Turn on any news channel today, and you'll likely hear about interest rates. After the pandemic's economy pushed rates to all-time lows and inflation to record highs, the rates' rebound has shaken would-be borrowers and financial institutions alike. You might wonder if bank stocks go up when interest rates rise. The answer is more complex than expected and can vary depending on other economic factors.

Today we'll look at the current status of interest rates and how their ever-changing environment can impact banks and consumers. After reading this article, you should clearly understand the relationship between higher interest rates and bank stocks during inflation.

The Interest Rate Environment

At the macro level, interest rates are controlled by the Federal Reserve. The U.S. government uses interest rate manipulations to boost the economy or control rising inflation rates.

When the Fed moves interest rates lower, it encourages people and businesses to borrow money, which can stimulate the economy as a whole. An example of this situation could be seen during the COVID-19 pandemic. Movements from the Federal Reserve lowered interest rates, which helped stimulate the economy by making money more readily available to borrow and spend. This helped many businesses recover during a period of economic uncertainty.

However, this made inflation tick up at a rapid pace as well. If you've been shopping recently, you have likely seen the negative effects of inflation on your receipt.

Continuing to use the current economy as an example, the Fed decided to raise rates since inflation seemed to spiral out of control following the pandemic. When rates go up, the inverse effect happens from what we discussed before. Fewer homes, cars or other purchases which require financing are sold. Businesses can't expand operations and start to slow production, and prices will eventually fall because purchasing power will drop across the board.

This ebb and flow of inflation, rate changes and subsequent market fluctuation isn't new to the pandemic; it's a staple of America's economy and has been for a long time. Inflation is often tracked by the Consumer Price Index (CPI), which is used to determine rate changes.

The Fed's decisions can significantly impact so many factors that it's easy to see why their changes can create big headlines. Because these decisions are left in the hands of just a few people, it's easy to see why some groups might disagree with a Fed rate hike in the stock market. Stock market fluctuations are widespread when the rates change.

When the Fed changes a rate, it might not immediately change the rate on your typical mortgage. However, the Fed's prime rates affect every lender's rate in the long run. Now that you understand how interest rates work better, let's get into the question of how bank stocks perform during inflation and times of rising rates.

The Relationship Between Interest Rates and Bank Stocks

The Fed puts rising rates into place to try to combat inflation. So, do bank stocks do well when interest rates rise? As a general rule, bank stocks tend to increase when interest rates rise, as the banks have potential to bring in more revenue.

To understand the relationship between interest rates and the performance of financial institutions, know how banks work. Banks don't simply hold on to the money deposited into their accounts. Instead, the bank generates income by lending money to investors or individuals using an instrument like a mortgage loan.

A bank will always make the money it lends out more expensive than the money it takes in. This means a mortgage rate will always be higher than a savings account interest rate. The difference between these two numbers is the bank's profit.

When interest rates rise, banks usually can compound that profit faster. It's not uncommon for loan rates to grow two or three times more than interest rates on money deposited, so the bank can increase their profit margin when rates go up. For this reason, it's common for bank rates to rise during times of interest rate increase, especially in the early phases of rate hikes.

How do bank stocks perform during inflation? While the overall performance of bank stocks is good during inflation, this is not universal. For example, the higher the interest rate rises, the less people will be willing to take any loans. There is a point where the lack of loans overshadows the increased profit margin, and if loans dry up too much, a bank might not meet the expected revenue. In this case, the stock would almost certainly fall.

Example of a Bank Stock in a Rising Interest Rate Environment

From January 2021 to November 2022, mortgage interest rates ballooned from near-record lows of around 3% to more than 7%. This time was volatile for many sectors, but it allows us to view real-world examples of bank stocks' performance when rates were skyrocketing.

With that said, the past performance of the stock market is never a guarantee of future results. With that in mind, let's look at how Bank of America (NYSE: BAC) performed during this period.

Bank of America

Bank of America's stock chart from January 2021 through November 2022) is a great example of the ebb and flow bank stocks experience during times of rate increase. As you'll see from the chart, the stock began to perform well in late 2020 and experienced tremendous growth until October 2021, when it topped out at more than $48.

Following the prosperity of the early period of rate increases, the stock returned to earth for most of 2022 before a small rebound heading into November 2022. When rates flattened from November 2022 to April 2023, there was a decline to a regular stock price.

