The peak months of the COVID-19 pandemic showcased just how important the logistics matrix is for several, if not all, industries and nations. The disruption of the so-called supply chain merely indicates the interruptions and, in some cases, the complete bending of the logistics systems set in place to ensure timely delivery and transport of underlying goods and products.

A few key industries that heavily rely on well-placed and stress-tested logistic roadmaps and systems are the automotive and housing industries. Within the automotive "leg" of things, parts (whether OEM or aftermarket) rely on containers and airplanes to arrive in the United States from their respective continents of manufacturing. But once they are on United States soil, they need the backbone of trucking to deliver said finished products or essential parts to the respective dealerships or mechanic repair shops.

The housing industry, from construction to renovation, also depends on airtight logistics systems in place to deliver necessary materials to construction sites and home items such as furniture, appliances, paints, and piping to deliverable homes or renovation projects. The ecosystem becomes clearer on the need for a reliable and timely supply of trucks as a means of transportation for these industries.

As the supply chain still holds the center stage for being "disrupted" and tightened out of historical extremes, these two specific industries seem to be affected more than others. As new car supply is scarce and the used car market stepped in to fulfill this demand gap, automotive parts (again, whether OEM or aftermarket) become the knight in shining armor sent to rescue the concerns of millions of Americans acquiring second-hand model vehicles.

As the housing supply also tightens, more homes traded hands in 2022 than builders expected. As the rate of construction fell behind that of new homebuyers, a majority of mortgages and real estate transactions went to used homes. Now when consumers buy a used home, the likelihood of that home containing the specifics fitting the taste of the new buyers is low, causing furniture and renovation volumes to spike as a result.

Accelerating Trends in Need of Universal Logistics

Now that markets have caught on to the importance of a robust logistics system and the underlying necessity of ample trucking supply available on-call for these rising transport needs, Universal Logistics (NASDAQ: ULH) steps right into the middle to fix these problems. As many investors know, the money is made by stepping in the middle of the flow where money is about to exchange hands.

As consumers realize that the new car supply situation is unlikely to change soon, most just keep settling for alternatives in the used car market. This is reflected in the recent rallies in United States total vehicle sales starting in 2022. Increased used car ownership will make it all the more important for select dealerships and auto part stores to be able to hold enough inventory to satisfy the ensuing demand for automotive parts from customers looking to fix or maintain anything that may concern them in their newly acquired used car.

This thesis can be corroborated by looking at the figures Universal Logistics delivered to investors in 2022. Revenue increased by 15.1%, while margins expanded to a five-year high of 11.9%. Net income margins didn't fall far behind and clocked in at 8.4%, also a five-year high. This higher net income retention brought investors and other stakeholders diluted $6.37 earnings per share after management deployed their share buyback budget and retired 440 thousand shares from the open market.

Sustainability Breakdown

Taking into account that approximately 45% of revenues in the fourth quarter came from the company's contract logistics segment, this specific segment saw revenue growth of 27.9% in the fourth quarter of 2022. It operates mainly in the dedicated trucking service to the automotive industry, whether for finished products or underlying parts, a space that is experiencing higher than normal volumes and therefore needs to look for trucking and transport capacity on demand.

Furthermore, this segment operates in what management calls the value-add business, in other words, the company's way of meeting customer needs through supplying special purpose trucks for construction materials and other automotive needs.

The advantageous position that Universal Logistics found itself in allowing the company to operate at elevated contracting values (due to pent-up demand in their services) as well as operative cost reductions across the equipment and personnel line items of their income statement. All told, the company increased its operational margin from 5.9% in 2021 to 11.9% in 2022 with most of the acceleration coming in the fourth quarter.

A word of caution for investors looking at these measures, a continued manufacturing slowdown witnessed in the six months plus contraction of the manufacturing PMI index can place Universal Logistics in a downward revenue spiral as their "just-in-time" transportation services fall out of favor amid decreased transport urgency. The key to sustained success and elevated financials lies upon tight supply chains amongst the automotive and housing industries.

When in Doubt, Measure the Value

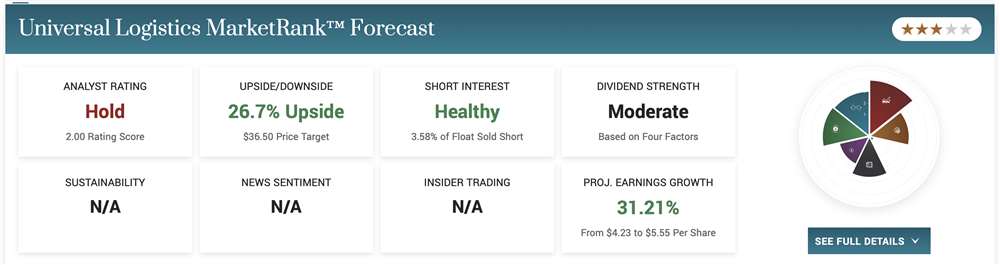

Analysts still see further upside in this stock, perhaps realizing that the transport and trucking needs from the housing and automotive industries have yet to cool down. Nonetheless, a 25% upside can be enhanced by exercising caution and buying at a sensible price range.

The Company's NAV (net asset value) per share, computed as total assets minus total debt divided by the number of shares outstanding, was $26.35 in 2022, along with a book value per share of $16.87 for the same period. These two key prices happen to fall within a major support level for the stock (in the $18-$22 range), as well as the "golden ratio" of Fibonacci retracements.