Articles from D.A. Davidson Companies

D.A. Davidson announced today that it served as exclusive sell-side financial advisor to Allivet, Inc. (“Allivet” or the “Company”), an online pet pharmacy that sells medications, supplements, and other products for pets, on its pending sale to Tractor Supply Company (NASDAQTSCO) (“Tractor Supply”).

By D.A. Davidson Companies · Via Business Wire · October 24, 2024

D.A. Davidson has hired Paul Colone and Chris Donegan to expand its Diversified Industrials group to focus on the Specialty Materials and Industrial Automation sectors. These hires, together with a team that joined the Boston office in 2023, represent the firm’s dedication to Boston as a strategic priority for its Investment Banking business.

By D.A. Davidson Companies · Via Business Wire · February 15, 2024

D.A. Davidson announced today that George “Toby” F. Albright, III has joined Investment Banking as Managing Director, Diversified Industrials. Albright’s addition to the firm’s Aerospace, Defense, and Government Services practice expands its geographic footprint to Washington, D.C. and deepens sector expertise in Defense Electronics, Government Technology and Services, National Security and Intelligence, and Space and Satellite Communications.

By D.A. Davidson Companies · Via Business Wire · February 1, 2024

D.A. Davidson & Co. is pleased to announce the hiring of Burton Vance and Matt Michalski both as Managing Director, Institutional Sales by the Equity Capital Markets Group. The appointments mark six senior hires to D.A. Davidson’s Institutional Equities Team in 2023, further demonstrating D.A. Davidson’s commitment to becoming the preeminent full-service middle-market investment bank.

By D.A. Davidson Companies · Via Business Wire · November 30, 2023

D.A. Davidson’s Technology Group today released its second annual FinTech Herd report featuring the top 100 privately-held financial technology companies based in the U.S. All fall within D.A. Davidson’s core areas of expertise: Bank Tech, Capital Markets Tech, Consumer Finance Tech, Crypto & Blockchain, Data & Analytics, Insurance Tech, Payments Tech, Real Estate Tech, Regulatory Tech, Wealth Tech. These private companies were selected for their disruptive and innovative technology, growing market presence and overall notoriety within their respective sub-sectors.

By D.A. Davidson Companies · Via Business Wire · June 12, 2023

D.A. Davidson’s Special District Group, in partnership with Petros PACE Finance, has successfully priced and closed $160 million in Commercial Property Assessed Clean Energy (C-PACE) financing for Summit Vista, Utah’s first life plan retirement community. Representing the largest C-PACE deal in history, the proceeds will be dedicated towards ongoing construction with a focus on enhancing the development’s energy efficiency, renewable energy and water efficiency.

By D.A. Davidson Companies · Via Business Wire · May 22, 2023

D.A. Davidson & Co. is pleased to announce that Zach Rosen has joined as a Managing Director in the Financial Sponsors Group in the New York office, where he will be responsible for further developing the financial sponsor coverage platform, with a focus on broadening and deepening relationships with Technology-focused private equity firms around the United States.

By D.A. Davidson Companies · Via Business Wire · January 18, 2023

D.A. Davidson’s Special District Group, a nationally recognized team of capital market professionals, has successfully sold $64 million in Limited Tax General Obligation Bonds, Series 2022A-1 and Convertible Capital Appreciation Limited Tax General Obligation Bonds, Series 2022A-2 for the continued development of Peak Innovation Park. The bond proceeds will help finance the second phase of the development journey of the 1,600-acre Peak Innovation Park located near Colorado Springs, Colorado.

By D.A. Davidson Companies · Via Business Wire · January 5, 2023

D.A. Davidson’s Special District Group, a nationally recognized team of capital market professionals, has closed $48 million in Commercial Property Assessed Clean Energy (CPACE) financing for Black Rock Mountain Resort in Wasatch County, Utah. Building upon the Special District Group’s previous CPACE capabilities, this deal represents the expansion of its CPACE portfolio and reinforces the group’s proven track record across amenity-rich mountain resort and residential communities.

