Let’s dig into the relative performance of Lindblad Expeditions (NASDAQ:LIND) and its peers as we unravel the now-completed Q3 travel and vacation providers earnings season.

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 16 travel and vacation providers stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was 0.9% below.

Luckily, travel and vacation providers stocks have performed well with share prices up 12.8% on average since the latest earnings results.

Lindblad Expeditions (NASDAQ:LIND)

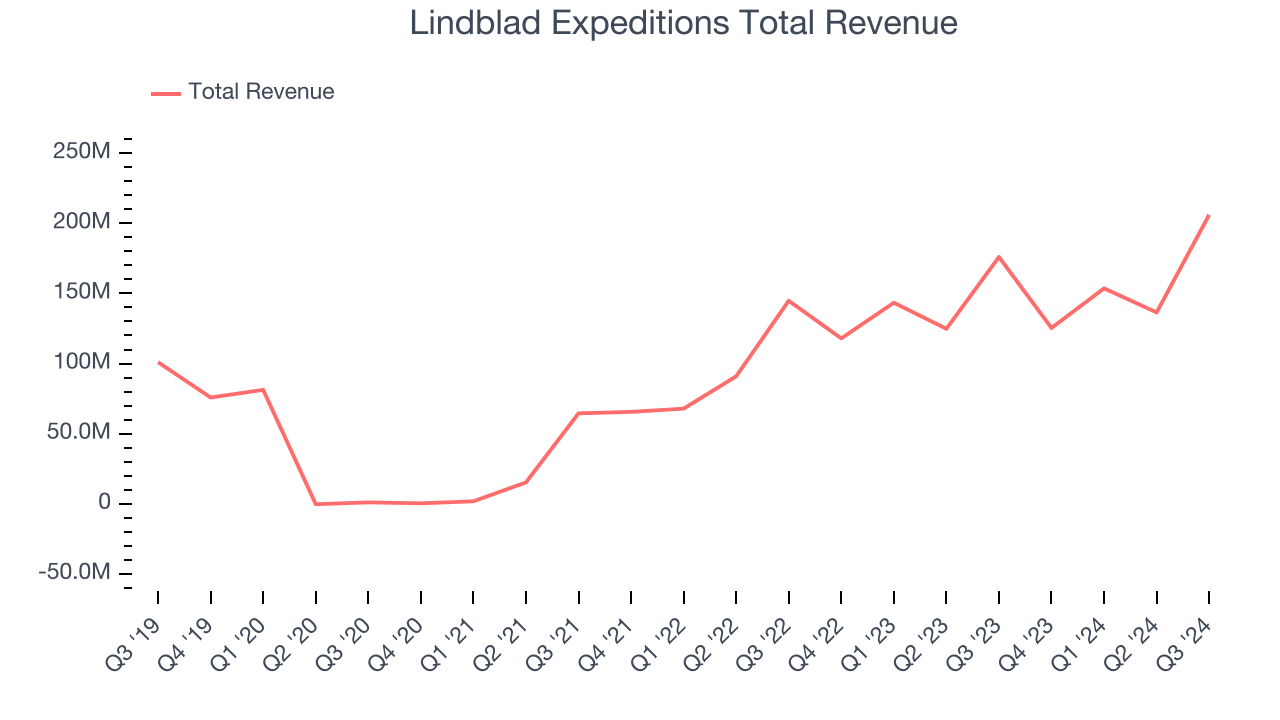

Founded by explorer Sven-Olof Lindblad in 1979, Lindblad Expeditions (NASDAQ:LIND) offers cruising experiences to remote destinations in partnership with National Geographic.

Lindblad Expeditions reported revenues of $206 million, up 17.1% year on year. This print exceeded analysts’ expectations by 6.3%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EPS estimates and full-year EBITDA guidance topping analysts’ expectations.

Sven Lindblad, Chief Executive Officer, said "Lindblad delivered a record third quarter as we continue to generate strong operating results across both our fleet and expanded land experiences portfolio. Looking ahead, this strong growth is poised to continue as current year bookings for future travel have reached record levels. Our focus continues to be on providing high quality travel experiences and strategically expanding our travel platform to capture this demand. We believe we are well positioned to deliver meaningful shareholder value in the years to come. "

Interestingly, the stock is up 34.8% since reporting and currently trades at $12.60.

Is now the time to buy Lindblad Expeditions? Access our full analysis of the earnings results here, it’s free.