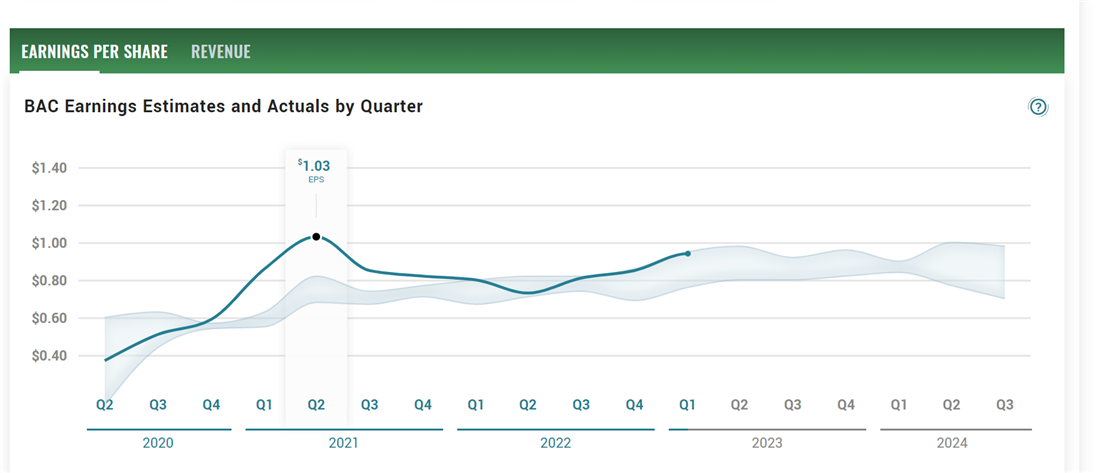

This stock is a perfect example of what we discussed in the section detailing the relationship between interest rates and bank stocks. When rates first started to rise, we saw the stock start to perform well, and you'll also see Bank of America's earnings topped out in the second quarter of 2021.

Earnings were boosted by the increased profit margins we discussed earlier when the difference in loan rates and interest payments increased. This relationship is shown perfectly in Bank of America's estimated earnings from these quarters.

Earnings bumped up in early 2021 and we saw the negative relationship between rates and bank stocks take effect after the peak in October. When rates got too high, loan volume went down. You could see it in the earnings report for the second half of 2021, and the first half of 2022, where earnings decreased from their peak, and the stock price did as well. Fewer loans mean less profit, so this is evidence of that second negative relationship we discussed in the real world.

Bank of America's performance through the most recent rate hikes is a great microcosm of how bank stocks perform during periods of inflation controlled by increasing interest rates. Typically, there is an initial boost in earnings and stock performance, but as fewer loans are issued, the stock price will fall because earnings do as well.

Pros and Cons of Rising Rates for Bank Stocks

While rising interest rates may mean good things for bank stocks and their profits, it can also negatively affect financial and other stock sectors.

Pros

Bank stocks increase in value during periods of inflation, which makes them appealing to investors.

- Higher net interest margins: Banks earn money from the difference between the interest rates they charge on loans and the interest rates they pay on deposits. When interest rates rise, the spread between these two rates widens, increasing banks' net interest margins and ultimately boosting profits.

- Increased deposit rates: As interest rates rise, banks can increase the rates they pay on deposits, which can attract more deposits and help grow their customer base. This can provide a stable funding source for banks' ongoing lending activities, even when rates rise.

- Improved credit quality: Rising interest rates can also improve credit quality for banks, as borrowers are less likely to default on loans when rates are higher. This can help reduce losses and boost banks' overall financial health.

Cons

While rising rates can be good for banks, they're bad for the average consumer — which may ultimately lead to lost revenue and cut dividends on normally well-paying finance stocks.

- Reduced demand for loans: Rising interest rates can lead to reduced demand for loans, as higher rates can make borrowing more expensive and less attractive for consumers and businesses. This can negatively impact banks' lending activity and overall revenue.

- Increased funding costs: Banks need to raise capital to fund their lending activity, and rising interest rates can also increase the cost of borrowing for banks. This can put pressure on banks' profit margins and dampen stock prices.

Other Stocks that Increase with Rising Interest Rates

In addition to bank stocks, there are other finance stocks to invest in that may benefit from rising interest rates.

Insurance Stocks

Insurance companies invest a significant portion of their premiums in fixed-income securities such as municipal bonds. When interest rates rise, the yield on these securities increases, which can boost insurance companies' investment income and profitability.

Real Estate Investment Trusts (REITs)

Real estate investment trusts (REITs) own and operate income-producing real estate properties like office buildings and shopping centers. Rising interest rates can lead to higher rental income for REITs, increasing their profitability and potentially leading to higher stock prices.

Should You Buy Bank Stocks When Interest Rates Rise?

While the general safety of bank stocks can be appealing in a rising rate environment, these stocks may not be best for everyone. Before buying bank stocks, it's important to consider whether they are currently undervalued or overvalued relative to their earnings, book value and other relevant metrics. You can compare the current valuation of bank stocks to historical averages and other market sectors to determine whether they are a good investment opportunity.

Investing During Inflation

Are bank stocks good during inflation? While bank stocks are known to provide more stability during times of rising inflation, it's important to remember that no individual stock is a guaranteed bet against loss. If this is your first time investing during inflation, consider a diversified financial ETF instead of selecting individual stocks.

FAQs

Before learning more about how to find undervalued stocks to invest in, learn the answers to a few of the most common questions investors have about bank stocks below.

Will bank shares go up if interest rates rise?

When interest rates rise, bank stocks can go up because banks can earn more money from lending. However, rising interest rates may also lead to decreased consumer spending, resulting in lower loan originations. Individual performance will vary by bank stock.

What makes bank stocks go up?

Several factors can cause bank stocks to go up, including interest rates and economic growth. As with any stock, the financial performance of bank stocks also plays a direct role in share price.

What stocks do well with high interest rates?

Financial and real estate stocks tend to perform better in environments with rising interest rates. Consumer staple and energy sector stocks also tend to hold value during these periods, as they produce products that are in demand even when spending power is low.