By D.A. Davidson Companies · Via Business Wire · December 22, 2022

D.A. Davidson & Co. announced today that 24 professionals across the Equity Capital Markets Group, including investment bankers and research analysts, earned promotions based on their exceptional contributions throughout 2022. The Equity Capital Markets business consists of investment banking, institutional sales and trading, and equity research spanning four industries: Consumer, Diversified Industrials, Financial Institutions, and Technology. In addition, D.A. Davidson, together with MCF Corporate Finance under its strategic partnership, works on origination and execution of transatlantic transactions under the brand D.A. Davidson MCF International with offices in Hamburg, Helsinki, London, and Stockholm.

By D.A. Davidson Companies · Via Business Wire · December 15, 2022

D.A. Davidson & Co. announced today that it has served as exclusive financial advisor to Helbiz, Inc. (NasdaqCM:HLBZ) (Helbiz) on its acquisition of Wheels Labs, Inc. (Wheels). Wheels is a leading last-mile, shared electric mobility platform using proprietary vehicles with integrated helmet technology. The acquisition is expected to strengthen the ability to operate by expanding Helbiz’s presence to 67 markets globally, create a more diversified business model, and enhance the financial profile of the company. Wheels is headquartered in Los Angeles, Calif.

By D.A. Davidson Companies · Via Business Wire · December 7, 2022

D.A. Davidson & Co. announced today that its Fixed Income Capital Markets Group has hired veteran sales professional Ray Moreland to serve as Senior Vice President, Institutional Sales. He will be based in the firm’s Boca Raton, Florida office. This announcement follows the addition of several seasoned taxable fixed income professionals, displaying the firm’s continued growth and investment in this line of business.

By D.A. Davidson Companies · Via Business Wire · December 7, 2022

D.A. Davidson & Co. announced today that the firm has strengthened its Fixed Income Capital Markets group with the addition of Lee White, a veteran public finance investment banker. White joins the firm as a Managing Director and is based in Denver.

By D.A. Davidson Companies · Via Business Wire · October 11, 2022

D.A. Davidson & Co. announced today that it has served as the exclusive strategic and financial advisor to Wavecrest Growth Partners-led Tier1 CRM, a global leader in deal management and compliance solutions, on its sale to SS&C Technologies Holdings, Inc., (NASDAQSSNC) a multinational holding company that provides software and services to customers across the financial services industry.

By D.A. Davidson Companies · Via Business Wire · August 24, 2022

D.A. Davidson announced today that it served as financial advisor to leading precious metals platform A-Mark Precious Metals, Inc. (NASDAQAMRK) (A-Mark) on its recently closed acquisition of an additional 40% of the outstanding equity interest in Calgary-based Silver Gold Bull Inc. (SGB). This transaction valued SGB at approximately $110 million and will increase A-Mark’s ownership in SGB to 47.4%. The transaction also provides A-Mark with an option to increase its ownership to 75% in the future.

By D.A. Davidson Companies · Via Business Wire · July 7, 2022

D.A. Davidson announced today its commitment to accelerate its marketing and digital transformation across its investment banking and institutional equities divisions. Andreea Popa has joined as head of Equity Capital Markets (ECM) Marketing to develop and execute a strategic marketing plan that positions D.A. Davidson’s ECM Group for continued growth across consumer, diversified industrials, financial institutions, and technology industry verticals and geographies. D.A. Davidson’s ECM Group provides capital markets services and products, including investment banking, institutional sales, trading, research and corporate services. Andreea will be responsible for raising the firm’s visibility, supporting its business development efforts and leading communications.

By D.A. Davidson Companies · Via Business Wire · May 11, 2022

D.A. Davidson is pleased to announce that John Jameson has joined as a managing director, specializing in direct-to-consumer, omnichannel, and eCommerce businesses within the Home Environment and Branded Consumer Products segments. John has represented a wide range of entrepreneurial and institutional clients in sell-side and buy-side M&A, capital raising, and strategic advisory mandates and executed more than 25 transactions totaling over $2 billion in enterprise value.

By D.A. Davidson Companies · Via Business Wire · May 9, 2022

D.A. Davidson & Co. announced today that the firm has hired Brandon Rollé as part of a continued effort to grow the firm’s consumer research coverage. Rollé will be based in the firm’s Independence, Ohio office and will serve as managing director, senior research analyst with a focus on the leisure and powersports sectors.

