Constellation Brands Inc. (NYSE: STZ) sells beer, wine and spirits. Its portfolio of alcoholic beverage brands is familiar to anyone who’s been to a sports bar, had drinks dining in a restaurant or attended a backyard barbecue on a sweltering summer afternoon. The company has been focused on premiumization, shedding low-end brands for the higher-margin premium brands, which can be less susceptible to pricing competition. This strategy with its beer portfolio is paying off, while its wine and spirits portfolio is still trying to stabilize.

Constellation Brands operates in the consumer staples sector, competing with Molson Coors Beverage Co. (NYSE: TAP), Boston Beer Co. (NYSE: SAM), and major spirits producer Diageo plc (NYSE: DEO).

Constellation Brands Has a Strong, Well-Known Portfolio of Brands

One of Constellation Brands' competitive advantages is the popularity and familiarity of its portfolio of brands, which are grouped into beer and wine and spirits segments.

- Beer brands are the company's best-performing group in the second quarter of fiscal 2025, achieving a 6% YoY jump in net sales and a 4.6% YoY jump in shipment volume, delivering the third-highest share gain in the beverage industry. Depletion volume rose 2.4% YoY, which includes the loss of one selling day. Modelo Especial had a 5% demand growth, maintaining its #1 brand status, while Pacifico saw 23% growth and remained the #4 dollar share gainer, and Modelo Chelada brands had 2%.

Its legacy Corona Extra brand had a 3% decline but still maintained its position as a top 5 brand. This segment generated $2.53 billion in net sales with operating income of $1.08 billion. Operating margin jumped 270 bps to 42.6% thanks to ongoing cost savings, favorable pricing, and fixed cost absorption driven by volume growth.

- Wine and Spirits brands are its worst-performing groups, with net sales falling 12% YoY, driven by a 9.8% YoY decline in shipment volumes. The businesses continue to face challenging market conditions in the U.S. wholesale channels. The company expects these groups to continue their declining net sales at a rate of 4% to 6% YoY and operating income to decline 16% to 18% for fiscal 2025. The Wine and Spirits segment generated $388.7 million in net sales with $70.5 million in net losses. Operating margin remained flat at 18.1%. However, Wine and Spirits generates only 15.4% of the revenue generated by its Beer segment.

Taking a Peek at Overall Performance

Constellation Brands reported fiscal second quarter of 2025 EPS of $4.32, beating consensus analyst estimates by 24 cents. Revenues rose 3% YoY to $2.92 billion, falling short of the $2.95 billion consensus estimates. While the company has 48 million hectares of capacity across its existing facilities in Mexico, it expects to spend around $3 billion in capital expenditures (CAPEX) to continue developing modular additions at its Mexico facilities and its Veracruz facility from fiscal 2025 to fiscal 2028.

Constellation Brands reaffirmed its fiscal 2025 guidance for EPS of $13.60 to $13.80 versus $13.71 consensus estimates. Fiscal full year 2025 net revenues are expected to grow 4% to 6% or $10.36 billion to $10.56 billion versus $10.46 billion consensus estimates.

Outperforming in a Tough Macroeconomic Backdrop

Constellation Brands CEO Bill Newlands reiterated that the macroeconomic backdrop weighed down on beverage alcohol demand and broadly across consumer packaged goods, underscoring the company's quarter's outperformance. Based on Circana-tracked channels, Constellation Brands maintains the #1 dollar sales growth and gains within all beverage alcohol categories.

Newlands wrapped up his comments in the earnings conference call with, “So in closing, while our sector is facing less favorable consumer demand due to macroeconomic headwinds, we delivered another quarter of strong financial results underpinned by the continued solid net sales growth and significant margin expansion of our Beer business, ultimately achieving our second quarter double-digit comparable EPS growth in line with our full fiscal year expectations.”

