472.9 million of revenue exceeded Wall Street’s estimates by 6.8%.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and illustrates the market believes its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

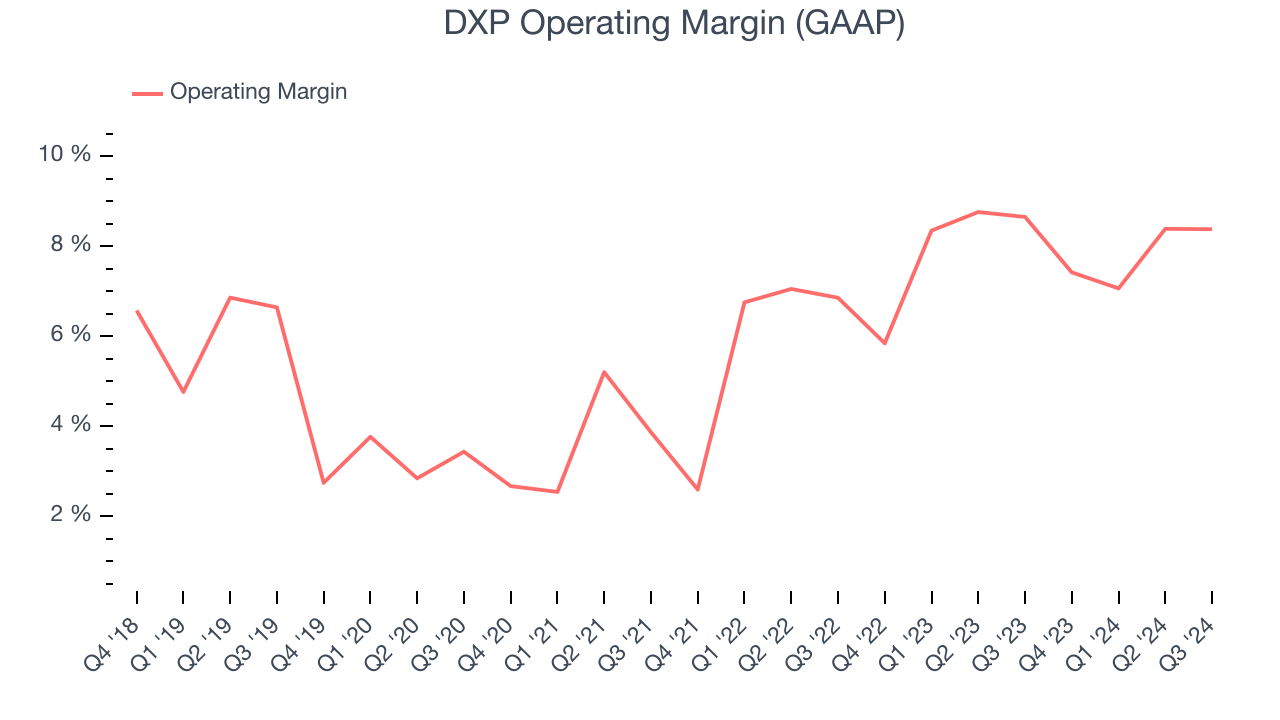

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

DXP was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.1% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, DXP’s annual operating margin rose by 4.6 percentage points over the last five years.

This quarter, DXP generated an operating profit margin of 8.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