By D.A. Davidson Companies · Via Business Wire · March 24, 2022

D.A. Davidson & Co. announced today that it has served as exclusive buy-side financial advisor to NinjaTrader on its acquisition of Columbus, Ohio based Tradovate, a cloud-based futures trading platform offering unlimited, commission-free trading for a flat price.

By D.A. Davidson Companies · Via Business Wire · January 28, 2022

D.A. Davidson’s Special District Group has successfully priced and closed $106 million of limited tax general obligation bonds for Black Desert Public Infrastructure District (PID), encompassing approximately 278 acres. The proceeds will fund public infrastructure for a commercial and residential resort community known as Black Desert Resort at Entrada.

By D.A. Davidson Companies · Via Business Wire · September 30, 2021

D.A. Davidson & Co. announced today that it has served as exclusive financial advisor to Levelset on its signing of a definitive agreement to be acquired for approximately $500 million by Procore Technologies, Inc. (NYSEPCOR), a leading provider of construction management software.

By D.A. Davidson Companies · Via Business Wire · September 22, 2021

D.A. Davidson & Co. announced today that is has served as exclusive financial advisor to Alliance Corporation, a portfolio company of Toronto-based Ironbridge Equity Partners, in its sale to Lee Equity and Twin Point Capital.

By D.A. Davidson Companies · Via Business Wire · September 14, 2021

D.A. Davidson Companies announced today results from a survey on student loan debt, which revealed that an overwhelming majority of the public (81%) believes America has a student debt problem. The sentiment proved consistent among all respondents – regardless of personal experiences with student debt – with three quarters of those who have never had student debt agreeing alongside 89% of those who have.

By D.A. Davidson Companies · Via Business Wire · September 14, 2021

D.A. Davidson Companies announced today that its middle market technology investment banking group has crossed the $20 billion threshold in transaction volume — advising 35 mid-market technology clients on successful M&A transactions and participating in 15 equity offerings since January 1, 2021. This milestone is in part due to D.A. Davidson’s recent acquisition of Marlin & Associates, one of the most active investment banks serving buyers, investors, and sellers of mid-market companies across the financial technology and data & analytics industries.

By D.A. Davidson Companies · Via Business Wire · September 1, 2021

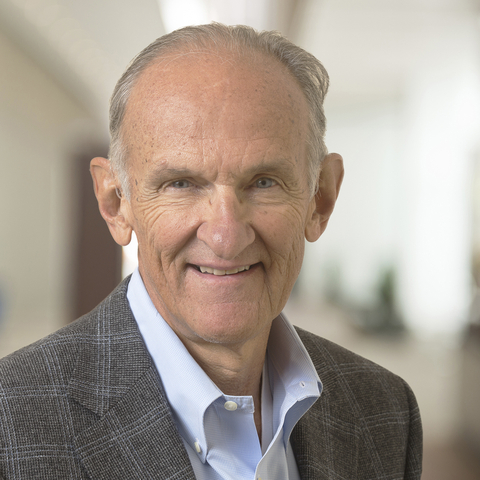

D.A. Davidson Companies announced today that James (Jim) Kerr, Chairman and CEO of D.A. Davidson Companies, has announced his retirement, effective as of the company’s annual meeting in January 2022, and the company has appointed Lawrence (Larry) Martinez as CEO, effective as of that time. Kerr will continue to serve as Executive Chairman of the company.

By D.A. Davidson Companies · Via Business Wire · August 25, 2021

D.A. Davidson & Co. announced today that the firm has deepened its institutional research team and technology coverage by hiring Rudy Kessinger as a senior research analyst. Kessinger will be responsible for covering enterprise software companies.

By D.A. Davidson Companies · Via Business Wire · July 15, 2021

D.A. Davidson Companies announced today that it has entered into a definitive purchase agreement to acquire Marlin & Associates, one of the most active investment banks serving companies and investors across the financial technology and data & analytics industries.

By D.A. Davidson Companies · Via Business Wire · June 14, 2021

D.A. Davidson & Co. announced today that the firm has deepened its fintech expertise by hiring Christopher Brendler as managing director, senior research analyst. Brendler will be responsible for covering payments, balance sheet oriented fintech and crypto.

By D.A. Davidson Companies · Via Business Wire · June 1, 2021