DigitalOcean currently trades at $38.70 per share and has shown little upside over the past six months, posting a middling return of 3.7%. The stock also fell short of the S&P 500’s 13.4% gain during that period.

Is there a buying opportunity in DigitalOcean, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We don't have much confidence in DigitalOcean. Here are two reasons why DOCN doesn't excite us and one stock we'd rather own today.

Why Is DigitalOcean Not Exciting?

Started by brothers Ben and Moisey Uretsky, DigitalOcean (NYSE: DOCN) provides a simple, low-cost platform that allows developers and small and medium-sized businesses to host applications and data in the cloud.

1. Customer Churn Hurts Long-Term Outlook

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

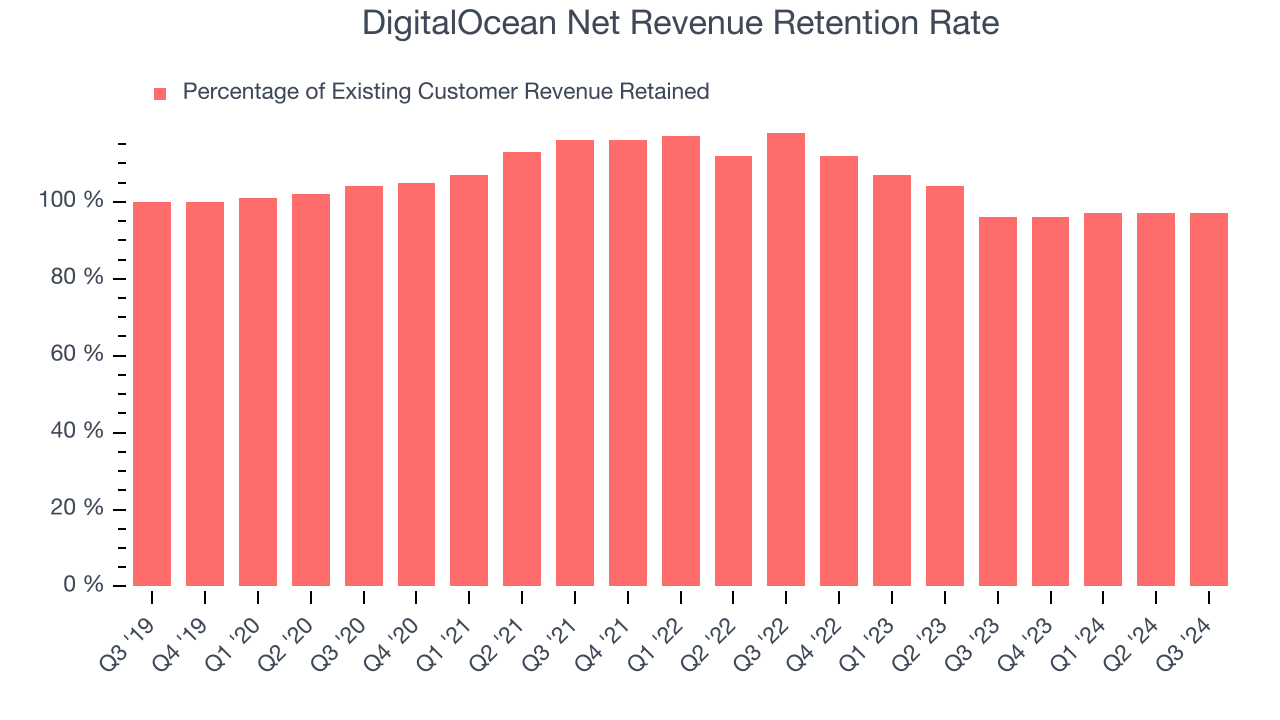

DigitalOcean’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 96.8% in Q3. This means DigitalOcean’s revenue would’ve decreased by 3.2% over the last 12 months if it didn’t win any new customers.

DigitalOcean has a weak net retention rate, signaling that some customers aren’t satisfied with its products, leading to lost contracts and revenue streams.

2. Low Gross Margin Reveals Weak Structural Profitability

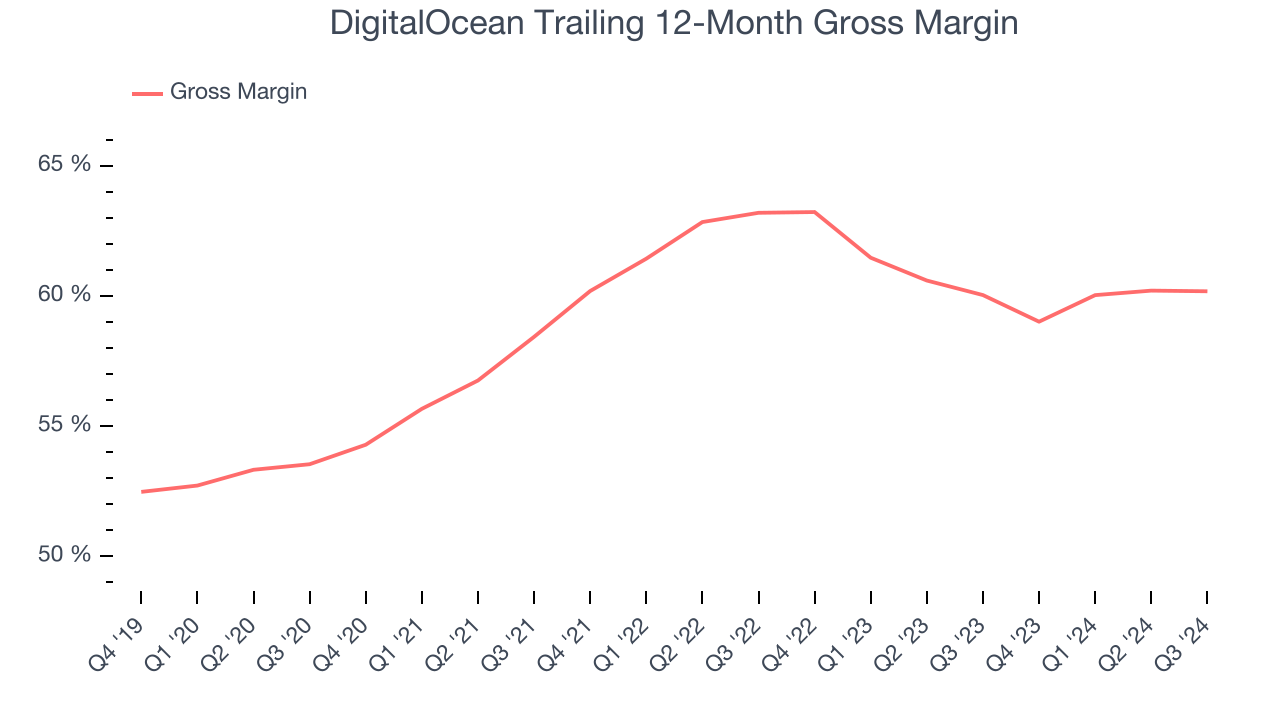

For software companies like DigitalOcean, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more competitive than other industries.

DigitalOcean’s gross margin is substantially worse than most other software businesses, signaling it has relatively high infrastructure costs compared to an asset-lite business like ServiceNow. As you can see below, it averaged a 60.2% gross margin over the last year. That means DigitalOcean paid its providers a lot of money ($39.82 for every $100 in revenue) to run its business.

Final Judgment

DigitalOcean’s business quality ultimately falls short of our standards. With its shares trailing the market in recent months, the stock trades at 4.7x forward price-to-sales (or $38.70 per share). This valuation multiple could be justified, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere in the market. We’d suggest taking a look at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than DigitalOcean

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.