Articles from EPIC Crude Holdings, LP

EPIC Crude Holdings, LP (“EPIC Crude” or “the Company”) is excited that the Port of Corpus Christi has finalized their significant four-phase Channel Improvement Project (“CIP Project”) that began in 2017. The CIP Project deepened the channel from 47 to 54 feet and widened the channel to 530 feet from 400 feet, all centered on accommodating the growing demand for larger vessels. The CIP Project was focused on expanding the waterways for larger vessels and two-way traffic while reducing overall transportation costs. This will allow the Port of Corpus Christi to enable more efficient transport of crude oil, liquefied natural gas and other commodities given its focus on exporting hydrocarbons.

By EPIC Crude Holdings, LP · Via Business Wire · June 24, 2025

EPIC Crude Holdings, LP (“EPIC Crude” or “the Company”) today announced that it has completed the issuance of a new $1,200 million senior secured Term Loan B due 2031. The Company used the net proceeds from the Term Loan to repay its existing $1,125 million Term Loan B and Term Loan C due 2026 and repay its existing $40 million senior secured revolver due 2026. As part of the transaction, the Company entered into a new agreement for a super-priority revolving credit facility of $125 million due 2029, undrawn at close. This refinancing is a key component of the overall transformation of the EPIC Crude business and is reflected in the Company’s Ba3 and BB- credit ratings from Moody’s and S&P, respectively. With the refinancing, EPIC Crude expects to save more than $25 million in interest expense on an annual basis.

By EPIC Crude Holdings, LP · Via Business Wire · October 16, 2024

EPIC Crude Holdings, LP (“EPIC Crude” or “the Company”) today announced that Platts will include the Company’s Crude Marine Terminal in Corpus Christi as a pre-approved terminal for WTI Midland crude oil in its Platts Dated Brent and Cash BFOE* Market-on-Close (“Dated Brent”) price assessment beginning with June 2023 deliveries.

By EPIC Crude Holdings, LP · Via Business Wire · November 14, 2022

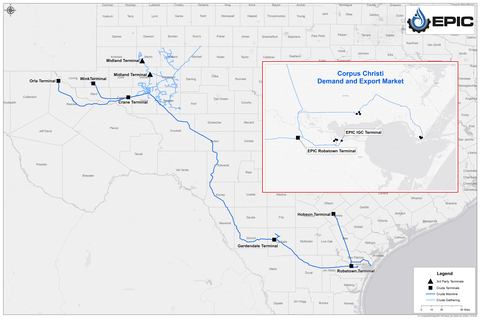

EPIC Crude Holdings, LP (“EPIC Crude” or “the Company”) continues to ship record crude volumes of 500,000 barrels per day during 2022. EPIC Crude provides shippers access to the premium Corpus Christi market including EPIC Crude’s export facility as well as local refineries and other export docks. The overall quality of crude being transported continues to differentiate EPIC Crude from other transport providers.

By EPIC Crude Holdings, LP · Via Business Wire · April 6, 2022