Simpson Manufacturing’s (NYSE: SSD) share price more than doubled in 2023 and is on track to double again over the coming years. The company is supported by a double tailwind with favorable housing market dynamics and its lean toward growth. The takeaway for investors is that Simpson persistently outperforms its target market and peers while delivering value for shareholders. That story is expected to continue this year.

Simpson Manufacturing invests in growth: Q4 results are mixed

Simpson Manufacturing reported a mixed quarter in which top-line strength was offset by bottom-line weakness. Ordinarily, this combination is not good for share prices, but in this case, an investment in growth is the culprit. Increased spending on headcount, wages and working capital is tied to expansion and production ramps that point to increased leverage as 2024 progresses. Assuming the Fed follows through on the expectation to cut rates, Simpson’s business will probably accelerate by year-end, and there is already an outlook for accelerated results.

Analysts forecast Simpson's revenue growth will accelerate to nearly 5% this year and 6% the following year but are underestimating company strength. The shortfall in housing inventory supports a solid outlook for construction in 2024, with the NAR forecasting 13% growth in new home sales. Assuming the company can sustain its market-leading performance, it should outperform top-line forecasts by a wide margin.

The analysts' forecasts for earnings are also low. The analysts expect sequential growth throughout the year and YOY growth to return quarterly by year’s end, but the FY forecast is for contraction. The Q1 forecasts are especially light, with earnings forecasted to contract nearly 12%, while Simpson forecasts about 600 bps of operating margin expansion in 2024 compared to the Q4 result.

Simpson’s Q4 results were impaired; FY cash flow is robust

Simpson’s Q4 results were impaired by investment in growth, but the cash flow remains solid. The company reported a $30 million increase in operating income, about 7.5%, and an increase in net income that supports a healthy share repurchase and dividend outlook. The dividend is small at 0.55% of the share price but safe at only 12% of the earnings. The distribution is also growing and on track for its 4th consecutive annual increase, which should come with the next declaration. That is expected in April.

The company uses share-based compensation, but the repurchases were enough to offset the impact in 2023. The board approved $100 million for repurchases, and $50 was used in Q4, reducing the YOY count by 0.03%. That is a slim figure, but repurchases should continue in 2024 and may increase by year-end. The company has $50 million left under the current authorization, about 0.6% of the market cap with shares near $192.50, and the balance sheet is a fortress. Leverage is low at 17% of assets and 27% of equity, with equity up 20% and expected to improve again in 2024.

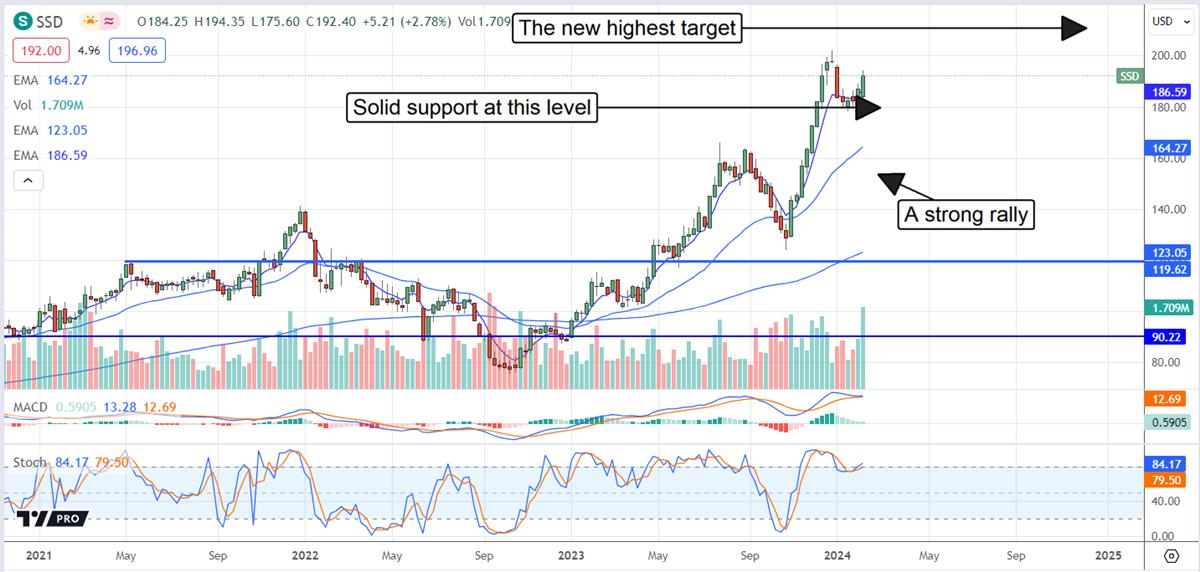

Analysts are driving Simpson to new highs

There are not a lot of analysts covering Simpson Manufacturing, but the few who do rate it a Moderate Buy are leading the market higher. The consensus price target assumes fair value with shares near $192.50, but the most recent revision, issued by Baird following the Q4 release, includes the new high target of $205. That is about 6% above the current action, a far cry from the 100% possible, but a significant target for two reasons.

The first is that SSD has been trending strongly and is in consolidation now, and the 2nd because a move to new highs would indicate a continuation of the current trend. That trend is worth $50 to $70 in the near term, about 30% to 50% upside, and more than 100% in the mid to long-term. Coincidentally, the institutions own about 90% of the stock and have been buying on balance quarterly for the last three years.