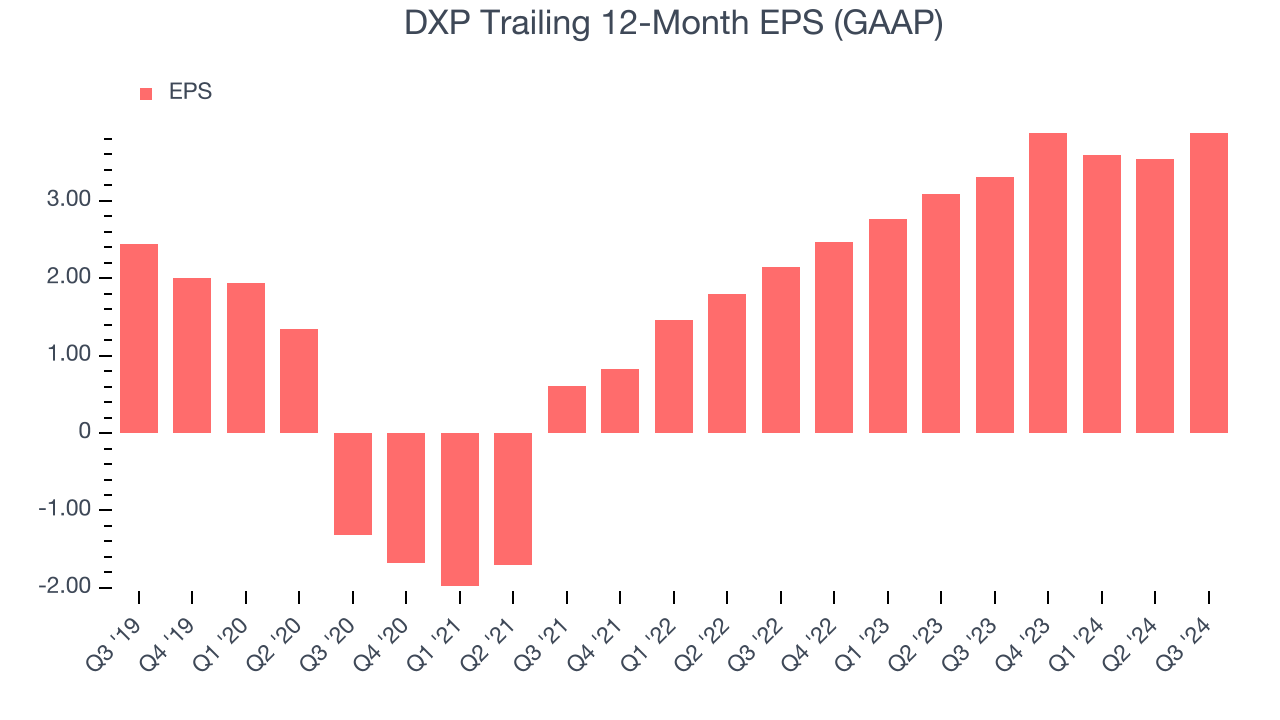

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

DXP’s EPS grew at a decent 9.7% compounded annual growth rate over the last five years, higher than its 6.3% annualized revenue growth. This tells us the company became more profitable as it expanded.

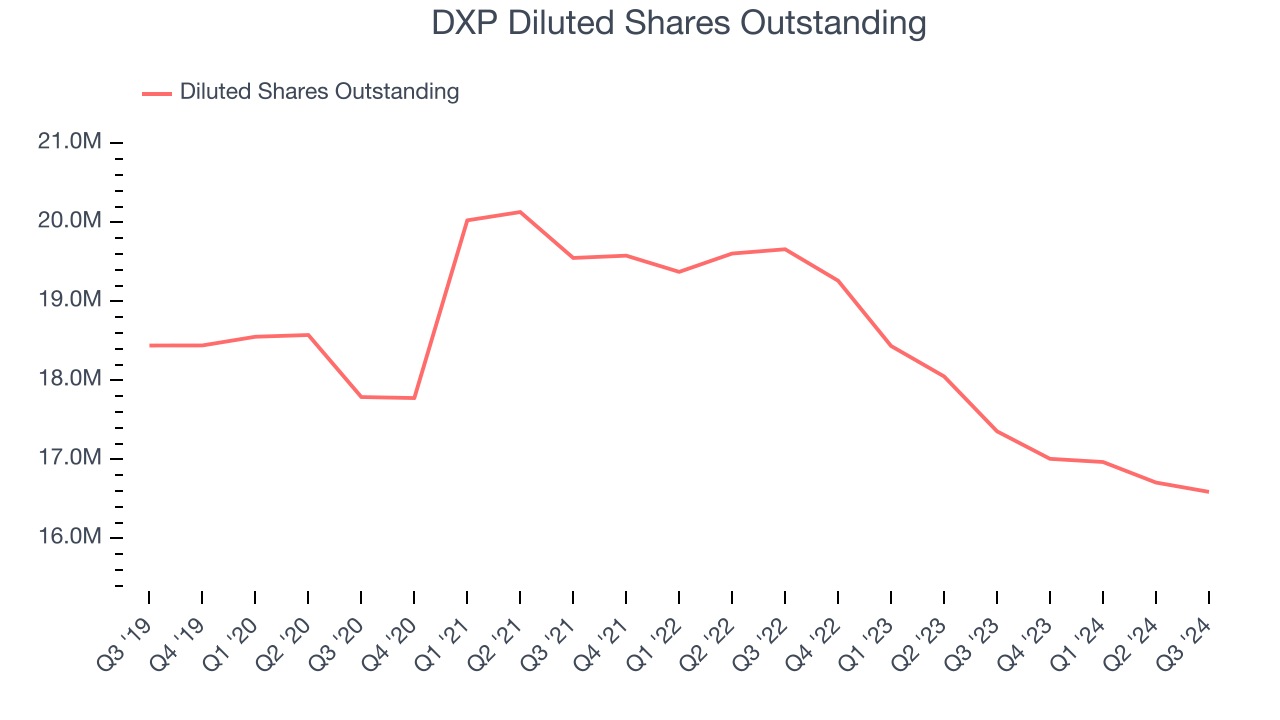

Diving into the nuances of DXP’s earnings can give us a better understanding of its performance. As we mentioned earlier, DXP’s operating margin was flat this quarter but expanded by 4.6 percentage points over the last five years. On top of that, its share count shrank by 10%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For DXP, its two-year annual EPS growth of 34.5% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, DXP reported EPS at $1.27, up from $0.93 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects DXP’s full-year EPS of $3.88 to shrink by 2.3%.

Key Takeaways from DXP’s Q3 Results

We were impressed by how significantly DXP blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock remained flat at $50.92 immediately following the results.

So do we think DXP is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.