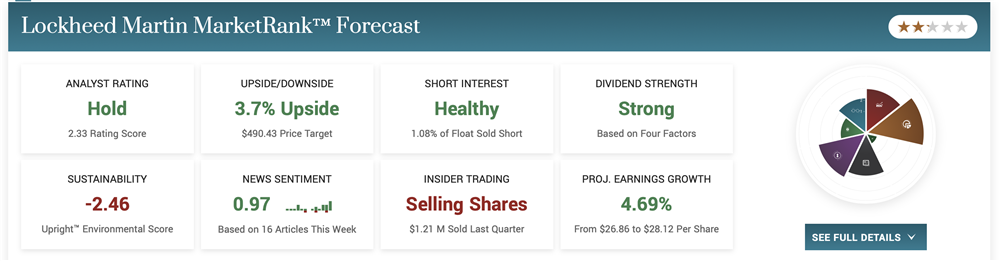

The world’s largest defense contractor Lockheed Martin Co. (NYSE: LMT) stock, has been hovering near all-time highs setting up a potential breakout on a weekly ascending triangle pattern. The company continues to report new U.S. military contracts weekly. Near-term disruptions with its supply chain are not impacting the stock very much as the market is already looking past it. Lockheed Martin comprises four divisions: Aeronautics, Space, Rotary and Mission Systems, Missiles, and Fire Control. The defense industry is a highly competitive landscape with major players vying for contracts, including The Boeing Co. (NYSE: BA), Raytheon Technologies Co. (NYSE: RTX), Northrop Grumman Co. (NYSE: NOC), and General Dynamics (NYSE: GD).

Supply Chain Headwinds

While most industries are seeing supply chains normalize from the pandemic disruption, the defense industry is moving at a snail’s pace. Supply chain constraints plagued Lockheed Martin in 2022, causing top and bottom slippage, and are expected to continue through 2023. Remember that defense equipment is subject to the highest quality standards and regulations passed by numerous suppliers, and sourcing materials and components from various countries require a long lead time. Examples include electronics, semiconductors, rare earth elements, specialty metals, and advanced composites like carbon fiber.

GFE Engine Suspension for the F-35

The F-35 Joint Strike Fighter is an effective program in its Aeronautic division, which accounted for 41% of the net sales and 40% of the profits in 2022. The F-35 program accounts for 27% of total sales. A problem arising from the Government Furnished Equipment (GFE) engine at the end of 2022, causing flight operations to be put on hold, has resulted in the temporary suspension of F-35 aircraft deliveries. GFEs are equipment, tools, and materials owned and provided by the government to a contractor to help them fulfill a contract.

GFE delays can have a material impact on contractors causing potential deadline delays, budget constraints, cost overruns, and general inability to complete the contract. The company should get more clarity in 2023 as to what adjustments will be needed for its aircraft delivery schedule and when the suspension will be lifted.

Top and Bottom Line Beat

On Jan. 26, 2023, Lockheed Martin released its fiscal fourth-quarter 2022 results for the quarter ending December 2022. The company reported an earnings-per-share (EPS) profit of $7.79, excluding non-recurring items, versus consensus analyst estimates for a profit of $7.37, a $0.42 beat. Revenues grew 7.1% year-over-year (YoY) to $18.99 billion, beating analyst estimates of $18.25 billion.

Lockheed Martin CEO James Taiclet commented, "Our ongoing expansion of 21st Century capabilities and commercial partnerships are delivering deterrence solutions and value enhancing growth opportunities across our businesses. As we track toward our objective of growth resumption in 2024, we will continue to execute our dynamic and disciplined capital allocation program, by reinvesting in our business and pursuing growth opportunities, and returning capital to shareholders.”

In-Line Full-Year 2023 Guidance

Lockheed Martin provided in-line guidance for fiscal full-year 2023 EPS between $26.60 to $26.90 versus $26.83 consensus analyst estimates. It expects revenue between $65 billion to $66 billion versus $65.75 billion analyst estimates.

Weekly Ascending Triangle

The weekly candlestick chart on LMT shows a flat-top resistance at $495.83. Each pullback has bounced off higher lows, which comprises the diagonal rising trendline. As prices move towards the apex of the flat and rising trendlines, LMT will either break out to new all-time highs or breakdown threw through the rising trendline.

The weekly stochastic has been attempting a mini pup but went flat just above the 60-band as LMT tests the diagonal rising trendline again after the last spike was triggered on the weekly market structure low (MSL) breakout through $463.76. The weekly 20-period exponential moving average (EMA) support overlaps the weekly MSL trigger. The weekly 50-period MA secondary support is starting to flatten at $441.19. Pullback support levels are $463.76 weekly MSL trigger, $448.03, $434.95 swing low, $426.43, and $406.85.