Best Q3: Target Hospitality (NASDAQ:TH)

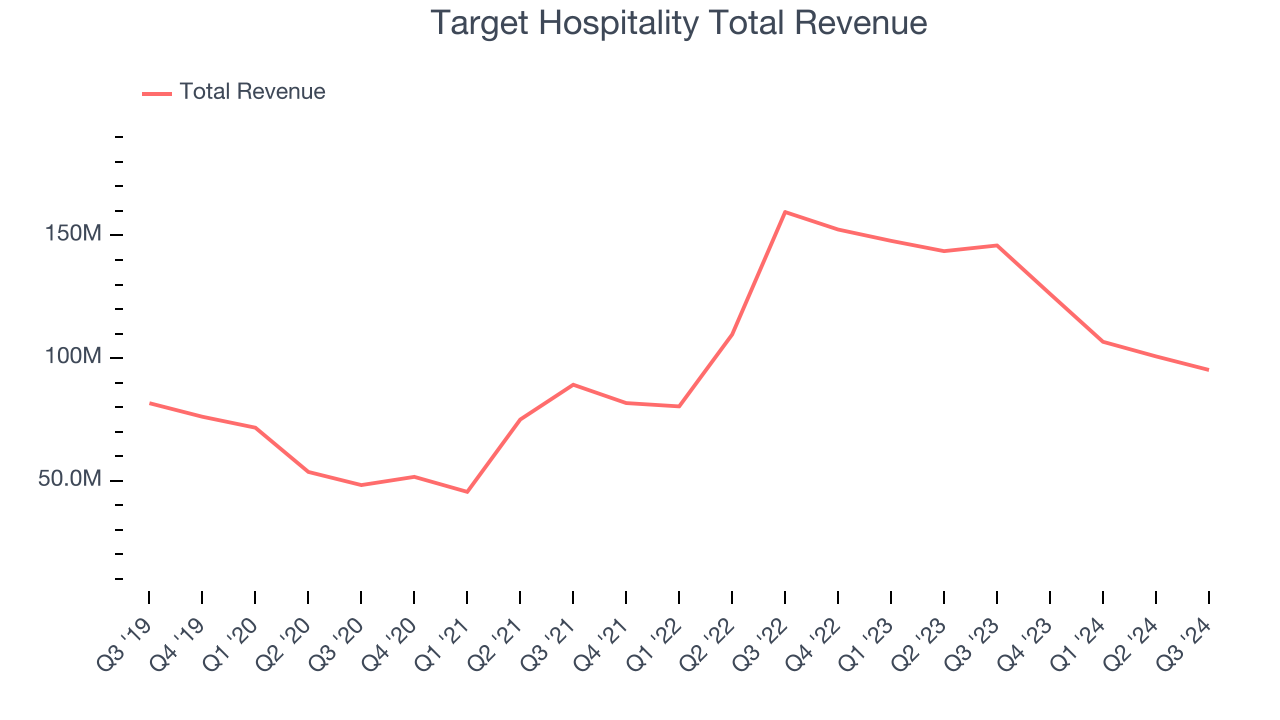

Essentially a builder of mini communities, Target Hospitality (NASDAQ:TH) is a provider of specialty workforce lodging accommodations and services.

Target Hospitality reported revenues of $95.19 million, down 34.8% year on year, outperforming analysts’ expectations by 8.3%. The business had a very strong quarter with an impressive beat of analysts’ EPS and adjusted operating income estimates.

Target Hospitality delivered the biggest analyst estimates beat and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 10.3% since reporting. It currently trades at $8.25.

Is now the time to buy Target Hospitality? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Sabre (NASDAQ:SABR)

Originally a division of American Airlines, Sabre (NASDAQ:SABR) is a technology provider for the global travel and tourism industry.

Sabre reported revenues of $764.7 million, up 3.3% year on year, falling short of analysts’ expectations by 1.4%. It was a slower quarter as it posted a significant miss of analysts’ EPS and airline bookings estimates.

Sabre delivered the weakest full-year guidance update in the group. As expected, the stock is down 9.7% since the results and currently trades at $3.72.

Read our full analysis of Sabre’s results here.

Carnival (NYSE:CCL)

Boasting outrageous amenities like a planetarium on board its ships, Carnival (NYSE:CCL) is one of the world's largest leisure travel companies and a prominent player in the cruise industry.

Carnival reported revenues of $7.90 billion, up 15.2% year on year. This number surpassed analysts’ expectations by 1%. Taking a step back, it was a satisfactory quarter as it also produced a decent beat of analysts’ adjusted operating income estimates but EBITDA guidance for next quarter missing analysts’ expectations.

The stock is up 35.8% since reporting and currently trades at $25.18.

Read our full, actionable report on Carnival here, it’s free.

American Airlines (NASDAQ:AAL)

One of the ‘Big Four’ airlines in the US, American Airlines (NASDAQ:AAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

American Airlines reported revenues of $13.65 billion, up 1.2% year on year. This result topped analysts’ expectations by 0.5%. It was a very strong quarter as it also put up a solid beat of analysts’ EPS estimates and full-year EPS guidance exceeding analysts’ expectations.

The stock is up 14% since reporting and currently trades at $14.65.

Read our full, actionable report on American Airlines here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.