When New Jersey-based J&J Snack Foods Corp. (NASDAQ: JJSF) announced disappointing holiday quarter results last week, the market got salty.

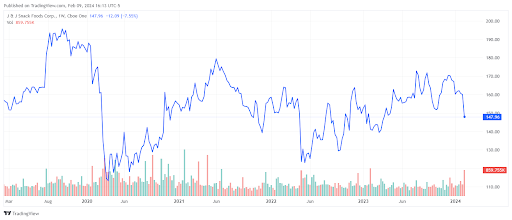

Shares of the Super Pretzel and Dippin’ Dots maker dipped as low as $140.23 on Wednesday after the company reported that fiscal 2024 first-quarter sales fell 0.9% year-over-year to $348.3 million. Wall Street analysts were expecting 3.3% top-line growth for the three months ending December 30th, 2023. The stock rebounded to $148.09 by Friday but remains 17% below its 2023 peak.

For income-focused investors who like a growing dividend, JJSF just got tastier.

President & CEO Dan Fachner noted “a softer consumer environment” as the reason behind J&J’s sales decline, a result that was consistent with industry trends. Over the last two years, U.S. food manufacturers have been challenged by the ripple effects of inflation and higher interest rates on consumer purchasing behavior. But it's not all doom and gloom.

Despite a decrease in shopper traffic at grocery and convenience stores, J&J retail sales increased 1.6% amid resilient demand for soft pretzels and convenient, handheld snacks. Combined with machine sales and maintenance, frozen beverage revenue grew 8.5%. These two growth figures should be viewed as positive silver linings. They show that Americans continue to opt for their favorite brand-name snacks and frozen treats even with many cheaper generic alternatives available. If the macroeconomic environment improves as the market expects, spending on these items should only rise.

The main culprit for the fiscal Q1 revenue shortfall was J&J’s Food Service business, which caters to quick service restaurants and event venues. Sales slipped 4.1% in the segment as certain customers pared back on holiday pie and cookie inventories amid spending uncertainty. Churros, an emerging high-margin category for J&J, was an exception, witnessing 8.9% growth.

All things considered, the company deserves a pass for the soft quarter because:

- It reported record quarterly sales of $443.9 million in the previous quarter.

- The gross margin expanded 1.3%, a byproduct of cost disinflation, as well as management’s focus on more profitable products and productivity.

- Adjusted earnings per share (EPS) increased 24% from last year. Such bottom-line growth was uncommon in the industry during calendar Q4.

- Above all, the company has a solid long-term track record of sales growth and profitability.

A sweet portfolio of iconic brands

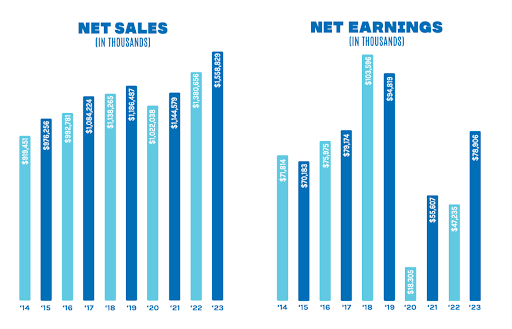

Putting the 2020 pandemic year aside, J&J has grown sales every year over the past decade. The company has yet to return to peak profits of 2018 but, after recording net earnings of $78.9 million in fiscal 2023, is trending in the right direction. Easing consumer inflation pressures and moderating prices on sugar, chocolates and other raw materials should go a long way in this regard.

Led by Superpretzel, the world’s top selling soft pretzel, J&J’s financials are backed by a portfolio of well known consumer brands. Its stuff is all over the frozen food aisle — Icee, Slush Puppie, Dippin Dots, Luigi’s Italian ice, Minute Maid frozen ice, Whole Fruit sorbet and bars, Philly Swirl and Sour Patch Kids ice pops. Over in the bakery aisle, Hola! churros, The Funnel Cake Factory and several other bakery brands command significant shelf space. And to tap into the growing pet treat space, there is even ice cream for dogs in the form of Dogsters frozen dog treats. To generate revenue growth going forward, continued product innovation and customer expansion will be key parts of the playbook. As in the past, brand acquisitions are also likely to come into play.

J&J is also investing in production and distribution as part of its growth strategy. In October 2023, it opened a second regional distribution center in Woolwich, NJ to bolster its supply chain network. With these moves intended to improve scale and efficiency, Mr. Facher noted on the earnings call that its revamped distribution footprint is already “exceeding expectations.”

In spite of the slow start to fiscal 2024, management expects that momentum will build during the year as core brands perform, cross-sell opportunities arise and the customer base increases. Of course, the success of this strategy will largely depend on a better consumer spending backdrop. If economic activity picks up, there will be more occasions for people to buy J&J indulgences — concerts, sporting events, tourist activities, and so on.