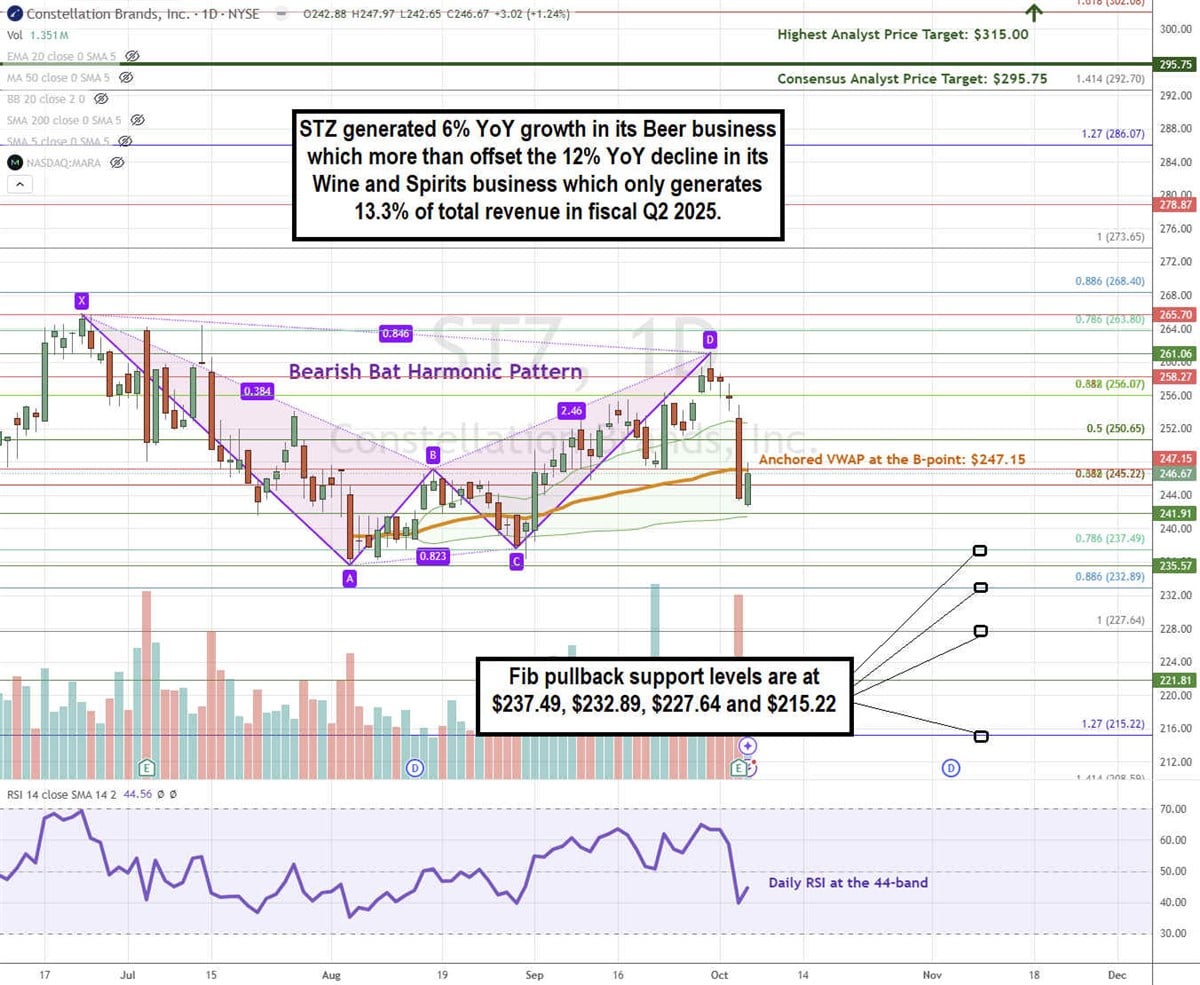

STZ Triggers a Bearish Bat Pattern

A bearish bat is a harmonic chart pattern comprised of one peak starting point X followed by two higher bottoms at point A and point C, a midpoint B, and a reversal breakdown at point D. The fib ratio of the distance between point A and B falls between 0.382 to 0.886. The fib ratio between points B and D should fall between 1.618 to 2.618.

STZ peaked at the X-point at $265.70 on June 24, 2024. Shares fell to a swing low A-point at $235.57, coiling to the B-point at $247.15 and falling to a higher low C-point at $237.49. STZ rallied to $the D-point swing high at $261.06 before triggering the reversal breakdown. STZ fell through its daily anchored VWAP at $247.15, which it needs to recover, or a further sell-off to its C-point and A-point may ensue. The daily relative strength index (RSI) is trying to bounce at the 44-band. Fibonacci (Fib) pullback support levels are at $237.49, $232.89, $227.64, and $215.22

The average consensus price target is $295.75, and the highest analyst price target is $315.00. Analysts have given the stock 14 Buy ratings and two Hold ratings. It trades at 18.23x forward earnings.

Actionable Options Strategies: STZ is in a bearish reversal pattern, which presents pullback opportunities at the fib support levels. Bullish investors can use pullbacks to enter stocks using cash-secured puts at the fib pullback supports and write covered calls to execute a wheel strategy for income in addition to the 1.64% annual dividend yield.