Approaching 20 straight years of dividend hikes

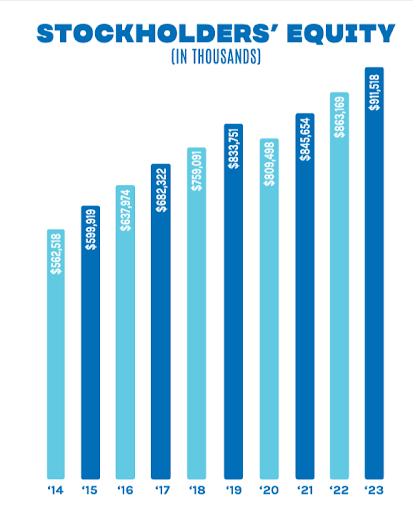

Since going public in 1986, J&J’s ability to generate steady cash flow throughout the economic cycle has served its shareholders well. The stock has been a steady climber since then (splitting 2-for-1 along the way) and, more recently, kicked off a juicy dividend.

J&J has raised its quarterly dividend for 19 consecutive years. This has earned it a spot on the Dividend Achievers, a list of Nasdaq companies that have increased their cash payouts for at least 10 years in a row and have average daily trading volume of at least $1 million. A 19-year streak is unusual for Nasdaq-listed stocks, which are typically more growth-oriented and have an average dividend hike streak of 7 years.

JJSF’s latest boost came in August 2023 when the quarterly dividend was increased to $0.735 per share. This gives the stock a $2.94 per share annualized dividend and a 2.0% dividend yield that is slightly above the consumer staples average. This is the highest the forward yield has been in three years.

A useful resource for determining a stock’s dividend-only return is MarketBeat’s Dividend Yield Calculator. It allows you to enter a stock and receive information about its share price, dividend amount and dividend frequency to ultimately arrive at a dividend yield. Here you’ll also find recent articles about stock dividend yields and other dividend-related educational content.

Analyst sees more than 30% upside

The dividend may not be the only thing worth reaching for when it comes to JJSF. In the wake of last week’s earnings call, sell-side research firm Benchmark Co. reiterated its buy rating on JJSF. The analyst there set a $195.00 price target that implies 32% share price appreciation from Friday’s close. Combined with the dividend, this gives JJSF 34% total return potential over the next 12 months.

For a defensive food stock, this presents a highly favorable risk-reward profile. Although it is well-above what the stock has historically returned (11.1% annualized over the last 15 years), it suggests that JJSF has reached a favorable entry point with prospects for above-normal returns.

Benchmark’s bullish reaction to the market’s overreaction makes sense from a valuation standpoint. JJSF is trading at 24x the consensus EPS estimate for next year (fiscal 2025). This is above the 19x average price-to-earnings (P/E) ratio of mid-cap packaged foods companies — but it is one that is warranted. J&J’s proven product portfolio, expanding distribution footprint and dividend growth history make it worthy of an above-average P/E. The stock arguably deserves a multiple similar to that of more expensive food peers like Sovos Brands, Lancaster Colony and Utz Brands — which trade in the 26x to 28x range.

The next catalyst for JJSF could be the company’s Annual General Meeting (AGM) on Tuesday, February 13th. An upbeat outlook for the rest of the year and beyond could help ease the market’s worries about a growth slowdown and help the stock continue to bounce off its Wednesday low.

Recovering from technical oversold conditions

At this point, JJSF also appears to have more upside than downside from a technical analysis perspective. On the daily chart, the relative strength indicator (RSI) dipped as low as 17 on Wednesday, firmly into oversold territory. The stock also dipped well outside its lower Bollinger Band — the lowest it has slipped since May 2022. This marked a bottom from which the stock rallied approximately 20% over the ensuing 12 months. JJSF has already started to recover from both troughs but has a lot of room to get to ‘normal’ trading levels.

Speaking of levels, JJSF found support around $144.00, which has been a reliable floor over the last couple of years. This is a good sign because it suggests that sellers aren’t willing to sell much below this level, and buyers consider this an attractive trigger point. And with the stock entering this week at $148.09, the downside may be limited to about $4.00 — and the upside significantly higher. Again, for a low-risk stock, this seemingly lopsided trade-off is unusual.

Bottom Line

J&J Snack Foods is a leading food and drink company that owns a portfolio of iconic snack and frozen treat brands. It's hard to know if the consumer spending environment will strengthen in 2024 or if we are in for hotter-than-expected inflation readings. Either way, the hot pretzel maker has the potential to be a safe, dividend-paying bet for stock investors.